Summary:

- Visa continues to innovate in the digital payments sector by launching initiatives like the Visa Tokenized Asset Platform to enhance its competitive edge in next-gen finance.

- Visa’s consistent revenue growth, averaging 10.9% annually, positions it favorably against industry competitors.

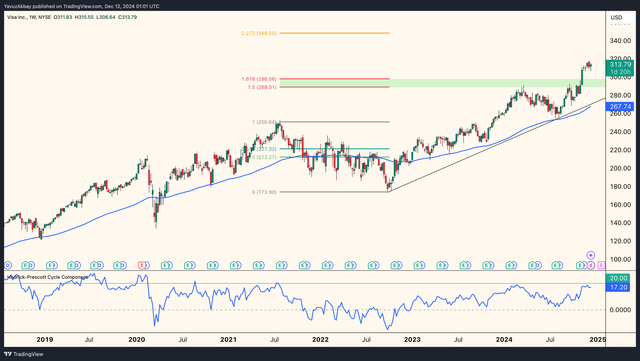

- Technical analysis suggests that as long as V stays above the uptrend it could target $348 with $277 as a key uptrend support.

FinkAvenue

Visa Inc. (NYSE:V) is one of the most stable stocks in the SP500 index. V, which brings incredibly stable profits both in the short term and the long term, supports this profitability with its innovative and developing structure that perfectly adapts to the current financial system. This is the biggest reason for my “buy” position on the stock. Now I want to explain this to you in more detail.

Business Developments

V is probably the most evolving company in the financial world. While most financial companies in the SP500 have not yet moved beyond the traditional finance mindset, V has started to make itself heard in the new generation finance sector after becoming the most important player in traditional finance. I am not saying this lightly.

This year, the company launched the Visa Tokenized Asset Platform (VTAP), which allows banks to print and manage stablecoins on the Ethereum blockchain. V aims to close the gap between traditional finance and blockchain technology and enable secure transactions with both euro and dollar-backed tokens, by piloting with BBVA.

The fact that V is so keen on the new generation finance issue and is constantly trying to be a part of it is a clear indication of how much the company wants to exist in the future of the financial world. For me, this is one of the most important elements that adds value to the company.

Additionally, V has recently innovated in the development of its product line. It unveiled the Visa Flexible Credential service, which enables consumers to use a single card to switch between various payment options. This service is providing flexible payment options and giving consumers control over their financial instruments. In addition to these innovations, V also offers the Visa Payment Key Service which is integrated into Click to Pay for a smoother and more secure online payment experience. This gives users opportunity to replace conventional passwords with device PINs or biometric authentication.

V has made significant improvements not only globally but also locally. Visa Protect for Account-to-Account (A2A) Payments has been launched in the UK. This service leverages Visa’s AI expertise to detect and prevent fraud in real-time, particularly on real-time payment networks, which are increasingly important as digital transactions increase.

Looking ahead, V’s trajectory appears to include deepening its integration with emerging technologies like generative AI and digital identity. During its annual Payments Forum, where discussions focused on how these technologies could revolutionise commerce, the company reaffirmed its commitment to these sectors. I expect V to continue to lead in areas like digital identity solutions and next-generation finance (cryptocurrency and DeFi), which translates to more secure and personalized payment experiences.

Financial Analysis

In my experience, when evaluating financial companies like V, Mastercard (MA) or other financial sector firms, traditional valuation metrics like EV/EBITDA are less effective because these companies have unique balance sheets and revenue models. Especially in payment network companies, RoE, Operating Margin and EPS Growth ratios are important. Therefore, it was analyzed whether V is financially positive or negative by looking at these ratios.

Return of Equity

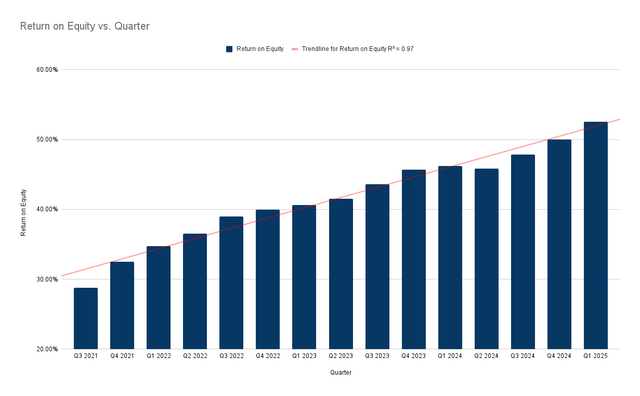

First of all, when looking at V’s RoE historically, I detected a RoE of over 30% since 2022 and over 40% since 2023. Since RoE is constantly on an upward trend, I thought that doing linear regression analysis would be useful in determining the value in the next quarter. When analyzed using the linear regression method, the RoE in the first quarter of the next quarter, 2025, is determined as 52.53%. This means that the RoE increases by 10% every year. This is a really excellent rate.

Image created by Yavuz Akbay with data from tradingview.com (tradingview.com)

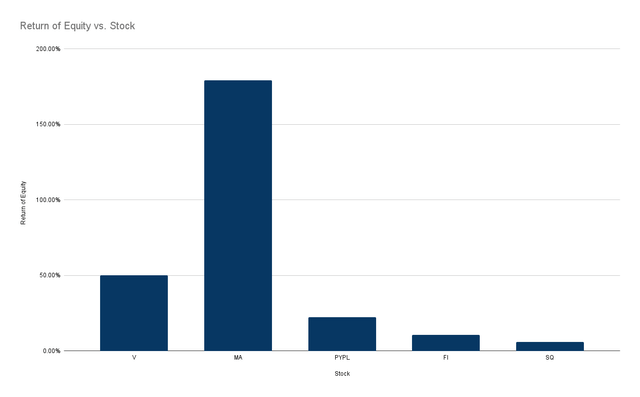

Although a RoE above 20% for a finance company tells me that the company is in an excellent position, it is always useful to compare it with its sector competitors. V’s industry competitors are MA, PayPal Holdings (PYPL), Fiserv (FI), and Block (SQ). V has a higher RoE than all 3 of its industry competitors. This is an incredibly positive picture.

