Summary:

- The stock market is experiencing a strong bullish momentum, with the Dow Jones Industrial index hitting new all-time highs.

- Visa, a dividend growth stock, is still trading at an attractive valuation and has consistently outperformed the market.

- Visa’s growth prospects, high transaction volumes, and predictable business model make it an attractive investment with potential for future dividend growth.

Justin Sullivan

An everything rally.

A classic melt-up.

Santa Claus coming to town…

Call it what you will, but this bullish momentum in the stock market is making it hard to go shopping.

The Dow Jones Industrial index just crossed up above the 37,000 threshold for the first time, hitting new all-time highs. The S&P 500 hasn’t hit record levels yet, but it’s still up by roughly 12.5% since the end of October.

That’s a big move in a short period of time…and this rally has pushed just about every company on my watch list up above my fair value estimate.

Thankfully, one of my favorite dividend growth stocks is still trading with an attractive valuation attached. This company is known for consistently beating the market. It’s up more than 380% during the past decade (crushing the S&P 500’s 159.6% gains). And moving forward, I expect to see this outperformance continue because of the stock’s outsized growth prospects.

I’m talking about Visa (NYSE:V), which is still trading at a discount here in the $260 area.

Visa: This Ultimate Toll Booth

I recently highlighted Visa as one of my favorite perpetual compounder picks.

I provided bullish analysis of this company, alongside its peer, Mastercard, writing:

“Sticking to the financial services space, I’m very bullish on both Visa and Mastercard (MA) over the long term. As we move towards a cashless society, digital payment volumes continue to increase. There has been talk of things like crypto disrupting legacy payment systems like the networks that V and MA have built over the years, but I’m not seeing that yet (and I trust their management teams to take the necessary steps to evolve and adapt alongside crypto as it matures). Rising volumes are great for these two companies because their business models are akin to toll booths. They don’t deal with consumer credit (that’s a big plus in my mind; unlike peers such as Capital One or American Express, defaults and delinquency aren’t concerns for V/MA shareholders). Every time that someone makes a transaction with a Visa or Mastercard card, the company collects what’s called a credit card assessment fee. For Visa it’s 0.14%. For Mastercard it’s either 0.13% or 0.14% (on large transactions). That might not seem like much, but Visa, for instance, has processed more than 276 billion transactions during the past year, with its total TTM payment volume rising up above $15 trillion. These companies partner with financial institutions who offer cards to consumers (such as banks or retailers). Those partners collect larger fees (between 1 and 3% typically). And the consumer gets best-in-class fraud protection and access to payment networks accepted by hundreds of millions of merchant locations in 200+ countries across the world. This arrangement is a win-win-win for all parties involved. The ease, simplicity, and predictability of the toll booth model also results in fantastic gains for shareholders as well.”

But unlike Mastercard at its current price, I believe that Visa shares are attractively priced.

When it comes to toll booths, it doesn’t get much better than Visa. This company’s total transactions last year were 276 billion. Management notes that this means that Visa’s credentials were used more than 757 million times per day in fiscal 2023.

Its transaction growth during 2023 was 10%. And the total volume of these payments increased by 9%. Total commercial volumes were $1.57 trillion last year. And all of those little fees that Visa collected on these payments added up.

