Summary:

- Visa operates one of the best businesses in the world, as one of the two payment processing giants which form the duopoly responsible for processing most of the world’s transactions.

- Even after decades of market outperformance and high double-digit growth, the company has plenty of room for growth, with cash still being a major portion of global transactions.

- The company is expanding into new lines of business with new value-added services (acceptance, risk & identity, and more) and by processing new money flows (A2A, P2P, B2B, G2B).

- Despite its high quality and immense growth prospects, Visa is trading 15.0% below its 5-year average valuation, reflecting investors’ worries about competition like FedNow and regulatory pressures.

- Historically, these are the best times to buy Visa. I rate the stock a Strong Buy with a fair value of $270.0 per share.

Justin Sullivan

Visa (NYSE:V) is a global brand, trusted by billions of people to process their payments all over the world. Even after decades of outperformance and impressive high double-digit growth, I believe there’s still plenty of room for upside, as cash still takes a major portion of global transactions, and the company is diversifying its offerings to new value-added services and new flows. The company is trading below its historical multiples and below my estimated fair value of $274.0, reflecting a 21.1% upside. Thus, I rate the stock a Strong Buy.

Background & Introduction

I recently wrote an article about Mastercard (MA), explaining why I think both payment giants are great businesses, with plenty of room for upside. I also explained that if I want to stay true to my strategy, I have to pick only one between them, as I’m looking for a concentrated portfolio. I listed in detail the reasons I picked Visa and why I find it more attractive at current prices, so I urge you to read the full comparison.

In short, I believe the market is underrating Visa’s growth trajectory, and disregards its much better margins. There’s no sign to suggest that the 10-percentage-point gap between the companies’ EBIT margins is narrowing, and if we look at the past 6 years, Mastercard isn’t outgrowing Visa in terms of revenue and volumes to a material extent. Thus, I find Mastercard’s premium over Visa unjustified.

Now that we got that cleared out, let’s dig deeper into Visa, its unstoppable revenue streams, and why as an investor I’m not worried about FedNow.

Company Overview

Visa facilitates global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions, and government entities. In FY22, 193 billion transactions were processed by Visa. The company has nearly 15,000 clients that provide 4.1 billion credentials with credit, debit, and prepaid cards. Since 2017, Visa earns 52.0%-55.0% of its revenues outside the U.S.

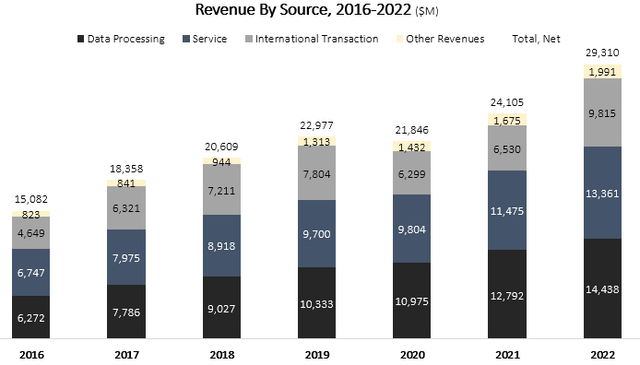

The company disaggregates its revenues into four categories – Data Processing, Service, International Transaction, and Other.

Created by the author using data from Visa’s financial reports

Unlike Mastercard, Visa doesn’t divide its revenues between payment facilitation and value-added services. However, we know that value-added services drove $6B in revenue in 2022.

Strategy & Growth Prospects

Visa’s strategy is to accelerate its revenue growth through increased volumes of existing consumer payments, new flows as electronic payments take share from cash and checks, and value-added services.

In existing consumer payments, growth will be enabled by the ever-increasing convenience to transact with cards, as innovations like tap-to-pay, tokenization, and click-to-pay, continue to gain traction.

In new flows, Visa has a ‘network of networks’ approach, enabled by Visa Direct, which creates opportunities to capture value from new sources of money movement like peer-to-peer, business-to-consumer, business-to-business, and government-to-consumer. These kinds of transactions are all still a small portion of the company’s business, yet they account for a huge portion of worldwide volumes. In 2022, Visa Direct had 5.9 billion transactions, which is a 36% increase from 2021.

In value-added services, Visa offers issuing solutions, acceptance solutions, risk & identity, open banking, and other advisory services.

