Summary:

- Visa is a dominant payment network with a robust 40% cash flow margin.

- The company’s revenue is closely tied to global payment flows.

- Visa has benefited from inflation over the past three years.

- The DOJ has highlighted barriers to entry for competition.

J Studios

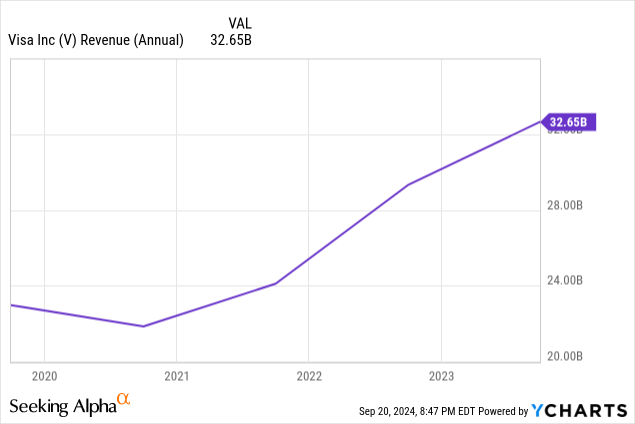

Visa (NYSE:V) is an entrenched payment network that produces gobs of cash flow with 40% cash flow margin. Revenue is tied to payment flows around the world which has allowed them to be a beneficiary of inflation the past 3 years.

I wrote about Visa by in 2019 discussing its moat. The business has a wide moat and is known quite well among quality investors. This is easy to see through some basic financial metrics:

- Return on Equity 49%

- Return on Capital 25%

- EBITDA Margin 70%

- Income conversion to cash flow >100%

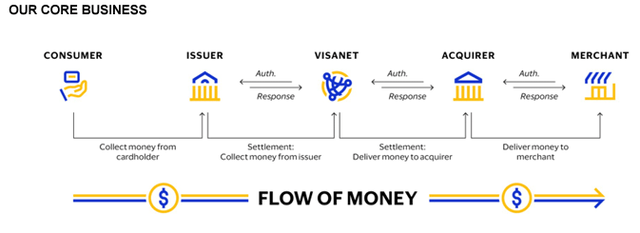

All these attractive financial metrics are produced because the company has a durable network effect. The network effects have been molded and endured much competition over the years as the fintech industry has ramped up. Having built the toll-road between the account holders and merchants, they’ve been able to collect a small percentage of every cashless transaction using a Visa card.

10K

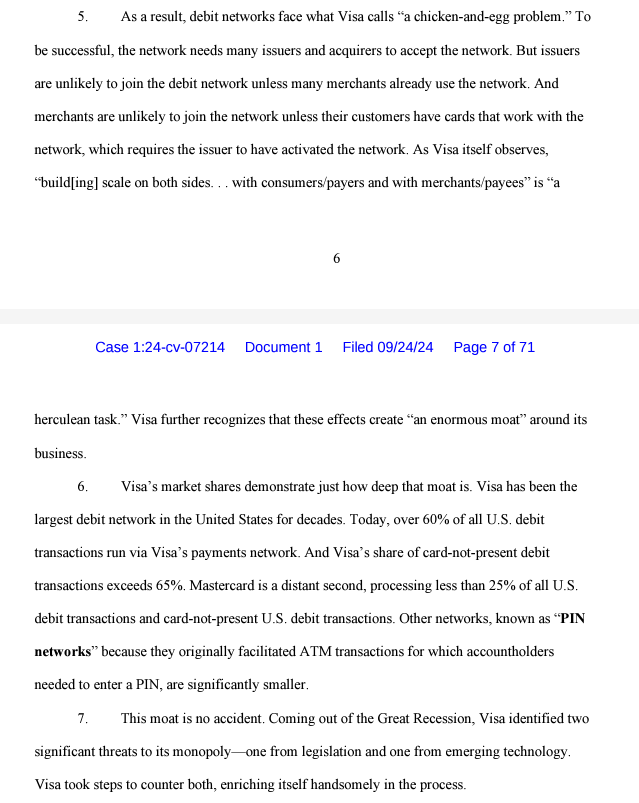

Even recently with the DOJ’s lawsuit, the document for part of it sounds like a sell-side equity analysis:

DOJ Lawsuit Document

The Story

Visa is one of the most durable and profitable businesses I know. So, how did this occur? I wouldn’t start by looking at the balance sheet, as that doesn’t really highlight what has transpired over time. The focus has been on growing the network effects and continuing to direct/grow payment transactions on its rails. Which basically means building the VisaNet platform. The way this occurred is by being one of the most trusted networks for financial transactions and was created through marketing. Visa has been running their marketing spend around $1 billion annually. This is a substantial amount of dollars when compared to their overall expenses.

In addition, the lawsuit also highlights Visa leveraging its monopoly like position to create routing deals, where Visa leverages its non-contestable transactions they help with and create contracts for most of the transaction volume to go through their rails. This has benefited them greatly in reducing competition after the Durbin Amendment was introduced to help spur competition among debit card transactions.

Digital wallets were another hurdle for Visa years ago, as this setup could possibly bypass Visa’s rails all together. Providers of digital wallets wanted the consumer to link directly to their bank accounts and transact in a closed loop, leaving Visa out of the picture. Customers complained about not having the ability to link their Visa card to the digital wallet, and once one digital wallet provider gave in, many had to follow. Consumers trust Visa, it’s accepted at many places around the world, and they want their rewards. A digital wallet provider that didn’t allow Visa as a payment option was at a disadvantage to ones that did.

