Summary:

- Visa is a strong long-term investment due to its unique business model, excellent margins, and dominant market position in the global digital payments processing industry.

- The company has a wide economic moat, primarily stemming from its proprietary payments processing network (VisaNet) and its established reputation in the field.

- Some risks facing Visa include the cyclical nature of the global economy, potential cybersecurity breaches, and competition from rivals like Mastercard.

- I have entered into a sizable position given the aforementioned points and steady, index-beating value accumulation achieved by the company.

hatchapong

Investment Thesis

Visa (NYSE:V) is the world’s most widely accepted payments processing service provider with the company operating across more than 175 different currencies.

Their unrivalled market position and excellent VisaNet payments processing network has helped the company build a truly huge and robust economic moat.

While I conducted an in-depth analysis of Visa’s closest rivals Mastercard (MA) back in March (Mastercard: Keeps On Ringing The Cash Register), I wanted to take my time in analyzing Visa to ensure I had all the right information to hand.

My verdict is simple: Visa is in my opinion a stellar long-term buy and hold even at their relatively fairly valued share price thanks to a unique business model and excellent margins.

Company Background

Visa is an American payment processing and fintech company which is positioned within it’s industry as the market leader of a duopoly it shares with Mastercard. The company specializes in electronic payment solutions and operates a proprietary payments network to process the transactions its customers execute.

The company has often been referred to as a “tollbooth” operator thanks to the manner in which they extract value from their business. As customers utilize Visa’s payments network, the company demands a small fee in exchange for swift and safe processing of transactions.

Given the rapidly growing rate at which payments are being processed electronically across the globe, Visa has an almost guaranteed path of continued growth moving forwards into the future. Furthermore, rapid diversification of their payment’s solutions into novel and emerging business segments such as crypto has helped the company remain relevant in a highly competitive field.

Nonetheless, a difficult macroeconomic environment combined with the potential for a short-term decrease in payments due to the ever-looming recession forecast for 2023 makes evaluating Visa’s current position a little more difficult.

Therefore, a fundamental company analysis and intrinsic value calculation must be completed to fully understand what sort of investment opportunity may exist in Visa from a value perspective and I’ll reveal why I have begun building a position into this solid long-term performer.

Economic Moat – In Depth Analysis

Visa has a wide economic moat primarily stemming from its proprietary payments processing network (VisaNet) and from the reputation the company has established itself within the field. Visa also harbors some economic moat from the network effect arising from widespread adoption of their platform.

Visa | VisaNet Overview

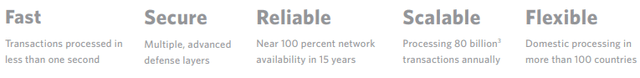

The VisaNet payments processing network operated by Visa is one of the most advanced such examples in the world. Visa’s devotion to developing a network which can handle a huge number of payments per day has allowed the company to become the preferred choice for most financial institutions and thus, merchants and consumers alike.

This allows Visa to handle a huge number of payments per quarter which ultimately forms the Payments Volume metric. In this regard, Visa is almost 75% larger than their closest rival Mastercard handling over 707 million transactions per day in 2022.

While Visa and Mastercard ultimately have very similar business propositions and product offerings, Visa’s more efficient payments processing network has allowed the company to grow faster and become the primary choice for most financial institutions.

A devotion to risk management and threat mitigation by Visa has ensured that their exposure to fraud remains at a historical low. Less than six U.S. cents per $100 transacted on Visa products are fraudulent activities. This figure is incredibly impressive given the continuous growth in Visa’s network and increase in transaction volumes.

Visa’s network also harbors a larger theoretical maximum payment processing rate of up to 24,000 transactions per second which is double that of Mastercard’s. This provides Visa with a more fiscally stable pathway to future growth as significant network development is not required to facilitate an increase in payments per time period.

These factors compound to form a powerful business advantage for Visa whereby over 61 million merchants accept Visa as a payment method.

Any attempt by Mastercard or another novel competitor to replicate Visa’s payments network would take decades to accomplish. Furthermore, the reputation Visa has garnered itself within the industry is truly unparalleled which is only partially rivalled by Mastercard.

