Summary:

- The electronic payments industry is facing regulatory scrutiny and increasingly tight consumer protection regulations.

- Visa’s dominance in the payments industry may be challenged by regulatory and technological developments.

- Current price multiples seem to overlook these challenges, dismissing any concerns over Visa’s market position.

- Investors seem overly confident in V’s ability to maintain this market position, as mirrored in its high price multiples.

Justin Sullivan

Investment Thesis

At the heart of capitalism lies the idea of competition, which incentivizes businesses to operate more efficiently, innovate, and ultimately deliver better products and services at a lower cost to consumers. The Perfect Competition Model, which describes an ideal free market economy, predicts zero corporate profit as new entrants ultimately drive down market prices until marginal gains are zero.

Despite the many benefits of capitalism, it is critical to note that market failures do happen, which many believe is the case in the electronic payment industry, an anomaly attracting public scrutiny and investors alike. At the center of this attention is the spectacular profitability of the two duopolies in the market, Visa Inc. (NYSE:V) and Mastercard (MA), boasting a net profit margin of 50% and 45%, respectively, among the highest in the world.

Profitability is only one reason explaining why V (and MA) are often found in the lists of the most over-weighted stocks. Another factor is the company’s ubiquitous presence in the global payments system that, in the eyes of many, seems ingrained in the ecosystem.

I believe that the company’s high price multiples mirror investors’ over-confidence in Visa’s ability to almost permanently maintain its market position, overlooking significant regulatory and technological challenges that could fundamentally change the payments industry, constituting a red flag that underpins this article’s hold rating. Although many of these risks are hardly imminent, the only way to make sense of Visa’s price given its current growth is to think in a 10 – 20 year horizon, bringing us to discuss the industry’s megatrends below.

The Regulatory Hurdle

Visa has long been the envy of many, enjoying a 5-year average PE ratio of 34x, reflecting the high confidence investors place in the company. However, one can’t help but wonder if the market is underestimating the potential impact of regulatory challenges on this seemingly invincible powerhouse.

Since the Great Recession, the financial industry has faced increasing scrutiny and tighter regulations, with governments across the globe becoming more proactive in their efforts to protect consumers and ensure fair competition. As a dominant player in the payments industry, Visa is at the center of these regulatory challenges. The risk of regulatory intervention cannot be ignored, as it could disrupt the company’s long-standing dominance in the sector.

The Dodd-Frank Act is known for its efforts to enhance financial stability. Still, as the bill’s full name suggests (The Dodd-Frank Wall Street Reform and Consumer Protection Act), it includes provisions directly impacting Visa. One key provision of the Durbin Amendment, which introduced new regulations on debit card interchange fees, the fees that merchants pay to card-issuing banks (and are then shared with payment networks like Visa) for processing debit card transactions. In 2021, the Federal Reserve estimates Visa’s average interchange fee rate at 0.76% of every card transaction processed, down from 1.5% in 2011, just before the Amendment became effective. Most importantly, the Act set the foundation for enhanced competition that underpins the recent DOJ and FTC probes into Visa regarding transaction routing after the Amendment required payment networks to make available two network options for merchants to choose from when processing purchases. Commenting on the routing issue last month, the company Vice President stated

So we expect minimal impact in FY ’23. In the medium term and longer term, we’ll see. It’s definitely unclear in terms of how this will unfold. Oliver Jenkyn – 7th Annual Evercore ISI Payments & Fintech Innovators Forum. March 2023

Senator Durbin recently was behind an attempt to introduce a new bill that aims to expand the Durbin Amendment beyond debit card transactions to include credit card transactions, which are currently exempt from the Durbin Amendment. According to data from the Federal Reserve, a third of Visa transactions are currently exempt from the Durbin Amendment. On average, Visa charges twice as much for except payments as those covered under the Durbin Amendment (1.44% vs. 0.76%). Pundits expect that the bill has more chances of success in a Democratic-led Congress. Still, one can’t ignore the public’s scrutiny over Visa’s sales practices, as mirrored in the recent $5.6 billion settlement order with US merchants and the pending litigation in the UK and other parts of the world. Commenting on Visa’s decision to increase interchange fees post-Brexit, the UK watchdog commented:

The PSR wants to understand the rationale behind these increases and whether they are an indication that the market is not working well.

In the past, these “frictions” have and continue to impact Visa’s profitability, casting shadows over its high valuation. It gets worse since the problems of Visa extend beyond earnings into the heart of its market position, as discussed in more detail below.

The Technological Hurdle

Visa has traditionally fended off competition through acquisition, including Tink (an open banking platform) in 2022, CurrencyCloud (a cross-border payment planform) in 2021, Earthport (another cross-border payments platform) in 2019, CardinalCommerce (a provider of e-commerce authentication technology) in 2017 and many other.

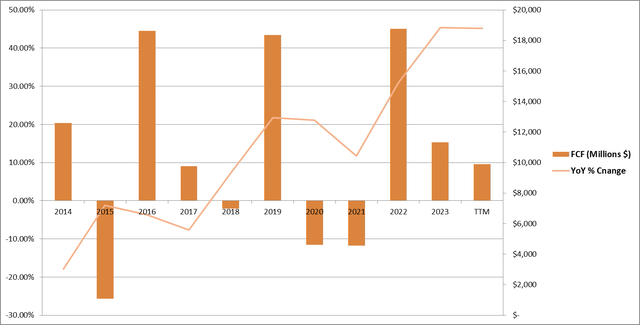

Visa has been able to leverage these deals to expand its market share and revenue for now. However, I don’t believe it has a choice but to continue buying competition to protect its market share, which negatively impacts FCF. At some point, when the market is mature, its M&A will barely be enough to maintain its revenue.

