Summary:

- The company’s fair value by the historical method is 29x earnings.

- The current price upside based on technical analysis does not exceed 5.5%.

- Visa has significant levels of net margin of 55% and return on equity of 50%.

- Earnings-per-share is expected to grow 13-14% with acceleration in 2028, and revenue growth is projected to be more stable.

- The global card market is expected to grow at a 7.9% CAGR over the next 4 years, reaching $458b.

FinkAvenue

I have been a long-term shareholder of Visa (NYSE: NYSE:V, NEOE:VISA: CA) and I am starting to cover the stock on Seeking Alpha with a Hold rating. Quantitative analysis has shown that the company has significant competitive advantages, which allows us to expect an acceleration in earnings growth in the next 3 years. Visa is an investment in finance and IT simultaneously, as well as the mix of mature company and growth story. However, the company’s current valuation is fair to me and does not leave significant short-term potential for justified upside.

Thesis Explanation

For the first coverage, I usually do a full review of the business, starting with a detailed study of the value provided to customers, revenue breakdown, and an examination of market size and trends. Then, I analyze the financial statements from a quantitative perspective, and only then do I come to the valuation and fair price calculation. But today, I will try a reverse format. I will start with the fair value.

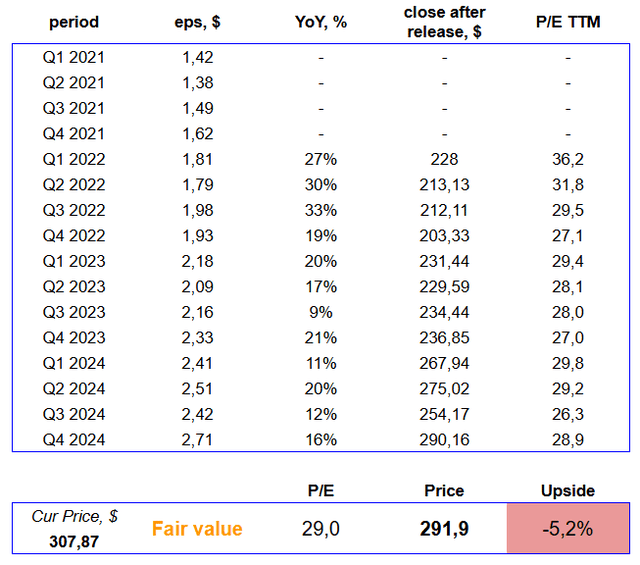

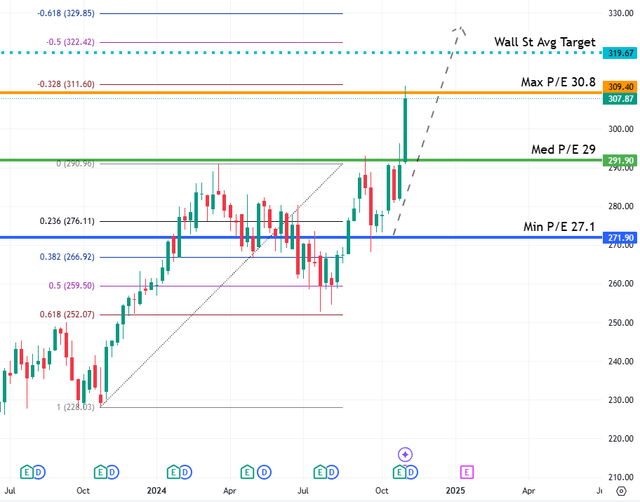

Visa currently trades at 30.4x earnings or 27.3x forward P/E. Seeking Alpha rates the company’s valuation an “F”, and I can confirm that statement using another method. I like unbiased quantitative analysis that doesn’t compare companies to each other, but rather looks at the historical valuation of a company relative to itself. If I calculate Visa’s TTM valuation for the close after its earnings release, which I’ve done below, the median P/E is 29. That’s a price of $292, or 5.2% below the current level (as of 8 Nov). I call that level “fair value”.

