Summary:

- Visa has a dominant global presence in a rapidly expanding digital payments market, set to capitalize on the increasing shift toward cashless transactions.

- Strategic fintech partnerships and integration of blockchain technology, along with robust financial performance, make Visa an appealing growth prospect in the changing financial landscape.

- Despite these risks, Visa’s strong financial performance, robust business model, and strategic initiatives present a compelling investment opportunity.

miniseries

Thesis

Visa Inc. (NYSE:V) is a global leader in the digital payment industry, with a vast network spanning over 200 countries and territories. The company is well-positioned to capitalize on the increasing shift towards cashless transactions and digital banking, particularly in emerging markets. Visa’s recent strategic partnerships and technological innovations, such as its expansion into blockchain technology, further enhance its growth prospects. However, the company faces potential regulatory challenges and competition from new market entrants. Despite these risks, Visa’s strong financial performance, robust business model, and strategic initiatives present a compelling investment opportunity.

Introduction

Visa is a multinational financial services corporation that facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards, and prepaid cards. The company operates one of the world’s largest retail electronic payments networks and is one of the most recognized global financial services brands. Visa’s business model is based on a network that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories

Digital Payments: A Rapidly Expanding Industry

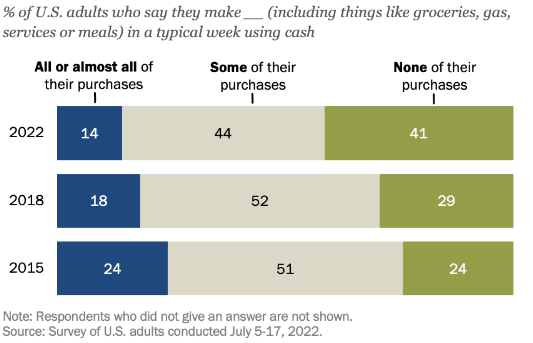

Visa is a part of the global digital payments market, which is currently valued at USD $96.07 billion and is expected to grow at a CAGR of 20.8% from 2023 to 2030, according to a report by Grand View Research. This fast-paced growth can be attributed to the decreasing use of cash and a surge in e-commerce, as well as rapid growth in expanding markets like India. Visa’s dominant position in the digital payments landscape is clear, with a share of 61.6% of the total U.S. credit card market and 40% globally. They have a strong economic moat since new entrants cannot incentivize a customer to utilize their network unless they have a network set up already, which they cannot do without getting individuals/banks to use the network. Basically, people want to use a network that others are already on to conveniently navigate transactions. Thus, with its extensive global network and trusted brand, they are positioned to capitalize on the increasing demand and growth in the digital payments industry.

Pew Research

Partnerships with FinTech and Incorporation of Blockchain Technology

Recognizing the potential of blockchain technology in transforming the financial services industry, Visa has made strategic moves to integrate this technology into its operations. The company has launched Visa B2B Connect, a platform that uses blockchain technology to provide financial institutions with a simple, fast, and secure way to process cross-border payments. This initiative not only enhances Visa’s service offerings but also positions the company at the forefront of technological innovation in the financial services industry. Additionally, Visa has strategically expanded its Fintech Partner Connect program, fostering innovation and collaboration within its ecosystem. This global initiative connects Visa card-issuing banks with fintech companies, enabling banks to enhance their digital reach without the need for costly in-house technology development. Partnerships include companies like Alloy, Jumio, Hummingbird, Railz, and Western Union, among others. These collaborations not only improve service offerings and customer experiences for banks but also drive revenue growth for Visa through increased transaction volumes. This aligns with Visa’s broader strategy of embracing technological innovation, positioning the company for future growth in the rapidly evolving digital payments industry.

Financial Overview

Visa is a well-established company with a market cap of over $473 billion. Its revenue has moderately grown at an approximate CAGR of 7% over the last 5 years. However, future projections suggest growth upwards of 11% for the next couple of years, likely due to a rebounding economy. In addition to its remarkable revenue growth, in 2022, Visa had an exceptional ROIC of 25.7%. This highlights how efficiently the company is growing since the returns on the capital they were actually investing to grow were far above the average ROIC of the S&P 500 of 10.2%. With a quick ratio of over 1, they are also able to cover any current liabilities meaning that they are well positioned for an economic downturn.

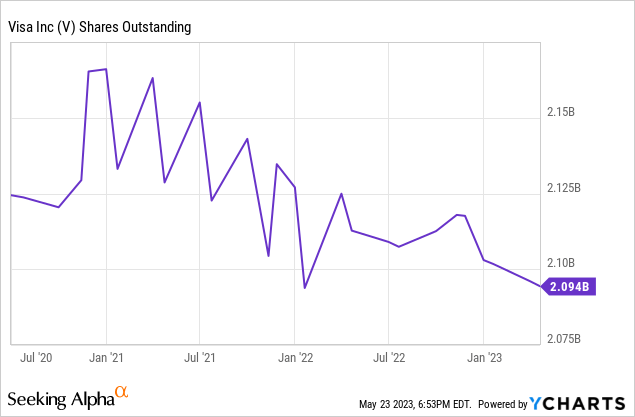

Visa has also consistently performed share buybacks, a great sign for a company since it signals to investors that management is confident in the growth of their own company.

