Summary:

- Visa is a powerful dividend growth stock with a $500 billion market cap and a track record of 14 consecutive years of uninterrupted dividend growth.

- The company has hiked its dividend by 17% per year on average over the past five years and has a strong buyback program.

- Despite economic challenges, Visa reported a 12% increase in net revenues in Q3 2023 and remains promising with steady EBITDA growth and resilient margins.

_laurent/iStock Unreleased via Getty Images

Introduction

In my quest to further diversify my portfolio, I have to discuss Visa Inc. (NYSE:V), which may be one of the most powerful dividend growth stocks on the market.

The other day, I said that Home Depot (HD), with its >$300 billion market cap, is one of the companies that helped countless investors reach their financial goals.

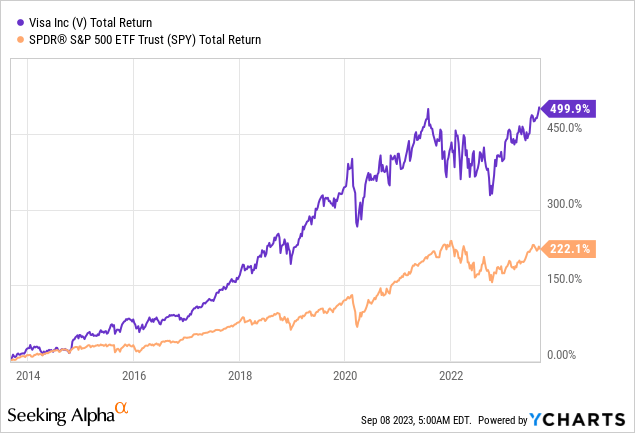

Visa is certainly in that arena as well. With a $500 billion market cap, this Credit Services giant has returned 500% in the past ten years alone, beating the S&P 500’s already stellar performance by roughly 280 points.

On top of that, while the company sees a slow-down in growth, its business is expected to thrive with double-digit long-term EBITDA growth, accelerating free cash flow used to boost dividend payments and buy back stock and rock-solid margins in a time when a lot of companies struggle with elevated inflation.

In this article, I’ll share my thoughts on Visa, as the stock still looks attractively valued after rising more than 40% from its 52-week lows.

So, let’s dive in!

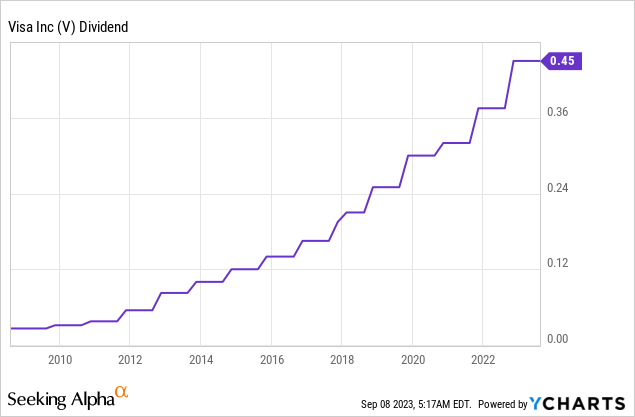

Stellar Dividend Growth

Sometimes, people get mad at me when I call a stock with a yield of less than 1% a dividend stock.

However, even with a 0.7% yield, Visa is a great dividend stock. Bear in mind that the yield isn’t low because the company is a poor dividend stock. No, the yield is only low because investors do not let the yield get elevated!

Visa is doing everything in its power to get its investors a decent yield.

Over the past five years, the company has hiked its dividend by 17% per year – on average. This beats almost all dividend growth stocks on my radar.

Since initiating its dividend, the company has hiked it every single year. It now has a track record of 14 consecutive years of uninterrupted dividend growth.

On October 20, 2022, the company hiked its dividend by 20%. Back then, it also announced a $12 billion buyback program. The dividend has an 18% cash payout ratio, which suggests there’s a ton of upside. It also helps that the company is expected to be net cash positive next year (more cash than gross debt). The company has an AA- credit rating – one of the best ratings in the world!

Morgan Stanley (MS) also owns Visa in its dividend portfolio (overweight!).

While I am not making the case that Visa is a good income stock (it is not), we need to focus on the growth part of dividend growth. After all, that’s what’s driving high long-term returns.

