Summary:

- Visa’s competitive advantage and growth are all based on its huge global networks.

- Visa’s growth strategy focuses on its network of networks and value-added services, but it faces risks from stagnant earnings growth and competition from fintech startups and larger companies.

- The way Visa operates such networks is also the root cause of concern for duopoly along with its close competitor, Mastercard.

- A global trend of lowering payment processing fees is driven by both consumer demand, government regulation and technological advancement, which in turn will compress the point-of-sale margin for the company.

Justin Sullivan

Investment Thesis

Company Overview

Visa (NYSE:V), founded in 1958 with headquarters in Foster City, California, is one of the largest digital payment service providers that facilitates global commerce across more than 200 countries serving consumers, merchants, financial institutions, and government entities.

Strength

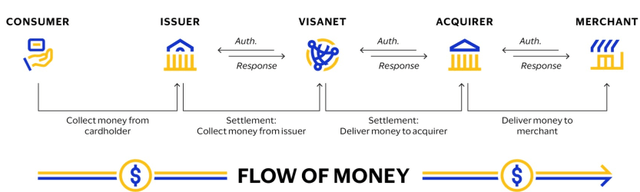

Visa provides payment facilitation to merchants and consumers. Their core business encompasses the whole process of payment going from one end to the other. The company boasts processed transactions of $192.5 billion annually in its FY 22 with $11.6 trillion in payment volumes in 160 currencies. According to the data provided by the company, there are on average 707 million transactions per day using the Visa brand, among which 75% were processed by the company.

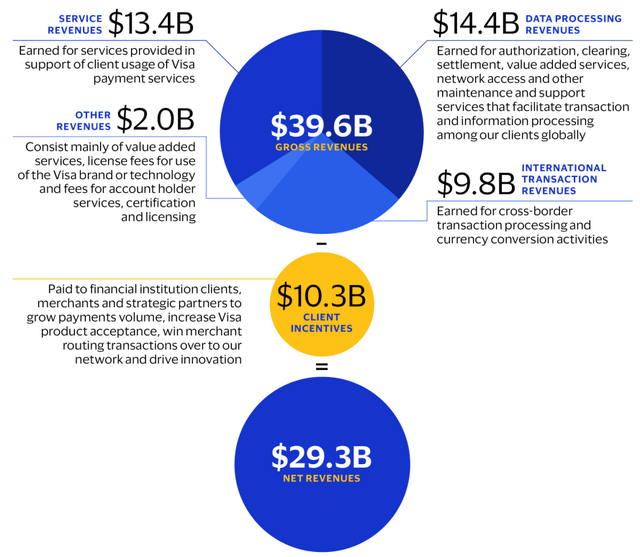

This created the revenue stream from four different sources, although they are all in one segment as the company presents it. The largest contributors are its Service Revenue and Data Processing Revenues. They are the essence of the company’s functions, usage of Visa payment services, and authorizing, processing, clearing, or settling the services.

Visa: Net Revenue Composition (Company 2022 Annual Report)

Visa’s growth strategy is firmly based on its network. The strategy grows the largest portion of its services in consumer payment by driving new flows into the network and is based on the foundation of a network of networks, aided by technological development and security. In this vast network, since the company connects various different parties in the fund transfer process, it not only is able to provide card-based payment processing but also direct fast fund delivery, such as ACH (Automated Clearing House) and RTP (Real-Time Payment), in capabilities of push-to-account and push-to-card. On top of its competitive advantage in its network, it also offers value-added solutions that utilize its global payment management platform called “Cycbersource” which is cloud-based and omnichannel.

