Summary:

- Visa is a strong company with a great business model and strong cash flows, making it an attractive investment for dividend investors.

- Despite a slight decline in share price due to miss volume estimates, Visa had a strong quarter and is expected to continue growing, especially with new partnerships.

- Visa’s current valuation is still below its 5-year average P/E near 32x, making it a good time to buy or add the stock.

- Visa’s annual net revenues are expected to slow this year to low double digits vice high single digits prior.

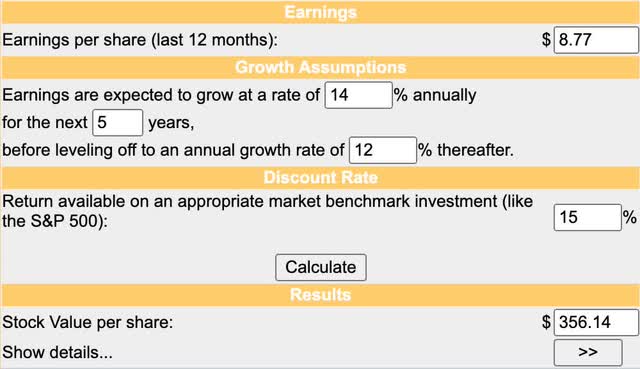

- Additionally, my fair value estimate is $356, showing why Visa is a high-growth dividend stock investors should consider owning forever.

2Ban

Introduction

If you’re reading this article, that means you’re probably an avid dividend investor like myself, a Visa (NYSE:V) shareholder, or have a keen interest in someday holding the stock. Visa is a well-known company that has been around for quite a while. And whether you know it or not, you probably contribute to the company’s financials in some way, shape, or form.

That’s because there’s a high likelihood you have at least one Visa credit card, or perhaps even a few. Or maybe you hold shares in their peers and close competitors, American Express (AXP) or Mastercard (MA). But companies like Visa is one who investors, especially those who enjoy dividends, probably own or should consider owning. And in this article, I’ll tell you why Visa is a company to consider buying and holding for the long-term.

Earlier Thesis

I last covered Visa back in early November in an article titled: Visa: Buybacks And Dividend Growth Make This Stock An Attractive Buy. Well, by looking at the title you can tell the theme of the article. In it I discussed the free cash flow payout ratio of the company, which is what attracted me to initially write about them.

I was so attracted to the company that I instantly opened a position in them the next day. Normally, I’m a buy and hold investor, but due to REITs being out of favor currently, I decided to deploy that capital into what I deemed to be more attractive stocks. To be honest, the position was very small, only 10 shares.

I also discussed their growth outlook and the $25 billion buyback program they announced back in October. Three months and an earnings call later, I still think the stock is a great buy and a forever hold.

Great Business Model & Strong Cash Flows

Although I sold out of Visa, I plan on buying the stock back when I save up enough capital to do so. I’m actually in the process of selling a car, and I will likely invest those proceeds back into the stock. Besides the dividend and buybacks, I also really like the business model. And it’s probably one of the reasons Warren Buffett owns them along with their peers mentioned previously.

As a payment processor, slightly different that of AXP who’s a processor and issuer, Visa makes money from customers swiping their credit cards. And unless you’re old school and prefer to pay with cash, you likely have multiple credit cards that you use on a daily basis. And there’s a high likelihood that some, or all of them are associated with Visa.

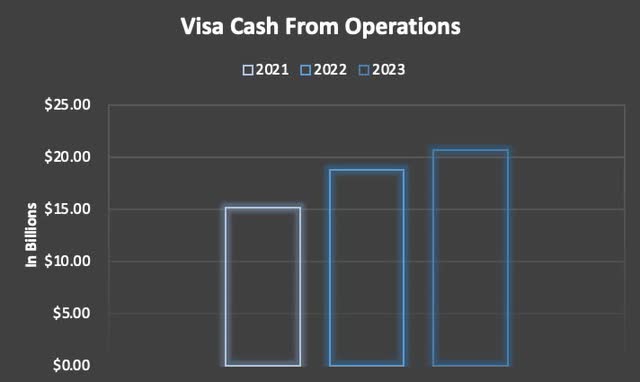

I also like that the business model is not CAPEX intensive like other companies, such as brick-and-mortar businesses. Over the past 3 years, the company’s capital expenditures have averaged roughly $1 million. Over the same period, their cash from operations have averaged $18.2 billion! That means the company uses little cash to continue operating the business, which means more free cash flow.

