Summary:

- I previously rated Visa Inc. stock as a hold, but I am now downgrading to a strong sell due to the rejected $30 billion settlement and weakening consumer spending trends.

- A lawsuit rejection by a federal judge in Brooklyn raises concerns about Visa’s legal standing and potential impact on earnings and financial health.

- Regulatory challenges and the macroeconomic environment are both not in Visa’s favor, leading to a potential revenue decline now exceeding my estimated $1.6 billion.

- With this, I think the Visa P/E ratio needs to come down.

Arturo Holmes

Investment Thesis

After previously rating Visa Inc. (NYSE:V) a hold in March, I believe the stock now is a strong sell. However, with recent developments, my view of the stock’s future has turned negative.

A federal court’s rejection of the lawsuit settlement by the judge represents a substantial setback for Visa. This $30 billion antitrust settlement would’ve forced Visa and Mastercard to roll back on their swipe fees for 3 years by 4 basis points, along with limiting their fees for the next 5 years to 2023 levels. This settlement was rejected by a federal judge in Brooklyn, New York. Judge Margo Brodie indicated that the settlement does not appear to provide sufficient relief, signaling the need for a more generous compensation for the affected merchants. This not only casts a shadow on the company’s legal standing but also leaves me weary as it suggests that the eventual settlement could be much higher than initially anticipated. This settlement is already huge, meaning that if it expands, it could severely impact Visa’s earnings and overall financial health.

Additionally, the macroeconomic environment is not in Visa’s favor. Consumer spending trends, which I will expand on later in this article, have shown signs of weakening, which directly affects Visa’s revenue as a payment processor. According to Visa’s financial results, the company reported an 11% increase in net revenues to $32.653 billion for the fiscal year 2023, up from $29.31 billion in 2022. Despite this growth, the weakening consumer spending trend could dampen future revenue growth, as fewer transactions lead to reduced fee income.

This situation is further compounded by the ongoing regulatory scrutiny on interchange fees, both in the U.S. and internationally. For instance, Visa and Mastercard have agreed to extend the caps on non-EU card fees until 2029, maintaining the 0.2% fee cap on non-EU debit card payments and a 0.3% fee cap on credit card payments. As I previously mentioned, assuming a conservative 5% decrease in overall net revenue as a result of regulatory pressures, Visa could face a revenue decline exceeding $1.6 billion, significantly affecting their net income and market cap. Therefore, these regulatory challenges could really cut into Visa’s revenue streams and profitability. My estimate in March assumed that the settlement would get approved. This estimate is now likely too conservative given where the court stands. This makes me bearish.

Given these factors, I think Visa’s stock presents more risks than rewards. I think the potential for a higher settlement is very likely, meaning that earning expectations may be inflated as a result of this. I now have modified my stance on Visa to a strong sell.

Why I Am Doing Follow-up Coverage

As I mentioned above, I previously covered Visa in March, and since then, the stock has fallen by 4.87%, while the S&P 500 (SP500) has risen by 8.89%.

In my previous article, my position on Visa was a hold. My reasoning behind this was the potential challenges Visa may face from regulatory pressures. However, since then, these concerns have not only persisted, but I am now additionally concerned with the lawsuit settlement rejection. Since March, consumer spending has weakened as well, raising another concern. I think with these 3 challenges combined, they paint a poor picture for Visa’s future performance. Therefore, the purpose of this article is not only to inform readers that my position has changed, but to also explain these additional concerns.

Lawsuit Debrief

I briefly discussed this lawsuit above, but it is important to understand all the details to truly acknowledge how impactful this could be for Visa. This lawsuit involves both Visa and Mastercard (MA) (an effective oligopoly) and is centered around a $30 billion antitrust settlement brought about in a class action suit from merchants who have or currently use these two payment processors. The initial terms of the settlement required Visa and Mastercard to decrease their swipe fees for 3 years and cap the rates for 5 years, estimating to deliver roughly $29.79 billion in savings to the plaintiffs (and cost Visa and Mastercard about this much in lost revenue). The settlement was initially brought by U.S. merchants almost 2 decades ago, aimed at addressing the high fees charged by the companies for processing card payments.