Quite simply, Visa is the king when it comes to electronic payments processing. This high-quality network combined with their establish and reputable partnerships harbors Visa a very wide and robust economic moat.

Visa’s huge user base manifests itself in the form of 16,000 financial institutional partners, 3.4 billion active visa credit and debit cards along with over 50 million individual merchants accepting Visa as a payment method. This global spread of influence acts as a source of economic moat for the company thanks to the networking effect generated by this massive user base.

Each day over 700 million transactions are processed by VisaNet across 175 currencies. Annually, Visa is capable of handling over 80 billion transactions. These figures illustrate the absolutely huge scale of Visa.

The more financial institutions that use Visa for the issuance of their debit and credit cards means more consumers want to pay with Visa which ultimately means more merchants want to accept Visa as a payments method. When it comes to paying electronically, Visa is essentially the default and universal standard for most transactions.

Visa also has devoted a significant portion of it’s focus to developing attractive value-added services to expand the diversity of their economic moat. The company specializes in offering customers a number of issuances, acceptance, risk and identity and open banking solutions in order to expand the abilities of their VisaNet network.

A move towards catering for crypto currencies and supplying payments products that satisfy the needs of decentralized currency users proves Visa’s utmost dedication to developing their range of products to suit the current market demands.

This pro-consumer behavior is a hallmark of Visa’s operational strategy and illustrates the importance management has identified in ensuring customer satisfaction is at the forefront of their business model.

Overall, Visa harbors an incredibly robust economic moat thanks to their “tollbooth” style business. Without Visa, the majority of electronic payments would simply cease the be processed. Their advanced payments network would be incredibly difficult for a competitor to replicate as evidenced by even Mastercard struggling to match Visa’s technological capabilities.

Visa’s moat is solid and set for long-term growth. While Mastercard also has a solid business case, Visa’s superior market position gives it a tangible and almost unrivalled competitive advantage.

Financial Situation

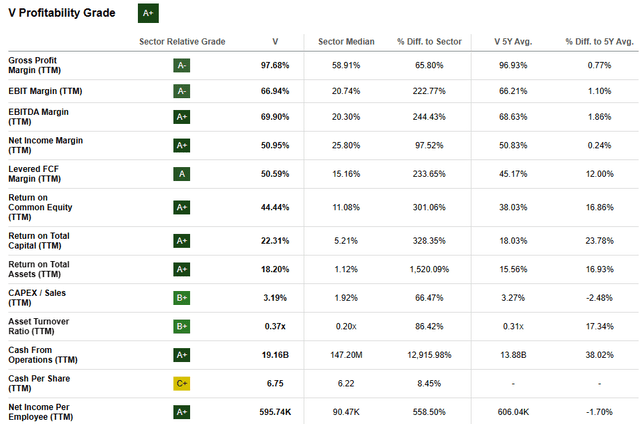

Visa has had a profitable and robust history for much of their existence. Their 5Y average ROIC is an impressive 24.8% combined with a very healthy ROE for the same period of 39%. An equally impressive set of 5Y average gross, operating and net margins of 80.4%, 66% and 51% respectively illustrates the hugely profitable and sustainable nature of Visa’s business even on its current scale.

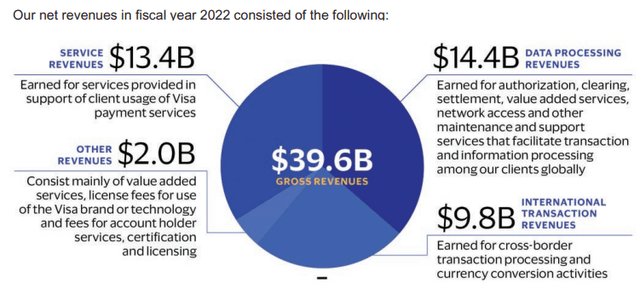

The company has started FY23 strong with Q1 earnings reports illustrating the company achieving a double beat both on revenue and EPS estimates.

