Summary:

- Visa continues to outperform the market and fully capitalize on the prolonged business cycle.

- With pandemic lockdowns hopefully behind our backs, it seems that tailwinds for Visa’s business model will be sustained.

- The company’s share price appears fairly valued both relative to peers and to its historical business fundamentals.

Justin Sullivan

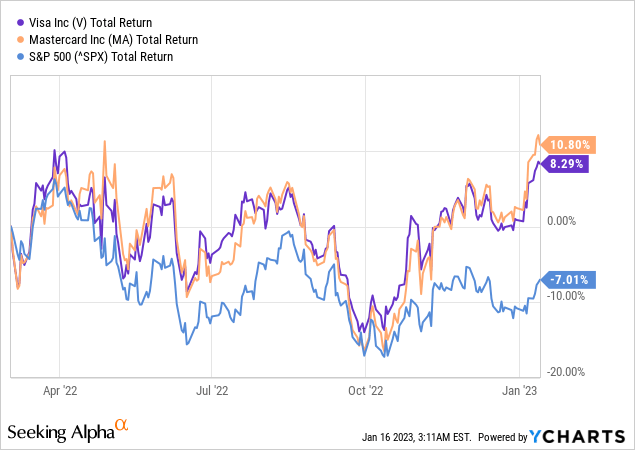

In March of last year, when I first covered Visa (NYSE:V), the S&P 500 was still trading near all-time highs and it seemed like the equity valuations could keep on making new records. Since then things have changed drastically (more on that later) and Visa delivered more than 8% total return while the broader index fell by 7%, thus opening a wide performance gap between the two.

The reason why I have also included Mastercard (NYSE:MA), a company that I have recently turned cautiously positive on, in the graph above is to illustrate that share price movements of both V and MA have been largely driven by industry-wide tailwinds.

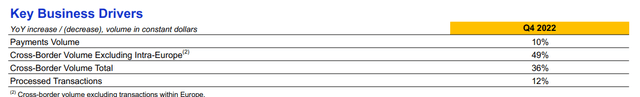

Growth in cross-border volumes exceeded expectations in recent quarters, while payment volumes remained strong.

Visa Investor Presentation

Not only that, but cross-border volumes have already surpassed their pre-pandemic levels as travel recovered and digitalization following the lockdowns created a favourable environment for non-cash payments.

Q4 cross-border volumes, excluding intra-Europe were up 49% year-over-year and 130% versus three years ago, up 7 points from Q3. Excluding Russia, cross-border year-over-year growth was higher by about 5 points.

Travel-related cross-border volumes rose 12 points from 104% of 2019 in Q3 to 116% in Q4 as travel continued to recover. Processed transactions were up 12% year-over-year or 140% versus 2019 and we processed 553 million transactions a day during the quarter.

Source: Visa Q4 2022 Earnings Transcript

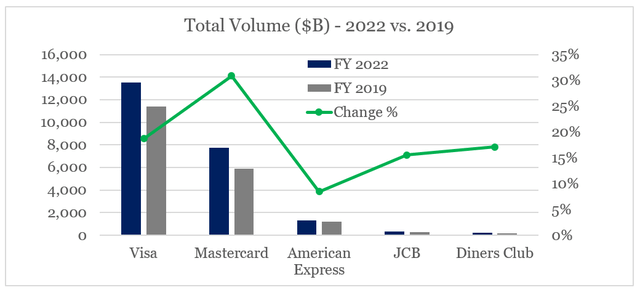

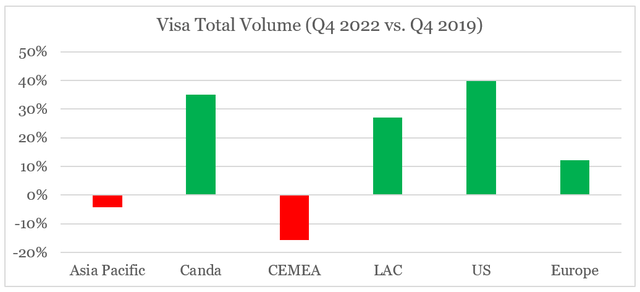

In total volume, Visa still has the lion’s share of the market after noting nearly 20% growth on its pre-pandemic volumes (see below).

prepared by the author, using data from SEC Filings

Mastercard also capitalized on recent industry-wide tailwinds and achieved higher volume growth on its pre-pandemic levels due to its strong international exposure. Mastercard, however, engaged in outside M&A deals to a greater extent in recent years than Visa did which also helped to slightly narrow the gap between the two rivals.

