Summary:

- Visa is a dominant player in the payment processing industry with impressive financial growth and innovative offerings.

- Despite high quality and growth, shares of Visa are pricey, making it a challenging investment for value investors.

- Management’s commitment to innovation and strong financial performance make Visa a solid long-term investment, but shares remain expensive.

Atstock Productions

With a market capitalization as of this writing of $552.9 billion, Visa (NYSE:V) is not just a behemoth in the payment processing space. It’s a behemoth in the market in general. The company is a massive global player that dominates much of the payment processing industry. And as the world continues to develop, management has been successful in growing the company’s top and bottom lines. Unfortunately, this kind of quality also comes at a hefty price. And for a value investor like me, that premium can be a dealbreaker.

This is not the first time that I have talked about how pricey shares of Visa are. Back in March of this year, I wrote an article about the company wherein I discussed the quality operation that management has built over the years. However, I also stated that shares were getting awfully close to warranting a downgrade. Since I reaffirmed my ‘hold’ rating back then, the stock has indeed underperformed the broader market, experiencing total downside of 1.8% at a time when the S&P 500 is up by 3.8%. Looking at new data that’s available, which covers the second quarter of the 2024 fiscal year, I remain convinced that the company is not an ideal opportunity for investors to buy into at this time. But with improved fundamentals, I also think it would be premature to downgrade the firm.

