Summary:

- Visa, the largest payment services provider, faces an undervalued challenge from cryptocurrencies. While integrating crypto, Visa must carefully navigate its long-term future.

- Visa boasts exceptional profitability margins, with a net income margin over 50% and a gross margin over 97%. Its growth is less compelling than Block’s, but Visa’s stability is attractive.

- Visa is ~50% overvalued based on my DCF model, which is common for such companies. It is likely fairly valued when comparing its P/E GAAP ratios to competitors and historically.

- Visa must navigate younger generations adopting advanced tech payment solutions in social media and digital apps. Additionally, Mastercard’s international growth could disrupt Visa’s market share.

Michael H/DigitalVision via Getty Images

I last covered Visa (NYSE:V) in December 2023; it was my first analysis of Visa. I put out a Buy rating at the time, and since then, the stock has gained 7.25% in price. Now, I am reiterating my Buy rating when comparing the company to the growing cryptocurrency trends and newer fintech companies like Block (SQ) and PayPal (PYPL). I consider Visa overvalued based on my DCF model of the company, but fairly valued when considering historical market sentiment for the stock and its valuation compared to competitors. In my opinion, Visa is likely to navigate the risks that occur in emerging markets and fintech innovation with sufficient strategic foresight.

Operations Analysis

Visa offers payment technology connecting consumers, merchants, financial institutions, and governments in almost every part of the globe. Its core payment products include services and products for credit, debit, prepaid and cash access.

The company’s VisaNet processing platform works to authorize, clear and settle payment transactions. Visa is focusing on integrating new technologies such as tokenization, artificial intelligence, and embedded finance to enhance security, user convenience, and operational efficiency. As an example, tokenization substitutes sensitive card information for unique identifiers, which enhances the security of Visa’s network.

Visa’s main revenue streams come from these core sources:

| Service Revenues | Fees from financial institutions based on card activity levels. |

| Data Processing Revenues | Fees for processing transactions through VisaNet. |

| International Transaction Revenues | Fees from cross-border transactions. |

| Other Revenues | Including value-added services like fraud prevention and advisory services. |

Visa is also driving the adoption of embedded finance, where payment functionalities are seamlessly integrated into various consumer and commercial platforms; this is an effort to enhance user engagement and improve the payment experience.

There are growing competitive threats from cryptocurrencies like Bitcoin and Ethereum; while I do not believe this to be a significant detractor from Visa’s market share in the immediate future, it remains unclear how high the demand for cryptocurrencies could become. Hence, I think it is important for long-term investors in Visa to consider what could happen if younger generations begin to adopt cryptocurrencies more aggressively in the future. In addition, platforms like Block and PayPal are integrating crypto extensively into their offerings, opening up room for this area of fintech to expand in the coming decades.

There are also lower transaction fees with cryptocurrencies compared to traditional payment networks. The elimination of intermediaries can make cryptocurrencies more attractive, especially for cross-border payments. Additionally, cryptocurrencies operate 24/7, which can lead to quicker and more convenient transactions than with traditional banking systems. These are all important considerations for long-term Visa shareholders to contend with.

Visa is not ignoring the rise of cryptocurrencies; it has been exploring ways to integrate the technology into its ecosystem. As an example, Visa has partnered with several cryptocurrency platforms to enable the use of cryptocurrencies for everyday transactions. The company has also been investing in blockchain technology, the foundation of cryptocurrency transactions, to develop the benefits of anonymity and security that come with this while still controlling its transaction network.

There are several further key growth drivers for Visa, which include the expansion of digital payments in emerging markets, the rapid growth in online commerce, and new growth opportunities in fraud prevention, advisory services and data analytics. However, the primary position that gives Visa a moat against competitors is its size and the associated reputation:

| Transactions | Cardholders | Merchant Locations | |

| Visa | ~212.6B | ~4.3B | ~130M |

| Mastercard (MA) | ~136B | ~3.1B | ~60M |

| American Express (AXP) | ~10.3B | ~118M | ~25M |

All data is according to the latest annual reports.

Visa’s transaction volume means it can spread its fixed costs over a greater number of transactions, and its larger network allows it to negotiate better deals with merchants and financial institutions. Visa can also achieve greater operational efficiencies, including optimized transaction processing and bulk purchasing of hardware and software, due to its vast operations.

