Summary:

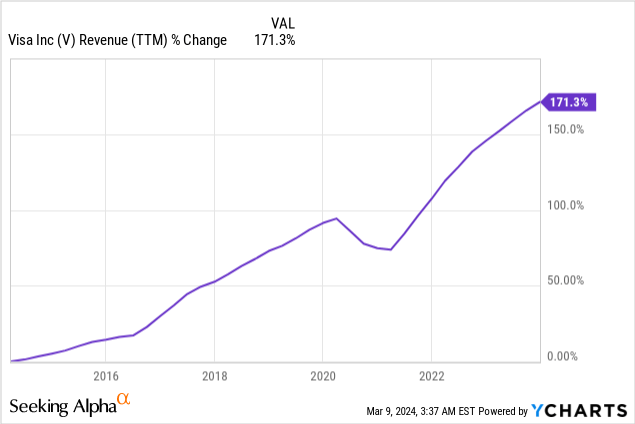

- Visa’s revenues have increased by 171% over the last decade, with sales expected to continue growing at a rate of ~10% annually.

- Visa has significant growth opportunities in emerging markets, particularly in Latin America, and is expanding its value-added services to increase volumes and net flows.

- Despite its high valuation, the sales and EPS growth together with future opportunities make it a BUY.

Justin Sullivan

Introduction

I recently wrote about American Express (AXP) as an exciting investment option in financial services. One of the comments I got asked me about the difference between American Express and Visa (NYSE:V). Visa is focused on the infrastructure of transactions and doesn’t offer credit like American Express. However, some parts of their business still overlap, such as payments. Therefore, they are competing in some competitive arenas.

On March 7th, Visa presented at the Morgan Stanley Technology, Media, and Telecom Conference. There were some interesting strategic insights at the conference, and I believe this is an excellent opportunity to revisit Visa. Visa today is more of an IT than a financial services company as it offers the basic tech framework to transfer money quickly and swiftly. In this article, I will explain my BUY thesis for Visa and why I still think American Express offers a slightly better investment opportunity.

Regarding Visa, Seeking Alpha’s company overview shows that:

Visa operates as a payment technology company in the United States and internationally. The company operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. It also offers credit, debit, and prepaid card products, Visa B2B Connect, a multilateral business-to-business cross-border payments network, Visa Cross-Border Solution, a cross-border consumer payments solution, and Visa DPS that provides a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services.

Excellent fundamentals are coming at a high price

Visa’s revenues have increased by 171% over the last decade. This is an extraordinary growth rate for a mega-cap company. The sales increased organically as the company enjoyed more consumers shifting from cash to cards and increased volume and spending. The company’s activity in the M&A market with acquisitions like Tink and Earthport allowed Visa to expand its value proposition and add more value-added products to its offerings. In the future, as seen on Seeking Alpha, the analyst consensus expects Visa to keep growing sales at an annual rate of ~10% in the medium term.

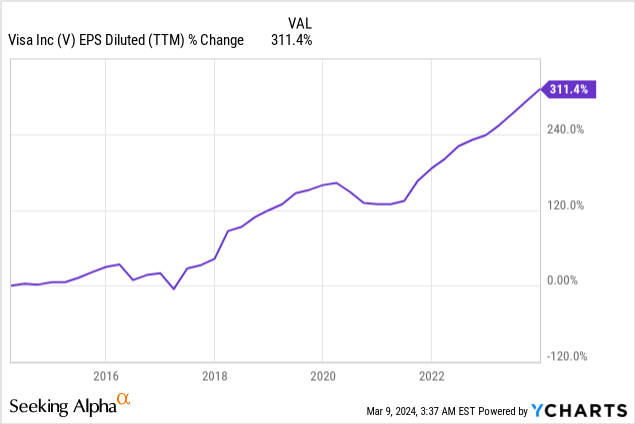

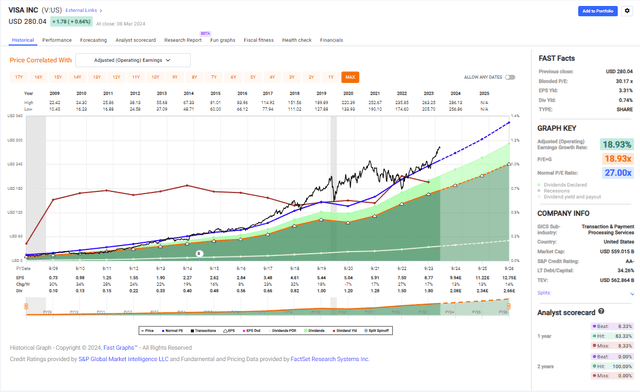

The EPS (earnings per share) of Visa during the same period showed an even more impressive increase of 311%, which means EPS has quadrupled over the last decade. The company managed to do it by supplementing its sales growth with margin expansion due to its business model, where the variable cost of each new transaction is marginal. It also supported EPS growth with its aggressive buybacks over the last decade. As we advance, as seen on Seeking Alpha, the analyst consensus expects Visa to keep growing EPS at an annual rate of ~13% in the medium term.

