Summary:

- Visa has consistently delivered solid double-digit growth and is a beneficiary of the switch from cash to electronic payments.

- The company has shown operating leverage and effective buyback programs, resulting in strong EPS growth.

- Visa’s growth trends are expected to continue, and its valuation is in line with historical levels and compared to its competitor Mastercard.

- Visa has the edge over Mastercard as its size and low net debt enable M&A to maintain its technological advantage.

Justin Sullivan

When Buy And Hold Works

When a company puts up solid double-digit growth year after year, there is rarely a reason to sell it, even if it looks expensive compared to the general market. That is especially true when the company is a beneficiary of a secular trend like the switch from cash to electronic payments. That has been the case with Visa (NYSE:V) since its IPO in 2008. I rarely write about Visa here, covering it only twice – once in 2019 and once in 2020. Nevertheless, it is my second largest holding, at 7% of my account. While I traded it a few times between the IPO and early 2011, I wised up in August 2011 and bought the position I hold today, earning a 14-bagger including reinvested dividends, or nearly a 24% annualized rate of return. Despite the strong stock performance, the investment thesis has not changed much since I last wrote about it. Still, it is worth checking up on to make sure the growth trends are still intact and the stock has not gotten ahead of the company’s financial performance.

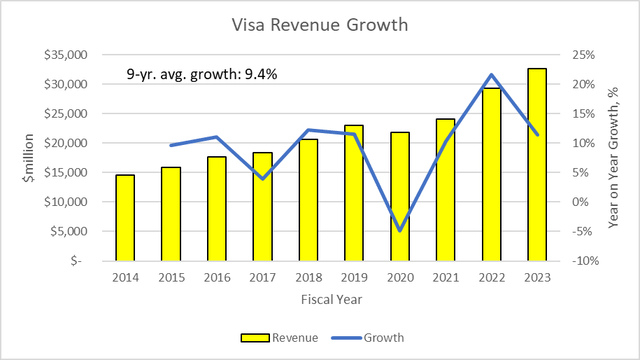

Visa’s solid growth trends were interrupted only in 2020 by the pandemic. After a strong bounce back in 2021 and 2022, growth returned to long-term rates in 2023. Another characteristic of a solid long-term buy and hold stock is its ability to deliver operating leverage, meaning that cost control allows net income to grow faster than revenues. An effective buyback program allows EPS to grow still faster. In the case of Visa, the company has averaged a revenue growth rate of 9.4% per year over the last 9 years.

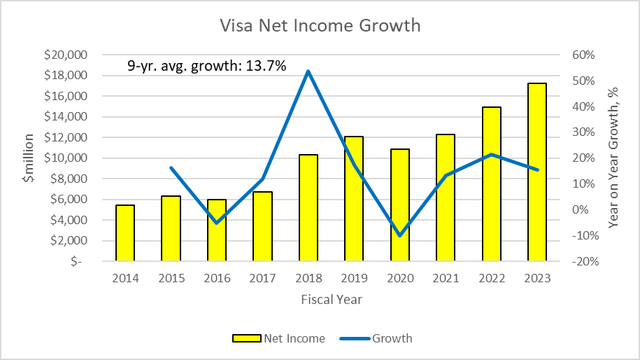

During this time, Visa kept operating expenses under control, growing them around as fast as revenue. The company was still able to grow net income faster than revenue thanks to increasing net interest and investment income. Visa also benefited from a lower tax rate from 2019 forward thanks to the Tax Cut and Jobs Act. As a result, Visa grew net income by an average of 13.7% per year.

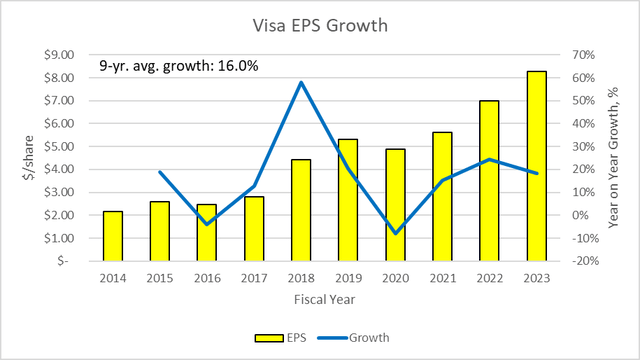

Visa used its strong cash flow not only to avoid adding debt, but to reduce share count. Over the 9-year period, the company bought back 18.1% of outstanding shares at the start of the period. This produced EPS growth averaging 16% over the period.

