Summary:

- Visa is a market leader in electronic payments, with a strong moat and industry-leading profitability margins.

- In the post-pandemic era, the electronic payment industry is experiencing favorable trends that are expected to benefit Visa’s future prospects.

- I anticipate Visa to report robust FY23 Q4 earnings, with a yearly sales increase of 10.8% YoY and EPS reaching $8.68.

- Visa’s stock rarely goes on sale, but today, the company is trading with a 14% discount to its historical averages.

- Visa is a rock-solid choice for dividend growth, having increased its dividends by a remarkable 350% in the past 10 years, with no slowing down in sight.

TanjalaGica/iStock Editorial via Getty Images

Investment Thesis

As a decade long dividend growth investor, I have recently embarked on the journey of writing about my favorite DGR stocks.

In the past few days, I’ve written articles about Texas Instruments (TXN) and Home Depot (HD) – one of my absolute favorites in the market.

Today, I’m especially enthusiastic about discussing Visa (NYSE:V), a stock that holds a special place in my heart because it was the very first one I ever bought.

In our fast-paced global environment, where globalization plays vital role and digital transactions are the norm, Visa has not just survived but thrived.

Visa’s success story can be attributed to the globalization, increased international travel accessibility, and the rapid shift towards a cashless society, a shift that gained even more momentum due to the COVID-19 pandemic.

Despite the strong performance of both Visa and its counterpart Mastercard (MA) over the past decade, essentially creating a cashless payment duopoly, Visa shines with its solid competitive advantage and strategic readiness for a cashless future.

What makes Visa exceptional is its strong economic moat, backed by a business model that requires minimal capital investment. It leads the industry with impressive profit margins and benefits from powerful market trends.

All these factors not only ensure Visa’s current success but also position it incredibly well for the cashless future that awaits us.

That’s why, even after more than a decade since I first invested in Visa, it still holds a spot in the top 5 positions of my dividend growth portfolio. Visa has truly outperformed, making up about 4.6% of my portfolio and benefiting my family significantly.

Allow me to illustrate why Visa stands out among its peers and why I believe it has the potential to continue delivering impressive returns in the future.

Industry Leading Profitability and Strong Moat

Visa runs what I would call a pretty straightforward yet sophisticated operation. They act as the middleman between customers wanting to make electronic payments and the businesses that accept those payments.

So, when your bank gives you a Visa card, you can go ahead and use it for your purchases. When you make a payment, Visa ensures that your money travels safely from your bank account to the merchant’s account.

Here’s the interesting bit: Visa makes money by taking a small cut from each transaction, kind of a toll system. Let’s say you spend $100 at a grocery store by swiping your Visa card. Visa will pocket $0.30 from that transaction.

Different transactions at different places come with varying fees, but that’s the basic business model of how Visa operates.

Here’s the idea: the more Visa cards and money there are in the system, the better it is for Visa. Why? Because with more cards and more money circulating, Visa can earn more from each transaction.

Now, think about this: in the past ten years, due to measures like quantitative easing, the M2 supply in the US has increased by a whopping 90%. While this alone won’t directly boost Visa’s revenue, it’s a clear sign that there’s a significant opportunity for Visa in this expanding market.

Visa’s success story isn’t just about its simple business model-it’s about how well they execute it.

In Q3 FY23, Visa once again impressed with its efficiency. They reported an impressive 98% Gross Margin and a 51% Net Margin, leaving competitors like Mastercard behind with their 43% net margin.

What’s even more surprising is that Visa’s efficiency beats out tech giants such as Microsoft (MSFT), Broadcom (AVGO), and Apple (AAPL), all of which have net margins below 40%. In fact, Visa is the most profitable company I ever owned.

Visa’s secret lies in its minimal COGS, their expenses in this area are almost non-existent as their network and processing costs are incredibly low at just $0.2 billion per quarter.

They don’t need to make hefty investments in CAPEX either. This efficiency is also reflected in their financial structure. Despite being a massive $477 billion company, Visa holds a mere $3.92 in net long-term debt. For that reason, the company has a credit rating of AA-, with a stable outlook.

Visualized Income Statement (App Economy Insights)

In the US, Visa leads the pack by issuing the majority of debit and credit cards, holding a whopping 61% market share. Mastercard follows in second place with a combined market share of 26%, while American Express (AXP) takes the third spot with 11%. When it comes to Purchase Volume, the market share distribution is similar.

Even on the global stage, while Visa’s dominance might not be as overwhelming, they still wear the crown as both a domestic and international market leader.