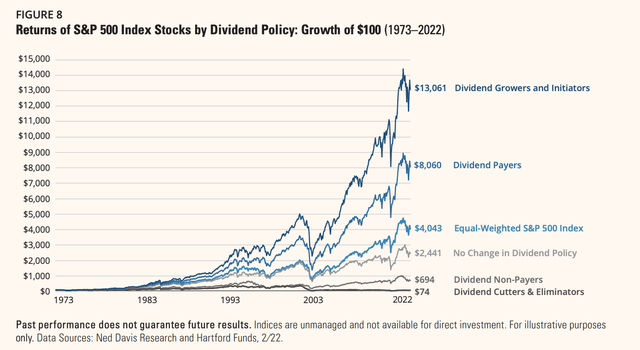

Historically speaking, dividend growers have outperformed the market and dividend payers by a significant margin.

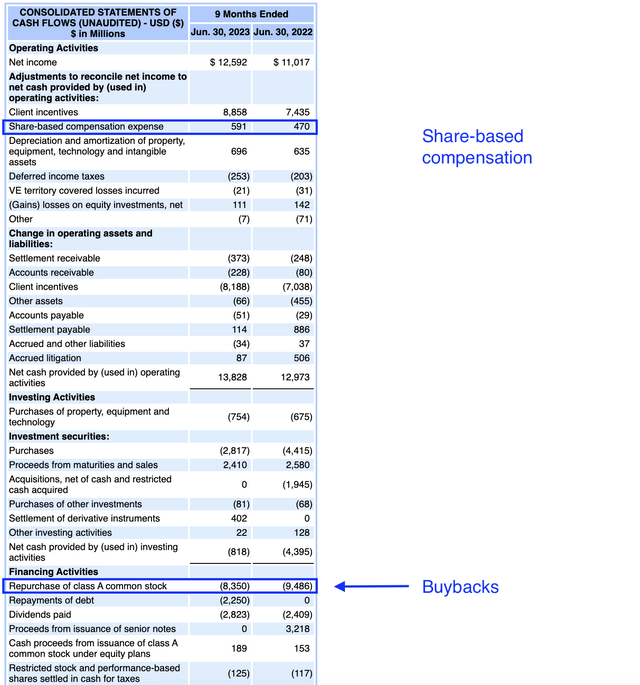

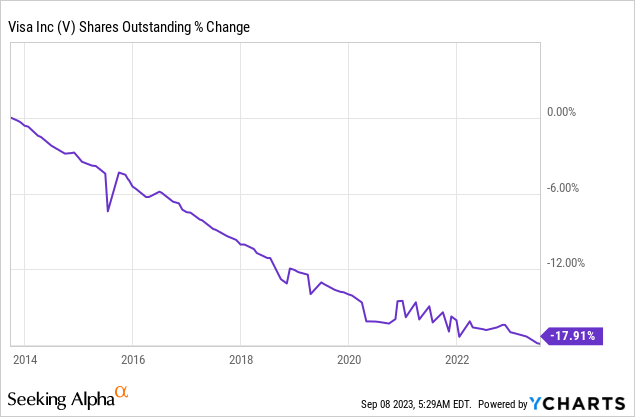

Visa is also a buyback champion. In the first three quarters of its 2023 fiscal year, the company has bought back $8.4 billion worth of common stock.

This is roughly 1.7% of its current market cap.

Over the past ten years, V has bought back roughly 18% of its shares.

Additionally, the company has reduced its use of stock-based compensation. Many fast-growing companies tend to over-reward employees with stock options, but this is not the case here.

With that said, let’s take a closer look at Visa’s progress. After all, a 20% dividend hike in 4Q22 may suggest that the company has confidence in its future.

Firing On All Cylinders

The economy isn’t in great shape. Europe is on the brink of a recession, with Germany already being in a recession. China’s real estate bubble is popping in front of our eyes, and U.S. economic growth is declining as well.

Meanwhile, inflation remains sticky.

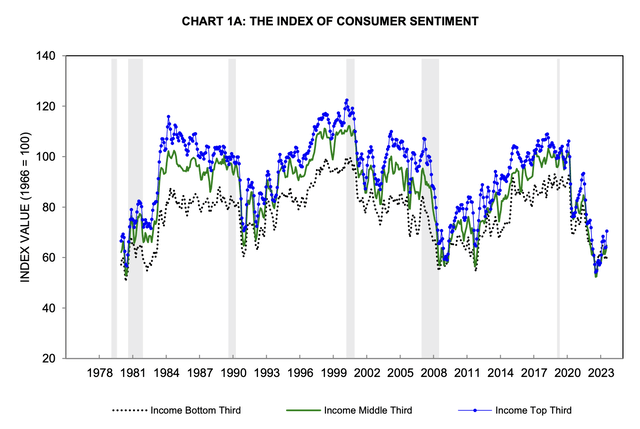

As a result, consumer sentiment is still close to 2008 bottom levels – despite a recent surge. While it’s hard to see, this surge is mainly the result of higher-income groups being more upbeat about their future.

