Summary:

- I consider both Visa and Mastercard to be excellent investment choices when it comes to risk and reward.

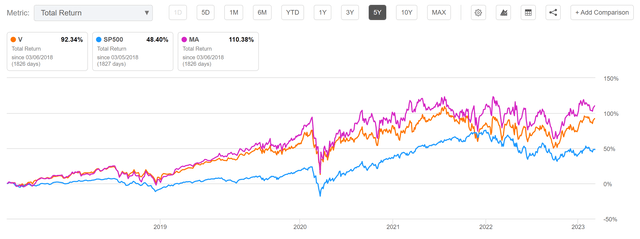

- Both companies have outperformed the S&P 500 over the past 5 years.

- While Visa’s Total Return has been 92.34% over the last 5 years, Mastercard’s has been 110.38% (the S&P 500 has shown a Total Return of 48.40%).

- In this comparative analysis, I will show you which of the companies is the lower-risk investment and which offers the higher reward.

shaun

Investment Thesis

In my opinion, both Visa (NYSE:V) and Mastercard (NYSE:MA) provide (dividend growth) investors with excellent chances when it comes to risk and reward.

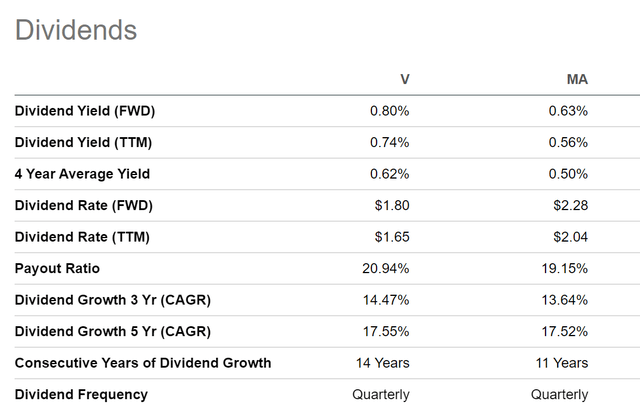

At this moment in time, Visa shows a Dividend Yield [FWD] of 0.80% while Mastercard’s Dividend Yield [FWD] is 0.63%. Both companies have shown a high Dividend Growth Rate [CAGR] over the past 5 years: while Visa’s is 17.55%, Mastercard’s is 17.52%, providing evidence that both are excellent picks for dividend growth investors.

Both companies are extremely profitable: while Visa has an EBIT Margin [TTM] of 67.14%, Mastercard’s is 56.77%. Their enormous Profitability is further underlined by an Aa3 credit rating from Moody’s for both companies.

However, when it comes to Growth, Mastercard is slightly ahead of its competitor. While Mastercard has shown a Revenue Growth 5 Year [CAGR] of 12.22%, Visa’s is 9.98%. The same is shown when taking a closer look at the EBIT Growth 3 Year [CAGR]: while Mastercard’s is 9.30%, Visa’s is 8.81%.

Particularly due to Mastercard’s slightly higher Growth Rates in combination with the results of my DCF Model (which indicates an Internal Rate of Return of 12% for Mastercard and 10% for Visa), I currently rate Mastercard as a strong buy while Visa receives my buy rating. If I could only select one out of the two, I would chose Mastercard for the reasons mentioned before.

Visa and Mastercard’s Performance within the past 5 years

When we have a look at the companies’ performances over the past 5 years, we find out that both have outperformed the S&P 500: while the S&P 500 has shown a Total Return of 48.40% over the past 5 years, Visa’s Total Return has been 92.34% and Mastercard’s 110.38%.

These results underline my theory that Mastercard is the slightly more attractive choice when compared to its competitor Visa.

Due to the companies’ strong competitive advantages and their excellent position within the Data Processing and Outsourced Services Industry as well as their Growth perspectives, I believe that both could be able to continue outperforming the S&P 500 over the coming years.

The Valuation of Visa and Mastercard

Discounted Cash Flow [DCF]-Model

Internal Rate of Return for Visa

Below you can find the Internal Rate of Return calculated with my DCF Model where I have assumed different purchase prices for the Visa stock.