This is exactly what I mean, when I say a business has a strong moat.

Global Network Cards in US (Genuine Impact)

Visa’s Robust Financial Growth

Looking back at Visa’s past financial performance, they’ve shown significant growth, with their top line expanding by a remarkable 119% over the last decade. By the end of 2022, their revenue had reached $29.3 billion, indicating an annual growth rate of 11.9%.

What makes this growth even more impressive is the fact that their Operating Profit increased at an even faster pace, with an annualized growth rate of 17.2%. This is noteworthy because many companies struggle to translate their revenue growth into substantial profits. However, Visa stands out from the crowd in this aspect. Their bottom-line growth not only kept up with their top-line growth but actually outperformed it.

Revenue & Operating Income (Seeking Alpha)

However, we know that past performance doesn’t guarantee future outcomes. So, where is the company headed now?

As I mentioned earlier, Visa is riding high on some significant trends.

Our world is rapidly digitizing, online shopping is booming, and many developing nations are advancing their economies. Moreover, we’re steadily moving toward a cashless society. These shifts present vast opportunities for Visa in the coming years.

Visa is set to reveal its Q4 FY23 earnings at the end of October, and there’s optimism in the air. Expectations are pinned at $2.25 in EPS, marking a 16.6% increase from the same quarter last year. I believe this goal is entirely feasible for the company.

Looking at the bigger picture, I anticipate Visa’s full-year revenue for FY23 to hit around $32.5 billion, representing 10.8% YoY increase, with a full-year EPS of $8.68.

Looking beyond FY23, analysts predict Visa’s top-line growth to hover around 10% annually for the next four years. Afterward, the growth rate is expected to taper down to 8% for the rest of the decade.

While this might not be an astronomical growth rate, what’s more significant here is the EPS, expected to grow at an annualized rate of about 14% over the next 4 years.

Risks to Visa’s Business

Certainly, Visa’s business is no stranger to risks, especially given its dominant position in the market, which often makes it a target for politicians.

As we discussed earlier, the core of Visa’s business revolves around the sheer volume and size of transactions. One immediate threat comes from the possibility of slowing economy. If interest rates continue to rise, it could put a damper on the economy, leading to reduced spending. Naturally, this would translate to a slowdown in the number and scale of transactions processed by Visa.

Another major concern stems from governmental actions, specifically the proposed Credit Card Competition Act. This legislation suggests that large banks, those with assets exceeding $100 billion, must offer merchants a choice between two transaction processing networks. While one option could still be Visa or Mastercard, the other would have to be a different network altogether.

The reason behind this move is the legislators’ worry about the duopoly that Visa and Mastercard currently enjoy, controlling over 80% of the credit card network market with more than 576 million cards. This lack of competition is seen as a reason for the persistently high processing fees.

Adding to these concerns is the ever-looming threat posed by new technologies. While it’s true that breaking into this market is challenging due to strict regulations and high entry barriers, the rapid advancements in FinTech are undeniable.

Companies like Block (SQ) and PayPal (PYPL) are only some examples of alternative payment solutions. The constant evolution in the tech landscape poses a tangible risk to Visa, as there’s always the possibility of a new, superior, and faster technology emerging, potentially reshaping the entire payment industry.

Low Yield, but Strong Dividend Growth

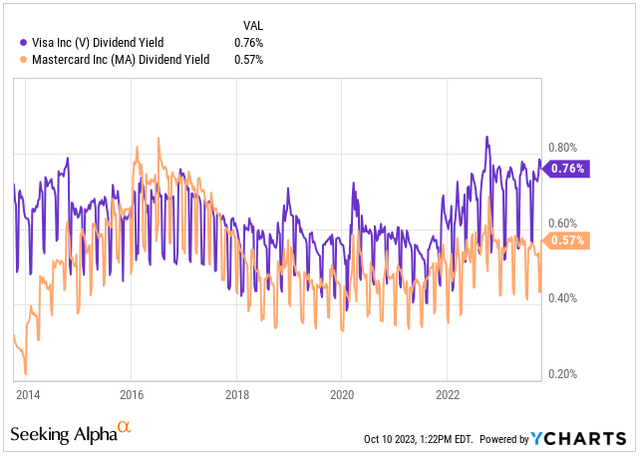

Some investors argue that a company offering less than a 1% yield shouldn’t be seen as a strong dividend growth stock, given its modest dividend and the need for long-term compounding to make it a substantial income source.

I understand that Visa’s 0.76% dividend yield might seem relatively low. However, it’s important to view Visa not as an immediate income provider but as a growth opportunity.