Visa: Strategy (Company 2022 Annual Report)

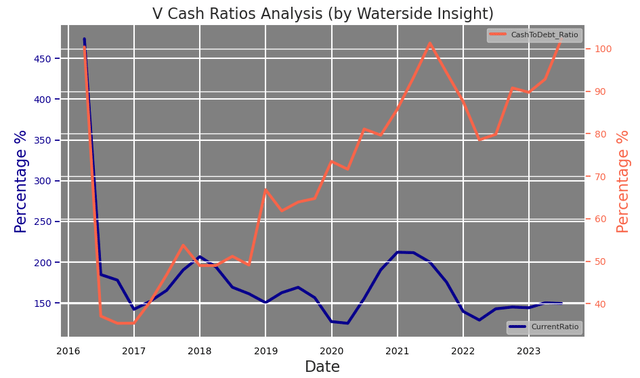

Such a strategy has brought in strong growth in its revenue, and its business model provides exposure to consumer credit expansion minus the credit risks. And it doesn’t typically carry seasonality in its topline growth. Strengthened by its recent years’ strong growth, Visa has made large debt repayments in the past three years. Despite its current ratio at its recent lows of 1.5x, its cash-to-debt ratio has risen to above 100%, back to where it was in 2016. With its cash being able to fully cover its debt, it is in a strong position liquidity-wise.

Visa: Cash Ratios (Calculated and Charted by Waterside Insight with data from Company)

In comparison with its competitors, VISA’s own data shows that it was leading by a large margin in Payments Volume, Total Transactions and the number of cards in 2021. In particular, its Payments Volume is almost double its closest rival, Mastercard (MA), and is more than the other four competitors combined.

Visa: Comparison versus Competitors (Company 2022 10K)

Weakness/Risks

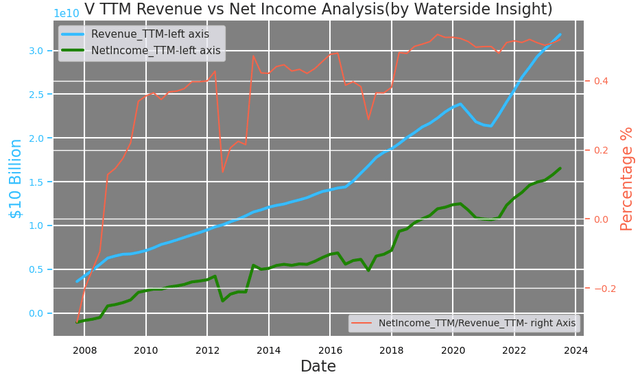

Since going IPO, it seems every few years, Visa’s net margin would get hit and fall, mostly due to the impact of lower net income while its revenue was growing strong. The company explained in its 10K in 2013, 2016, 2017 that it was most due to the impacts of litigation pressuring its operating income. Without going into the details of the individual litigation, this is in general a constant battle between the company’s efforts to expand its network and the anti-trust forces against it. There is ongoing pressure to lower the fees per transaction with both the government and the consumers’ demand. This is such a common phenomenon for Visa that it has a litigation escrow account set up specifically to handle the litigations against it.

visa (Calculated and Charted by Waterside Insight with data from company)

Referring back to the competition landscape we alluded to earlier, the concern of duopoly of VISA/Master from regulators and advocated groups is not a maybe but a distinctive yes. As described by the introduction of the Credit Card Competition Act of 2023, the take-it-or-leave-it network controlled by Visa/Master is responsible for limiting the choice of the merchants to have to accept its high fees. And this Act is intended to guarantee more competition and choices for both consumers and merchants, against Visa’s control.

According to the National Retail Federation, American families on average spend $1000 on credit/debit card processing fees, in the form of higher final prices or surcharges. Visa’s fee premium is mostly based on its competitive advantage derived from its vast network and breadth of reach, but the same payment processing operation can be delivered with cheaper alternatives, either by the introduction of more competition or increased adoption of technology. In fact, there is nothing stopping various fintech startups from entering the competition, and this trend will only continue, given not only technological developments in blockchain, and cryptocurrency but other larger companies, such as Walmart (WMT) and Amazon (AMZN), joining in this pressure. Such pressure has been described by the company in its 2022 10k as the following:

Interchange reimbursement fees, certain operating rules and related practices continue to be subject to increased government regulation globally, and regulatory authorities and central banks in a number of jurisdictions have reviewed or are reviewing these fees, rules and practices.