Free Cash Flow (Author’s estimates based on company filings)

In recent years, Visa has been facing increasing scrutiny over its M&A activities by regulators and consumer protection agencies, as manifested in its failed attempt to acquire Plaid, signaling a tightening regulatory landscape in the face of the payments giant. Last month, the DOJ hosted the Annual Spring Enforcers Summit, which included attorney generals from around the world. The discussion panel made it clear that there is a need for a renewed commitment to scrutinize M&A deals.

Another strategy employed by Visa is forging a partnership with potential competition, leveraging its size to maintain its relevance, including its partnership with PayPal, Stripe, Square, and even TransferWise (Wise), with the latter, using Visa push-payment platform, in return for Visa opening its network that allows Wise customers to use their multi-current debit card wherever Visa is accepted. These partnerships are also currently under investigation.

The regulatory response to Visa’s M&A initiatives lessens the effectiveness of a fundamental tool that the payment giant uses to fend off competition. Thus, its investment proposition at 27x PE ratio as a long-term investment doesn’t make sense in my view.

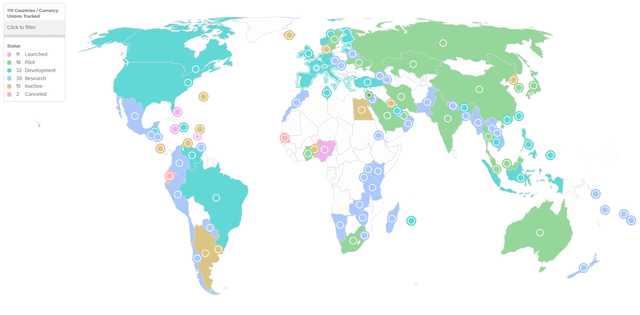

More importantly, I think it is wrong to assume that Visa’s services are indispensable. Many regions have their own payment networks, such as UnionPay in China, JCB in Japan, and RuPay in India. These networks could expand or replace Visa’s network. I also believe that the world now realizes that the status quo under a US-led infrastructure system is too slow and expensive. More than 100 countries are currently exploring alternatives, as manifested in the Digital Dollar Projects or Central Bank Digital Currency “CBDC,” as shown in the map below. CBDCs are currencies supported by a central bank and, from my understanding, use blockchain technology to maintain ledgers, allowing for faster, more affordable payments to consumers.

CBDC Tracker (Atlantic Council)

More fundamentally, we see emerging technologies that threaten the business model of traditional payment systems. Although currently, mobile payment technologies such as Apple Pay, Google Pay, and Samsung Pay rely on Visa’s network for processing transactions, one can imagine an open-source network being developed that undercut Visa’s role as the middleman. This is especially true given current developments regarding the Open Banking frameworks aimed at allowing customers to share their financial data with third-party financial service providers through secure APIs provided by banks. In Europe, the Second Payment Services Directive “PSD2” introduced banking regulations requiring banks to allow third-party providers to access their customer’s payment accounts data, allowing companies such as Plaid (which Visa tried to acquire) to circumvent the need for a Visa network. Open Banking regulations were also introduced in Singapore and Australia, and one can imagine the US implementing similar initiatives.

Beyond open banking, peer-to-peer transactions proved a reliable alternative way to transfer value. They currently face some challenges in terms of adoption rates and regulatory uncertainty, but one can’t deny their cost efficiency. Apps such as Wise have proven very efficient in transferring international payments without the need for a payment network. Again, brand recognition and adoption are the primary challenges.

The Fed is launching a new payment system called FedNow this summer (July 2023). I’m not sure what technology the FedNow service is based on, but from my understanding, it is independent of traditional payment networks, such as Visa and Mastercard.

Given these dynamics, it is clear that the payments industry is undergoing a significant transformation, with emerging technologies threatening to disrupt established players such as Visa. Despite this, investors seem to be overly confident in Visa’s ability to maintain its market dominance. The price multiples assigned to Visa seem to assume that the company will continue to hold its position for at least the next decade. However, this is a risky assumption. Visa might be a bargain twenty years from now, and given the threats discussed above, it might not, underpinning my hold rating on the ticker.

How I Might Be Wrong

Historically, Visa has been able to leverage its acquisitions to expand its revenue and market share, utilizing the fruits of its lobbying efforts to gain support from Congress. Whether to rein in Visa’s power or not is ideological, and I believe there is no right or wrong answer. Thus, the extent of the future regulatory impact is conditional on political dynamics that are hard to predict, and my concerns over market position might not materialize. While I am more than happy with my Visa exposure through my various ETF investments, I could be missing an opportunity to overweight the ticker through a stock position in Visa. Ultimately, the decision of whether to invest or not depends on individual risk/reward preferences.

Summary

The electronic payments industry is facing regulatory scrutiny and increasingly tight consumer protection regulations. Visa’s dominance in the payments industry may be challenged by regulatory and technological developments, and I believe the market is underestimating the potential impact of these factors. Regulatory challenges such as the Durbin-Marshal Act and technological advancements such as Blockchain and peer-to-peer finance could fundamentally change the payments industry. Investors must recognize that Visa’s position in the market is not guaranteed as its price multiples suggest. No one knows how the payments industry will be ten years from now, in my view. Given these dynamics, and the company’s valuation, I am passing on this opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.