Summary:

- Visa and Mastercard have seen their share prices underperform the S&P 500 over the past few years, which is unusual for these firms.

- I believe that the card companies are well-positioned and will return to beating the index considerably.

- Visa shares are cheaper than usual today and 2023 should be a solid year as the U.S. Dollar slides, which will boost profitability.

hatchapong

Credit card giant Visa (NYSE:V) needs little introduction. The payments leader saw its earnings waver a bit during the pandemic, but it’s now back to steady growth mode. Interestingly enough, however, Visa shares are still down meaningfully from their all-time highs, and the valuation is much less demanding than it was prior to 2020. That has put Visa shares on my radar over the past few months, and I continue to like their outlook heading into 2023.

You don’t need a particularly complicated thesis to own the two major credit card companies. They have some of the highest EBITDA margins in the S&P 500. The businesses grow effortlessly as they serve as an effective transaction tax on the global economy. A long runway remains, particularly in emerging markets, for more folks to switch from cash to plastic.

The bull thesis is a simple but powerful one. The issue is usually that you have to pay up pretty dramatically to own either Visa or Mastercard (MA) stock. That, or you have to go off brand and buy a smaller issuer like Discover (DFS) that also takes significant credit risk. I quite like Discover stock, don’t get me wrong, but it’s not a pureplay competitor to Visa or Mastercard. And, with the crash in valuations for the FinTech stocks, the threat of disruption from upstart payment rivals has greatly diminished as well now that they can’t rely on equity investors to keep funding their losses indefinitely.

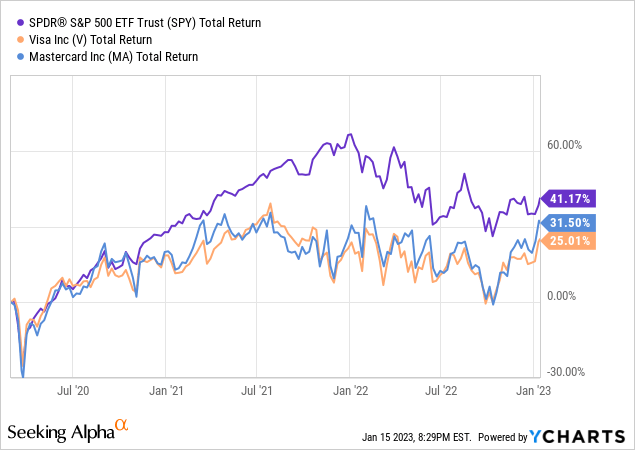

But, what about valuation? Are Visa and Mastercard cheap enough to own yet? I’d argue they’re in that conversation, yes. Consider the performance of those two versus the S&P 500 since the start of the pandemic:

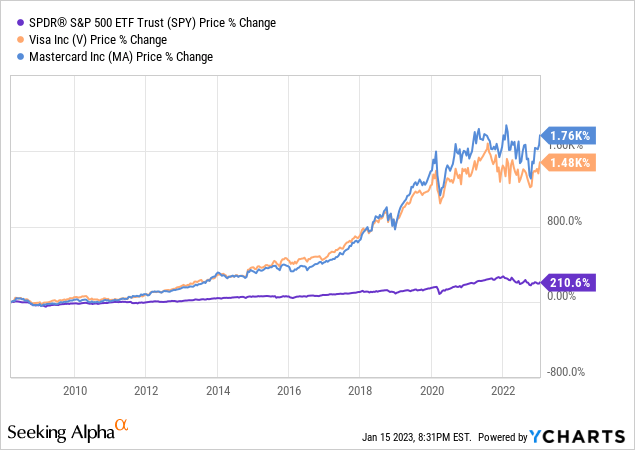

The gap has started to close a bit. Visa and Mastercard were at their best relative valuation versus the market a year ago. Still, the card companies have underperformed to a meaningful degree, especially Visa which is only up 25% versus the market’s 41% gain. Over a longer time horizon, however, the card companies trounce the market:

That’s only natural as the card companies have put up double-digit annualized earnings growth like clockwork and have low-volatility businesses. Put up superior earnings growth at massive profit margins with minimal operational risk and you should clobber the S&P 500 over the long haul. And yet, for three years running now, the card companies have trailed the market meaningfully.