Taking another look

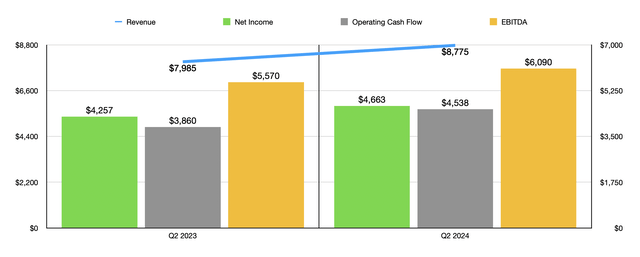

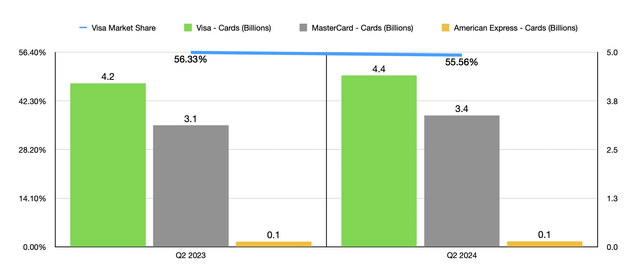

Author – SEC EDGAR Data

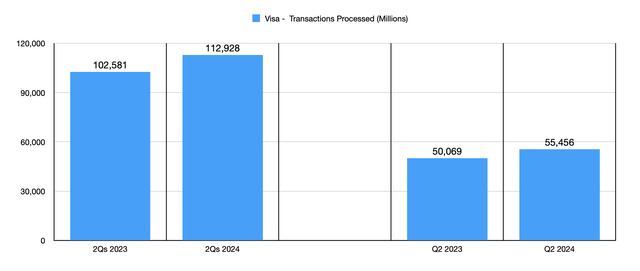

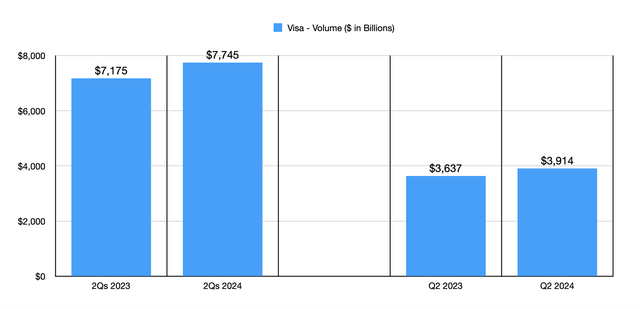

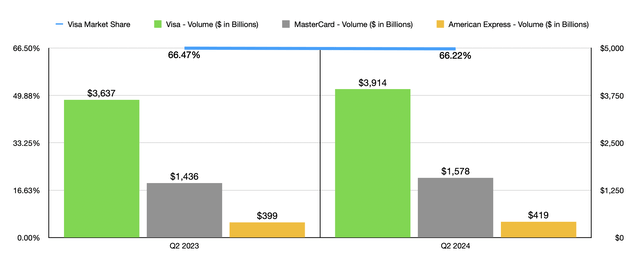

Fundamentally speaking, things have been going quite well for Visa. Take financial performance from the second quarter of the 2024 fiscal year as an example. During that time, the business generated revenue of $8.78 billion. That’s 9.9% higher than the $7.99 billion the company reported the same time of the 2023 fiscal year. This expansion has come with overall growth at the firm. For starters, year over year, the company has grown from having 4.2 billion debit and credit cards outstanding to having 4.4 billion. The number of transactions processed jumped by 10.8% from 50.07 billion to 55.46 billion. And this allowed the total global volume of payments to expand by 7.6% from $3.64 trillion to $3.91 trillion.

Author – SEC EDGAR Data

As with any high-quality industry leader experiencing attractive growth, you can expect the increase in sales to push profitability and cash flows higher as well. Net income for the business rose year over year, jumping 9.5% from $4.26 billion to $4.66 billion. Other profitability metrics followed suit as well. Operating cash flow increased by 17.6% from $3.86 billion to $4.54 billion. And lastly, EBITDA for the processing giant expanded by 9.3% from $5.57 billion to $6.09 billion.

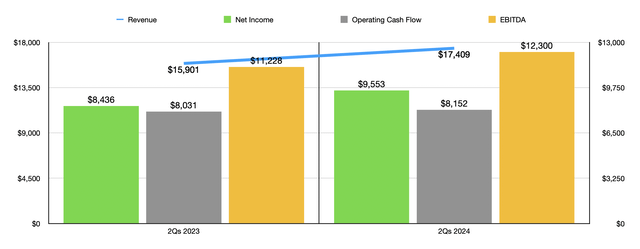

Author – SEC EDGAR Data

The second quarter on its own was not a one-time event. The fact of the matter is that, over the long haul, Visa has done nothing but grow. In the first half of 2024, for instance, the company reported revenue of $17.41 billion. This happened to be 9.3% above the $15.92 billion reported one year earlier. With the increase in cards, the number of transactions jumped from 102.58 billion to 112.93 billion, while the total volumes processed by the company increased from $7.18 trillion to $7.75 trillion.

Author – SEC EDGAR Data

As was the case with the second quarter on its own, for the first half of 2024 relative to 2023, Visa was successful in growing its bottom line. Net profits, for instance, came in at $9.55 billion for the first half of this year. That’s comfortably above the $8.44 billion reported one year earlier. Operating cash flow inched up only slightly from $8.03 billion to $8.15 billion. Meanwhile, EBITDA for the company managed to grow from $11.23 billion to $12.30 billion.

One of the problems with large, entrenched companies is that there is a tendency for management to rest on their laurels. This creates complacency that ultimately opens up the door of opportunity for other firms to step up to the plate. However, management has made clear time and time again that Visa will not be subjected to that kind of situation. The fact of the matter is that the company is highly innovative and that it is making interesting moves even as it stands today. The latest example of this actually came on June 13 when the company announced the relaunch of a program called SavingsEdge. This is a program that has been operational for more than a decade. Through it, Visa provides small business card holders with a variety of offerings like tools and other resources in order to help them make better decisions.