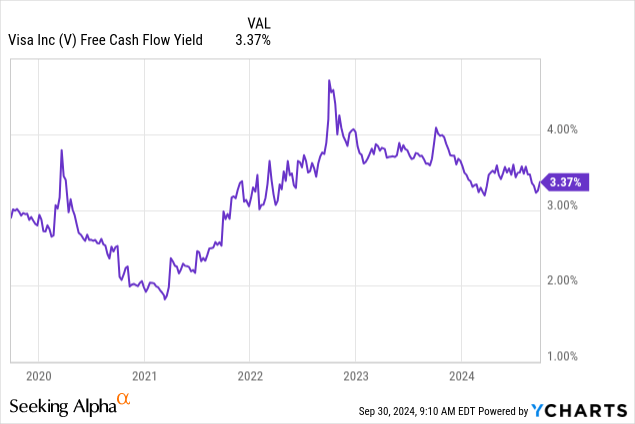

Cash Flow and Valuation

As a cash flow investor, the higher the yield the more attractive the investment is. As you start to look at higher quality companies it’s a little more difficult to judge if the cash flow yield shows if the organization is undervalued as quality tends to have lower yields. Below is a good visual of the yield trend over the last 5 years.

Based on looking at this chart, anything above a 4% yield would have been an opportune time to purchase some shares. Buying at a favorable valuation, investors get a possible rerating benefit of the yield trending back to the average, along with the growth of the cash flow. The FCF has basically doubled since 2020:

Seeking Alpha

With being a capital light business, free cash flow margins are high and allow management to return cash to investors efficiently. I say efficiently, as the company is still able to grow FCF and continue to return cash at a substantial rate. Over the last 10 years, Visa has reduced their shares outstanding by 20% with paying a modest dividend along the way.

Path for Continued Growth

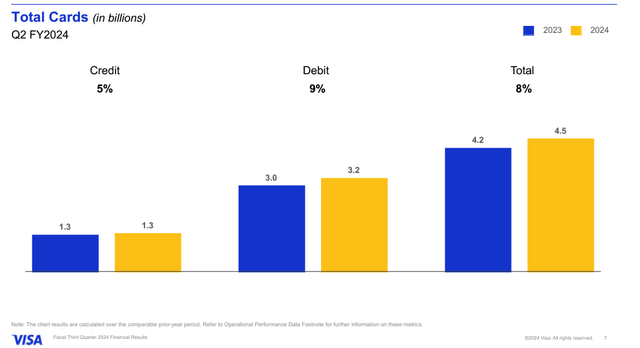

Growth will continue to come from transaction volume and fortifying the network. Transaction volume comes from a strong consumer and adding more card users. Total cards continue to consistently grow per the most recent quarterly data:

Visa Investor Relations

Along with payment volume as that was also mid to high single digit growth this past quarter.

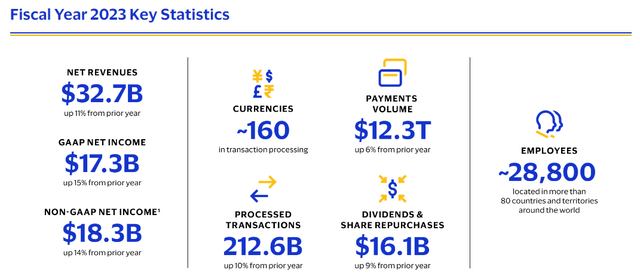

Here are some key financial metrics that give a good summary of 2023 operations.

Visa Investor Relations

I would like to point out that in 2023 payment volume was $12.3T on Visa’s rails. For comparison, back in 2017 payment volume was $10.3T. Two trillion dollars more was funnelled to Visa’s rails over this 6-year period.

Risk

Regulatory risk is real, and that’s obvious with the DOJ lawsuit. This lawsuit will likely take years to come to any sort of conclusion, but highlights Visa is not immune to regulatory issues.

Other forms of payment methods like crypto are risks. This risk though seems low and futuristic as behavioral changes would have to be made as many consumers use their card or phone for payment in the physical world.

Upcoming Quarter

The 4th quarter and full-year earnings call will be October 29th. As I don’t put too much emphasis on what’s going to happen in the next earnings quarter, I would like to highlight full-year outlook is supposed to see low double-digit EPS growth on the high end. Good information and data is acquired on these calls to form a future outlook long-term, and any Visa investor should review the information and data put out next week. I suspect more will be discussed also about the DOJ lawsuit and future implications.

Final Thoughts

Visa is a compounder and has been for decades. High returns on capital, low capital intensity, and organic growth have all been contributors to producing its outsized returns for investors. Management has been protecting their network effects with everything they have, as owning the toll road on cashless transactions around the world is a priceless asset. For the time being, valuation looks a little stretched from a FCF yield perspective, especially when compared to risk-free rates, as I consider this a hold for now.

Time will tell with what the DOJ lawsuit brings, but the report does highlight some monopolistic dynamics. One can argue though many players have come into the space over the last 5 years creating more competition and Visa has had to navigate through that. I believe Visa will continue to be a compounder of free cash flow over the next 5 years, I just don’t like the valuation. Patience is a quality that is investors’ best friend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained in this article is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors' own review of publicly available information, and should not rely on the information contained herein. The information contained in this article has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice. Any projections, market outlooks, or estimates herein are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update, or revise the information in this document or to otherwise provide any additional materials. The author, the author's affiliates, and clients of the author's affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.