And this translates to higher free cash flows, which means not only more capital to use to reinvest back into the business, but more to pay out in the form of dividends and buybacks. And with their conservative payout ratio that has averaged roughly 20% in the past four years, this is a dividend investor’s dream holding.

Follow-Up Quarter & 2024 Outlook

Visa reported its Q1 earnings this past January and the company continued its impressive growth to start the year off. EPS of $2.41 beat estimates by $0.07 while revenue of $8.63 billion beat by $50 million. Earnings grew quarter-over-quarter by 3.43% while revenue grew by less than 1%. However, year-over-year this grew 10.5% and 8.4% respectively. So, despite the challenging economic backdrop, consumer spending remained resilient.

This resilient spending translated well for the company as payment volumes grew. In the U.S., volumes grew 5% while more than doubling internationally at 11%. Year-over-year total volumes grew 8%. But despite the impressive growth, volumes were weaker-than-expected with total volumes of $3.28 trillion, slightly missing the consensus of $3.29 trillion.

This caused the share price to decline slightly. But all things considered 2023 was a strong year for Visa. However, in 2024 growth is expected to slow with annual net revenue expected to be in the low double-digits compared to the high single-digits prior.

Maybe the company is factoring in a slowdown in the economy via a recession. Or it could be that they are assuming less transactions with American credit card debt continuing to surge. This increased quarter-over-quarter from $1.079 trillion to $1.129 trillion.

Growth In Partnerships

Even with the resilient consumer spending and expected slowdown, Visa has been continuing to focus on growth with partnerships, mainly internationally. In the latest quarter the company signed agreements in Poland, Japan, Mexico, and Brazil to name a few. Additionally, they signed an agreement with bKash, the largest mobile financial services player in Bangladesh.

They also signed a partnership with Isbank, the largest private bank in Turkey with 33 million cards for its consumer and commercial credit & debit portfolios. In the U.S. they renewed with Fintech Chime, a company that offers online & mobile banking, cryptocurrency, and digital wallets. This is important because every day the world becomes more digitized. And as crypto becomes more regulated as seen with the recent approval of some Bitcoin ETF’s, this will only fuel further growth for Visa.

Valuation

Since my last article roughly nearly 4 months ago, Visa’s share price has climbed double-digits from $243 to $283 at the time of writing. Despite their share price appreciation, I think the stock still has room to grow. Their current P/E of roughly 28x still sits below their 5-year average of nearly 32x. Investors know higher-quality stocks like Visa normally trade at a premium. Using the earnings estimate of $9.92, this gives V a forward P/E of 28.5x.

Furthermore, the current P/E is still less than peer, Mastercard’s near 32x. Out of the better-known credit card companies, American Express’ current P/E of less than 17x seems to be closer to the sector median. But even with a new 52-week, high the stock still offers upside to their price target and Wall Street rates them a buy. For a company as high-quality as V, this is one you continue to buy no matter the price in my opinion as it will likely continue to trend higher.

Using the Discounted Cash Flow Model, this gives me a fair value of $356. Looking at estimates for the next few years, the stock is expected to grow double-digits at an average of 14% per year. Seeing as how they are a high growth stock, I think it’s only right the company will continue growing at a rapid pace. Do I think the share price can get near or surpass here? I think so, especially if rates decline and a bull market begins.

Risks To Thesis

One risk Visa faces is a slowdown in transactions if the economy enters into a recession. This will likely cause consumer spending to become tighter than it already has. If so, Visa along with their peers could see a decline in volumes as consumers rely heavily on credit cards and these become maxed out.

Furthermore, the recent merger between Capital One (COF) and Discover Financial Services (DFS) provides increased competition for the payment processor as well. With the merger, the company can cause a decline in card volumes from companies like Visa and Mastercard. This will also likely not only increase the merged companies’ financials, but strengthen their relationships with banks as well. But this remains to be seen as this could be held up or blocked by the FTC in the near future.

Bottom Line

Despite the macro environment, Visa has performed exceptionally well, growing payment volumes and cash from operations. Additionally, they continued to increase and renew partnerships, giving the company access to millions of additional users and this will only benefit them going forward. Although growth is expected to slow this year, I still expect their share price to continue growing, especially if interest rates do decline.

This will likely increase investor sentiment in the market, driving many stocks’ share prices higher. In lieu of increased competition from the pending merger between COF & DFS, I still think Visa will continue to outperform, rewarding shareholders with increased dividends and price appreciation for the long term. Even though the price increased $40 since my last article, I still rate the company a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.