Summary:

- Visa reported Q1 FY24 earnings that exceeded market expectations, with total payments volume and cross-border volume showing strong growth.

- The company ended the quarter with a robust financial position, including $21.4 billion in cash and equivalents.

- Visa’s U.S. payment volume experienced a deceleration in January, attributed to severe weather conditions, but overall trends indicate a moderation in payment volume as inflation moderates.

JulPo

Visa (NYSE:V) reported Q1 FY24 earnings that exceeded market expectations on January 25 after the market close. In my introductory article published last October, I highlighted their double-digit earnings growth and strong cross-border recovery. I remain confident in Visa’s overall strength in the global payment network and reiterate a ‘Strong Buy’ rating with a fair value of $320 per share.

Q1 FY24 Review

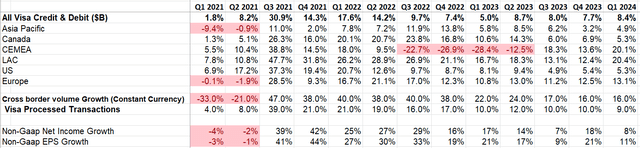

In Q1 FY24, the total payments volume increased by 8.4% in constant currency, and the cross-border volume grew by 16% year over year. Their revenue was up by 9%, and adjusted EPS grew by 11% year over year. It was a robust quarter of growth, indicating a strong consumer spending pattern.

On the balance sheet, they ended with $21.4 billion in cash and equivalents, indicating a robust financial position. During the quarter, they repurchased $3.4 billion of their own shares, with $26.4 billion still remaining authorized.

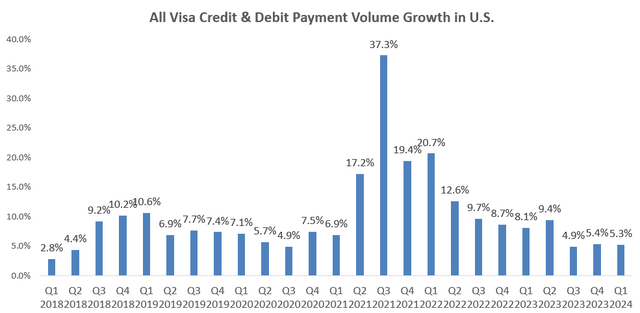

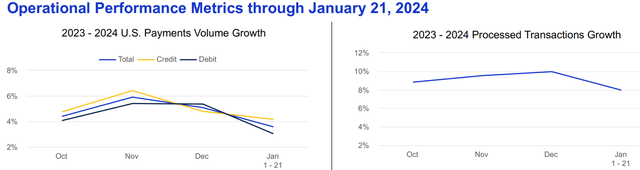

The chart below examines Visa’s credit and debit payment volume growth in the U.S. market on a constant currency basis. After a plateau in 2021, their U.S. payment volume has started to experience moderate, mid-single-digit type growth in recent quarters. It is somewhat akin to the growth rate normalizing back to their original trajectory. To some extent, the payment volume is correlated with the overall inflation rate. During periods of high inflation, consumers are compelled to spend more for the same amount of goods or services, thereby benefiting Visa’s payment volume growth. As inflation moderates, their payment volume also begins to moderate accordingly.

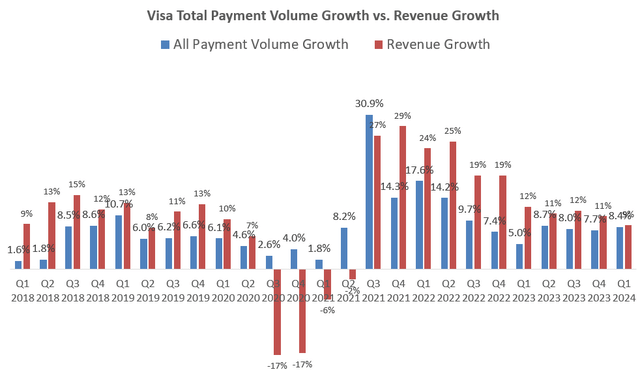

Historically, Visa possessed the capability to grow its revenue faster than its payment volumes. The chart below illustrates the total volume growth versus revenue growth, and Visa has been growing faster than the volume growth in most time periods. Visa is not solely engaged in network clearing services; rather, it offers a range of value-added services, including risk and identity solutions, maintenance services, security, and more. These additional services are not directly tied to payment volumes.