Overall, with cash transactions totaling $7.6T in 2022, I believe Visa still has a lot of growth opportunities ahead.

Explaining Its Unstoppable Revenue Streams

It’s very well-known but important to emphasize that Visa (and Mastercard) do not make money off of interest charged on its branded cards. The company has thousands of partnerships all over the world, through which Visa derives revenues from fees associated with its payment facilitation services. Those fees are calculated based on the size and type of a transaction and also depend on the role of Visa in the transaction. A key item to take here is that Visa does not carry any consumer credit risk on its balance sheet, which is the biggest difference between the company and American Express (AXP) for example.

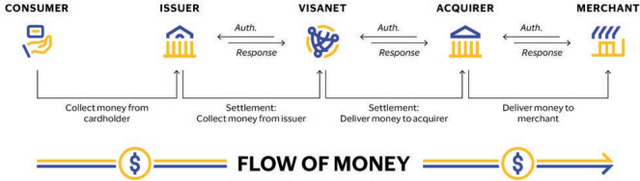

If you’ve been researching Visa or Mastercard, then I bet you’ve seen the following graph before:

Visa 2022 Financial Report (10-K)

The core business of Visa is facilitating the typical four-party transaction which occurs when a consumer (a person or entity who holds a card or other payment device) transfers funds from an issuer (the consumer’s financial institution) to the merchant’s acquirer (the merchant’s financial institution).

Under Data Processing, Visa collects fees for authorization, clearing, settlement, value-added services, network access, and other related services. Under Service, Visa collects fees for services provided to clients, based on their usage of Visa’s services. Under International Transaction, Visa collects fees for processing cross-border transactions and currency conversion activities. Under Other, Visa earns revenues for value-added services which are non-related to transactions, license fees, and certification charges.

Visa pays out approximately 27.0% of its gross revenues to clients in what it refers to as ‘Client Incentives’. These are essentially revenue-sharing arrangements between Visa and its partners.

So, What Do I Mean By ‘Unstoppable’?

We all know that the Software-as-a-Service (‘SaaS’) business model is viewed as one of the best models to operate. The reason is simple, the duplication cost is close to zero. In other words, the additional cost of providing the product to another customer is extremely low. Thus, the higher the revenues of such a company, the higher its profit margin. The gross margin is the financial metric that reflects that business model best. Companies like Adobe (ADBE) are the embodiment of SaaS, with its 87.7% gross margins in 2022.

Well, how about Visa? The only cost Visa incurs per additional transaction is aggregated under its ‘Network and processing’ expenses. In 2022, these expenses amounted to $743M, which is 2.5% of Visa’s net revenues. Simply put, Visa’s gross margin in 2022 was 97.5%. All its other costs are not directly related to revenues. By the way, thanks to its different accounting principles, Mastercard reports a 100.0% gross margin.

This is what I mean by unstoppable. The more revenues Visa generates, the higher its profit margin will get. Operationally, expanding into new geographies and new customer cohorts is a very low-risk and cheap investment for Visa.

That being said, and despite the double-digit growth estimates for the foreseeable future, Visa is currently valued at a 27.5 forward P/E ratio, which is 15.0% below its 5-year average. Clearly, investors are worried about something.

Historically, when it comes to Visa and Mastercard, we’ve seen worries about competition come and go, with the likes of PayPal (PYPL), Apple Pay (AAPL), or the popularization of Buy-Now-Pay-Later. Just like I said in my Mastercard article, these worries have so far ended with the realization that each one of those “competitors” became a customer and a growth driver. We’ve also seen the occasional headlines about regulators interfering with the companies’ success in all kinds of ways, like forcing them to break up their operations into separate segments or lower their fees. Those worries never seem to materialize as well.

As Visa’s latest volume numbers show no sign of a weakening consumer or a slowdown, what seems to worry investors now is competition from the likes of FedNow, and the simple question is – is this time going to be any different?

How Big Of An Issue Is FedNow?

According to the Federal Reserve Website – “The FedNow Service will be available to depository institutions in the United States and will enable individuals and businesses to send instant payments through their depository institution accounts. The service is intended to be a flexible, neutral platform that supports a broad variety of instant payments. At the most fundamental level, the service will provide interbank clearing and settlement that enables funds to be transferred from the account of a sender to the account of a receiver in near real-time and at any time, any day of the year”. The target release date for the service is May to July 2023.

