Summary:

- Visa has a clear picture of consumer spending, and they see no signs of recession.

- Visa benefits from a perpetual tailwind of payments growth, a continuation of the cash-to-cashless transition, and an incredible margin structure.

- At 24x TTM FCF, Visa is presenting a strong investment opportunity as long as consumer spending holds up.

Justin Sullivan

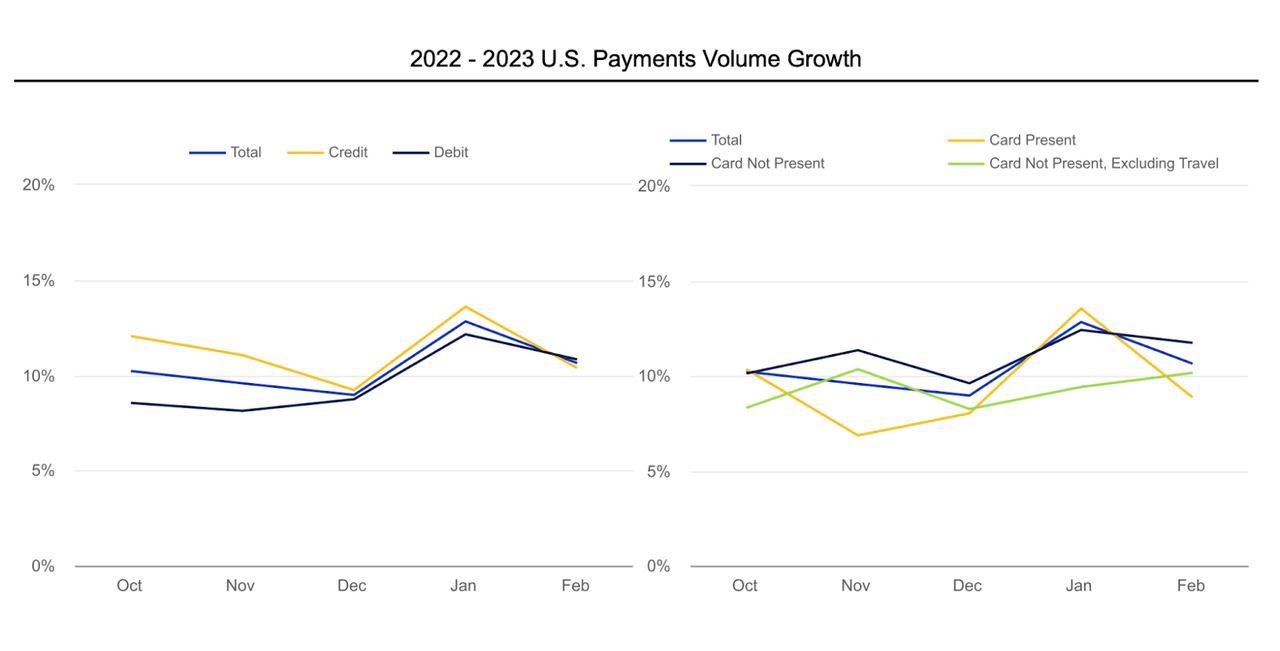

Visa (NYSE:V) processed a staggering $11.7T of credit and debit volume over calendar 2022. As such, Visa is a great barometer of the overall economy. Despite the recession commentary over the past several quarters, Visa’s results are yet to show signs of a slowdown. In fact, payments volume growth accelerated in January, and remained in the double digits in February:

Visa Investor Presentation

Fundamentals based investors understand how wildly volatile the macroeconomy can be. Even a business with the data and insights of Visa can only watch what is happening and react:

We went through our planning assumptions on the last call and we told you we had assumed no recession. As you can see, business trends have been remarkably stable…At this point, we’re not changing any expectations for the second half. The dollar has weakened a bit so that will change the exchange rate impact in the second half, but we’re not changing any of our assumptions. If there is a slowdown, then we will react accordingly. -Visa CFO Vasant Prabhu, Q1 Earnings Call

Visa’s guidance for Q2 calls for mid-teens revenue growth before factoring in the discontinuation of business in Russia and exchange rates. Visa has a number of data points that can give investors a snapshot of what overall consumer spending looks like around the world.