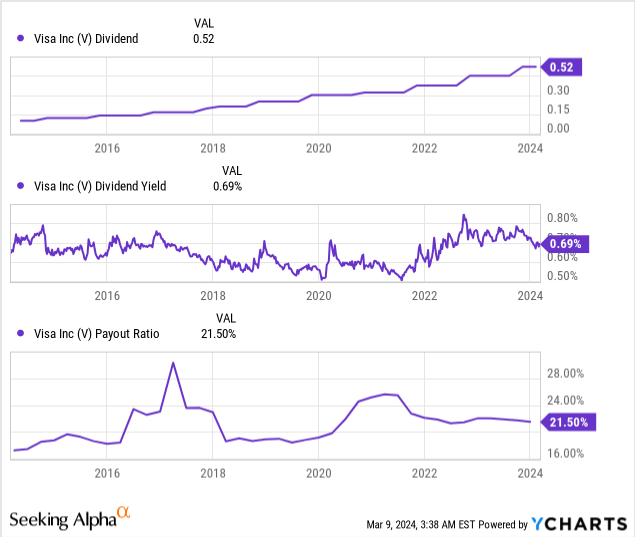

Visa has been paying and increasing its dividend yearly for the past 15 years since it went public. The company increased the dividend payment by 16% last October, and investors should expect the company to keep growing the dividend payment at a double-digit rate, possibly even faster than the EPS growth. The company is maintaining a payout ratio of 21%, which leaves it with significant room to keep increasing the payment and expand the payout ratio without risking the dividend. The only downside here is the current yield of 0.74%, which may be less attractive for investors seeking income.

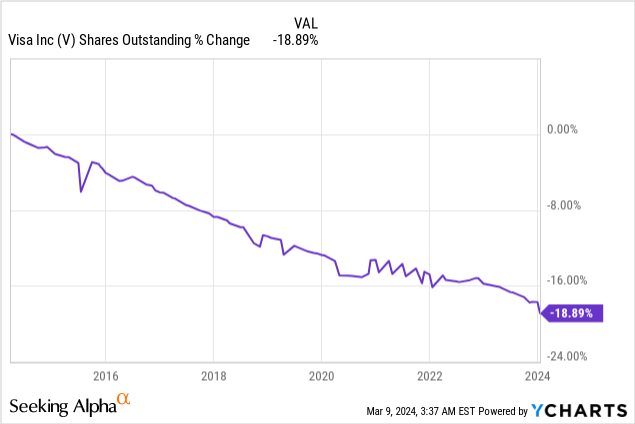

In addition to dividends, Visa returns significant capital to shareholders via buybacks. These shares repurchase plans support EPS growth as they decrease the number of outstanding shares. Over the last decade, the number of shares fell by almost 20%, implying aggressive buybacks despite high valuation. Buybacks are highly efficient when the valuation is low, which is usually not true for Visa. Still, with such impressive growth, these buybacks achieve a positive effect and increase shareholder returns.

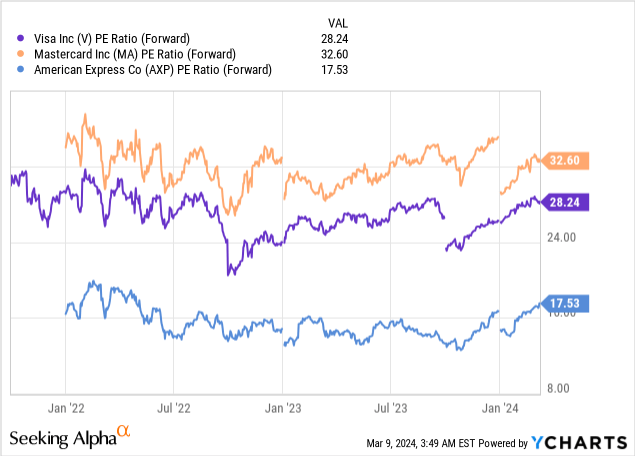

Regarding fundamentals, Visa, like American Express, shows an impressive growth rate, with both companies expected to keep growing in the medium term. The challenge for Visa is its valuation, as the company’s P/E (price to earnings) ratio is 28 when using the 2024 EPS estimates. This is not the highest valuation we have seen over the last twelve months, but it is significantly higher than we see with American Express (yet lower than Mastercard). Investors may believe the premium is justified due to Visa’s leaner, higher-margin business. While I believe that Visa deserves a premium, I am not comfortable with the size of the gap.

