Summary:

- On July 23, Visa reported its latest earnings results, presenting an EPS of $2.42, an increase of 12% compared to the same quarter in the previous year.

- The strong earnings results strengthen my belief that the company is on track for growth.

- Visa’s financial results further increase my confidence that the company can be a strategically important key element of your investment portfolio, strongly contributing to your portfolio’s dividend growth potential.

- Visa exhibits the lowest risk level compared to Mastercard, American Express, and PayPal due to Visa’s lower total debt-to-equity ratio, higher net income margin, and reduced 24M beta factor.

2Ban

Investment Thesis

On July 23, Visa Inc. (NYSE:V) presented its latest earnings results. The company reported an EPS of $2.42, which is an increase of 12% when compared to the same quarter in the previous year. It’s also worth highlighting that payment volumes increased by 7% year-over-year, cross-border volume by 14%, and processed transactions by 10%. The company’s board of directors announced a quarterly cash dividend of $0.52 per share, which will be paid on Sept. 3.

Visa’s excellent earnings results in Q3 2024 strengthen my belief that Visa remains an attractive dividend growth stock.

Compared to competitors such as Mastercard Incorporated (MA), American Express Company (AXP), and PayPal Holdings, Inc. (PYPL), I believe that Visa is the superior risk-reward choice, particularly due to its reduced risk-level when compared to these competitors. The company’s reduced risk level is evidenced by its lower 24M beta factor, reduced total debt-to-equity ratio, and higher net income margin.

Due to Visa’s financial health (Aa3 credit rating from Moody’s), impressive dividend growth metrics (10-year Dividend Growth Rate [CAGR] of 18.05%) and low Payout Ratio (21.36%), I’m convinced that Visa can be an important key element to provide your portfolio with dividend growth potential.

The company receives my strong buy rating. I particularly suggest that younger investors overweight the company in their portfolios to contribute to strong dividend growth potential for the overall portfolio.

Visa’s Latest Earnings Results

During Visa’s latest earnings results, the company presented an EPS of $2.42. This is an increase of 12% compared to the same quarter in the previous year. It’s also worth highlighting that the company reported net revenue of $8.9B in Q3 2024, which is an increase of 10% compared to the same quarter in 2023.

Visa’s strong earnings results strengthen my belief that the company is on track in terms of growth and that it remains an attractive risk-reward choice for investors. The results also raise my confidence that the company should be a key driver in providing your investment portfolio with dividend growth potential.

Visa’s Current Valuation

Visa presently exhibits a P/E GAAP [FWD] Ratio of 28.08, which stands at 12.21% below its five-year average of 31.99. This metric indicates that the company is currently undervalued.

Visa’s undervaluation is also indicated by the company’s price/sales [FWD] Ratio of 15.19, which is 7.76% below its five-year average.

Visa’s current valuation strengthens my belief in rating the company as a strong buy.

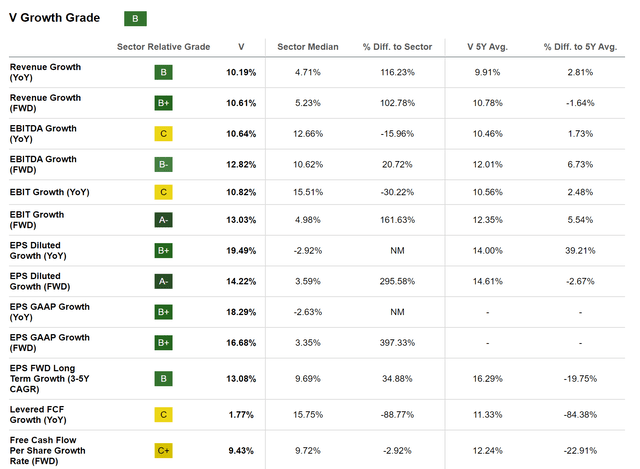

Visa’s Excellent Growth Outlook

The metrics below underline Visa’s excellent growth outlook: The company has shown an EPS diluted growth rate [FWD] of 14.22%, which is significantly above the sector median of 3.59%.

It is also worth highlighting Visa’s EPS FWD long-term growth rate (3-5Y CAGR) of 13.08%, which is significantly above the sector median of 9.69%. This underlines Visa’s attractiveness for long-term investors and the company’s enormous potential for dividend growth over the long term.