Revenues for the first quarter also grew at strong rates Net revenues for the quarter increased 11% on a YoY basis totaling approximately $8B. This represented a $210M beat of the analyst consensus estimates.

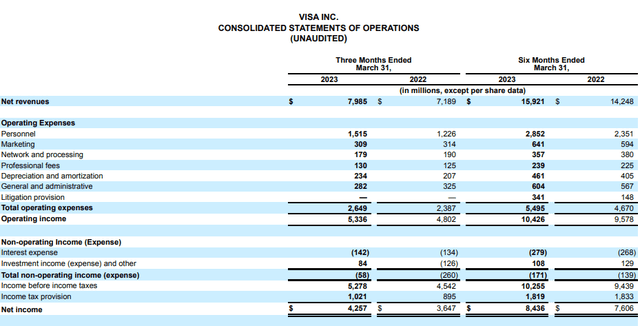

FY22 was an equally strong year for the company with total net revenue amounting to $29.3B, up 22% from the prior year. Similar growth was seen with the company’s net income increasing 21% from FY21.

Importantly, FY21 compared to FY20 only saw growth figures in the low 10’s. This highlights the truly remarkable results Visa achieved in FY22.

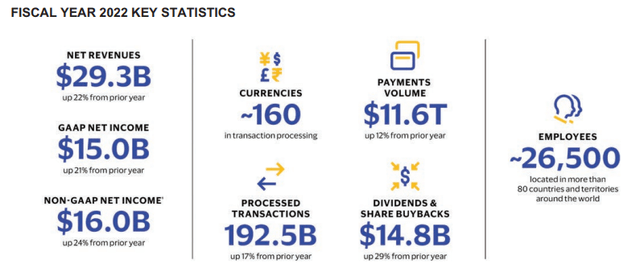

Around 1/3 ($14.4B) of Visa’s revenues consist of data processing revenues which are derived from their VisaNet transaction platform authorizing, clearing and settling transactions. While this is perhaps the most mature revenue stream for the company, Visa has still managed YoY growth of around 15% for the past five years.

Another third ($13.4B) of Visa’s revenues come from service revenues sourced from the support provided to clients using their payment platform. Their service revenues also continue to grow at around 16% YoY (5Y average) which is very healthy.

Given the continued expansion of digital payment services across the globe, I fully expect that Visa’s Services and Data Processing revenues will continue to exhibit these mid to high teens figures of growth for at least another 10 years.

International transactions accounted for $9.8B in revenues in FY22. This revenue stream is founded on transaction processing fees for cross-border and currency conversion transactions.

Finally, the company also made around $2B in value added services, Visa brand, license and technology fees and account holder fees.

Their focus on value-added services development is key to increasing the penetration and usability of their core VisaNet platform. While the revenues from this segment are quite low, the company’s awareness of its importance is refreshing to see.

Fundamentally, the strong growth across Visa’s revenue streams can be attributed to the 12% growth in payments volumes. Handling a whopping $11.6T in payments in FY22, Visa has continued their consistent expansionary habits.

One of the key advantages Visa holds over their close rivals Mastercard is the significant growth capability currently present in VisaNet. Mastercard’s proprietary payments processing network will require more costly development in order to handle more payments in the future whereas Visa has already devoted R&D to expanding VisaNet’s capabilities in years passed.

This should provide Visa with a less capital-intensive growth runway moving forwards.

The company also spent over $14.8B in dividends and share-buyback schemes which illustrates managements acute understanding of the importance of such pro-investor actions. Given Visa’s history of rewarding shareholders for holding their stock, it comes as no surprise that the company is continuing this trend.

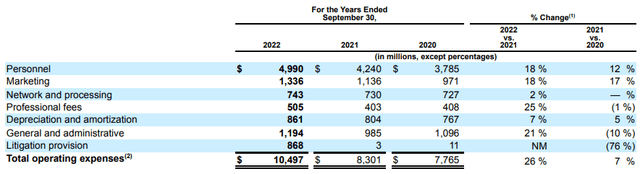

While the FY22 report was overall a very positive read, Visa’s significant growth in total operating expenses was an unfortunate consequence of macroeconomic conditions. Overall, total operating expenses grew 26% in FY22 compared to FY21. This was primarily due to significantly increase personnel expenses which were attributed to growth prospects.

