Summary:

- Visa’s Q1 2024 earnings demonstrate strong revenue growth, operating margin expansion, and continued diversification into value-added services.

- Visa’s focus on expanding its reach, enhancing service capabilities, and creating value for stakeholders positions it well for future success in the digital payments industry.

- A base-case valuation calculation suggests an 8% undervaluation in shares, making it a potentially attractive growth at a reasonable price (GARP) choice.

- Visa still faces significant regulatory, cyber security, and competitive risks in the marketplace along with a potentially difficult macro environment in 2024.

- Buy rating reiterated.

hatchapong

Investment Thesis

Visa (NYSE:V) continues to be the leading player in the digital payments processing industry with a solid Q1 of 2024 illustrating the firm’s earnings power.

Solid topline revenue growth has been complemented by great operating margin expansion and continued diversification into value-added services. Visa’s quantitative successes come despite a difficult macroeconomic environment and softening consumer spending outlook.

Current valuations suggest an 8% undervaluation in shares given current 2024 EPS estimates with the firm therefore potentially being a compelling GARP choice at present time.

I continue to rate Visa a Buy and believe the firm still has real room for growth in the coming years thanks to a great fundamental business.

Company Background

Visa Q1 FY24 Press Release

Visa is an American payment processing and fintech company enjoying a commanding position as the market leader leading the charge against key rivals Mastercard.

The company specializes in electronic payment solutions and operates a proprietary payments network to process the transactions its customers execute. As customers utilize Visa’s payments network, the company demands a fee in exchange for the processing of transactions.

Visa is therefore sometimes referred to as a digital payments “tollbooth” operator with the firm being able to extract revenues from the majority of card and online payments across the world.

Rapid diversification of their payment’s solutions into new and emerging business segments such as instant-payments and into geographic regions with underdeveloped digital payments networks could allow Visa to continue generating real growth for another decade.

Earnings Analysis – Q1 FY24

Last year I conducted a full in-depth analysis of Visa’s fiscal profile which I still believe is a great representation of the firm’s underlying profitability and stability. I urge you to read that article: “Visa: Why I’m Buying The Clear Market Leader” to gain a deeper understanding of the firm’s finances.

In this update, I would like to discuss Visa’s Q1 FY24 report analyzing both the firm’s quantitative and qualitative achievements in this past quarter.

The company recently reported its Q1 financial results highlighting solid growth in net revenues, net income, earnings per share, payments volume, cross-border volume and processed transactions in the first quarter of 2024.

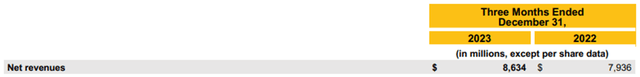

V FY 24 Q1 Press Release

Net revenues grew to $8.63 billion, marking a 9% increase on both nominal and constant-dollar basis, driven by growth in service revenues, data processing revenues and international transaction revenues.

While this growth is still solid, it lags behind their pre-pandemic figures of around 12% illustrating that even Visa is not entirely immune to a softening business environment.

V FY 24 Q1 Press Release

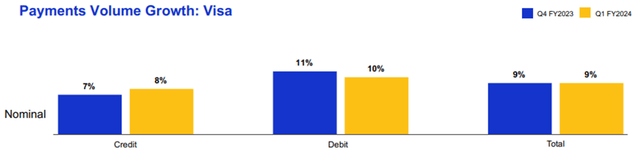

Payment volumes grew by 8%, with cross-border volume excluding intra-Europe up by 16%, reflecting a recovery in e-commerce spending. This solid growth in cross-border payments volumes was one of the key revenue drivers for Visa in Q1.

Processed transactions also saw great growth of 9%, totaling 57.5 billion transactions. This was driven by growth in debit and credit card usage and digital wallets.

I view the continued resilience of consumers quite encouraging despite a difficult macroeconomic environment weighing particularly hard on lower-income earners.

