Summary:

- Visa reported strong Q4 FY 2023 results which beat analyst estimates.

- Despite the positive results, V shares are trading lower, presenting a buying opportunity.

- V benefits from inflation and operates with high profit margins, making it an attractive investment for a rising inflationary environment.

- V is trading at an attractive valuation relative to its historic averages and is only modestly more expensive the S&P 500 despite having a very strong moat.

- I am initiating V with a strong buy.

andreswd

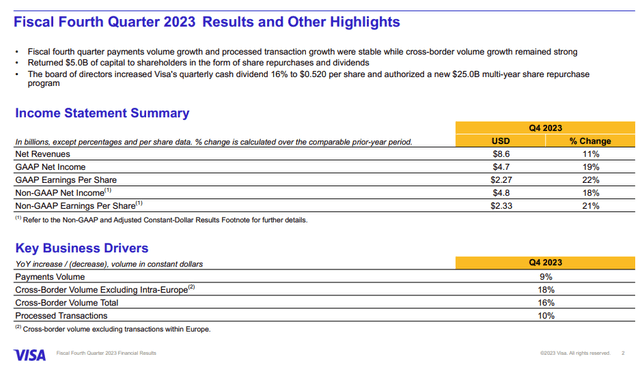

Visa Inc (NYSE:V) reported strong Q4 FY 2023 results that topped analyst estimates. Additionally, V announced a 15.6% increase in its quarterly dividend to $0.52 per share from $0.45 per share previously. The company also announced a new $ 25 billion share repurchase program.

Given these strong results, I would have expected shares to move sharply higher. However, as this writing, V shares are trading lower by ~1% in the after hours trading session. I believe current levels represent a very attractive buying opportunity for V.

Q4 FY 2023 Results

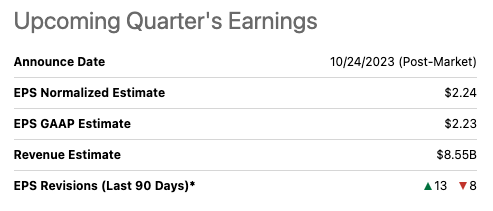

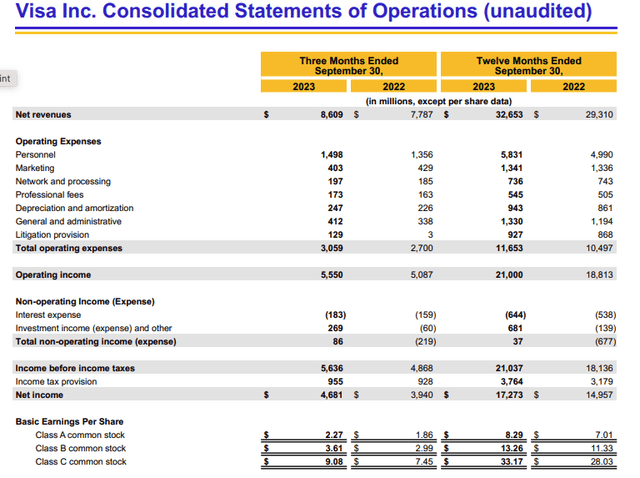

V reported GAAP EPS of $2.27 per share and Non-GAAP EPS of $2.33 per share. As shown by the table below, this compares to consensus estimates for $2.24 and $2.23 respectively. GAAP EPS increased 22% on a year-over-year basis while Non-GAAP EPS increased by 21% on a year-over-year basis. For FY 2023, GAAP EPS increased by 18% and Non-GAAP EPS increased by 17%.

In regards to revenue, V reported net revenue of $8.6 billion compared to analyst estimates of $8.55 billion. Revenue grew at 11% on a year-over-year basis or 10% on a constant-dollar basis.

Payments volume increased by 9% and processed transaction increased by 10% both on a year-over-year basis.

Visa Investor Presentation Visa Q4 FY 2023 Consensus Forecast (Seeking Alpha)

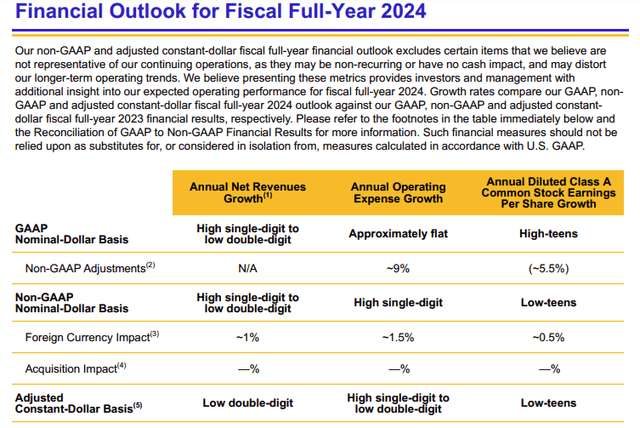

Full – Year 2024 Outlook

As part of its Q4 release, V released new FY 2024 guidance. The company expects revenue to grow by high single-digit to low double-digits and GAAP EPS to grow in the high-teens. This guidance is roughly in-line with current consensus analyst estimates for FY 2024 growth.