At Visa’s current stock price of $227, my DCF Model indicates a compound annual rate of return of approximately 10% for the company. (In bold you can see the compound annual rate of return for the company’s current stock price of $227.)

|

Purchase Price of the Visa Stock |

Internal Rate of Return as according to my DCF Model |

|

$190.00 |

15% |

|

$200.00 |

14% |

|

$210.00 |

12% |

|

$220.00 |

11% |

|

$227.00 |

10% |

|

$230.00 |

10% |

|

$240.00 |

9% |

|

$250.00 |

8% |

|

$260.00 |

7% |

Source: The Author

Internal Rate of Return for Mastercard

At Mastercard’s current stock price of $369.00, my DCF Model indicates an Internal Rate of Return of about 12% for the company.

|

Purchase Price of the Mastercard Stock |

Internal Rate of Return as according to my DCF Model |

|

$330.00 |

15% |

|

$340.00 |

14% |

|

$350.00 |

13% |

|

$360.00 |

12% |

|

$369.00 |

12% |

|

$370.00 |

12% |

|

$380.00 |

11% |

|

$390.00 |

11% |

|

$400.00 |

10% |

Source: The Author

The results of my DCF Model, which indicates a compound annual rate of return of 10% for Visa and 12% for Mastercard, confirm my investment thesis to rate Visa as a buy and Mastercard as a strong buy at this moment in time. It further strengthens my thesis to select Mastercard over Visa when only choosing one of the two companies.

Fundamentals: Visa vs. Mastercard

Visa has a higher market capitalization than Mastercard: while Visa has a market capitalization of $460.19B, Mastercard’s is $344.60B.

In terms of Profitability, it can be highlighted that Visa has a higher EBIT Margin [TTM] than its competitor. Visa has an EBIT Margin [TTM] of 67.14% while Mastercard’s is 56.77%.

However, when we look at the companies’ Return on Equity, the results are different: Mastercard’s ROE of 144.03% is significantly above the one of Visa (which has a ROE of 41.51%).

Let’s now take a look at the companies’ P/E [FWD] Ratio in order to see which is the more attractive in terms of Valuation: Visa’s P/E [FWD] Ratio of 27.33 is slightly below that of Mastercard (P/E [FWD] Ratio of 29.73). In my opinion, the slightly higher P/E [FWD] Ratio of Mastercard in comparison to Visa can be justified with Mastercard’s Growth Rates being above its competitor.

Both Mastercard’s Revenue Growth Rate [CAGR] and EBIT Growth Rate [CAGR] over the past 3 years have been above Visa: while Mastercard’s Revenue Growth Rate [CAGR] and EBIT Growth Rate [CAGR] are 9.62% and 9.30% respectively, Visa’s are 8.67% and 8.81%. Both metrics indicate that Mastercard is the slightly more attractive pick when it comes to Growth, thus strengthening my investment thesis to rate the company as a strong buy and Visa as a buy, and, in addition to that, to select Mastercard over Visa.

Below you can find an overview of the Fundamental Data for both Visa and Mastercard:

|

Visa |

Mastercard |

||

|

General Information |

Ticker |

V |

MA |

|

Sector |

Information Technology |

Information Technology |

|

|

Industry |

Data Processing and Outsourced Services |

Data Processing and Outsourced Services |

|

|

Market Cap |

460.19B |

344.60B |

|

|

Profitability |

EBIT Margin |

67.14% |

56.77% |

|

ROE |

41.51% |

144.03% |

|

|

Valuation |

P/E GAAP [FWD] |

27.33 |

29.73 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

8.67% |

9.62% |

|

Revenue Growth 5 Year [CAGR] |

9.98% |

12.22% |

|

|

EBIT Growth 3 Year [CAGR] |

8.81% |

9.30% |

|

|

EPS Diluted 3 Year [CAGR] |

9.30% |

8.78% |

|

|

Income Statement |

Revenue |

30.19B |

22.24B |

|

EBITDA |

21.16B |

13.37B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

55.48% |

231.97% |

Source: Seeking Alpha

The companies’ Dividend and Dividend Growth

When having a closer look at the companies’ Dividend, we find that Visa currently pays the slightly higher Dividend Yield [FWD] when compared to Mastercard: at this moment in time, Visa’s Dividend Yield [FWD] is 0.80% while Mastercard’s is 0.63%.

Both companies have shown similar Dividend Growth Rates [CAGR] over the past 5 years: with 17.55% for Visa, and 17.52% for Mastercard.

At this moment of writing, Mastercard has the slightly lower Payout Ratio, which strengthens my investment thesis to select the company over its rival: while Visa’s Payout Ratio is 20.94%, Mastercard’s is even lower (at 19.15%).

Below you can find some additional data in regards to the companies’ Dividends.