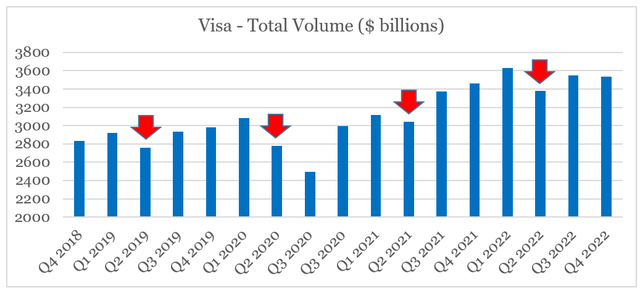

On an absolute basis, however, Visa has benefited the most from its major peers and has used that opportunity to expand its network. On a quarterly basis, Q1 of each fiscal year (note that its fiscal year ends in September) is usually the strongest and is then followed by a relatively low volume second quarter (see below).

prepared by the author, using data from SEC Filings

One thing that the graph above clearly illustrates is that higher volumes following the pandemic has now become the norm and Visa’s strong brand and global network have allowed the company to fully capitalize on these tailwinds. The upcoming first quarter of fiscal year 2023 is also expected to be by far the strongest in the company’s history.

On a regional basis, volumes have risen by roughly 40% in U.S. market relative to the same quarter prior to the pandemic. Although stimulus payments have played a major role in Visa’s largest market, the company has also solidified its positioning in Latin America and the Caribbean, Canada and Europe.

prepared by the author, using data from SEC Filings

Asia Pacific and CEMEA regions have been hit by continued lockdowns in China and recent geopolitical events in Russia and Ukraine, respectively. With these markets likely to remain challenged over the coming years, Visa has been making a stronger push to expanding more aggressively in Europe.

In Europe, we renewed and expanded our relationship with UBS, the largest issuer in Switzerland. We made excellent progress in Germany with our share growing significantly since 2018, adding more than 12 million debit credentials in the market. Visa Debit is now offered by three of the most significant banks in the market, ING, DKB and comdirect. And we are also pleased to announce that Santander Germany will begin issuance in 2023, making Visa the single scheme of choice for Santander in that country across debit and credit.

Source: Visa Q4 2022 Earnings Transcript

In addition to new issuing partnerships, Visa has also been making significant progress with its consumer payments portfolio in the old continent.

Visa 10-K SEC Filing

Fintechs are also key to our consumer payments growth. In Europe alone, we have more than 100 fintech programs that continue to deepen our relationship with these partners. Revolut is a great example. They already utilized a number of our capabilities, including Visa Direct and Currencycloud, and we just renewed our global issuing partnership. They also recently selected Tink for payment initiation services, which will allow users across Europe to seamlessly move money into their Revolut accounts.

Source: Visa Q3 2022 Earnings Transcript

Overall, Visa has been making an excellent progress with solidifying its leadership and existing competitive advantages across the globe. The business model has also benefited heavily from the pandemic and it seems that new purchasing habits are not going back their pre-pandemic levels.

Having said all that, it is important to take a look at Visa’s relative performance to its wider peer group and also consider how the company is priced as we are likely approaching a recession in the coming 12-18 month period.

How Is Visa Priced?

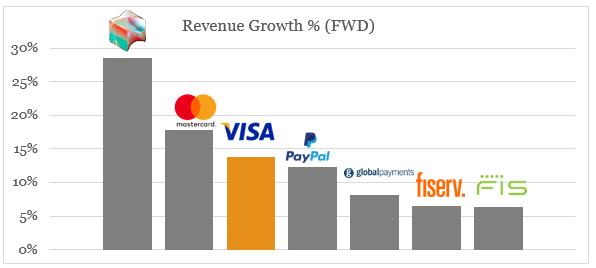

On a relative basis, Visa is still expected to be among the highest growing businesses within its peer group. Block’s (SQ) exceptionally high forward revenue growth rate is largely driven by the company’s accounting for bitcoin related operations and is also overshadowed by a number of other issues.

prepared by the author, using data from Seeking Alpha

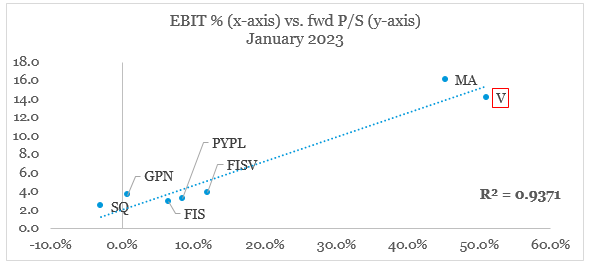

On a profitability basis, Visa’s highly profitable business model and operating margin of more than 67% is the major driver of the company’s premium sales multiple.

prepared by the author, using data from Seeking Alpha

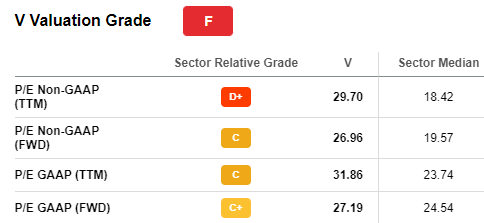

When considering its high topline growth and highly profitable operations, it is not hard to justify the company’s forward GAAP P/E ratio of roughly 27.