Financial Analysis

There are four major companies that I consider to be the biggest competitors to Visa. Two of these are traditional financial services companies, and two are modern pioneers in fintech. I think it is important for investors to consider the implications of the competitive threat from both.

| Mastercard | Mastercard is Visa’s most direct competitor, offering similar payment processing services; it has a moderately lower market share. |

| American Express | American Express competes with Visa primarily in premium and business segments; it has an exceptional brand. |

| PayPal | PayPal has robust digital wallet services, peer-to-peer payments, and integration with e-commerce platforms. It offers a growing modern alternative to Visa, although Visa products are embedded in its network. |

| Block | Block is predominantly catered to small and medium-sized businesses, offering point-of-sale systems, digital payment processing, and financial services. |

We can understand the recent historical financial performance for each of the five peers by assessing the data in the following table I have created:

| V | MA | AXP | PYPL | SQ | |

| FWD Revenue Growth 5Y Avg | 10.8% | 13.12% | 9.58% | 14.84% | 51.96% |

| FWD Diluted EPS Growth 5Y Avg | 14.77% | 17.63% | 17.1% | 15.5% | 33.37% |

| FWD Free Cash Flow Growth 5Y Avg | 12.44% | 15.12% | – | 15.46% | 92.56% |

| TTM Net Income Margin 5Y Avg | 51.45% | 44.54% | 15.35% | 14.29% | 1.1% |

| Equity-to-Asset Ratio | 0.44 | 0.17 | 0.11 | 0.25 | 0.53 |

| FWD P/E GAAP Ratio | 28 | 31.5 | 18.5 | 17 | 34.5 |

| FWD P/S Ratio | 15 | 15 | 2.5 | 2 | 1.5 |

In the above table, I have bolded the items that I consider to be particularly strong for each company; I have italicized the items I consider to be particularly weak.

I think Block’s high growth is indicative of the threat I mentioned in my operations analysis above that modern fintech ecosystems could displace Visa’s network significantly over the long term. What Visa has that significantly strengthens its position is a remarkably high net income margin, which, alongside Mastercard, allows it to maintain its moat through more resources at hand from its operations. The fact that both Visa and Mastercard are still growing healthily, along with having such rich profitability margins, shows how strong the investment case for both is at the time of this writing.

Block’s position is more speculative, but I do not think it should be underestimated. Equally, PayPal has shown success in modern fintech, but its growth is more reasonable, and its valuation is very appealing at this time, which I discussed in a recent analysis of the company.

Visa has a much better balance sheet than Mastercard, and I think this shouldn’t be underestimated. Personally, the information in the table has led to me holding Visa stock in my portfolio and none of the other companies. The biggest driver in this decision for me was the sense of stability that I feel Visa offers shareholders due to its highest net margin, stable balance sheet, and still competitive growth. In my opinion, the aggregation of each factor makes Visa slightly more attractive than Mastercard at this time. Additionally, I do not think the fundamentals and operational strategy of PayPal and Block can provide similar security to shareholders as either Visa or Mastercard.

Based on the latest quarterly report, Q2 2024, Visa has shown strength in Payments Volume (7% YoY growth), Processed Transactions (10% YoY growth), Cross-Border Volume (17% YoY growth) and Net Revenue segments (10% YoY growth). However, two areas of notable weakness include Value-Added Services and Commercial Payment Solutions segments. Growth has been slower for both of these segments, and strategies in emerging markets are particularly crucial for Visa to navigate, particularly with commercial clients, to avoid being watered down in certain regions by Mastercard.

The results listed above show promise for Visa overall after the challenge of the pandemic, but the company has noticeably more liabilities at the moment, with an equity-to-asset ratio of 0.44 compared to a 10-year median of 0.48 and a cash-to-debt ratio, which includes lease obligations, of 0.86, higher than its 10-year median of 0.79. While this is not of huge concern, it is a reminder that the effects of the pandemic are not fully gone, despite the strong growth in stock price the firm has experienced over the last year and a half after an overvaluation during the COVID-19 technology stock market bubble.