While FedNow is going to launch in the U.S., other governments are engaged in similar initiatives, like Brazil’s Pix system which was launched in 2020, and RuPay or UPI in India which launched more than 6 years ago. Interestingly, Brazil and India are one of Visa’s best-performing markets during those years.

In essence, what the FedNow service is going to enable is an instant and free Account-to-Account service. Already today, there are many alternatives for A2A transactions, and Visa’s main value proposition in that category is a secure instant transaction. At least for now, this means FedNow is going to compete with a very small portion of Visa’s business.

Well, our view is that everybody is a potential partner. Nobody really is a competitor. Anything that makes payments more ubiquitous, anything that causes consumers to adopt digital forms of payment, anything that makes merchants accept digital forms of payment is a good thing because it expands the market and maybe we have a large share of a market that’s 5 times as big than a larger share of a market that’s one-tenth the size.

And that’s historically proven to be the case because once people get used to, let’s say, a digital form of payment because they use Pix or RuPay in India, UPI in India, they get used to digital payments. That means they use digital payments for lots of things when it comes to higher-value payments, and they often come to us.

We don’t view these other networks necessarily competitors, they are open to us. Lots of reasons that we benefit. We partner with them, we send transactions to them. They send transactions to us, we may offer value-added services to them. Our payment volumes in India almost doubled. Brazil has been one of our strongest performing markets.

— Vasant Prabhu, Vice Chair and CFO, Morgan Stanley 2023 Conference

To me, FedNow will be just like any other potential disruptor that made waves throughout the years. I doubt we will ever see it materially affecting Visa’s results.

Valuation

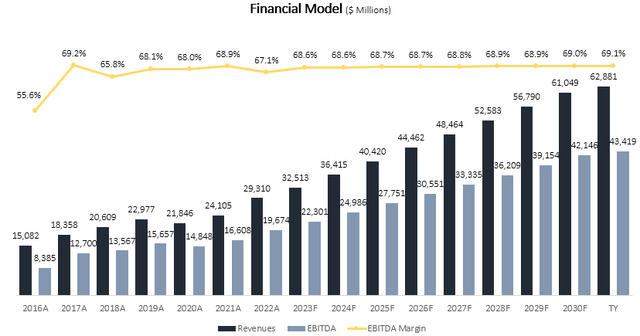

I used a discounted cash flow methodology to evaluate Visa’s fair value. I assume the company will grow revenues at a CAGR of 9.6% between 2022-2030, which is according to the company’s long-term growth targets, and slightly below my projection for Mastercard. I believe revenues will grow at that pace due to sequential declines in cash usage which will result in high GDV growth. Additionally, I expect the continued introduction of new value-added services and the growth of existing ones. I find this growth rate to be reasonable, as there’s still a huge untapped market, which amounts to $7.6T worth of volumes.

I project Visa’s EBITDA margins to increase incrementally up to 69.1%, which is in line with the company’s all-time highs. This projection results in EBITDA growth slightly above revenue growth, which is based on my assumption Visa will benefit from operational leverage. I find my EBITDA projection very conservative, as just last quarter we saw a higher margin when adjusting for non-recurring legal and Russia-related expenses. Honestly, I strongly believe Visa can surpass the 70.0% threshold.

Created and calculated by the author based on Visa’s financial reports and the author’s projections

Taking a WACC of 7.5%, I estimate Visa’s fair value at $563.4B or $274.0 per share, representing a 21.2% upside compared to its market value at the time of writing. This reflects a forward P/E of 33, in line with Visa’s 5-year average.

Conclusion

Visa probably has the best business model in the market, with 97.5% gross margins, and almost zero duplication costs. Even after many years of double-digit growth, there’s no sign of slowing down. Visa still has huge opportunities with its core business, new flows, and value-added services. However, at the time of writing, Visa is trading at a forward P/E of 27.5, which is 15.0% below its 5-year average. I estimate its fair value at $274.0 per share, reflecting a 21.2% upside. At its current price, Visa is trading at an 11% discount compared to Mastercard based on their P/E ratios, which I find unjustified. Therefore, I rate Visa a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.