V quantitative fair value by historical P/E method (Author`s calculations)

I think this method is quite reasonable because it is not dragged into the sell side and takes into account only the company’s profit and the closing price on the market. If the norm (that’s how I interpret the median) of the assessment of such a mature business as Visa is 29 over the past 3 years, I see no reason for significant changes soon.

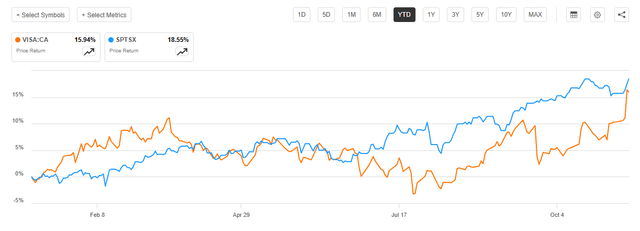

I am not a big fan of technical analysis (although I used to be) and today, as a long-term investor, I rarely use it. Except for one pattern on the weekly time frame, which is called “impulse-correction-impulse”. V chart today allows observing its implementation. After the growth from $230 to $290 at the junction of 2023 and 2024 and the subsequent correction by 50% (almost 61.8%) after setting the all-time high, I see the target range of $322-329, which coincides with the Street analysts’ average forecast.

Visa tech analysis (Author`s technical view. Data: Tradingview)

The growth potential, if I take the middle of the range I have indicated, is not great (~5.5%). It is also worth considering that the level of $309, which we touched upon when the report was published, corresponds to the price level of 30.8x profits, and this is the median of the upper percentile of historical value. In simple words, this is the best-case scenario, after which the stock becomes overbought for me.

In this scenario, I set a “Hold” rating because there is not enough upside to “Buy” and there are no compelling reasons to “Sell”. I believe Visa is an extremely valuable, efficient, and growing business that is attractive to long-term investors. However, in such companies, the entry point and timing of adding a position are extremely important to maximize income. Even though the yield is almost equal to the yield of the S&P 500 (SPX) index YTD, over a 5-year interval, the S&P500 return (13.9% CAGR from Nov 19 to Nov 24) outperforms Visa’s (11.1%), even if we add the average dividend yield for the same period of 0.8%.

VISA:CA vs S&P500 (Seeking Alpha)

The $270-280 range has been my go-to for adding to my position this summer and I plan to continue doing so. Here are the reasons why I think regular Visa purchases are justified.

Excellent Profitability

Do you know what I like, and what excites me about Visa most? This company belongs to the financial sector, takes all the corresponding benefits from the growth cycle, but does not bear typical financial risks (reserves, write-offs) and reacts extremely quickly to economic recovery. At the same time, the core of its business is closer to tech, but without the need for serious R&D expenses and CAPEX. Therefore, at the output, Visa is a company with a 55% net margin and 50% ROE. Capital expenditure does not exceed 6% of net income, and operating cash flow fully confirms the accrued profit from the income statement. For me, the company’s investment attractiveness begins with adequate financial performance indicators, which demonstrate the presence of competitive advantages. In the case of Visa, the numbers indicate its obvious presence. Visa is stable in the market and dominates in many segments. It accounts for more than 60% of the card market in the USA in 2023, according to Statista.

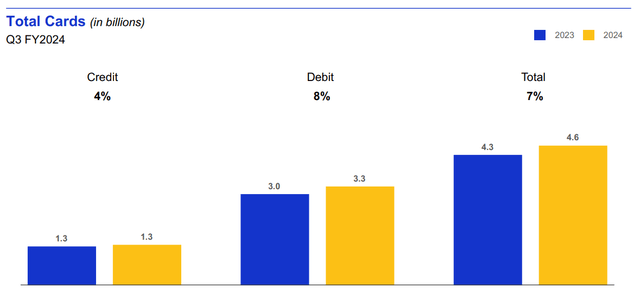

In total, there are approx 19 billion cards in the world today (2.3 for each person on earth, including children and the economically inactive population – not bad). Every fourth one operates on the Visa payment system. If we exclude the Chinese UnionPay, which is protected by administrative and legal barriers, then Visa is the world leader, continuing to issue new cards with a very good pace of 7% YoY growth rate.