Luckily, many of the significant increases in expenditures such as marketing expenses and general and administrative expenses were due to unique circumstances rather than any overall inefficiencies.

The consolidation and suspension of Visa’s Russian subsidiary along with increased FIFA World Cup 2022 marketing expenses resulted in not-insignificant one-off payments.

The majority of Visa’s operating expense increases were the result of entirely voluntarily strategy being pursued by management. My only concern is that the large increase in employees could potentially harm future returns and decrease the incredible workforce efficiency upon which Visa has operated for so many years.

Seeking Alpha | V | Profitability

Seeking Alpha’s quant assigns Visa with an “A+” profitability rating. I believe that this rating is a representative snapshot illustration of the company’s overall profit generating prowess.

Visa’s balance sheet looks to be in healthy shape too. The company currently has $28.7B in total current assets while total current liabilities only amount to $19B. This illustrates the relatively conservative fiscal strategy being pursued by management with regards to their growth strategies. For investors, such a well-managed and liquid company is excellent news.

The company has a debt/equity ratio of just 0.56x which again is fantastic to see from an investor perspective. Their quick ratio (current assets minus inventory divided by current liabilities) is 1.08x.

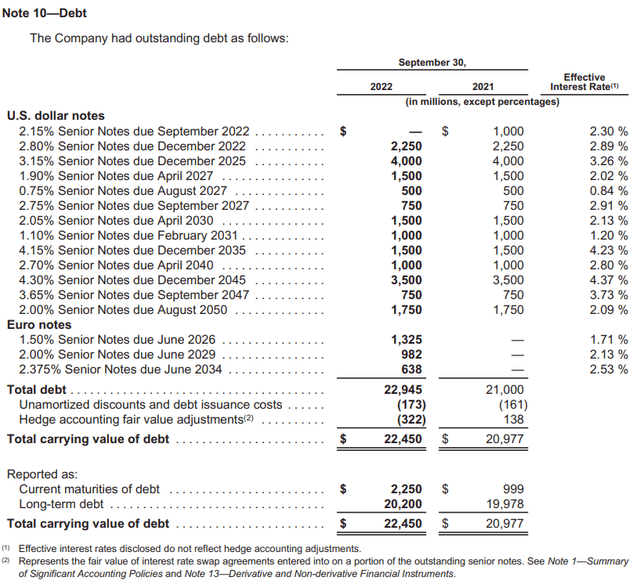

Visa has $22.45B in long-term debt with a majority of debentures maturing after 2027. While the company has $4B maturing in 2025, Visa may still choose to engage in refinancing of this debt to ensure it doesn’t weigh-down on their FCF for the year.

Visa operates with a financial leverage of just 2.4x which is fantastic to see, especially given the overleveraged nature of many fintech companies.

Overall, it is clear that the management at Visa is laser focused on maintaining their incredible levels of profitability across their business operations. Visa’s broad range of products continues to drive significant profitability while a global move towards digital payments all but guarantees that Visa’s client base will continue growing for many years to come.

Valuation

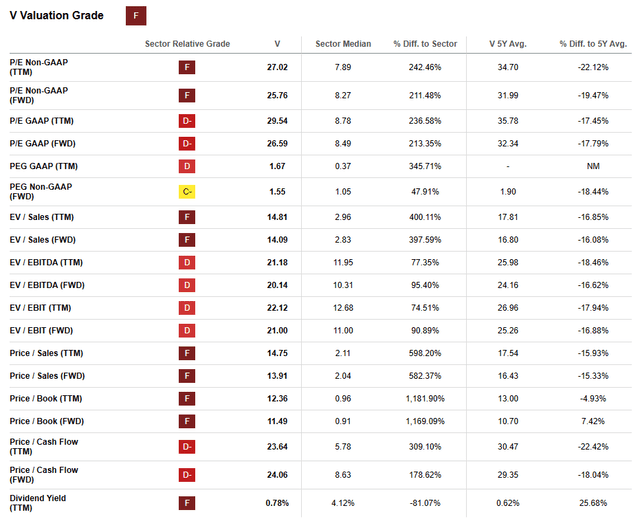

Seeking Alpha’s Quant has assigned Visa with an “F” Valuation rating. I find this valuation to be a little too pessimistic. I actually believe a potentially small undervaluation is present in Visa.