Source: Seeking Alpha

Visa’s Strong Dividend Growth Potential

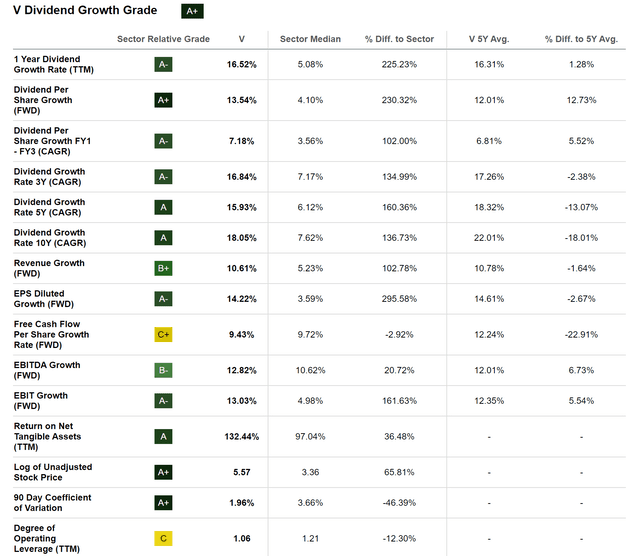

Visa receives an A+ rating from Seeking Alpha for dividend growth, further reflecting the company’s enormous potential for contributing to your portfolio’s dividend growth potential.

Visa exhibits a 10-year dividend growth rate [CAGR] of 18.05%, which stands 136.73% above the sector median.

At the same time, the company showcases an EBIT growth rate [FWD] of 13.03%, which stands 161.63% above the sector median, once again underlying the company’s impressive dividend growth potential.

Source: Seeking Alpha

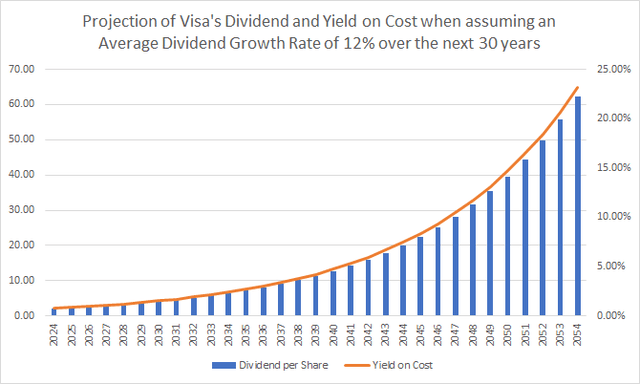

The Projection of Visa’s Dividend and Yield on Cost

The chart below underlines Visa’s ability to contribute to a strong dividend growth potential for your dividend portfolio. Assuming an average dividend growth rate [CAGR] of 12% for the following 30 years, you could potentially expect a yield on cost of 2.40% in 2034, 7.45% in 2044, and 23.15% in 2054.

Source: The Author

The chart further reinforces Visa’s dividend growth potential. Given Visa’s significant competitive advantages, financial health, and dividend growth potential, I plan to include the company in The Dividend Income Accelerator Portfolio, which is a portfolio that balances dividend income and dividend growth while providing investors with a reduced risk level and elevated chances of reaching attractive investment outcomes.

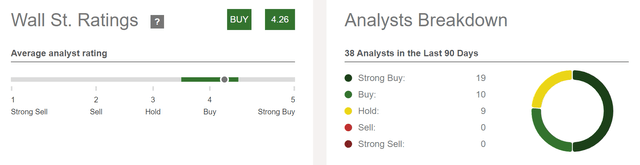

Visa According to Wall Street

It’s worth highlighting that Visa is presently a buy, according to Wall Street. Visa receives a strong buy rating from 19 analysts and a buy rating from 10. Nine analysts presently rate Visa as a hold.

It’s also worth mentioning that Visa does not receive any sell or strong sell ratings.

Source: Seeking Alpha

The Wall Street Ratings reinforces my belief that Visa’s growth outlook remains intact and that the company can be an important element in contributing to your portfolio’s dividend growth potential. The Wall Street Ratings further underline my own strong buy rating for Visa.