However, it was recently rejected by a federal judge in Brooklyn, New York. The judge, Margo Brodie, expressed concerns that the settlement did not provide sufficient relief to the merchants affected by the high swipe fees, indicating a need for a more substantial compensation package. Other trade groups chimed in, agreeing with Brodie, stating that this solution would only provide temporary relief, in addition to making future legal troubles more difficult. The general counsel of the National Association of Convenience Stores, Doug Kantor, stated:

…[the settlement] didn’t address the problem of Visa, Mastercard and banks forming a cartel to issue credit cards and set fees, such that merchants have to accept all cards or none -Kantor.

He then went on the state that:

…the next step, presumably, is a trial -Kantor.

As a fair warning, Jury trials are usually detrimental to large businesses, as juries have been known in the US to side against big companies. Visa and Mastercard will likely not be an exception.

With this rejection, I have become bearish on Visa’s outlook. This lawsuit only adds to Visa’s legal hurdles. Just earlier this year, Visa and Mastercard agreed to a different settlement concerning consumer ATM fees, which totaled $197 million.

Considering the judge’s reasoning for her rejection and the general standpoint on the settlement, I think we will see the settlement offer increase drastically. Of course, if Visa and Mastercard are unable to settle, like Kantor stated, this will go to trial.

Weak Consumer

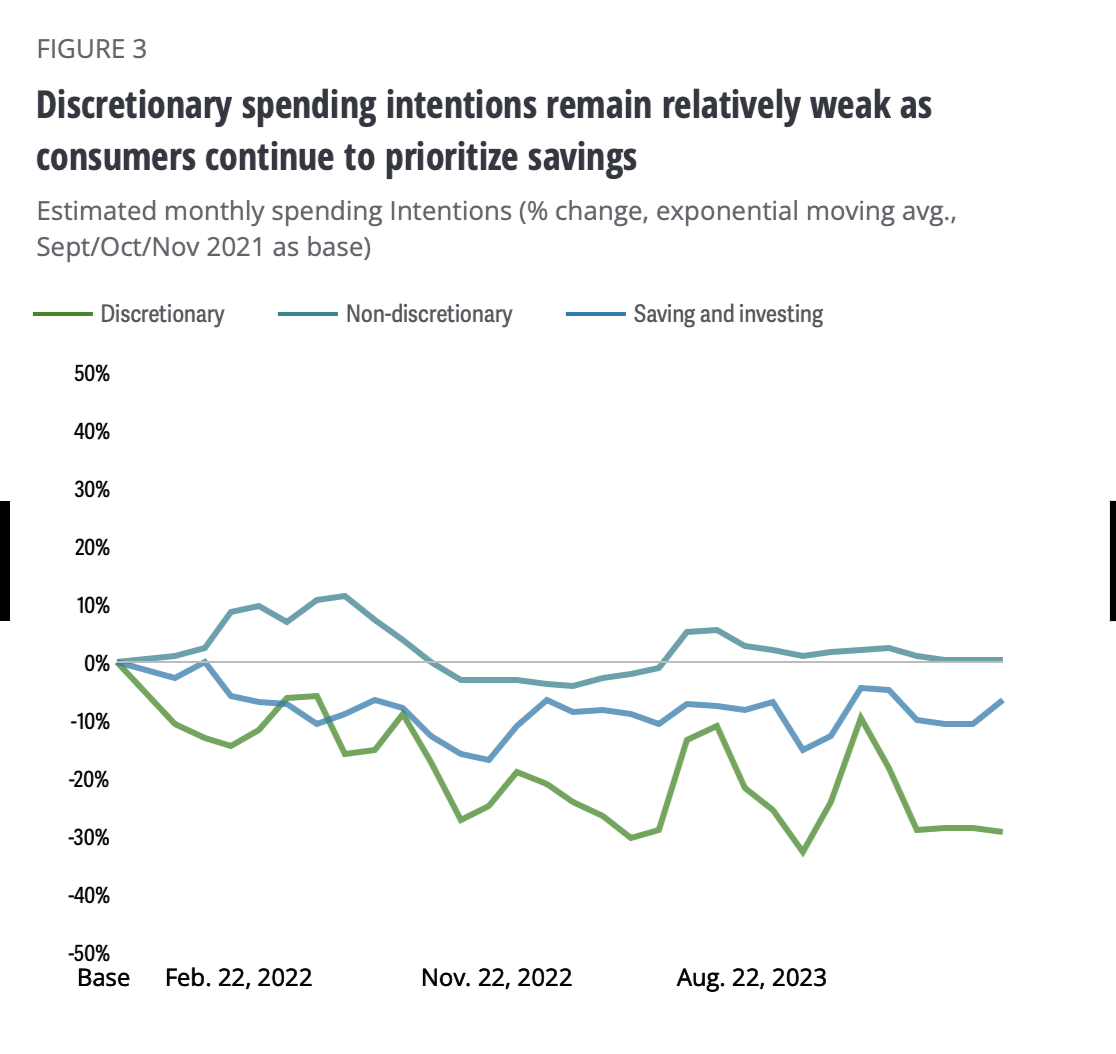

Like I mentioned in my investment thesis section, not only could this lawsuit severely affect Visa’s financial condition, but the current economic environment is not also favoring Visa, particularly in light of weakening consumer spending. As a payment processor, Visa’s revenue is directly tied to the volume and value of transactions they process. Weaker consumer spending translates to fewer transactions, which in turn means less fee income for Visa. Recent data highlights this trend, raising concerns about Visa’s financial performance in the coming quarters. Seen below are two graphs covering the spending of U.S. consumers dating from February 2020 to April 2024.

US Consumer Spending Intentions (Deloitte)

Since late 2021, consumer spending has been stuck in a stagnating trend, likely caused by higher inflation. Discretionary spending (the bottom green line) has faced the largest decrease in spending. It is also important to note that the only type of spending that has seen any positive percentage increase in the last few years is essential spending. The below figure focuses on discretionary spending based on income.