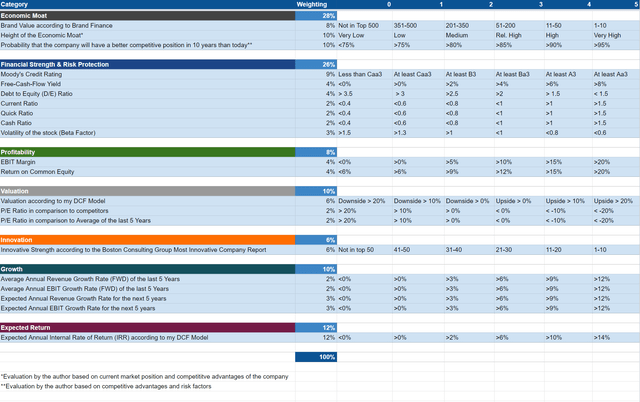

The High-Quality Company [HQC] Scorecard

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

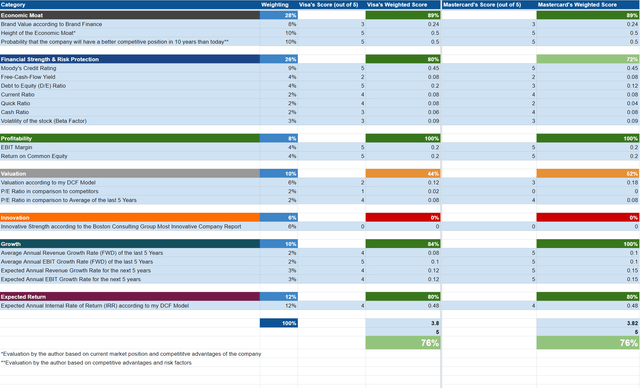

Visa vs. Mastercard According to the HQC Scorecard

According to the HQC Scorecard, both companies receive 76/100 points, which means an attractive overall rating in terms of risk and reward.

The Scorecard shows that Visa is slightly ahead of Mastercard in the category of Financial Strength and that Mastercard is ahead of Visa in the category of Growth.

Mastercard’s higher rating in terms of Growth as according to the Scorecard, strengthens my belief to select the company over Visa.

Risks

I see the risk for Mastercard investors to be slightly higher than for Visa investors. My opinion is based on different factors that I will discuss in the following.

One of them is that Visa has an even higher EBIT Margin [TTM] (67.14%) than Mastercard (EBIT Margin [TTM] of 56.77%), indicating that Visa is slightly ahead of its competitor when it comes to Profitability.

Another reason is that in Mastercard’s current Valuation, higher Growth expectations are already priced in compared to Visa’s Valuation. The reason for this being that Mastercard has a slightly higher P/E [FWD] Ratio of 29.73 when compared to Visa’s (P/E [FWD] Ratio of 27.33). As a result, a recession could affect Mastercard investors to a slightly higher degree than Visa investors.

In addition to that, Visa’s 60M Beta of 0.96 is slightly lower than Mastercard’s (60M Beta of 1.08), indicating that Visa is the slightly lower risk investment.

Furthermore, Visa has a higher Current Ratio (1.44 compared to 1.17) and a higher Quick Ratio (1.05 compared to 0.76), further indicating that Visa is the company with the slightly lower risk level.

However, in my opinion, the higher risk level in regards to a Mastercard investment is minimal and as I have shown in a previous chapter, I expect the reward (the compound annual rate of return) for Mastercard investors to be slightly higher than for Visa investors. Therefore, I still consider Mastercard to be the slightly better risk and reward choice between the two competitors.

The Bottom Line

The objective of this article was to show that both Visa and Mastercard are excellent choices for (dividend growth) investors. In terms of risks, I consider Visa to be the lower risk investment when compared to its competitor. One of the reasons for this is that I consider the company to be even stronger when it comes to Profitability.

However, different Growth Rates indicate that Mastercard is the better fit when it comes to Growth. Mastercard’s Revenue Growth 5 Year [CAGR] of 12.22% is higher than Visa’s (9.98%). In addition to that, Mastercard’s EBIT Growth 3 Year [CAGR] of 9.30% is above the one of Visa (8.81%). Moreover, my DCF Model indicates a compound annual rate of return of 12% for Mastercard while it shows one of 10% for Visa. For these reasons, Visa stock currently receives my buy rating while Mastercard stock gets my strong buy rating. In case you would like to choose one out of the two, I would currently choose Mastercard over Visa.

Author’s Note: Thank you very much for reading! I would love to hear your opinion on this comparative analysis on Visa and Mastercard and to hear which you consider to be more attractive. Do you already own one of the two companies?

Disclosure: I/we have a beneficial long position in the shares of V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.