Visa in Comparison to its Competitors

When compared to competitors such as Mastercard, American Express, and PayPal, Visa’s superior profitability metrics can be highlighted: While Visa exhibits a Net Income Margin of 53.86%, Mastercard’s is 46.09%, American Express’s is 16.93%, and PayPal’s is 14.26%.

I also believe that Visa has the lowest risk level among these peers. Visa’s reduced risk level is evidenced by the company’s lower 24M Beta Factor of 0.85 when compared to Mastercard (1.00), American Express (1.15), and PayPal (1.60). It further shows that Visa can contribute to reducing the volatility of your investment portfolio.

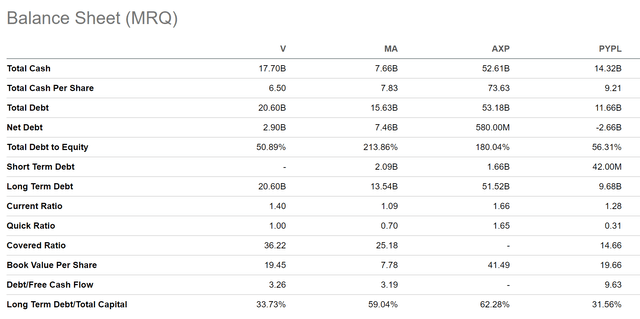

Visa’s reduced risk level is further evidenced by the company’s reduced total debt-to-equity ratio of 50.89% when compared to competitors such as PayPal (56.31%), American Express (180.04%), and Mastercard (213.86%).

Source: Seeking Alpha

However, in terms of growth, I see Mastercard slightly ahead of Visa: While Mastercard’s EPS Diluted 3 Year [CAGR] stands at 24.53%, Visa’s is at 22.72%, American Express’s at 15.91% and PayPal’s at -3.18%.

Visa’s Risk Factors

I believe that the risk factors for those investors who plan to invest in Visa over the long term are relatively low.

I consider Visa to be one of the world’s best investment choices in terms of risk and reward due to the company’s significant competitive advantages, its enormous financial health (Aa3 credit rating from Moody’s and EBIT Margin [TTM] of 67.26%) and its strong dividend growth potential (dividend growth rate 10Y [CAGR] of 18.05%) in addition to its presently attractive valuation.

However, Visa is not immune to market risks, particularly over the short term.

Among the main risk factors I see for Visa investors is if the company is unable to meet its growth targets. The company’s current share price of $269.37 has relatively high growth expectations priced into it. This is evidenced by Visa’s P/E GAAP [FWD] Ratio of 28.08. This means that the company’s stock price could drop strongly if the company’s growth targets are not met in one of the following years. However, Visa’s latest earnings results have shown that the company is absolutely on track in terms of growth.

The Case for a 5% Allocation Limit for Visa Investors to Reduce Your Portfolio’s Company-Specific Allocation Risk

Since I believe that the risk factors are significantly lower for long-term investors, I recommend investing in Visa over the long term, with an investment horizon of at least five years.

In general, I suggest overweighting the Visa position in a long-term investment portfolio, particularly for younger investors who plan to benefit from the company’s dividend growth potential.

However, I suggest setting an allocation limit of 5% for Visa to reduce your portfolio’s company-specific allocation risk.

Conclusion

Visa’s latest earnings results have strengthened my belief that the company can be an excellent core part of your dividend portfolio, contributing to a strong dividend growth potential.

In its latest earnings results, the company has presented an increase of 12% in its earnings per share, underlining its strong potential for dividend growth. Visa’s 10-year dividend growth rate [CAGR] of 18.05% provides further evidence of its capacity to raise the dividend.

When compared to competitors such as Mastercard, American Express, and PayPal, Visa’s reduced risk level is evidenced by the company’s higher net income margin, reduced 24M beta factor, and lower total debt-to-equity ratio.

Due to Visa’s reduced risk level, I believe the company is the most attractive pick in terms of risk and reward compared to these competitors. Visa presently receives my strong buy rating and a suggestion to overweight it in a long-term investment portfolio.

When including Visa in your portfolio, I suggest a long-term investment approach of at least five years to reduce the risk level of your portfolio.

I also recommend setting an allocation limit of 5% when compared to the overall portfolio. This approach ensures a reduced company-specific allocation risk for your overall portfolio while benefiting from Visa’s attractive risk-reward profile in addition to the company’s strong dividend growth potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V, MA, AXP, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.