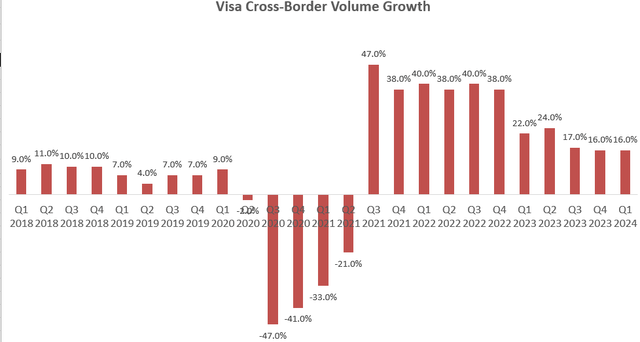

Additionally, cross-border growth is another variable for Visa, and the cross-border volume tends to generate higher revenue growth and margins for Visa due to the inclusion of foreign exchange services. As illustrated in the chart below, Visa’s cross-border volume was significantly impacted during the global pandemic period, and in the post-pandemic period, it has shown signs of recovery. Notably, there was a 16% growth in Q1 FY24, and during their earnings call, management indicated that cross-border volume growth remained robust from January 1st to January 21st. I anticipate that cross-border volume growth will continue to act as a growth tailwind for Visa.

FY24 Outlook

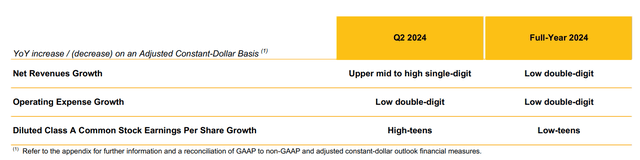

There is no material change to their full-year guidance, as shown in the table below. They continue to anticipate low-double-digit revenue growth and low-teens EPS growth for the full year.

I would expect Visa to maintain high-single-digit payment volume growth in FY24, and as discussed earlier, the revenue could grow at a faster rate than the volume growth. Margin expansion is likely to be driven by operating leverage. Given that their cross-border growth rate exceeds the group level, the business mix is expected to further contribute to margin expansion.

Soft January in U.S. Payment Volume

From January 1st to 21st, their U.S. payments volume growth exhibited a deceleration, with below 4% year-over-year growth. Both debit and credit spending volumes declined compared to the levels in December, as shown in the chart below. During the earnings call, their management attributed this deceleration to severe weather conditions in January. They provided examples such as Kansas City, where the temperature dropped from 45 degrees in the last week of December to negative 10 in the first few weeks of January. As a result, Visa observed volume in Kansas City shifting from mid-single digits growing to declining mid-single digits. While U.S. payment volumes could be influenced by weather conditions in certain cities, the broader trend indicates that as inflation begins to moderate, Visa’s payment volume is likely to follow suit and also moderate.

Valuations

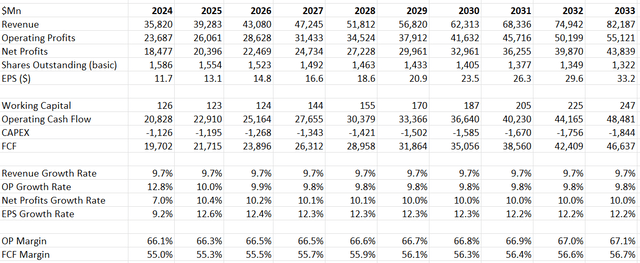

I made no changes in my financial model, projecting 9% organic revenue growth and 70 basis points from acquisition growth for Visa. Given their extensive track record of growth, they have demonstrated the capability to grow their revenue faster than the overall payment volume. Considering their already high margins, the model assumes only a 10 basis points margin expansion. As per my estimate, the fair value is estimated to be $320 per share.

Visa DCF -Author’s Calculations

Verdict

Visa remains a high-quality growth investment for long-term investors, and I reiterate a ‘Strong Buy’ rating with a fair value of $320 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.