Seeking Alpha

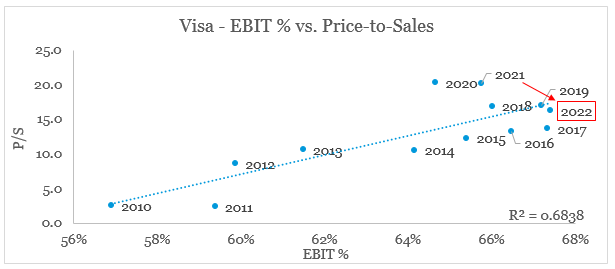

As aforementioned cross-border volumes returned to normal, Visa’s margins have also improved. As we also see in the graph below, the company’s Price-to-Sales multiple has also contracted relative to the same period of fiscal year 2021 which makes Visa fairly valued at this point in time.

prepared by the author, using data from SEC Filings and Seeking Alpha

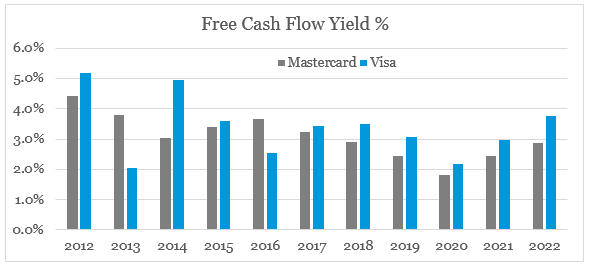

On a free cash flow basis, Visa now trades at its most attractive levels since 2014 and is still cheaper than its major peer – Mastercard.

prepared by the author, using data from SEC Filings and Seeking Alpha

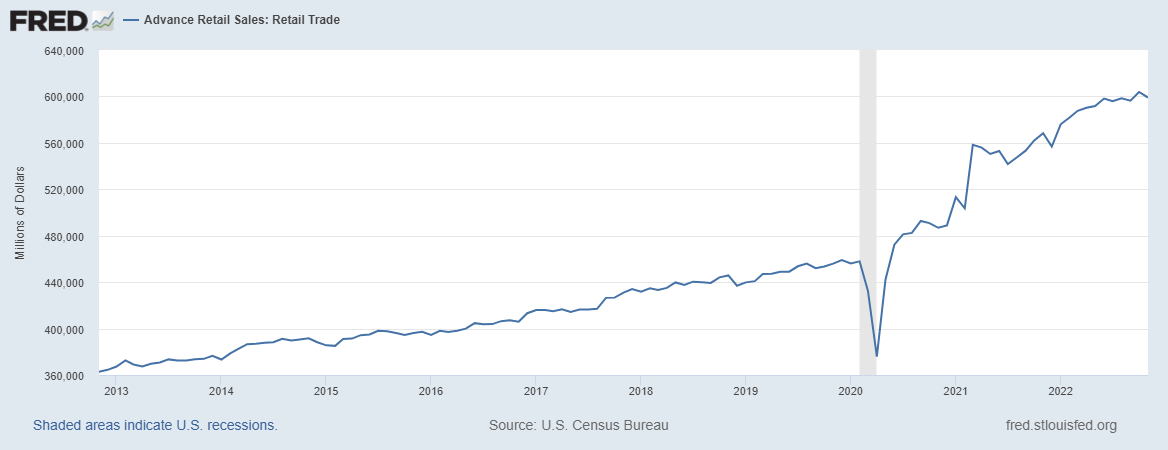

With all that in mind, there is certainly the risk of a recession in the coming year which could result in a significant slowdown of both cross-border and domestic transactions.

FRED

Trying to time an economic slowdown, however, is a futile exercise and the overall impact on Visa’s business model beyond the short-term is highly uncertain, especially in an environment where long-term inflation rates are likely to remain elevated.

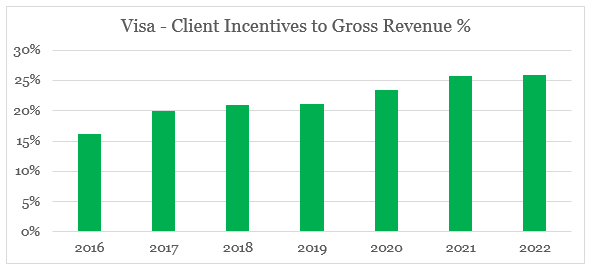

Visa’s client incentives have also recently reached historical highs relative to the company’s gross revenue which have been a significant headwind for margins. Should a worse than currently expected scenario play out, the company could also reduce the amount of these client incentives over the short-term in order to protect the industry-leading profitability.

prepared by the author, using data from SEC Filings

Investor Takeaway

Visa has significantly outperformed the market since March of last year and left many of the so-called ‘disruptors‘ of the payments sector in the dirt. The exceptionally strong business performance also resulted in the company becoming even more attractively priced than a year ago. While investors are increasingly looking at ways to time the market regarding the likely upcoming recession, the high quality business model of Visa is well-positioned to continue to deliver consistently higher returns than the broader market.

Disclosure: I/we have a beneficial long position in the shares of FISV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.