Valuation Analysis

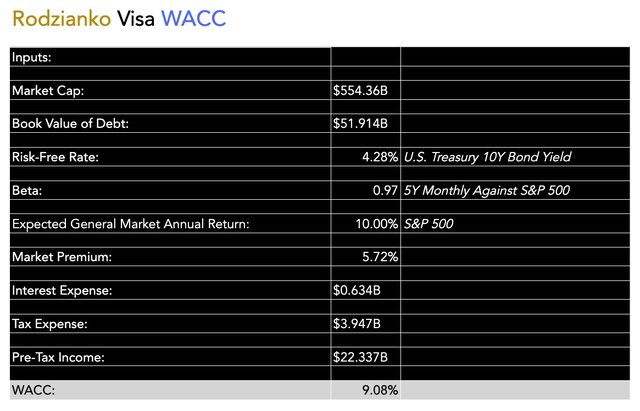

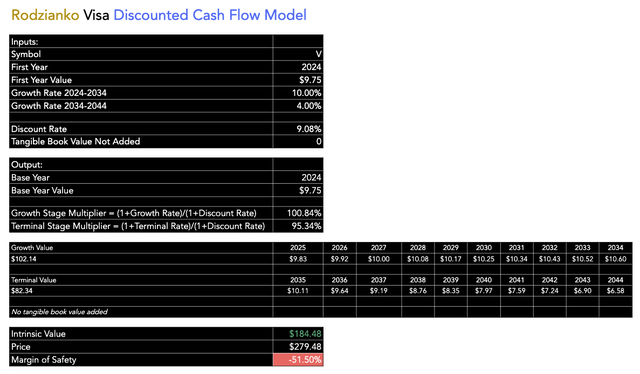

To assess the intrinsic value of Visa stock, I modeled a discounted cash flow analysis, which includes a 9.08% WACC as the discount rate, of which I have listed my inputs in detail below. I forecasted a 10% free cash flow per share annual growth rate for the first 10 years of my model, and a 4% free cash flow per share annual growth rate for the next 10 years after this. I used the starting TTM free cash flow per share of $9.75. The result indicates a margin of safety of negative 51.5%.

Author’s Calculation Author’s Model

This outlook is not unfavorable for Visa shareholders when we also consider the long-term sentiment surrounding the stock, which has allowed it to trade at high P/E, P/S, and P/FCF multiples over extended periods of time:

Considering its history, I assess the shares to be fairly valued at this time despite the premium against intrinsic value implied by my DCF model. Visa isn’t cheap, but the growth that the company delivers and the high profitability margins, which include a TTM gross profit margin of 97.15% as a five-year average, are extremely promising for shareholders. If investors are willing to bear some risk related to investing in a company that is valued more based on sentiment rather than intrinsic value, I think the long-term returns are likely to be very competitive despite the risk that this entails.

Further Risk Analysis

I consider Visa to be a low-risk investment, but it is still important to consider that the payments landscape is evolving, and while Visa is incorporating cryptocurrencies into its ecosystem, I think this risk is undervalued at the moment. Visa has an exceptional moat in brand and recognition, which has its foundation in the trust that it has developed with its customers. However, I think the greatest threat to Visa could come if major online ecosystems like X.com, Meta, and other international players like WeChat more directly integrate cryptocurrencies and alternative currencies that do not require Visa’s network. However, while this risk is potentially undervalued by the market, I still think it is highly unlikely that Visa will be uprooted from its top position in the payment services market any time soon. The primary reason for this is that it commands such a strong element of trust that it will be difficult for any revolutionary change to transform payment habits across multiple generations.

In addition to the threat from alternative currencies and payment solutions, Visa is also faced with a fast-growing Mastercard in emerging markets, which puts some growth constraints on Visa, especially at a time when the global market dynamics are expected to shift in favor of emerging economies like India and China, as growth slows and potentially starts to contract for the United States. Mastercard shareholders may be the beneficiaries of heightened card payments internationally, while Visa shareholders may begin to experience the effects of contraction in growth domestically unless it adopts a more rigorous international strategy to maintain its lead on Mastercard.

Key Elements

Visa is the largest payment services provider on the planet, and while it has an exceptional moat built around trust and efficiency, there is an undervalued challenge occurring in cryptocurrencies. Visa is doing well in incorporating cryptocurrencies into its business model, but it still needs to be careful over its long-term future.

Financially, Visa has exceptional profitability margins, including a net income margin of over 50% and a gross margin of over 97%. Its growth rates are less compelling than the newer fintech, Block, but the stability offered is what I find attractive about Visa.

Visa is ~50% overvalued based on my discounted cash flow model, but this is common for companies like it. It is likely fairly valued when comparing its P/E GAAP ratios to competitors and to its historical levels.

Visa must be careful in navigating younger generations adopting more advanced technology payment solutions, which could become embedded in popular social media and other digital applications. Additionally, Mastercard is making significant inroads in international markets, which could disrupt Visa’s market share over the long term.

Conclusion

I’m a Visa shareholder, and I consider the investment one of the greatest there is, primarily because there is so much stability in its brand and reputation in a field where there is a very difficult barrier to entry. While the valuation is high based on my DCF model, it is reasonably valued considering its competitors’ valuations and the historical market sentiment for Visa stock. I am confident, even given the risks, that Visa will be able to navigate a more digitally-oriented future with strategy and success.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.