An Ongoing Growing Story

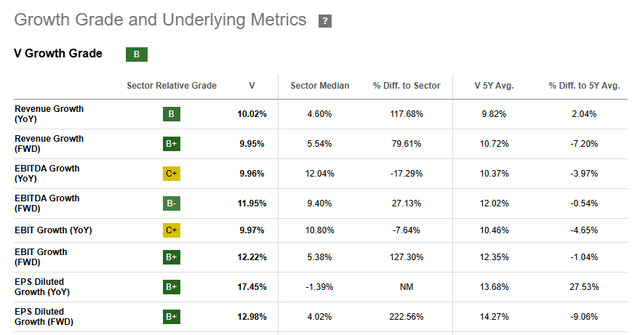

Seeking Alpha gives a pretty high “B” grade to Visa’s business growth. Again, I agree with this more than not. And if I disagree with something, I’m even more bullish on these points. However, in addition to that analysis, I also have an alternative metric to share.

But before that, I want to highlight a few numbers.Revenue is growing at a rate of 14.2% (3-year CAGR), which is better than the industry as a whole. It is also higher than the growth rate of a longer 5-year period, which hints to me about the growing phase of the cycle for the company’s business. The same story with earnings (+10% CAGR 5-years) and EPS (+12.8%).

However, the consensus on future growth rates is even more positive. EPS is expected to grow 13-14% with acceleration in 2028, and revenue growth is projected to be more stable approx +11/12% YoY. And this is exactly the story that investors are buying today, in my opinion. However, I repeat, it is financially safer to do this at $270-280.

Why do I have more confidence in the consensus forecast? Let me return to my alternative metric. Visa has beaten EPS expectations for the last 16 quarters, with an average YoY growth rate of 19.6%. To measure the sustainability of growth, I use the ratio of the average growth rate to the standard deviation, which was only 7.5%. This ratio is 2.6, which is an outstanding indicator (I haven’t seen an indicator above 1 for a long time), meaning that the track of Visa’s EPS is statistically stable and predictable. For me, Visa is not only a mix of financials and IT, but also a balance between maturity and growth.

Fundamental Growth Drivers

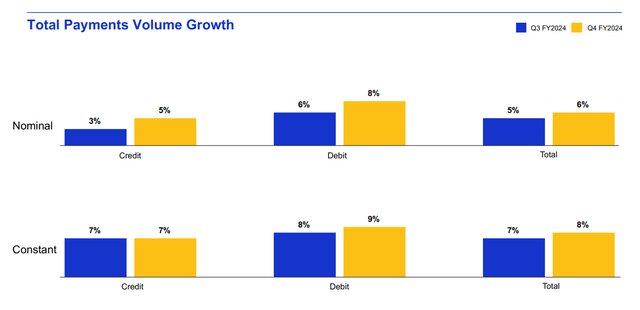

Visa makes money by providing financial services and data processing. The core of the business remains Consumer Payments, where the company is working on increasing turnover in the direction of tap-to-pay and click-to-pay services, as well as tokenization. However, the company also wants to strengthen its already dominant position in the market by working on additional revenue growth drivers.

These include Visa Direct, which can use third-party payment systems to simplify transactions (for example, Western Union). Also, commercial solutions for small and medium businesses, such as Visa B2B Connect. The latest Cross-Border solutions at some point in time can replace the bank for clients, providing real-time foreign exchange rates, enhanced liquidity and settlement capabilities.

In particular, for these purposes, the completion of the acquisition of Featurespace was finally announced. It is a “developer of real-time artificial intelligence payments protection technology that prevents and mitigates payments fraud and financial crime risks”.

According to The Business Research Company, the global card market is expected to grow at a 7.9% CAGR over the next 4 years, reaching $458b. Given the strong financial performance above and this data, the consensus average revenue growth rate for Visa of nearly 11% is justified, as is the average historical market valuation of 29x.