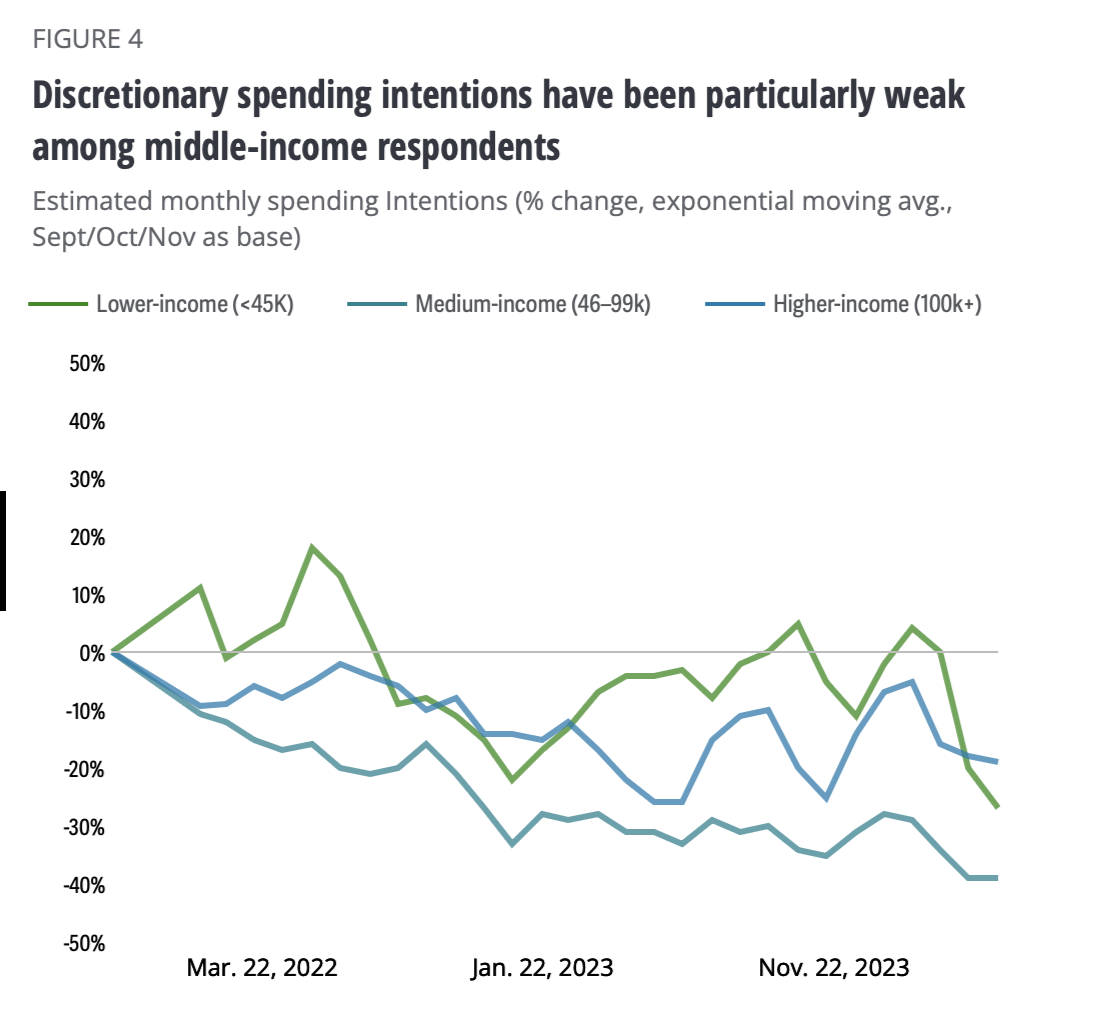

US Consumer Spending Intentions By Income (Deloitte)

The graph demonstrates that the income level facing the largest decrease in non-essential spending is the middle class (teal, bottom line). This is especially bad for Visa, considering they provide cards for about 58.3% of the country, among which 54% of Americans identify as middle class. As consumer spending falters, especially in the most prevalent income level, card provider companies, including Visa, will likely feel this downturn.

Valuation

Looking at Visa’s valuation, I do not believe the market is pricing in the tensions stemming from the lawsuit, decreased consumer spending, or regulatory challenges. For example, the company’s forward Non-GAAP price-to-earnings ratio (P/E) stands at 27.14, which is 160.20% higher than the sector median of 10.43. This overvaluation is likely due to their historical strong growth and asset light business model. However, I think the combination of recent legal setbacks and a weaker consumer spending environment calls this premium into question.

In my last analysis, I forecasted a $1.6 billion annual impairment to Visa’s earnings and a ~$45 billion hit to their market cap due to the legal and regulatory challenges. This was based on a conservative estimate of a 5% reduction in overall net revenue, which would flow almost entirely to the bottom line, given Visa’s high operating leverage.

Since we do not have visibility right now into Visa’s new settlement, I think this assumption will likely be conservative. But I am now also concerned that the company’s price to earnings ratio could drop. I think that as the market readjusts growth forecasts to a lower number due to concerns over consumer spending decreases and the lawsuit, Visa’s price to earnings ratio could drop 25%. On top of the 4.87% drop in Visa’s stock since my last report, I think we could see an additional 25% downside in shares assuming that EPS from here plateaus (this is a real risk in my opinion given where lawsuits and consumer spending are at).

Bull Thesis