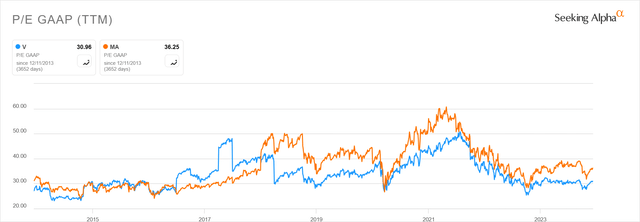

All this history is interesting but of course the relevant question for investors is whether the growth trend can continue into the future and whether or not the share price has gotten ahead of these growth expectations. To answer this, we can look at predictions for the global payments industry and how Visa actually makes money. Finally, we will look at stock valuation, which will show that even at record high prices, Visa’s earnings multiple is not out of line with history and is valued fairly with its key competitor Mastercard (MA).

Outlook

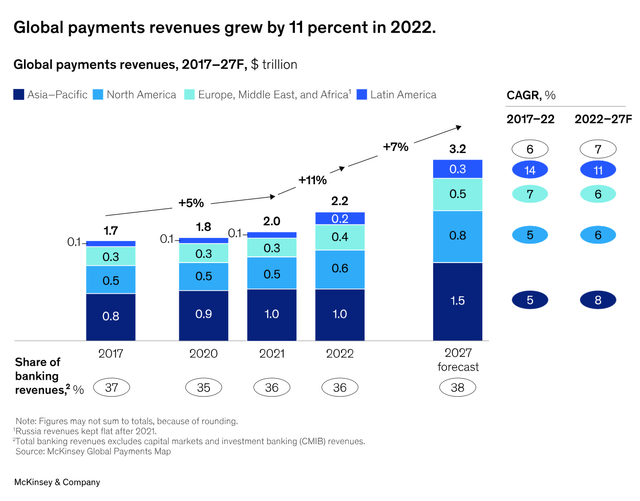

The latest McKinsey Global Payments Report shows global payments revenue grew at about 6% per year from 2017-2022 (5% for the first 4 years and 11% in 2022). As we see on the revenue growth chart in the last section, Visa beat this industry growth rate considerably. Looking forward, McKinsey predicts higher growth over the next 5 years than the last 5, estimating a 7% annual growth rate.

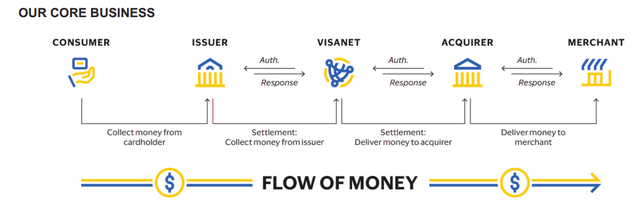

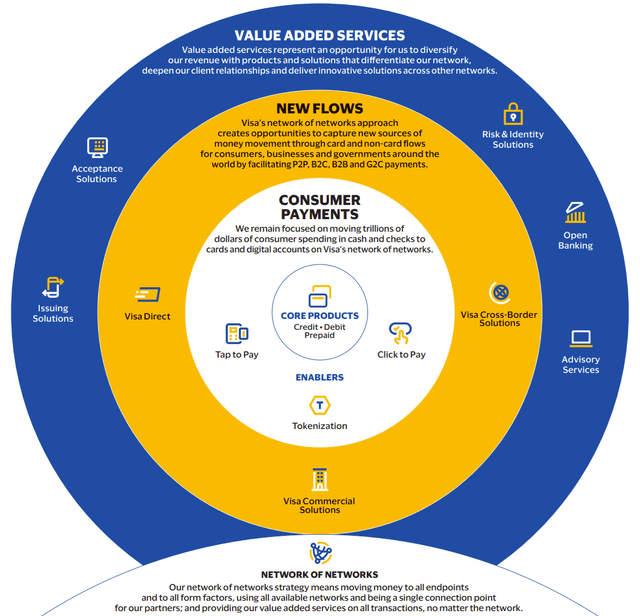

So, how does Visa actually make money off of global payments, and can they continue to grow faster than the industry overall? Visa is not a bank and does not hold loan balances or earn interest off them. When a consumer uses a Visa card to pay for goods or services from a merchant, Visa operates the network that transfers cash from the bank that issued the consumer’s card to the merchant’s bank. Visa keeps a tiny portion of the transferred funds as its revenue. Visa’s advantage is in its speed and scale, as it processed 212.6 billion such transactions in FY 2023, up 10% from the prior year. That works out to 6,742 transactions per second.