I’d argue this makes a great opportunity, as it seems highly likely that Visa and Mastercard will go back to dramatically outperforming the market once again in due time.

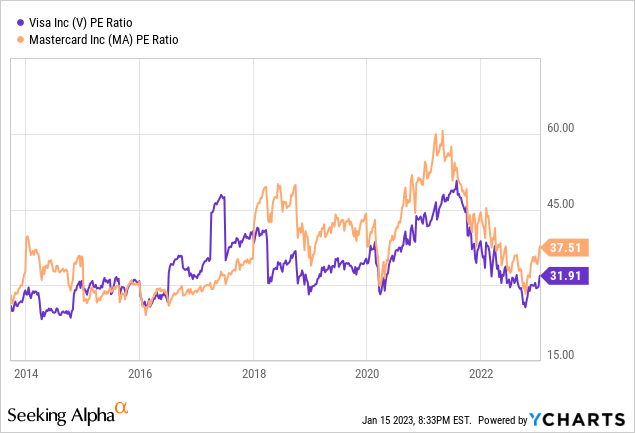

Why have the card companies underperformed? It’s not because their earnings have declined — they haven’t. Rather, it’s that P/E multiples have dropped:

Over the past ten years, Visa and Mastercard have had a tendency to trade with a trailing P/E ratio of between 30 and 45. Mastercard typically trades at a modest premium to Visa, although that has fluctuated from time to time.

The card companies were at a historically low valuation a few months ago, with Mastercard at 30x earnings and Visa into the high 20s. The recent market rally has moved things a bit, still Visa is near the low end of its typical range at 32x earnings. It’s also at a significant discount to Mastercard, which has now moved back up to 38x.

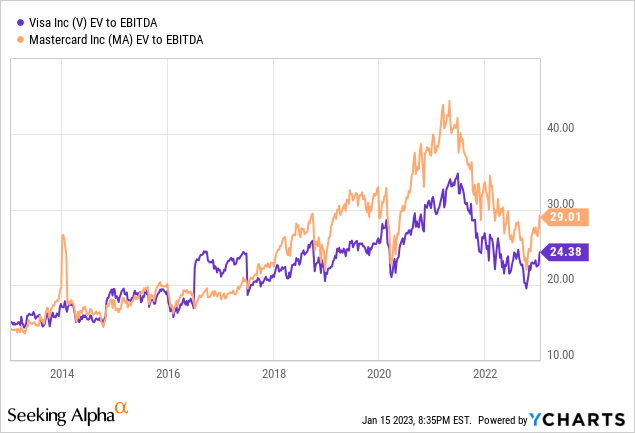

We see a similar move when comparing the companies on an EV/EBITDA basis.

Both are now trading around their pre-pandemic levels, albeit with Mastercard now trading at nearly a five turns premium to Visa.

I have no strong opinion on whether Visa or Mastercard is a better business. All else being equal, I’d rather buy the one that is currently at a cheaper valuation multiple. Right now, Visa wins on that count by a pretty significant margin. That said, I have no issues with owning MA stock for the long-term as well, however, Visa seems like a more actionable buy at today’s prices than Mastercard.

Weakening Dollar Will Boost Visa’s 2023 Results

Visa should benefit significantly in 2023 from the reversal we’ve seen in the value of the U.S. Dollar recently.

Here was Visa CFO Vasant Prabhu describing the negative impact of the Dollar’s rise on the company’s Q3 conference call:

“The strong dollar was a stiff headwind, dragging down reported net revenue growth by 4 points and non-GAAP EPS growth also by 4 points. Discontinuation of operations in Russia reduced net revenue growth by about 5 points.”