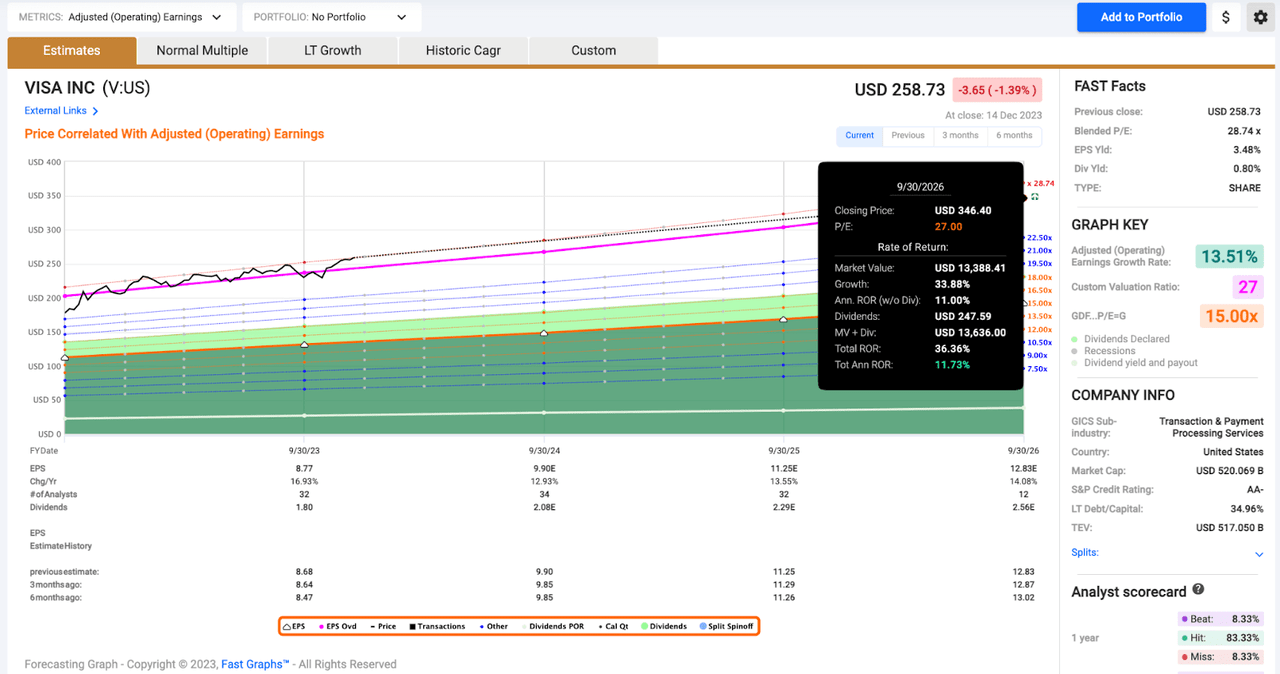

As you can see below, the company posted double digit growth in every major top and bottom-line measurement:

Visa Q4 Earnings Report

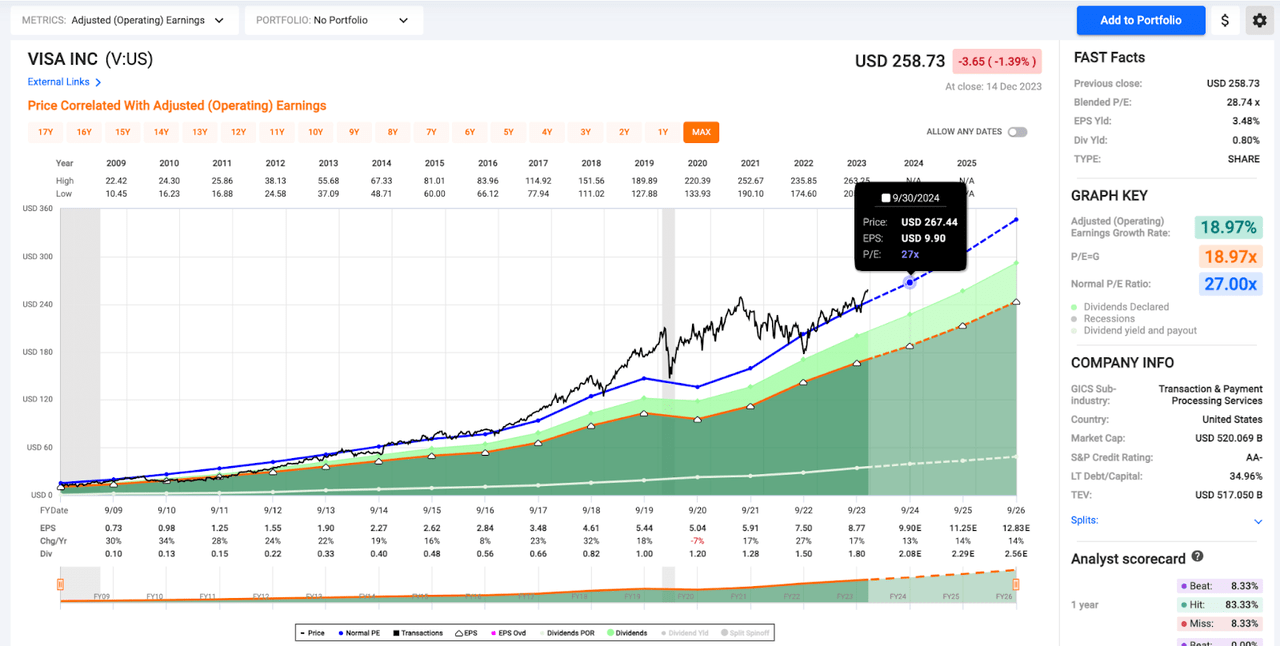

And this level of growth has been consistent since Visa’s IPO in 2008. Since going public, Visa has generated positive annual EPS growth during 14 out of its 15 fiscal years. What’s even more impressive is that Visa has produced double digit annual EPS growth during 13 out of its 15 years as a public company.

And it doesn’t appear as this growth is going to stop anytime soon. During its Q4 report, Visa noted that its merchant locations grew by 17% during 2023 (largely driven by success penetrating fast growing Latin American and Asian markets). The company signed over 500 commercial partnerships on the year, up 25% y/y. I’ve heard talk of Visa getting disrupted by crypto; however, all signs point towards this company’s global ecosystem expanding rapidly.

Right now, the consensus analyst estimate for Visa’s EPS growth in 2024 is 13%. That figure is 14% for 2025. So, it appears that Wall Street agrees with my bullish growth outlook.

All of this fundamental growth has led to fantastic dividend growth for Visa shareholders. Sure, the stock only yields 0.79%. But, that’s not due to a lack of generosity.

Visa shares have posted gains of over 1,550% since their IPO. When your stock price rises at such a rapid rate, it’s difficult to maintain a high yield (remember, dividend yields maintain an inverse relationship to stock prices).

But, management has done a valiant effort trying to keep up the pace with dividend growth. Visa’s 5-year dividend growth rate is 16.27%. At the end of its first fiscal year, Visa’s dividend was $0.10/share.

Today the company’s annual dividend is $2.08. That’s a post-IPO CAGR of 22.4%.

Visa’s most recent dividend raise came in at 15.6%. And looking at the company’s earnings growth rate expectations and payout ratio (just 23.7%), I think annual dividend growth in the ~15% range is sustainable over the next 3-5 years (at least). At that rate, the size of Visa’s dividend will double every 4.8 years.

If I’m correct and Visa is able to maintain its current pace of dividend growth, it means in 10 years’ time Visa’s annual dividend should be in the $8-$9.00 area. That’s a future I look forward to as a long-term shareholder.

Simply put, as far as compounding sales, earnings, cash flows, and dividends go… it doesn’t get much better (or better yet, reliable) than Visa.

Visa: Still Attractive At All-Time Highs

Because of Visa’s unique growth prospects and the high margin, predictable nature of its toll booth-like business structure, Visa has always traded with a high premium (relative to the market) attached to shares.

That premium makes perfect sense and for years, I’ve been willing to pay it.

That remains the case today.

Since its IPO, Visa’s average P/E ratio has been 27x. And during the last 5- and 10-year periods, Visa’s averages are even higher, at 32.0x and 29.2x, respectively.

I think that long-term 27x multiple is fair.

That’s a ~2.0 forward PEG, which is a fair multiple for growth that is of Visa’s quality/reliability.

What’s more, because of the predictable nature of Visa’s growth (and its long-term growth prospects), I apply that multiple to forward earnings when arriving at my fair value target.