The pressure from the government is not only in the US, but also EU, the UK, and countries in Asia and Latin America. So Visa’s International Transaction Revenue, which is about 25% of its gross revenue, will be impacted as well. Therefore, from both consumer demand and technological development points of view, there is no reason to believe Visa can continue to have its per transaction margin as it is a few years from now. In our opinion, at the end of the day, the nature of Visa’s payment processing business is, in some sense, similar to the utility companies. It provides a service that is essential but should not be of high margin, and it is under regulation by government bodies. In Visa’s case, it is by the Federal Reserve. At least, we believe such an analogy is the direction of travel for our society as a whole, especially when inflation is currently running high for consumers.

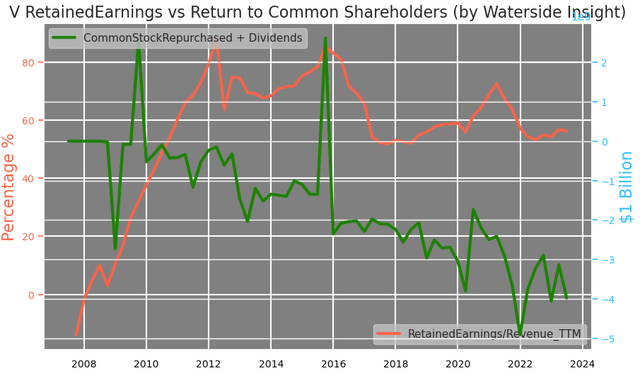

In contrast to its stock price that more than quadrupled since 2012, there has been a stagnant growth in retained earnings over revenue for VISA. Despite its revenue having grown to 3x more than where it was in 2012, the company is retaining less earnings as a percentage of revenue, after returning portions of them to shareholders, and such returns have been in decline in the past ten years.

visa (Calculated and Charted by Waterside Insight with data from company)

Financial Overview & Valuation

Visa: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

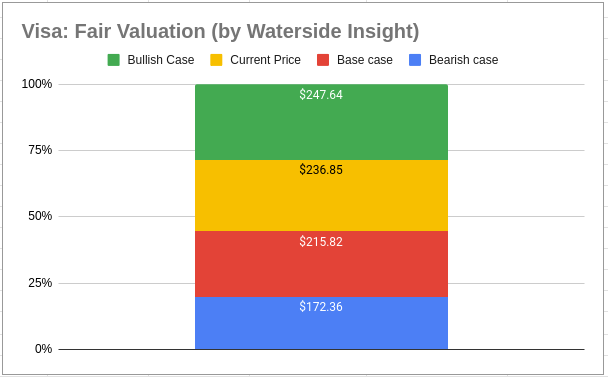

Based on the analysis above and our proprietary models, we assess Visa’s valuation with its growth of a ten-year projection forward. We assumed a cost of equity of 6.37% and a WACC of 6.4%. The company grew with the payment process industry but its market share declined from currently more than two-thirds to about half. In the base case, its cash flow faces adverse effects both the tighter regulatory environment next year introduced by the Credit Card Competition Act and higher competition, on top of macroeconomic pressure, with slower growth and decline coming in the longer term; the stock was valued at $222.05. In the bullish case, Visa has sped up its technological development and even facing competition, it was able to lower its own cost hence protecting the margin, it was valued at $247.64. In the bearish case, Visa faced even greater pushback from anti-trust momentum and losing not only margin erosion but also part of its exclusive network; it was valued at $170.88. The current price is a bit higher than the base case, reflecting some optimism from the market.

Visa: Fair Value (Calculated and Charted by Waterside Insight)

Conclusion

Visa has had a good recovery since Q3 of last year, rising over 30% in its stock prices. However, the tug-of-war Visa is constantly engaging in between its own expansion and control of the network versus the anti-trust momentum and consumer demands have been accelerated by the advancement of technology. This inevitable process will diminish Visa’s margin and eventually reduce its market share, although it will grow along with the whole payment processing industry. We think the current level is still in the bullish side but not far from the top range. Given the intermittent and medium-term risks we highlighted, we would recommend a hold at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.