Summary:

- US holiday spending trends were in line with estimates, indicating a resilient consumer, but there are some concerns about 2024 retail spending.

- I see shares of Visa Inc. as undervalued with the company boasting positive earnings growth and a favorable stock chart.

- Visa’s strong growth history and positive trends justify its premium valuation, and EPS growth is expected in the quarterly report due out next week.

- I highlight key price levels to monitor this market leader.

Justin Sullivan

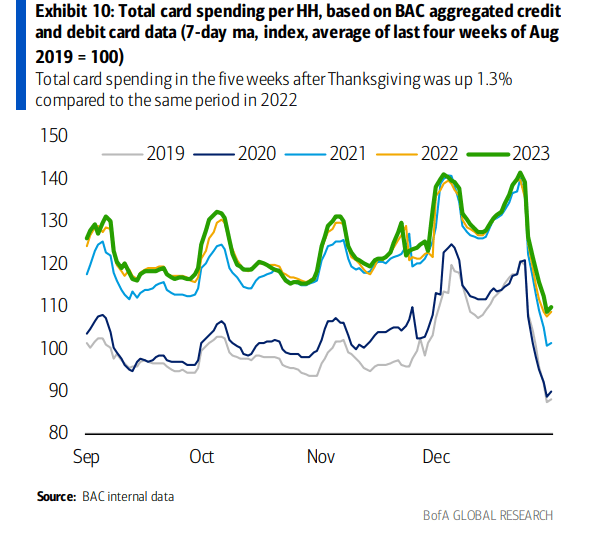

The consumer is in good shape, not great shape. Emerging macro data points to this reality. While U.S. retail sales from the Census Bureau reported this week showed solid consumption, holiday spending trends were roughly merely in line with estimates, according to Bank of America’s card spending figures. Moreover, Mastercard’s CEO remarked on Bloomberg TV this week that consumer spending was resilient in 2023 and that the outlook for 2024 is “fairly positive.”

Amid this backdrop, I reiterate my buy rating on Visa Inc. (NYSE:V). I see the stock as undervalued, with positive earnings growth and a favorable, outperforming chart in recent months.

Decent US Holiday Spending

BofA Global Research

According to Bank of America Global Research, Visa operates the world’s largest retail electronic payments network. The company provides processing services and payment product platforms, including consumer credit, debit, prepaid and commercial payments, that are offered under Visa and related brands. According to Nilson estimates, V is the largest global credit network (as measured by volume) and the second-largest global debit network.

This San Francisco-based $533 billion market cap Transaction & Payment Processing Services industry company within the Financials sector trades at a high 26.9 forward 12-month non-GAAP price-to-earnings ratio and pays a low 0.8% forward dividend yield. Ahead of its fiscal first quarter earnings release later this month (post-market on January 25th) and a shareholders’ meeting next week, shares feature a low implied volatility percentage of just 19%, while short interest on the stock is also low at 1.9%.

Back in October, Visa reported a strong set of quarterly results. Q4 2023 non-GAAP EPS verified at $2.33, topping the Wall Street consensus forecast of $2.24 while revenue of $8.6 billion, up more than 10% versus year-ago levels, was a modest beat. The company provided an initial FY 2024 guidance that was about in line with expectations for high-single digit to low-double digit net revenue growth.

Payment volume and processed transaction growth are expected to remain robust in the low-double digits. The firm sees adjusted EPS for the current year at $9.91. With a solid growth runway and secular tailwinds, Visa’s wide competitive moat supports a valuation premium. Its management team also has a proven history of strong execution.

Key risks include consumer spending that is weaker than expected, as well as soft cross-border travel spend trends. An increasingly concentrated pool of customers could also pose a risk if a macro slowdown takes place. Also, political and regulatory changes could adversely impact credit card processing companies.

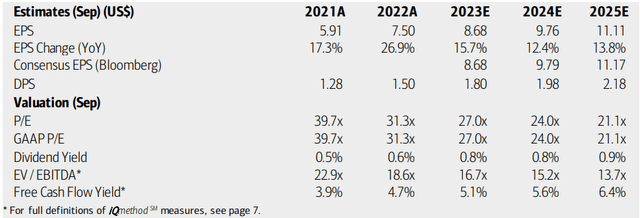

On valuation, analysts at BofA see earnings rising at a healthy pace in the low-double digits. Per share profits are expected to approach $10 this year with more than $11 in operating EPS in the out year. The current consensus estimates, per Seeking Alpha, show even healthier EPS forecasts, while sales growth is expected to gradually increase from +9.8% this year to +11.1% by 2026.

Dividends, meanwhile, are forecast to rise at a rate commensurate with EPS growth. Visa is by no means a value stock, evidenced by a significant valuation premium to the broad market. Moreover, its EV/EBITDA ratio is nearly 1.5x that of the S&P 500’s. Still, V is highly free cash flow (“FCF”) positive.

Visa: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume non-GAAP EPS of $10.20 over the next 12 months and apply the stock’s 5-year historical average earnings multiple, then we arrive at a price target of $316. Perhaps there is some modest downside risk to that fundamental intrinsic value given some emerging weakness in the consumer picture, but shares remain a compelling GARP (growth at a reasonable price) value today in my view.