Image created by Yavuz Akbay with data from tradingview.com (tradingview.com)

Operating Margin

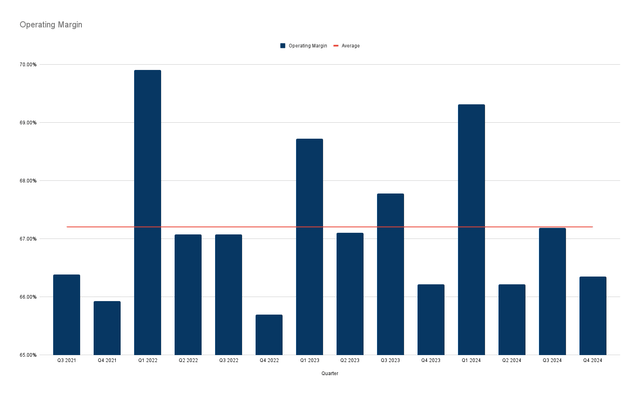

For payment companies like Visa and Mastercard, high operating margin is important because their business models are based on transaction fees and licensing. Therefore, I believe that an operating margin of at least 50% and above is positive for the company.

Image created by Yavuz Akbay with data from tradingview.com (tradingview.com)

When V’s historical operating margin level is analyzed, it is determined that the company’s operating margin has been above 62% since 2021. This is an incredibly positive picture. In addition, it was determined that an above-average operating margin is announced in the first quarter of each year. Therefore, an operating margin of above 67.21% is possible in the next quarter.

EPS Growth

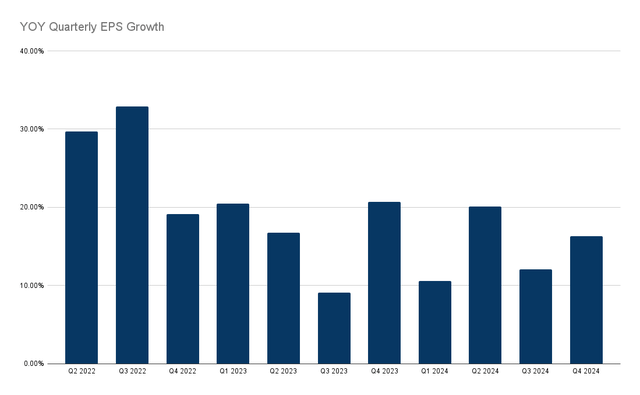

EPS growth is a key driver of valuation multiples for high-growth companies. Therefore, V’s positive EPS growth will give a positive outlook for the stock. When V’s annualized EPS growth since 2022 is examined, it appears to have completely positive growth. When these growths are averaged, an average growth of 19.14% is determined. This is truly excellent EPS growth. If it is calculated that the EPS announced as $2.71 last quarter will grow as much as this average, it would be logical to expect $2.87 EPS in the next quarter. Such good and stable EPS growth is truly excellent for the company.

Image created by Yavuz Akbay with data from earningshub.com (earningshub.com)

As a result, when looking at its general financials, the company looks very positive indeed. There is not even the slightest problem in the company’s financials and it is getting better every quarter.

Risks and Challenges

A few dangers could affect my analysis, even though V shows a really good investment opportunity. An antitrust inquiry into merchant litigation is being carried out by the Department of Justice. Since this investigation targets both V and MA’s credit operations, V faces ongoing regulatory scrutiny and legal challenges related to its market dominance. Significant monetary costs as well as possible income losses could arise from these legal disputes. In addition, the industry has intrinsic problems. For example, V is ultimately a traditional finance company. New-generation finance and the evolving fintech landscape pose inherent challenges to V’s market position. These challenges and lawsuits could impact V and delay the stock’s rise to my target price.

Technical Analysis

I will use both algorithmic indicators and the price action method to analyze the company technically. I will use the Hodrick-Prescott filter to determine the trend and to determine the rates at which the price will diverge and converge.

When the historical price movements of the company are analyzed, the first thing that stands out is that the company has been in an uptrend since 2023. This trend can be clearly detected with both the price action method and the HP filter. Historically, V continues its run by diverging from the HP filter by 20% every time it makes a run. Therefore, there is a potential to repeat this in this run. When the Fibonacci method is applied to the period when it was suppressed from 2021 to 2023, it is clearly seen that the target level of 1,618 has come to around $294. This level was broken last month and currently V continues to run to the secondary target of $348.

tradingview.com (tradingview.com)

I think V will reach this price as long as it stays above the HP filter and the uptrend. The price that confirms whether it stays above the trend is $277. If it falls below this level, the run for V will be delayed.

Conclusion

As a result, V presents an attractive investment opportunity supported by its strong financial performance, innovative approach to the evolving financial landscape and positive technical analysis. The company’s strategic initiatives, such as the Visa Tokenized Asset Platform (VTAP) and advances in artificial intelligence and digital identity, promise to remain at the forefront of the payments industry in the coming years. V appears to be financially secure based on its strong financial measures, which include its remarkable Return on Equity, continuously high Operating Margin and constant EPS growth. The optimistic perspective is further supported by technical analysis, which shows that the stock is clearly on the rise and has room to rise further. Given these factors, V appears well-positioned to deliver value to investors in both the short and long term, making it an attractive buy option for those looking to invest in the financial sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.