These developments aren’t great for Visa.

This is visible in its stock price. While it is, once again, at its all-time high, the stock price has lost some steam since 2021. It’s still one of the best performers, but it needs to be mentioned.

The good news is that the company remains in good shape.

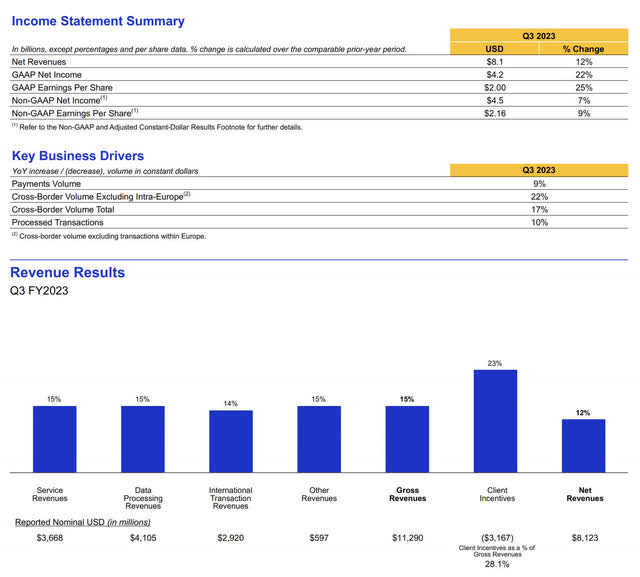

In the third quarter of 2023, Visa reported a strong financial performance, with net revenues surging by 12% year-over-year. Non-GAAP earnings per share reached $2.16, marking a 9% increase.

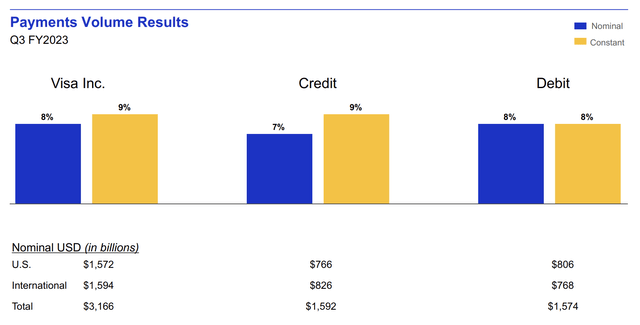

The global quarterly payments volume showed a 9% year-over-year growth rate, with a 6% increase in the U.S. and a 12% increase in international payments volume outside the U.S.

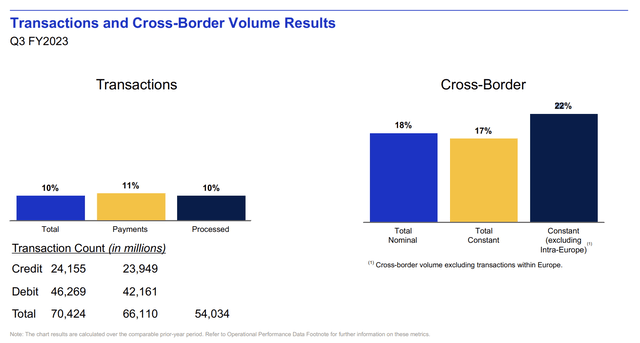

Furthermore, cross-border volume, excluding intra-Europe, remained strong, up 22%, and processed transactions grew by 10% year-over-year.

During its earnings call, the company’s CEO, Ryan McInerney, highlighted the company’s progress across its three primary growth levers: consumer payments, new flows, and value-added services.

In the consumer payments segment, Visa emphasized its success in expanding its client base and growing its partnership with various local, regional, and global competitors. Clients value Visa for its people, innovative products, value-added services, and brand.

I highlighted some examples in the quote below.

For example, across Eastern Europe, Intesa Sanpaolo will issue Visa debit in Croatia, Hungary, Romania, Slovakia and Slovenia representing over 3 million Visa credentials. Second, our payment products and innovations consistently help us win. Our clients tell us they choose Visa because our innovative products help ensure they are delivering leading-edge payment solutions to their customers. For example, in Korea, we recently renewed our partnership with Hyundai Card. As part of our new partnership, Hyundai will be taking advantage of our digital payment solutions like data and analytics services to launch a series of new innovations. Hyundai will grow their share of Visa cards in credit and debit for consumer and business. – V 3Q23 Earnings Call

The company succeeded in selling over 300 new issuing services, 600 new acceptance services, and nearly 500 new risk and identity services in the third quarter.

Notable innovations included a partnership with Pay.UK for fraud prevention and the impending acquisition of Pismo, a cloud-native issuer processing and core banking platform.