Again, we see a premium when comparing Visa to its past performance and valuation. The average P/E ratio of the company since its IPO was 27, which is slightly lower than the current P/E ratio of 28. During the same period, the company achieved a 17% annual growth rate, faster than the 13% forecasted growth rate for Visa in the medium term. Therefore, the shares are trading for a premium. While I believe Visa deserves a premium in today’s market due to its resilience and strong position, it still makes it less attractive.

Fast Graphs

Significant growth opportunities, mainly in emerging markets, eclipse the risks and justify a premium

The first growth opportunity for the company is expansion into new markets that are still focused on cash usage. These markets are mainly in Asia, Latin America and Africa. The company’s most significant endeavor and growth opportunity is shifting from cash to card in Latin America. Within Latin America, Visa has a great opportunity in Mexico. It’s a market close to the U.S. and is highly influenced by American culture and trends. As the company shifts more people to cards and increases the volume, it will enjoy better income and higher margins.

“In Latin America, cash displacement is job #1… Mexico is a great opportunity for us because it’s got great clients. It’s got a sophisticated citizenry, but there’s still over 50% of total purchase volume in Mexico is still cash.”

(Oliver Jenkyn, Group President of Global Markets, Morgan Stanley Technology, Media and Telecom Conference 2024)

Another growth opportunity for Visa is to increase volumes and net flows by adding more value-added services to its value proposition. Payments are becoming more complex for merchants. The cyber risks are growing, and the complexity of more e-commerce with different currencies and payment methods makes it harder to keep an up-to-date platform. Therefore, Visa offers payment solutions on top of its infrastructure. It includes, for example, fraud protection. These services allow Visa to increase fees based on the use cases the merchants buy.

“What we’re saying to our clients on value-added services is if you’ve got 40 things in your development queue that you need to get done to keep up in payments, give 20 of them to us… And we’re finding an extremely receptive audience.”

(Oliver Jenkyn, Group President of Global Markets, Morgan Stanley Technology, Media and Telecom Conference 2024)

One opportunity that still has an unclear business potential but may be emerging is China and its partnership with Tencent. Visa is cooperating with Tencent to reach more than 1 billion possible clients with its Visa Direct service for direct payments. This partnership will give Visa a significant foothold in China, which may expand later. Moreover, Visa is working with Tencent to cater to Vietnamese travelers to China, as the partnership creates close ties between Tencent’s popular digital wallet and Visa’s direct payment technology.

“When I was in Shenzhen, I spent some time with Tencent. It’s a range of things we’re talking about with Tencent about things that we can do to grow the business together, a lot of exciting things there.”

(Oliver Jenkyn, Group President of Global Markets, Morgan Stanley Technology, Media and Telecom Conference 2024)

The growth opportunities are up-and-coming, but several risks may hinder the opportunity’s attractiveness. First, the company deals with competition from Mastercard and somewhat from American Express and Discover. This competition is crucial when we look at the developed markets where consumers already use credit cards, and fierce competition exists to become the “leading credit card” in the consumer’s wallet. That’s why the company invests in value-added services and direct payment, as this is its place to shine over its competition and expand its addressable market.

Moreover, the company will be more sensitive to geopolitical and regulatory risks. We have already seen limitations in several markets, such as the European one, in the fees that payment companies may charge. This risk will likely increase as Visa enters emerging markets such as China and Latin America. Tensions between China and the U.S. may hurt the company’s growth profile. At the same time, possible regulatory changes may hinder growth in emerging markets, one of the company’s most crucial growth opportunities.

Lack of margin of safety is another risk for investors. While it doesn’t affect the company, investors who pay 28 times earnings for Visa expect it to keep executing flawlessly as it did over the last decade. If one of the risks materializes, investors will suffer twice. First, the growth rate will slow, and the company’s EPS estimates will decline. Moreover, we are likely to see the valuation contracts in that event. Thus, this may be a significant risk for short- and medium-term investors.

Conclusions

Visa offers some solid fundamentals with growing sales and EPS leading to significant buybacks and dividend increases. The company has several promising growth opportunities, mainly in emerging markets, but also with value-added services in developed markets. The risks are limited, in my opinion, when compared to the growth opportunities, and therefore, I believe that the company has a bright future. The only drawback is the valuation. With a high P/E ratio, investors do not have much of a margin of safety. Every hiccup in execution may result in a significant decrease in the P/E ratio and share price.

Still, I believe that the reward and opportunities justify the risk and that Visa is a BUY even now. I think that American Express is a slightly better investment opportunity due to the better margin of safety and similar forecasted growth rate. Yet, I believe both companies will be great additions for dividend growth investors. To deal with the valuation risk, investors may gradually consider building their position in Visa over the coming months and take advantage of any correction in the market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AXP, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.