I view the fact that V guided inline with analyst estimates as a bullish development as I am generally of the belief that companies tend to guide conservatively so as to avoid disappointing Wall Street. Thus, I would not be surprised if V delivers an even stronger 2024 than is currently expected.

Strong Business that Benefits From Inflation

Outside of commodity producers such as energy companies or mining companies, one would be hard pressed to find a business that benefits more from inflation than the card payment business.

V enjoys an oligopoly in the U.S. card payment business along with Mastercard (MA), and American Express (AXP). Due to limited competition and high barriers to entry, V is able to operate at very high margins. Moreover, V does not need to purchase any commodities and personnel expenses account for just 50% of total operating expenses. The next largest cost categories for V are marketing and G&A.

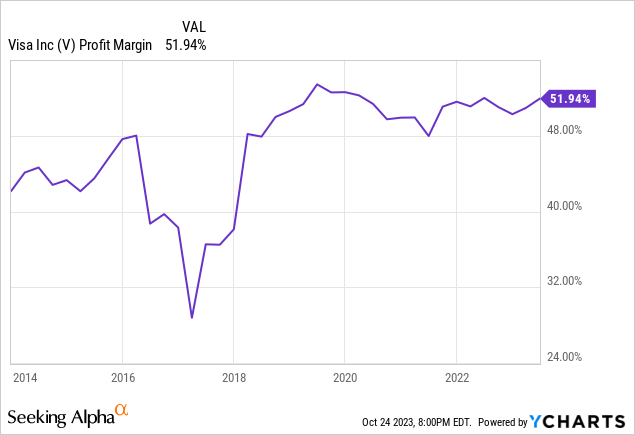

For the FY 2023 period, V posted a net profit margin of ~53%. This compares to net margins of ~51% during FY 2022.

In addition to expanding profit margins, V is also able to grow revenue faster in periods of high inflation.

For these reasons, I believe V is an excellent way to protect against a rising inflationary environment which is a negative for so many businesses.

Visa Investor Presentation

Valuation

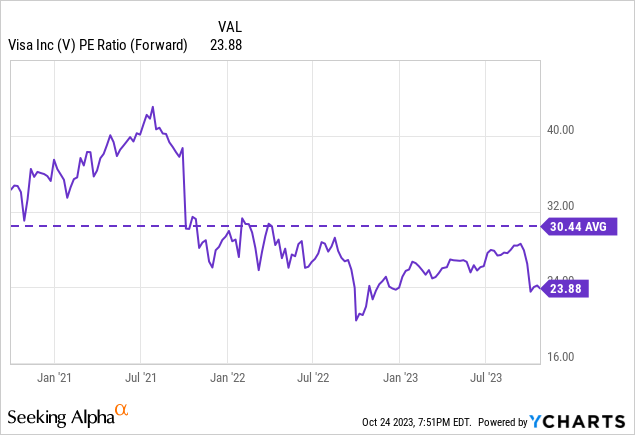

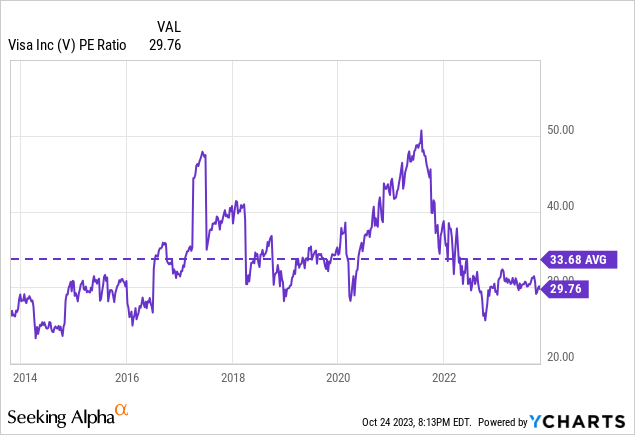

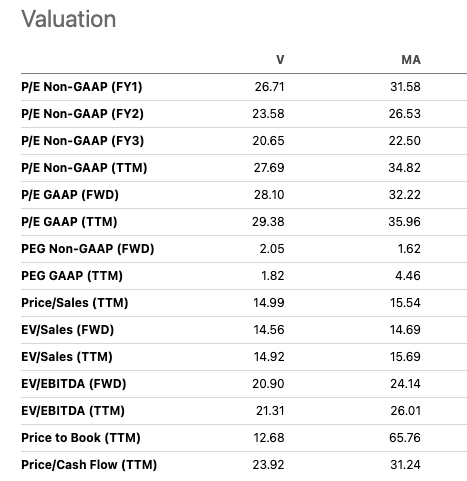

V currently trades at 23.8x 2024 earnings. This compares to 17.4x for the S&P 500. V trades at a forward PEG of 1.59x (assuming a 15% growth rate). Comparably, the S&P 500 trades at a forward PEG of 1.45x (assuming the consensus 12% growth rate.) While V is trading at a slightly higher PEG and PE ratio, I believe this premium is more than justified given V’s strong competitive moat and growth prospects.