The real potential lies in compounding, which can turn this low yield into a high-income source in the future.

In the world of dividend growth investing, around 70% of the total return comes from the appreciation of the stock, while the remaining 30% is from dividends.

Despite the current low yield, if you, like myself, invested in Visa more than a decade ago, your yield on cost would now be a significant 3.92%.

Additionally, it’s worth noting that the current dividend yield is higher than Visa’s 5-year average of 0.65%.

Dividend Yield (Seeking Alpha)

When it comes to dividend growth, Visa has demonstrated a remarkable increase of 350% over the last decade. While this figure is slightly below Mastercard’s growth rate, it’s understandable considering Visa’s larger size.

In fact, just last October, Visa raised its dividend by 20%. I anticipate a similar increase this year, falling within the range of 15% to 20%, which should be officially announced along with the earnings report.

Dividend Growth (Seeking Alpha)

Visa has been quite proactive in buying back its own shares since 2014. In fact, they’ve repurchased over 20% of the outstanding shares during this period. I am expecting Visa to announce a new stock buyback program this month of anywhere between $10 – 15$ billion, or roughly 2.7% of company’s market cap.

Valuation

When it comes to valuation, Seeking Alpha gives Visa an F grade, which might seem concerning. However, it’s crucial to understand the context.

The financial sector’s median PE stands at 8.15x, significantly lower than Visa’s 28.04x. This difference is mainly because the sector includes insurance companies, holding companies, and other highly cyclical financial businesses.

But here’s the catch: Visa isn’t your typical financial company. I see it more as a tech-financial entity. Currently, it’s trading at a considerable discount compared to its 5-year averages.

Normally, Visa, with its exceptional quality and strong moat, rarely dips below a PE ratio of 30x. Yet, right now, it’s trading below that mark.

Looking at the numbers, its forward PE ratio is 28.47x, whereas the 5-year average is 32.15x, indicating an 11.45% discount.

Even more significant is the EV/EBITDA ratio, which is at 21.58x, showing a 16.57% discount compared to its 5-year average of 25.87x.

In my opinion, Visa is currently at least 14% undervalued, making it a great opportunity to consider adding to your existing position or even starting a new one.

Valuation Grade (Seeking Alpha)

Based on my analysis, considering an anticipated EPS of $8.68 for FY23 and factoring in analysts’ growth projections until 2030, I’ve reached an intriguing conclusion.

With the consistent contraction of the Forward PE ratio, there’s a distinct possibility that the company’s stock could reach $458 by the close of 2030.

This estimate implies a significant capital appreciation of 93%, translating to an annual growth rate of 13.3%. If we take dividends into account, Visa seems poised to offer an attractive total ROI of around 14%, making it a compelling investment opportunity at today’s price.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue ($b) | 32.50 | 35.75 | 39.33 | 43.26 | 47.58 | 51.39 | 55.50 | 59.94 |

| Revenue Growth | 11% | 10% | 10% | 10% | 10% | 8% | 8% | 8% |

| EPS $ | 8.68 | 9.83 | 11.23 | 12.58 | 13.97 | 15.09 | 16.29 | 17.60 |

| EPS Growth | 15.7% | 13.2% | 14.2% | 12.0% | 11.0% | 8.0% | 8.0% | 8.0% |

| Forward PE | 27.3 | 28.0 | 28.5 | 28.0 | 27.5 | 27.0 | 27.0 | 26.0 |

| Stock Price $ | 237 | 275 | 320 | 352 | 384 | 407 | 440 | 458 |

Game Plan & Conclusion

In this article, I’ve shown that Visa is a powerhouse both nationally and internationally. It’s not just leading the pack in margins-it’s actually the most profitable company I own.

Visa’s strong position and its alignment with the cashless society trend make it a promising investment, especially as the world becomes more digital, money supply increases and emerging economies continue to grow.

Even though Visa’s dividend yield is below 1%, its consistent dividend growth makes it attractive for investors seeking steady dividend growth.

Considering the current market value, Visa appears to be trading at a substantial 14% discount compared to its historical averages.

Speaking from my own investment perspective, if Visa’s stock drops to around $225, I plan to increase my stake by 10%. If it falls further to about $215, I’m looking to add another 20% to my position. Ultimately my goal, if the price action allows, is to make Visa once again my largest holding.

For those who haven’t invested in Visa yet, perhaps this is a good time to consider it. The current price levels offer a compelling entry point into one of the strongest businesses in the market today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V, MSFT, AAPL, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.