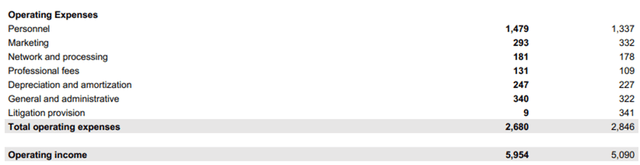

V FY 24 Q1 Press Release

Visa’s operating expenses for Q1 2024 were just $2.68 billion, down 5% YoY thanks to lower marketing and litigation provision expenses. While Personnel and Network and Processing expenses did increase YoY, the minute changes illustrate just how effectively the firm is managing their expense profile.

I believe Visa’s ongoing cost management efforts are incredibly positive to see and highlight how devoted the firm is to remaining a massively profitable and lean enterprise.

Given that such cost control comes amidst Visa expanding their product offerings through new and innovative solutions, I couldn’t be happier with the progress.

Visa’s operating income totaled $5.9 billion, up 13% YoY reflecting the higher revenues and lower operating expenses achieved by the firm in Q1.

The firm’s operating margin subsequently improved to 65%, up from 62% in the prior year quarter. This is a truly massive operating margin especially when compared to Mastercard’s current OM of just 55%.

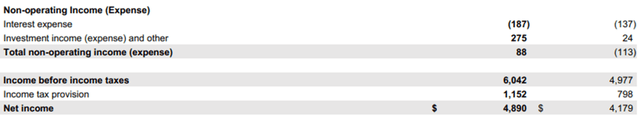

V FY 24 Q1 Press Release

Net income also grew a substantial 17% YoY to $4.9 billion. This came primarily thanks to their topline revenue growth and their expanded operating margin along with a very slightly lower effective tax rate for Q1.

The firm also rewarded shareholders in the quarter by repurchasing 14 million shares while also distributing a quarterly dividend of $0.52 per share.

I really like the firm’s continued devotion to improving the returns of shareholders and believe the current share repurchases were achieved at reasonable prices with an average cost of $239 a share.

Overall, Visa has had a pretty blockbuster Q1 of 2024. Visa continues to demonstrate the company’s ability to leverage its core payments network and increasingly diversified revenue streams to deliver consistent and robust growth in a challenging and dynamic environment.

I think the company’s focus on expanding its reach, enhancing its service capabilities, and creating value for its stakeholders positions it well for future success in the digital payments industry.

Visa also achieved some great qualitative wins in Q1 with the firm acquiring a majority interest in leading Mexican payments processor Prosa along with the complete acquisition of Pismo, a cloud-native issuer processor and core banking platform.

The firm’s continued expansion into emerging markets along with an on-going effort to expand the capabilities of their payments solutions illustrates just how focused the firm is on remaining at the forefront of the global payments business.

Valuation – Q4 FY23 Update

Seeking Alpha | V | Valuation

Seeking Alpha’s Quant has assigned Visa with an “F” Valuation rating. While the underlying multiples appear quite elevated, I still find such a poor letter grade surprising given the firm’s recent earnings prowess and relative to their historic multiples.

Visa currently trades at a P/E GAAP TTM ratio of 31.92x which actually represents a 10% decrease relative to their running 5Y average.

While the 5Y ratio does of course include a period of time in the near zero interest rate environment, it is still nice to see Visa’s P/E ratio come down a good bit from highs of around 38x.

I believe that Visa’s successes in 2023 have helped reduce the P/E ratio with no obvious selloff being the casual factor in this decrease.

Visa also has a P/CF ratio TTM of 27.57x and an EV/Sales TTM of 16.81x. Both of these relatively high ratios illustrate that the markets still have significant growth priced-in for Visa.

Seeking Alpha | V | 5Y Advanced Chart

From an absolute perspective, Visa stock has managed to slightly outperform the popular S&P 500 tracking index fund SPY (SPY). Volatility for the stock has also been quite low with a beta of 0.95x.

Seeking Alpha | V | 3M Advanced Chart

While this 5Y performance is warranted by the excellent fiscal performance achieved by Visa, I would like to highlight the huge rally that has occurred over the last three months.

This rally has come on the heels of a softening macroeconomic environment along with a slight slowdown in earnings growth at Visa. Considering the lack of all-time earnings records, I believe the most recent increase in share price may be slightly irrational.