Overall, I am bearish on Visa, but I do want to address where I could be wrong. In my opinion, the bull thesis hinges on several favorable outcomes regarding consumer spending and the interchange fee lawsuit.

First, consumer spending could rebound. The global economy is in a state of flux, and while recent trends show a slowdown, some pockets of the consumer economy signal strength, such as international travel.

Adding to this bull thesis is the possibility of a more favorable settlement in the ongoing lawsuit. While the judge rejected the $30 billion swipe fee settlement, there remains the potential for a revised settlement that might be more manageable for Visa. If the new settlement terms are less financially burdensome, this could mitigate some of the anticipated earnings impact and likely signal that the impacts of the settlement are overpriced into the stock.

However, I do not think this is likely, especially considering the judge found the lawsuit is not generous enough for smaller business merchants. There could be a workaround that is reached that results in a lower dollar settlement but more benefits to merchants, but I think the odds of this are low.

Takeaway

While Visa provides cards to a large swath of U.S. cardholders, I think they have a rocky future ahead. The rejection of the $30 billion swipe fee settlement by the judge leaves me concerned about Visa’s outlook. The reasoning for the judge’s rejection in addition to other critics’ remarks suggest that the final settlement will likely be higher. Of course, there is always the potential that this case could go to court, which would only hurt Visa more.

While there are some bullish outcomes, such as bright pockets in the consumer economy and the potential for a more favorable settlement, I see both of these as low-odd events. I truly do not see a reason for Visa Inc. stock to move up from here, especially given the high P/E compared to sector median. I see many reasons as to why the payment processor’s stock will go down. With this, I now believe Visa is a strong sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.