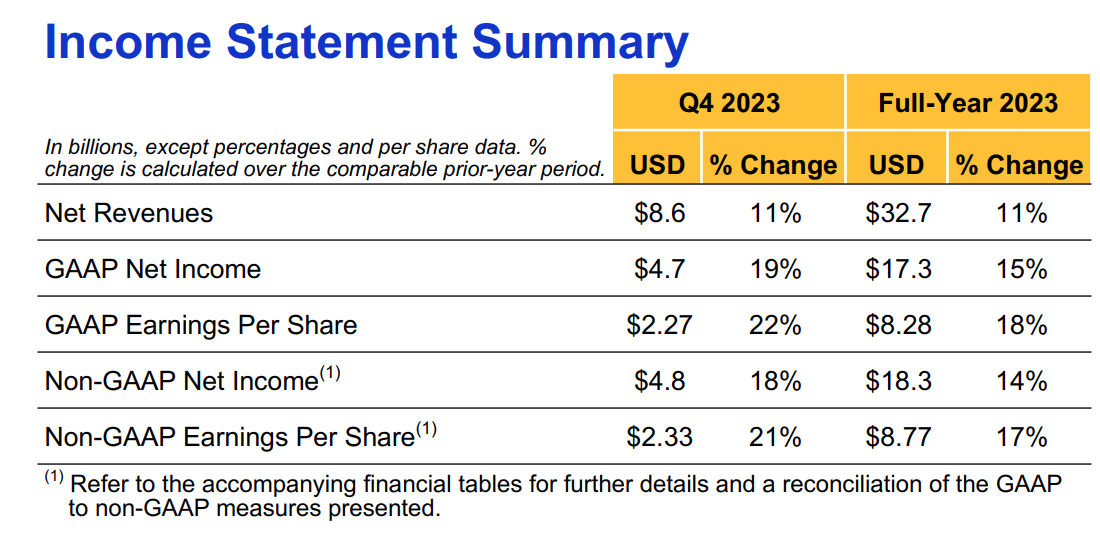

Therefore, as you can see on the chart below, I’m estimating that Visa is worth approximately $270/share.

FAST Graphs

I say $270 instead of the exact $267 that 27x the current analyst consensus for 2024 is because I expect Visa to beat those estimates. After all, Visa has beaten Wall Street’s expectations during 19 out of the last 20 quarters.

I think EPS will be at least $10.00/share next year. And due to the extremely high quality nature of Visa’s company, I’m happy to pay fair value.

For blue chips like Visa, I stick with the classic Warren Buffett mantra: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

In other words, I don’t need to see a margin of safety to comfortably buy Visa. When a company is growing its earnings at a double digit rate it doesn’t take very long for fair value estimates to rise.

All of my fair value calculations are based upon future earnings and cash flows, and therefore, I suspect that it won’t be long before I edit that $270 figure higher (this time next year, that estimate will likely be in the $300 area).

As another classic saying goes (this time, an old Chinese proverb): “The best time to plant a tree was 20 years ago. The second best time is now.”

I believe that’s also the case with buying high quality dividend growth stocks that produce regular fundamental growth. And if you don’t believe me, ask someone who bought Visa 15 years ago at its IPO how they feel about the stock. Up 1,500%+ with a yield on cost of approximately 15%, I’m sure they’re loving the money tree they planted.

If Visa continues to hug that 27x level and grows its EPS like Wall Street expects, then by buying shares today, I’d be setting myself up to generate an annualized rate of return of nearly 12% over the next 3 years or so.

That’s a CAGR that I’m more than happy with, and therefore, Visa remains a top target on my watch list.

Conclusion

I have a bit of cash that I’d like to put to work in the markets before the month is over. It’s not burning a hole in my pocket because of the market’s recent macro rally.

I know that historically speaking, Santa Claus rallies push the market higher during the last week of the year, so waiting to invest those funds might come back to bite me.

Right now they’re earning 5% in a Fidelity money market fund, so there’s no rush.

And if I see a slight pullback in the markets, Visa will be a top target.

I want to see if any other attractive opportunities arise (Visa is already a top-10 position for me, so I wouldn’t mind adding funds to other high conviction bets with lower weightings). But, if I’m able to buy Visa shares at a discount to fair value, then I’ll be happy with my purchase.

That would be a great way to end 2023 and I’m grateful that this blue chip still looks cheap after the market’s recent rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADC, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CARR, CME, CMI, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, DLR, ECL, ENB, ESS, FRT, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, LOW, MA, MAIN, MCD, MCO, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.