Summary:

- The pandemic boosted Visa’s payment network.

- Its stock price, however, has not been equally rewarded.

- Visa continues to generate double-digit top-line growth alongside strong profit margins.

- Now trading at 27x earnings, the stock looks ready to take off.

MoMo Productions

Visa (NYSE:V) is typically a stock market leader, but the stock has gone nowhere since the pandemic started. This is in spite of V having greatly increased its network since pre-pandemic levels as the pandemic helped to accelerate the shift to cashless payments. V continues to generate robust free cash flows and reward shareholders with share repurchases and growing dividends. A successful investment in V largely counts on the potential for multiple expansion, something that appears quite likely given the strong execution and highly visible growth runway.

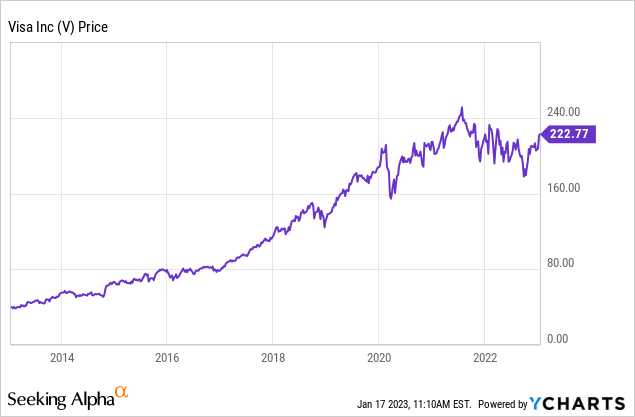

V Stock Price

V stock seemingly did not know the existence of gravity until the pandemic hit, and it has found itself rangebound ever since.

I last covered V in February of 2022 where I rated it a buy on account of the secular growth and ongoing share repurchases. The stock has gone nowhere since then which in conjunction with the growing earnings has led to significant multiple contraction.

V Stock Key Metrics

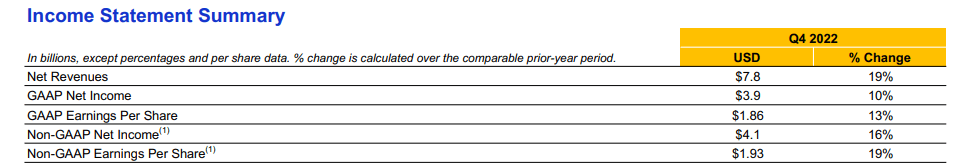

In large part due to its use across a wide breadth of industries, V has been able to deliver solid growth in spite of tough pandemic comps. The most recent quarter saw revenues grow by 19% YOY and non-GAAP earnings per share to grow by 19% as well.

2022 Q4 Presentation

As can be expected, much of that growth was driven by ongoing expansion of its payments network. V increased credentials by 9% YOY and increased merchant locations by 11% YOY.

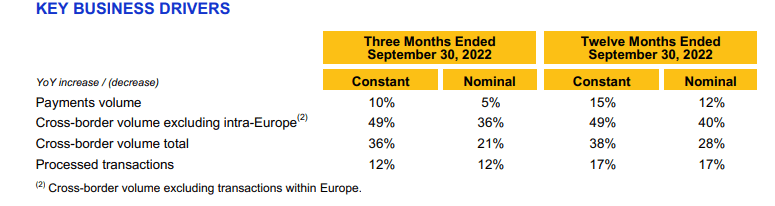

Yet even more significant was the ongoing recovery from pandemic lockdowns, as a recovery in the travel sector helped V deliver strong cross-border volume growth.

2022 Q4 Presentation

On the conference call, management noted that the travel recovery has been strong but comes in spite of China having not yet fully reopened. Management noted that travel in and out of Asia has recovered to almost 70% of 2019 levels. I expect that recovery to gain steam as China has finally reopened its economy.

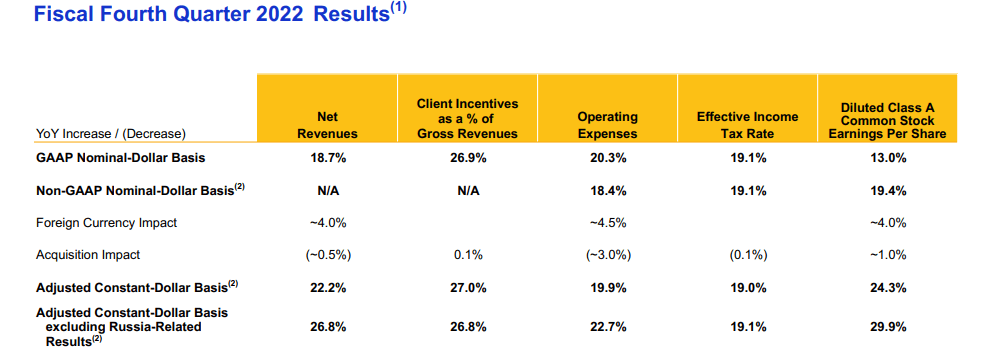

One should also note that V’s strong financial results came even as it exited Russian operations earlier in the year. Excluding its exit from Russia, earnings would have grown by nearly 30% on a constant currency basis.

2022 Q4 Presentation

Management expects that Russian exit to impact the next two quarters before the company fully laps the transition.

V ended the quarter with $20.6 billion of cash & investments versus $22.5 billion of debt. The sturdiness of this business arguably warrants significant leverage, something I expect the company to make ample use of over the long term.

For the full year, V repurchased $11.6 billion of stock which, together with the $3.2 billion of dividends, were fully funded by free cash flow.

Looking ahead, management expects “normal year-over-year growth rates in the low-double digits” followed by 9% expense growth. That guidance incorporates no expectation of a recession.

Is V Stock A Buy, Sell, or Hold?

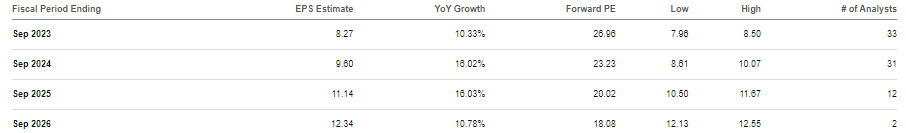

At recent prices, V was trading at just under 27x earnings. That is a reasonable multiple for a name that is expected to sustain robust double-digit earnings growth for many years.

Seeking Alpha

V has historically traded at around 35x earnings, implying just over 20% potential upside from multiple expansion alone. Along with double-digit growth and the ongoing 4% earnings yield, I could see V easily delivering double-digit returns even without multiple expansion. I note that if V eventually levers its balance sheet up to 2x debt to EBITDA, then that could lead to another 10% to 15% of earnings growth alone.

What are the key risks? The most near-term risk is that of volatility. V is not “that” cheap, especially if one is open to appreciating the value in beaten down tech stocks. Investors should brace themselves for the possibility that non-tech sectors experience a material valuation contraction after outperforming tech stocks over the past year. I noted above that V’s guidance includes no assumption of recession. As a result, the company might underperform expectations given that banks are now expecting some sort of recession as a base case. Another risk is that of regulation. For instance, the Credit Card Competition Act may threaten V’s duopoly with Mastercard (MA). While I can see V trading at higher multiples as discussed above, I wouldn’t be surprised to see the multiple decline precipitously if such a bill were to pass. V may be able to continue benefiting from the cashless transition regardless, but the prospects of losing market share would undoubtedly have some toll on the multiple. An investment in V likely requires the belief that such legislation cannot pass. I continue to find V buyable here, as at the very least the company is enjoying the low valuations through its ongoing share repurchase program.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!