Valuation

Visa is relatively undervalued compared to its main competitor Mastercard (MA). Its current P/E ratio of 27.87 is far below Mastercard’s which sits at 38.50. Its EV/EBITDA ratio of 19.79 is also well under Mastercard’s which is 27.43. The main point of interest however is that Visa is trading with a 22.6% upside to its 5-year median P/E of 34.19, and assuming a reversion to the mean in the long term, there is ample room for growth.

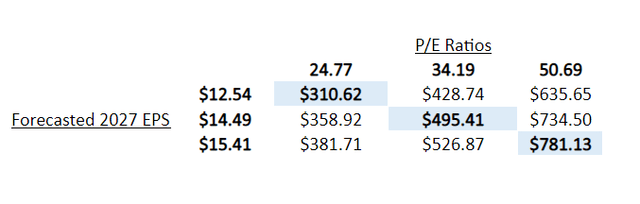

To determine a five-year target price for Visa, I examined analysts’ projections for the company’s earnings per share (EPS) in 2023. By employing the low, average, and high estimates, I established conservative, base, and optimistic scenarios. Subsequently, I grew each EPS forecast at rates of 13%, 14%, and 15% respectively per annum until 2027. To estimate the price-to-earnings (P/E) multiple at which Visa might trade in 2027, I used a value of 24.77 for the conservative scenario, since this was the lowest value from the last 5 years. Meanwhile, I utilized its five-year median as the base case. For the optimistic scenario, I chose the highest value Visa has traded at over the last 5 years. By combining the base case projected EPS and the projected P/E ratio, I arrived at a 5-year target price of $495.41 for Visa. This calculation yields a CAGR of over 16%, which outperforms the S&P 500’s average yearly return of approximately 10%.

Risks

Despite Visa’s optimistic growth prospects, there are a few potential challenges to consider. Regulatory risk is a serious threat, especially with Visa facing antitrust allegations by the DOJ. Thus, compliance costs can potentially impact profitability. Another significant risk comes from the rise of fintech companies like Affirm, which are disrupting the traditional financial services industry with innovative solutions. Affirm, for instance, offers a buy now, pay later service that allows consumers to make purchases and pay for them over time with no interest. This model is gaining popularity, particularly among younger consumers who are wary of traditional credit products. If this trend continues, it could pose a threat to Visa’s credit card business. However, Visa is keeping up with its own buy now, pay later options. Additionally. Visa’s heavy reliance on consumer spending poses a risk during periods of economic downturns. However, the increasing trend of digitization and the shift from cash to digital payments, accelerated by the COVID-19 pandemic, may help Visa maintain its revenue stream even during recessions.

ESG

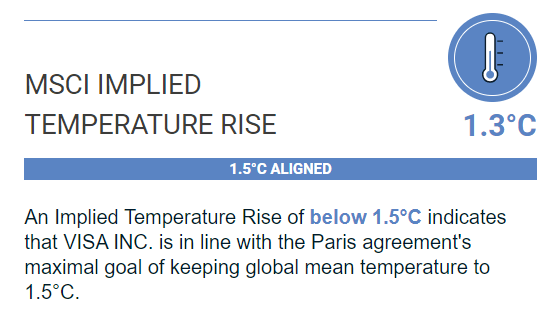

With an MSCI ESG rating of A, Visa is close to being a leader amongst its peers. Visa is in line with the Paris Agreement’s maximal goal of keeping global mean temperature rise to 1.5°C.

MSCI

One of Visa’s notable ESG initiatives is the Visa Green Bond, which underscores the company’s commitment to environmental sustainability. The Green Bond report provides insights into how Visa is financing projects that have environmental benefits, further reinforcing its dedication to protecting the planet. Additionally, they are only engaged in moderate-level controversies with anti-competitive practices. They are also considered to be the UN Sustainable Development Goals in the categories of gender equality, affordable and clean energy, and climate action.

Conclusion

Visa, with its well-established global network, strategic fintech partnerships, and developments in blockchain technology signal a strong future growth trajectory. Despite facing potential regulatory and competitive challenges, Visa’s robust financial performance and well-structured business model ensure its standing as a compelling investment opportunity with high upside potential. Furthermore, the company’s commitment to sustainability, as seen in its favorable ESG ratings and initiatives, also bolsters its appeal to a growing community of socially conscious investors. Keeping these factors in mind, Visa is a “Buy.”

Analyst recommendation by: Vayun Chugh

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.