Risk To The Thesis

Given the company’s financial position, I don’t see any major downside risks in the short term. Even considering a $5.6b of net debt, I don’t see any insolvency risks, as interest expenses are under 3% of operating income. However, I would like to highlight two points that Visa investors should keep in mind.

The first is regulatory. The payment market is under strict control of the authorities of different countries. On September 24, Visa became a defendant in a complaint from the U.S. Department of Justice in violation of the Sherman Act (Antitrust Act).

Despite the fact that the company fundamentally disagrees with the arguments of the opponent side and intends to defend its interests, 2 days later Visa deposited $1.5b in its account for retrospective liability. This is not the first case and definitely will not be the last one. The company’s dominant position is closely related to the violation of antitrust rules, and this is the main risk for the company’s revenue growth track.

The second risk, I will call it structural, I found as a result of studying the breakdown of issued card segments and trends in these segments. The fact is that Visa issued almost 2.5 times more Debit cards than Credit and continues to issue them with better growth rates (3.3b vs 1.3b). However, purchasing power according to Fed Reserve statistics is higher in the credit card segment.

According to Allied Market Research, the growth rate of the credit market will be higher than the debit card market (8.8% CAGR vs. 5.5%). I do not rule out that such a rebalance in the structure of Visa’s business will become a challenge for the company in the medium term. If I made a mistake in the conclusion or incorrectly interpreted the data, please share the information in the comments. I think it will be extremely useful.

Visa vs Mastercard

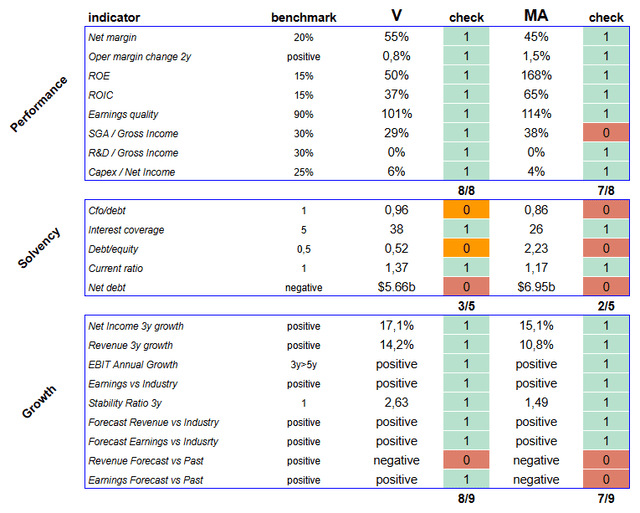

Why didn’t I list competitors in the risk section? I have already mentioned Union Pay. American Express (AXP) is in a slightly different segment and is not a global peer. The obvious and key competitor is Mastercard (MA). And it seems to me that the current status quo will be maintained. I conducted a comparative quantitative analysis on 3 evaluation segments by 22 parameters, comparing the corresponding indicators of the companies with the benchmarks I set for my system to find outstanding businesses.

Visa vs Mastercard by quantitative analysis (Author`s analysis)

It turned out that the companies are very similar to each other in the context of numbers, but Visa has an advantage in several positions for me. It is characteristic that MA is traded more expensively (~37x), and this is traditional for retrospectives as well, given that the growth rates of the last 3 years are slightly lower.

Takeaway

Historically, I included Visa shares in my portfolio, but not Mastercard. As far as I remember, the key arguments in the initial decision were debt metrics and valuation. I continue to hold Visa shares in the portfolio since the company passed all the tests. It has excellent financial performance and a stable position. Good growth in retrospect and excellent prospects for its acceleration, supported by fundamental factors and the market trend. I plan to systematically increase the position at times when the company is valued at ~27x earnings, and do not plan to quit the investment in the foreseeable future. This can only happen in two ways: either the business indicators deteriorate significantly (and I have not found compelling reasons to expect this), or the price flies high, making the stock overbought and equalizing it with the MA (~35-37).That’s all. Invest wisely.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.