Domestic volumes remain strong and have now completely lapped pandemic comps, but Visa continues to be assisted by the recovery in cross border volumes, albeit slowing. Visa has granular data from nearly all geographies around the world. Japan, LatAm, CEMEA, and even mainland China are showing strength in travel.

One of the most interesting notes from Visa’s Q1 earnings call is the lack of inflation chatter. In fact, the word inflation was used collectively 30 times over the past 3 earnings calls, yet not once on the Q2 call. Visa indirectly attributed growth in US credit and debt to inflation through retail spending and fuel prices, obviously impacted by higher costs.

Visa noted e-commerce spending as a percent of retail spending was flat over last year and cross border e-commerce has remained strong.

Favorable macro conditions should be celebrated, but that doesn’t mean things won’t change. It’s important Visa continues to innovate, but the biggest effect on Visa’s future revenue growth is overall consumer spending. To be bullish on the overall economy in the long run is to be bullish on Visa.

Fundamentals:

The size and scope of Visa’s business is enormous. Even so, credential growth was still 8% in Q1. Visa called out tap-to-pay penetration has now reached 72% globally, and 30% in the United States. Despite Visa’s size and lengthy history, they still lead the charge when powering easier ways to pay.

Visa is still a beneficiary of the cash to cashless transition, especially for the debit side of the business:

As good spending slowed down a bit, services spending really took up all the slack. And so, consumers have just shifted their spending but they’re spending the same amount, and that’s why debit has stayed resilient. Debit has been the biggest beneficiary of the move to digitization that happened globally and including in the U.S., more e-commerce, more tap-to-pay, more people using digital credentials just about on any payment occasion. -Visa CFO Vasant Prabhu, Q1 Earnings Call

Visa mentioned deal renewals with Bank of America (BAC), Commerce Bancshares (CBSH), and Capital One (COF). Visa’s competitive position or “moat” as some may call it, is enviable. Issuers only have two choices, Visa and Mastercard (MA). Share of payments volume between the two networks has been stable over the past several years. Mastercard processes about 70% of the volume that Visa does. The card networks are a valuable lynchpin in the entire banking and commerce system across many geographies.

Beyond Visa’s remarkable consumer payments business, new flows revenue grew 20% in Q1 New flows are still a very small piece of Visa’s business. Visa Direct, the largest segment of new flows, only accounts for about 2.5% of Visa’s total payments volume. Visa is optimistic that Visa Direct will be used for more sophisticated instances as customers evolve their payment flows. After all, most FinTechs are reliant on the card networks for backend functions.

Value added services accounted for about 22% of revenue in Q1. Just 25 cents on every $100 of transaction volume flows to revenue for Visa. Visa has a large, entrenched base of merchants and issuers, value added services add more opportunities to expand Visa’s business of existing products, launch new products, and expand geographically. Visa primarily mentioned Cybersource, a fraud detection solution as a big driver of value added services.

Visa remains optimistic on growth opportunities. A perpetual worry will be the saturation of card and digital payments, but opportunity remains to bring the hundreds of millions of people into the modern financial system around the world. There’s also opportunity in B2B. Visa has a number of avenues to continue to modernize payments.

Capital Allocation and Valuation:

Al Kelly is passing the baton to Ryan McInerny who became CEO last month. McInerny reiterated how close he’s worked with Kelly over the last decade, and how Visa will continue on course.

Nothing has changed in our strategy. We’re focused on organic growth and then growing through M&A, and then from there, dividend and share buybacks in that order. Clearly, there’s been a little bit of a burst of the balloon in terms of some of the valuations, in particular, in the fintech world. That’s a helpful characteristic of the environment right now. -(now former) Visa CEO Al Kelly, Q1 Earnings Call

Visa is a remarkably efficient business with great capital allocators at the helm. I’ve covered my full thesis here, why Visa is my favorite business to own. Even after this small recent rally, Visa trades at 24x TTM FCF. This is a more attractive valuation than Mastercard at 32x TTM FCF considering growth prospects should be similar moving forward.

This is a great price to pay as long as the macro skies stay clear. Visa benefits from the perpetual tailwind of payments volume growth, with the cash to cashless transition being the cherry on top. Investors get great capital allocators at the helm who will continue to take advantage of Visa’s durable competitive position in order to create shareholder value.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.