In addition to being attractive vs the S&P 500, I also believe V is trading at an attractive valuation relative to its own historic norm. V is currently trading at 23.8x 2024 earnings which represents a 22% discount to its historical average. On a trailing basis include of the FY 2023 results released today, V trades at ~28x trailing estimates which is a 16% discount to its historic average.

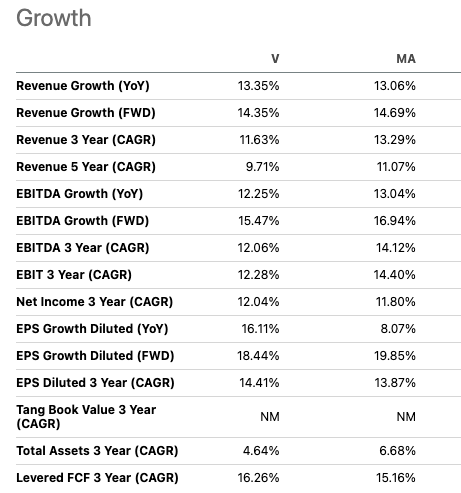

V also trades at a slight discount to its only true peer which is Mastercard. This valuation discount of ~10% exists despite both companies growing at nearly the same rate.

Seeking Alpha Seeking Alpha

Historical Performance

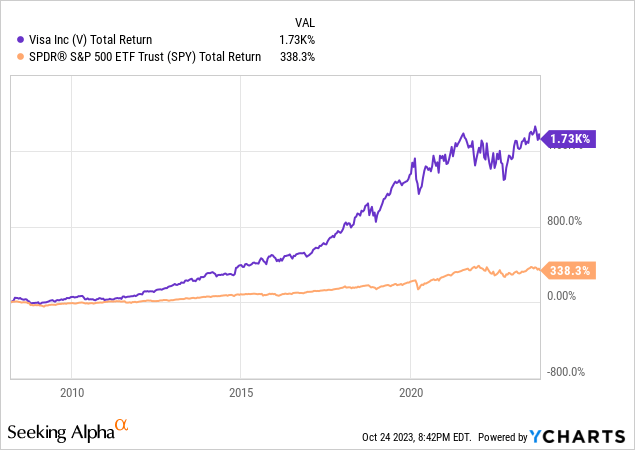

As shown by the chart below, V has massively outperformed the S&P 500 since coming public. I believe this speaks to the strength of V as a business. I also believe the strong degree of historical outperformance argues for a significant premium valuation relative to the S&P 500.

Risks To Consider

Perhaps the biggest risk to consider when investing in V is the potential for regulatory reform which would increase competition or limit how much card network operates such as V can charge merchants. One piece of legislation that has been put forward is the Credit Card Competition Act. The idea behind this act is to require big banks to give merchants a choice of two different networks to process credit card transactions. Currently, all V branded cards are processed through the V network while all MA branded cards get processed through the MA network.

As one would expect V and MA are opposed to the Credit Card Competition Act. Mastercard just recently wrote a public letter to sever members of Congress outlining its opposition.

Given the other major events currently going on in the world, including conflicts in Ukraine and Gaza as well as an impending government shut down if a deal to fund the government is not approved by Nov. 17, I do not believe Congress will prioritize the Credit Card Competition Act in the near-term. However, this is something investors must watch closely and it is a major risk to V.

Conclusion

V reported excellent Q4 results which surpassed analyst expectations. The company also announced significant dividend and buyback authorization increases. In addition to this, V also put out 2024 guidance that is in line with current consensus estimates.

Despite this strong report V shares have not moved sharply higher as I would have expected and are instead trading down following the release of Q3 earnings.

Limited competition and an oligopoly market structure allow V to enjoy very high profit margins. The company is also uniquely positioned to benefit from increases in inflation.

V is currently trading at a slight premium to the S&P 500 but is expected to grow earnings at a faster pace. Given the strength of V’s business, I believe the premium valuation is justified. The bullish valuation case for V is also strengthened by the fact that it is trading at a significant discount to its historic norms on both a forward and trailing PE ratio basis. V also trades at a ~10% discount to its closest peer MA despite both companies growing earnings at roughly the same rate.

For these reasons I am initiating V with a strong buy rating. I believe the biggest near-term risk to my view would be if the Credit Card Competition Act gains momentum in Congress. However, given the number of other competing priorities for the Congress I do not expect movement on the Credit Card Competition Act in the near-term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.