Summary:

- Visa operates in a duopoly industry with a strong payment network, generating high profitability and cash flows, poised for double-digit revenue growth.

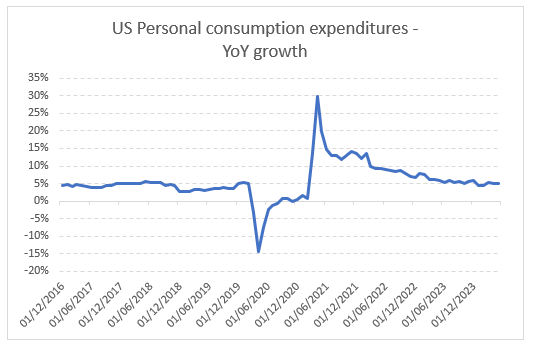

- Consumer spending has normalized at historical levels, with electronic payments expected to continue growing due to innovations and demographic shifts.

- Despite recent macro weakness, Visa’s revenue growth remains robust, with stable business trends driving mid-teen EPS growth.

hatchapong

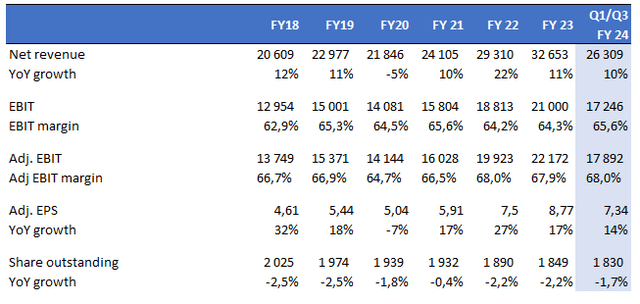

We have been bullish on Visa for a while, and wrote about it in April 2022. As a reminder, Visa operates in a duopoly industry and is a competitively advantaged business because of the strength of its payment network, which is very difficult to replicate and provides Visa with a cost advantage. Indeed, Visa partners with more than 15,000 financial institutions globally that have issued more than 3.8B Visa cards that are accepted in more than 100M merchant locations. As a result, the company is extremely profitable (the combination of an asset-light business model with an >65% EBIT margin translates in>35% return on invested capital) and generates tons of cash flows (FCF margin >60%) and very well positioned to capture growth opportunities. The growing consumer spending (that grew~ 4%/5% a year in the US over the last two decades), the ongoing cash to card transition (driven by the growth in e-commerce and the adoption of new solutions such as tap-to-pay) and new markets opportunities such as business-to-business, government-to-consumer, person-to-person or value-added services should drive double-digit revenue growth for years to come. EPS should grow even faster as the company should be able to improve the profitability (fixed-cost business) and use its strong FCF generation to reduce share count.

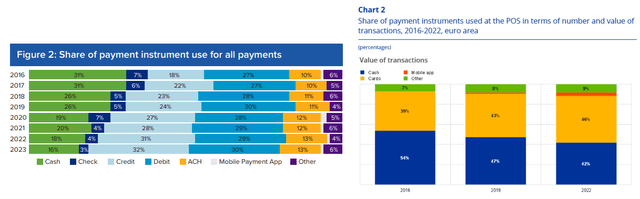

After several quarters of volatility due to the pandemic, consumer spending is now stable and back to its historical level of 4%/5%. While the share of cash payments has declined for many years, we have not found indicators enabling us to monitor the evolution on a quarterly or monthly basis. (our latest data are for 2023), we assume that electronic payments will continue to account for a larger share of total payments because of innovations (e.g.: Tap-to-pay is a great example of how Visa uses innovations to target small ticket cash transactions) and demographic changes (new generations are more technology-friendly). Indeed, the share of cash in total payments in the US and Europe has decreased from 26% to 16% in 2023 and from 47% to 42% in 2022, respectively.

(Source: BEA and Bloomberg)

(Source: San Francisco FED and ECB)

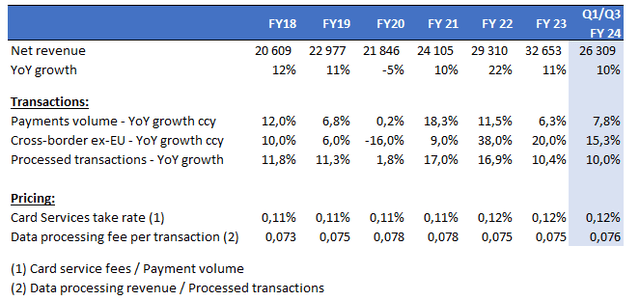

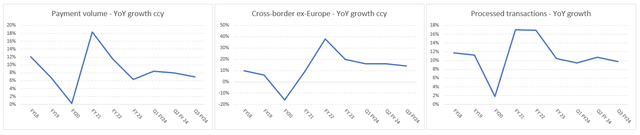

Revenue growth has remained robust, close to 10% over the first three quarters of the fiscal year 2024. This growth is driven by a combination of strong growth in total payments volume, including cross-borders ex-Europe volume, and in the number of transactions processed.

(Source: Earnings results and author)

The latest Q3 FY24 earnings release suggests that the business trends are stable. Growth in payment volumes slowed very modestly due to current macro weakness and the normalization in cross-border payment transactions (following the post-covid surge). US Payment volume growth further decelerated in July (measured from 1st to 21st of July) to 4% (vs 6% in Q2 and 5% in Q3). We consider that this trend should not be extrapolated, considering that most company’s explanations concerning July make sense. Indeed, Amazon Prime Day was held on 16th/17th of July (vs 11th/12th July last year), which make that some prime day-related transactions are not accounted for in that period (customers are billed, when the goods are shipped, but some of that shipping period fell out of that 21-days period). In addition, the major technology outage due to CrowdStrike also had some impact.

(Source: Earnings results and author)

(Source: Earnings results and author)

Adjusted operating margin is slightly improving over the first 9 months of the fiscal year as the payment network requires minimal additional costs to meet additional business activity. As a result, fixed costs are spread over a larger revenue base. EPS grew 14% over the same period, driven by double-digit revenue growth, slight margin expansion and a~ 2% share count reduction per year. This performance is in-line with historical trend, once adjusted for Covid fluctuations. All in all, we remain confident in the investment thesis given that the company delivers on our expectations of HSD/LDD revenue growth, EBIT margin of 65+% and mid-teen EPS growth. In addition, the number of shares outstanding continues to decline as Visa uses its FCF to reward shareholders.

In terms of valuations, Visa used to trade at 25x EPS in average over the last 10 years while the S&P 500 was trading around 17x/18x. As a result, Visa has traded~ 45% premium to the broad equity index. Nowadays, Visa is trading at ~23x EPS while the S&P 500 is trading at 20x, which is equivalent to a ~15% premium. We believe that a premium valuation is justified given its strong balance-sheet, strong track-record of earnings consistency, solid growth profile and above-average profitability. We believe that paying 23x EPS for a company able to grow earnings at a mid-teens rate is attractive, especially considering that the premium valuation is lower than the 40%+ it used to be.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.