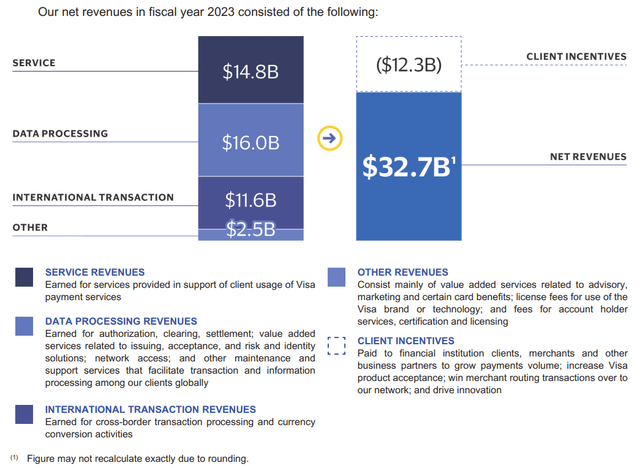

In addition to this core function, Visa provides tools to its partner banks to assist them with credit approval, card issuance, risk management, and fraud protection. Visa also provides other advisory services. The company also earns a substantial chunk of revenue on additional charges for cross-border international transaction processing and currency conversion services. This revenue source was the most disrupted in 2020 by the pandemic but is now back to its long-term trend with 16% growth last year. All regions now have significantly higher cross border transaction volume compared to 2019 except for China. The McKinsey report also sees continued strong cross border transaction growth in the future.

In recent years, Visa has been an actively acquiring fintech businesses and developing in-house products such as Visa Direct to move beyond the classic consumer to business payment solution. With direct payments, Visa can also participate in person-to-person transactions, business-to-business, and payments from both businesses and governments to consumers.

After adding in other income which includes marketing and licensing fees, and subtracting incentive rebates paid to partner banks and merchants, we get Visa’s net revenue. This was $32.7 billion in FY 2023, up 11.7% from 2022. Looking ahead to FY 2024, Visa’s guidance is for continued similar growth, which it phrases as “High single-digit to low double-digit” revenue growth.

Moving down the income statement, Visa also expects to continue generating positive operating leverage in 2024 by growing costs less than revenue. Operating expense growth is expected to be flat on a GAAP basis or up “high single digits” on a non-GAAP basis. The company also instituted a new $25 billion buyback program in October. With the operating leverage and share count reduction, EPS is therefore expected to grow by “high teens” GAAP or “low teens” non-GAAP in FY 2024.

Valuation And Peer Comparison

I am estimating EPS of $10 for Visa in FY 2024, which would represent 14% growth from the non-GAAP result in $8.77 for FY 2023. That is a P/E of 25.65 and a PEG ratio of 1.8. Mastercard uses a calendar fiscal year, in contrast with the October-September fiscal year used by Visa. Mastercard has not yet issued guidance for 2024, but analyst consensus is for EPS of $14.24, 17% growth from 2023. That results in a P/E of 29.2 and a PEG ratio of 1.7. Neither stock is particularly expensive right now relative to its history.

Visa has a slightly better dividend yield than Mastercard, but neither one is significant with Visa’s 0.8% yield compared to Mastercard’s 0.6%. Both companies recently announced a 16% dividend raise from last year. On the buyback front, Mastercard has been slightly more aggressive, repurchasing 2.45% of outstanding shares annually on average over the past 9 years, compared to Visa’s 2.20%. So, looking at total capital return, both are nearly identical.

So far, the two companies are neck and neck on valuation metrics, but Visa has an important edge on two metrics: total size and net debt. Both are important when it comes to capacity to make acquisitions. Both companies depend on network effects to retain customers. Startup fintechs with new technology are an ongoing threat, so the ability to buy and integrate these companies is a key tactic in maintaining a competitive moat. With the bigger cash hoard, Visa has the advantage as an M&A player and also benefits more in a high interest rate environment.

| $bn | V | MA |

| Market Cap | $514.00 | $386.50 |

| Book Equity | $37.04 | $6.31 |

| Cash | $20.13 | $7.49 |

| Net Debt | $1.17 | $7.62 |

| ND/E | 0.03 | 1.21 |

Conclusion

Visa has delivered consistent, strong growth over its whole existence as a public company, and all indications are that this will continue thanks to the secular trend of payments moving from cash to electronic. Visa, along with Mastercard, both have strong networks, allowing them to grow even faster than the industry average. While the two companies look similarly valued, Visa has the edge with its size and lower net debt, making it easier to buy and develop emerging technologies in the fintech space to maintain its advantage. While the company looks expensive relative to the general market, it is in line with historical valuations and therefore still worth buying at these levels for the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.