Another example of the company’s commitment to innovation came on June 4 when management announced the issuance of the company’s 10 billionth token. For 10 years now, Visa has used tokenization to improve security. In essence, tokenization replaces sensitive personal data of a user or an account with a cryptographic key that helps to obscure the data in question. In fact, about 29% of all transactions processed by Visa at this time utilize tokens. And that is almost certain to continue growing. This is because management recognizes the value that they bring to the table. According to their own research, tokenization technology has caused a six basis point increase in payment approval rates across the globe. This may not sound like much, but according to management, this represents an extra $40 billion in e-commerce revenue for businesses across the planet. And in fact, tokenization can reduce the rate at which fraud occurs by up to 60%. Through this effort alone, Visa estimates that the company has saved around $650 million as a result of reduced fraud, and that’s just in the past year.

Only a few weeks prior to this, the company also announced some other offerings. These were made public at the company’s annual Visa Payments Forum in San Francisco. These offerings include new tap to pay functionality, and other similar offerings. It also includes the firm’s Visa Payment Passkey Service, which is a feature that confirms a consumer’s identity and authorizes online payment using biometric scans of their face or fingerprint. Management is also integrating AI into some of its offerings in an effort to reduce fraud and encourage additional digital payments.

Author – SEC EDGAR Data

These kinds of innovations have made it possible for management to really grow the company into a dominant player in the space. However, this does not mean the company can overcome the competition in every instance. In the chart above, you can see the total number of credit and debit cards outstanding for Visa and how those numbers stack up against rivals Mastercard (MA) and American Express (AXP). With 4.4 billion cards right now, Visa controls about 55.56% of the market that the three firms I am looking at currently have. That’s actually down from the 56.33% seen last year. In the chart below, meanwhile, you can see overall payment volumes processed by each of the three businesses. In this case, Visa’s market share did decline from 66.47% to 66.22%. However, that is still a dominant stake in the space.

Author – SEC EDGAR Data

When it comes to the 2024 fiscal year in its entirety, management seems quite optimistic. Although they have not provided any concrete figures, they did say that earnings per share this year should rise at a rate that is in the low teens. If we simply annualized the results experienced so far, we would expect operating cash flow of about $21.07 billion and EBITDA of approximately $25.05 billion. Net profits, meanwhile, should come in at around $19.24 billion.

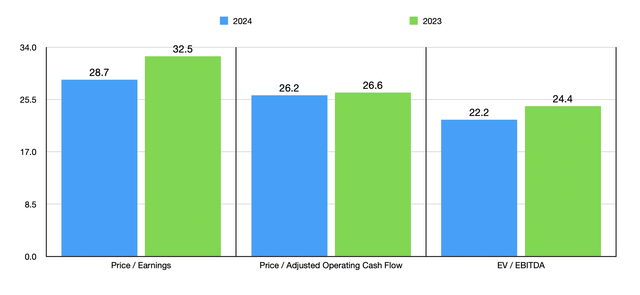

Author – SEC EDGAR Data

With these estimates, as well as historical figures for 2023, we can see how shares of the payment processor are priced as shown in the chart above. On an absolute basis, shares do look rather pricey. But that’s to be expected when you are looking at a high-quality industry leader. Relative to similar firms, shares fall in the middle of the group. In the table below, you can see what I mean. On a price to earnings basis and on a price to operating cash flow basis, Visa is between Mastercard and American Express. The table does not include an EV to EBITDA multiple for American Express because the structure of the institution is significantly different enough that this would not be an appropriate measure. In fact, I think one might even be able to argue that Mastercard as a whole is the more appropriate company to compare our candidate to.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Visa | 28.7 | 26.2 | 22.2 |

| Mastercard | 36.1 | 36.5 | 27.5 |

| American Express | 18.9 | 6.9 | N/A |

Takeaway

From the data that’s currently available, I must say that I remain impressed by the fundamental health and continued growth exhibited by Visa. The company is a solid player and I see no reason why investors should expect anything other than a continuation of this excellence in the long run. Management has proven itself to be highly innovative, and the company is a true cash cow. Having said that, while shares are cheaper than rival Mastercard, they are still quite lofty on an absolute basis. Given this, I think it’s only appropriate to keep the company rated a ‘hold’ at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!