Visa Direct transactions grew by 20% in the third quarter, which reflects the company’s success in expanding into new markets and increasing its cross-border presence.

Additionally, the company signed a significant co-brand agreement with Indian conglomerate Adani.

During the recent Goldman Sachs Communacopia & Technology Conference, the company mentioned that B2B (business-to-business) Connect targets large-ticker cross-border transactions with a $10 trillion annual opportunity.

B2B Connect is another one that you mentioned. We see a $10 trillion annual opportunity in cross-border, large-ticket transactions, which we built and designed Visa B2B Connect to serve. Building out a global network takes time. I think we’re processing transactions in Visa B2B Connect in 90 markets now but we’re continuing to build that out. – V GS Conference

Going forward, Visa anticipates stable growth in domestic payment volumes worldwide for the fourth quarter. The recovery in cross-border travel is expected to continue, particularly in Asia.

Cross-border e-commerce trends are predicted to remain consistent, adjusted for crypto-related volatility.

However, the year-over-year growth rate is expected to slow down.

Currency volatility is moderating compared to the previous year. Visa’s value-added services and new flows businesses continue to grow faster than consumer payments.

The incentives as a percentage of gross revenues are expected to range from 27.5% to 28.5% to finish the year at the high end of 26.5% to 27.5%.

So, what about the valuation?

Valuation

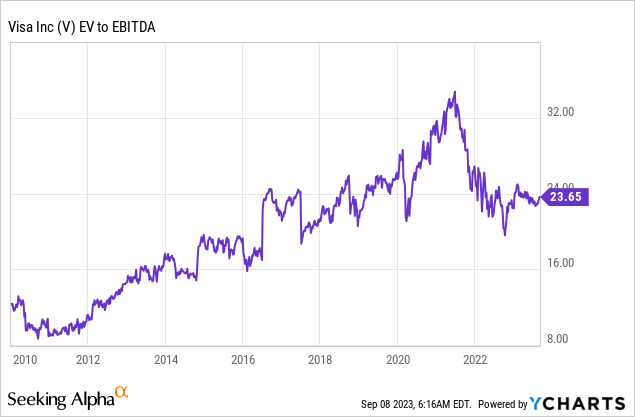

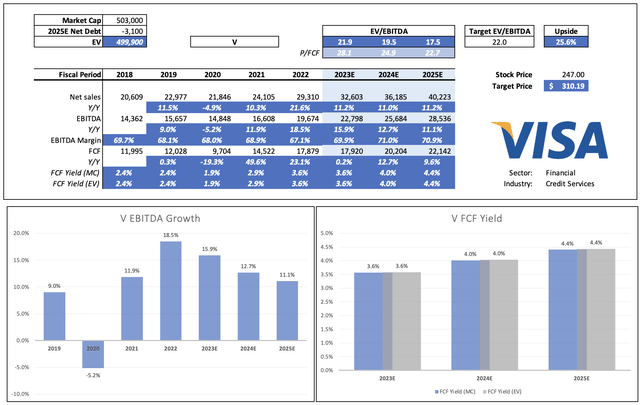

Visa shares are currently trading at 21.9x 2023E EBITDA.

Since the financial crisis, the company has enjoyed an increasing valuation multiple as market participants have grown increasingly bullish on the company’s growth prospects. It also helped that rates were subdued.

Looking at the data below, the company is expected to see slowing EBITDA growth. However, EBITDA growth is expected to remain elevated.

If we apply a longer-term 22x EBITDA multiple, we get a fair valuation 25% above its current share price. Also, note that margins are expected to remain elevated. The company is expected to maintain EBITDA margins close to 70%.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $278, which is 13% above the current price.

I put V on my watchlist as I’m currently assessing which stocks to add and which existing holdings to expand.

If the market gives us a deeper correction, odds are I’m a buyer of V.

Visa has been a top performer in the past, and I see no reason why that cannot continue for many more years (decades?) to come.

Takeaway

In my pursuit of diversifying my investment portfolio, Visa has emerged as a standout player in the world of dividend growth stocks. Despite its seemingly modest 0.7% yield, Visa has proven itself as a dividend growth powerhouse.

Over the past five years, it has consistently raised its dividend by an impressive 17% annually, boasting 14 consecutive years of uninterrupted dividend growth.

Visa’s financial strength is evident with its AA- credit rating and robust performance. Even in a challenging economic landscape, the company reported a 12% increase in net revenues in the third quarter of 2023.

Looking ahead, Visa remains promising, trading at an attractive valuation with steady EBITDA growth and resilient margins.

If market conditions are favorable, I am ready to take advantage. Visa’s impressive track record and growth potential make it a strong candidate for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.