The Value Corner

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Let’s start with a base-case valuation using Visa’s current share price of $277.18, a conservative 2024 EPS estimate of $9.92, a realistic “r” value of 0.12 (12%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $299.30. This represents just an 8% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.09 (9%) to reflect a worst-case scenario where Visa struggles to achieve top and bottom-line growth as a recession results in a slowdown in corporate and consumer spending, shares are valued at around $244 representing a 14% overvaluation in shares.

This bear-case scenario illustrates how much growth is baked-in to Visa’s share price and highlights the real reliance current share prices have on future growth.

Considering the valuation metrics, absolute valuation, and intrinsic value calculation, I believe Visa is trading somewhere between a slight undervaluation and essentially fair valuation in shares.

In the short term (3-12 months), I see multiple possibilities for the direction of Visa’s stock price. While the solid growth prospects continue to be a great positive in favor of the firm’s shares, any negative short-term catalyst could result in a sudden drop in share prices especially given the growth already priced into the stock at present.

In the long-term (2-10 years), I believe Visa will continue to dominate the digital payments marketplace. I like their fundamental business model, their underlying profitability and the firm’s expansion into value added services.

At present time, I view Visa as having multiple tangible opportunities to continue growing their revenues and profits tangibly despite maturing North American and European markets.

Visa Risk Profile

Visa still faces some competitive risk from their main industry rivals along with real ESG threats arising from regulatory changes and cybersecurity concerns.

The firm operates in a dynamic and evolving market, where consumer preferences, technological innovations, and competitive forces may affect its growth and profitability.

Visa has to constantly adapt to the changing needs and expectations of its customers, merchants, and partners, and offer new and improved products and services that enhance the value and convenience of its network.

Visa also faces stiff competition from other payment networks, such as Mastercard (MA), American Express (AXP), and Discover (DFS), as well as from digitally native players, such as PayPal (PYPL), Square, Stripe, Alipay, and cryptocurrencies. Visa must continue to innovate and differentiate itself from its competitors to ensure it does not fall behind in the long-term.

The firm also faces a real ESG threat of a complex and constantly changing regulatory environment.

Quite simply, there are a massive number of laws and regulations that may affect Visa’s pricing, fees, interchange rates, data protection, privacy, anti-money laundering, anti-trust, and consumer protection procedures.

Visa may face fines, penalties, lawsuits, or reputational damage if it fails to comply with the applicable rules or if it is involved in any legal disputes or investigations.

Furthermore, as a digital payment network, Visa is exposed to various cybersecurity and fraud risks that could compromise its data, systems, and reputation. Visa has to constantly invest in security measures and technologies to prevent, detect, and respond to cyberattacks and fraudulent activities.

Despite these real ESG threats, I believe Visa would still make for a solid ESG conscious investment pick given their current ability to safeguard against these threats from damaging their business operations.

Of course, opinions may vary and I urge you to conduct research of your own into Visa’s ESG risk profile should these matters be of particular importance to you.

Summary

Visa continues to be a world leader in digital payments with a pretty solid Q1 2024 report providing a positive start to the new fiscal year for the firm.

The firm’s continued ability to generate real returns, expand their operating margin and net incomes all the while achieving 9% revenue growth despite a softening macro-economic environment is simply impressive.

Current valuations suggest that shares may be around 8% undervalued with seemingly not all of the firm’s 2024 potential being baked-in to shares just yet.

However, as illustrated by my bear-case IV calculation, any miss in topline earnings growth could leave firms trading at what would be a reasonable overvaluation. This highlights how contingent the current valuations are on continued growth at Visa.

Nevertheless, I still really like the firm’s business model and view Visa as possessing multiple competitive advantages heading into 2024. While the firm doesn’t necessarily make for a deep-value opportunity, I believe it is a compelling GARP choice given their continued growth prospects for years to come.

I therefore continue to rate shares a Buy at present time with a Strong Buy rating being initiated once a base-case undervaluation provides a 25% margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.