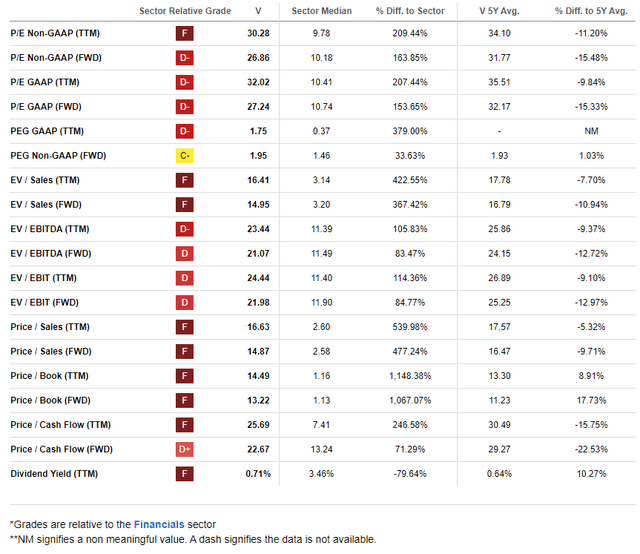

Visa: A Premium Valuation Warranted

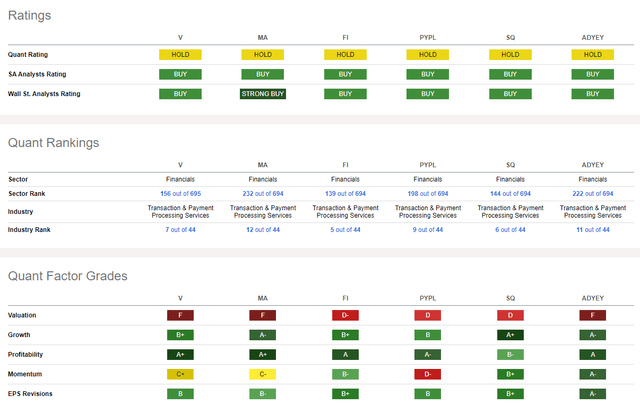

Compared to its peers, V features a lofty premium, but deservedly so in my view. It has among the best growth histories and trajectories in the marketplace while profitability trends, including strong free cash flow, are very positive. Share price momentum is impressive, and I will detail later in the article why I assert that the C+ grade does not tell the whole story. Finally, EPS revisions have been generally on the good side in the last three months.

Competitor Analysis

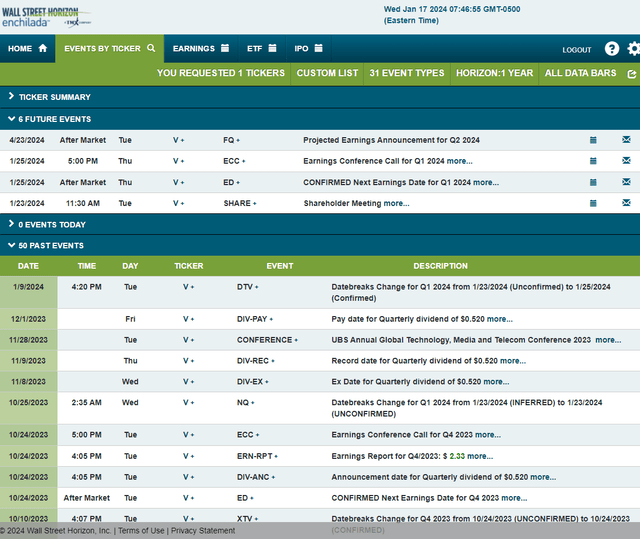

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed fiscal Q1 2024 earnings date of Thursday, January 25 AMC with a conference call immediately after the numbers hit the tape. You can listen live here. Before that, Visa holds a shareholders’ meeting on Tuesday, January 23.

Corporate Event Risk Calendar

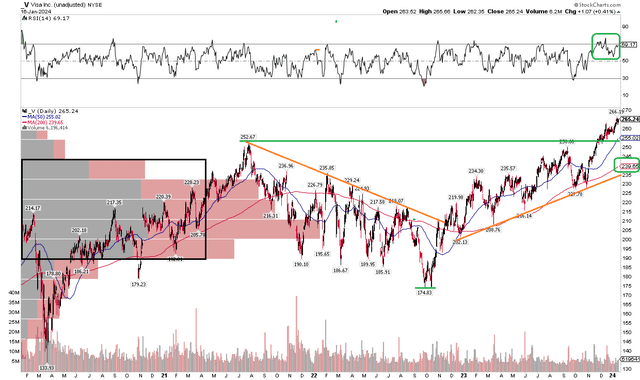

The Technical Take

With a strong growth profile and reasonable valuation given its fundamentals, the chart of Visa continues to do all the right things. Notice in the graph below that shares recently broke out to fresh all-time highs above the key $253 mark. I detailed the significance of that level back in Q3 last year, so I am pleased to see the breakout. Now we must monitor the chart to ensure it holds. Bigger picture, an uptrend support line is in place, currently near $235, a few dollars below the rising long-term 200-day moving average. V held the 200dma on several occasions dating back to late 2022, so that, too, is an important indicator to monitor.

I am not too concerned about a lower high in the RSI momentum oscillator at the top of the graph right now as bearish momentum and price divergence often resolve in higher prices during strong uptrends, but that is something to keep tabs on. But with a high amount of volume by price between $190 and $250, pullbacks have ample buying support from previous congestion. Long term, based on the $175 to $253 height of the multi-quarter range, an upside-measured move price objective to $331 is in play.

Overall, Visa is among the best charts in today’s market, and the recent breakout underscores the positive price action.

Visa: Shares Break Out Above the 2021 High

The Bottom Line

I reiterate my buy rating on Visa Inc. stock. I see both fundamental and technical upside to above $300 on this high-growth Financials sector stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.