Here’s a chart of the U.S. Dollar Index dating back to 2017:

The Dollar Index had soared from 90 to 114 over the past two years. Since October, however, it has given back half of that move, sliding to 102. This should start to be noted in the company’s Q4 results, and particularly make a positive impact in Visa’s results in 2023. Last year’s four point dollar-driven decline in earnings could turn into a similar-sized tailwind this year.

Also, of note, the exit from the Russia business was a one-time event, and so we shouldn’t see a similar headwind to topline growth this year either.

Visa Stock Bottom Line

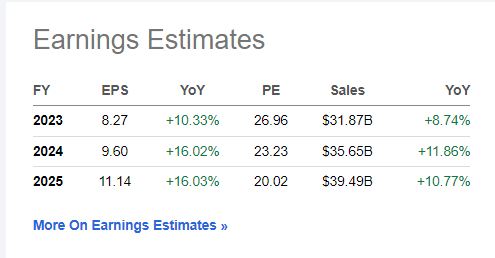

Visa is an easy company to own. It’s effectively a duopoly with Mastercard and has some of the best unit economics of any S&P 500 company. The firm continues to have a long runway for product adoption, and analysts expect it to post double-digit top and bottom line growth going forward:

Visa earnings forecast (Seeking Alpha)

The issue is usually that these credit card firms trade closer to 35 or 40 times earnings. There’s little debate over whether or not Visa is a great company, the problem is usually that the valuation reflects that greatness already.

At today’s price, however, we’re not having to make nearly as large of a concession on valuation to own the stock. Visa shares are at 27 times forward earnings, 23 times 2024 earnings and just 20 times projected 2025 earnings. That’s an attractive starting point for a firm that should be able to grow earnings in the 15%/year range for the foreseeable future.

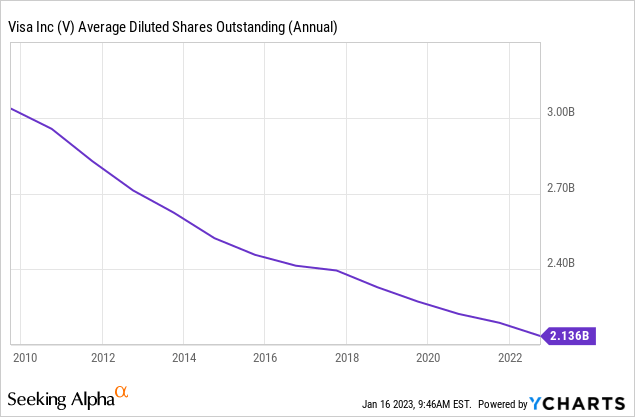

How does Visa manage 15% earnings growth off 10% or so topline revenue growth? That’s due to the share buyback:

Since 2009, the company has reduced its shares outstanding from more than 3 billion to just 2.14 billion today, marking a nearly 30% reduction. The share buyback is ongoing. And, I’d note, you get a lot more bang for your buck buying back stock at 27x earnings than repurchasing it in the high 30s. For long-term investors, this dip in the company’s valuation ratio should be a favorable development given just how much of Visa’s free cash flow goes to buying back stock.

There are risks, of course. If the economy tips into recession, that would likely slow down transaction growth significantly. Consumers significantly enhanced their personal balance sheets since 2020, but that momentum is bound to run out sooner or later. And the rebound we’ve seen in cross-border (higher profit margin) transactions is likely to slow down as well as travel figures start to normalize at a new set level.

That said, none of these risk factors to Visa break the thesis, particularly given the lower starting valuation. For a moment, it seemed the pandemic might help FinTech companies disrupt the traditional payments networks with their own unique solutions. However, fast forward to 2023 and the disruptors have seen their share prices collapse while Visa and Mastercard have managed to consolidate their positions and continue adding more vendors to their networks.

In other words, the long-term moat around the business model remains strong. And while there are risks such as a potential recession, there are also clear near-term positives such as the abrupt reversal in the value of the U.S. Dollar. All this bodes well for Visa, with 2023 being a year where we could see both double-digit earnings growth and a modest increase in the company’s valuation ratio, leading to strong total returns for shareholders.

Disclosure: I/we have a beneficial long position in the shares of V, DFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.