The firm is currently trading at P/E GAAP FWD ratio of 26.59x and a P/CF TTM ratio of 23.64x. Their FWD EV/EBITDA of 20.14x is not excessive in my opinion, nor is their EV/Sales FWD of 14.09x. While these figures are generally above the sector median, I believe given Visa’s strong growth expectations and continued margin improvements, these figures are not at all excessive and thus do not indicate an overvaluation.

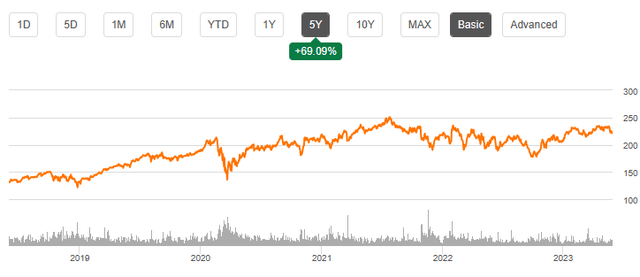

Seeking Alpha | V | Summary Chart

From an absolute perspective, Visa shares are trading at what seems to roughly be a fair value. The current valuation does not seem (from a historic perspective) to be excessive nor particularly low.

On a YoY basis, while the global markets have underperformed, Visa has left investors with a handy 4% return which, is welcomed given the difficult macroeconomic conditions. Given Visa’s beta value of 0.97x, this low volatility is to be expected.

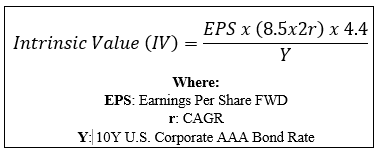

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2023 EPS of $8.58 a conservative r value of 0.10 (10%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for Visa of $241.

The Value Corner

When using this conservative CAGR value for r, Visa appears to be undervalued by around 8%. Given some margin of error, this represents what is essentially a fair valuation.

When using a more optimistic CAGR value of 0.12 (12%), shares are valued at around the $270 mark, which would represent a 20% undervaluation.

Therefore, I believe Visa as a company is currently sitting somewhere between fairly valued and slightly undervalued. If the firm is able to harness the expected growth in payments volumes and the resulting data processing revenues, I fully believe this base-case figure could be achieved.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and the ability of global economies to skirt a recession in 2023.

Given that most fundamental market metrics are forecasting a recession, the potential for reduce payments volume growth from chip fabricators due to an overall decrease in consumer discretionary spending could potentially harm Visa’s growth targets.

In the long term (2-4 years) I expect their position as the leader in digital payments processing industry to become even stronger. Their unique and differentiated selection of value-added services combined with a truly world-class core VisaNet transaction platform provides Visa a moat which is not only robust, but one which is efficient at providing real margins for the company’s business operations.

I believe current share prices are not quite in value or deep-value territory yet, as the base-case 20% undervaluation does not leave much in terms of a margin of safety.

However, given the high-quality business model at Visa and domineering market position, I believe this potentially 20% margin provides value-oriented investors with just enough breathing space to hypothesize building a position in the firm.

Risks Facing Visa

Visa’s primary risk stems from the cyclical nature of the global economy to some degree determining their transaction volumes along with the threat of a cyber security breach harming their reputation.

Ultimately, Visa is somewhat dependent on the situation present in the prevailing macroeconomic conditions. During recessions, consumers tend to spend less, especially on consumer discretionary items which translates in practice to a decreased number of total transactions processed by Visa in a given timeframe.

While Visa’s robust diversification into other revenue streams does provide the company a good deal of protection from this spending decrease by consumers, the impact that such a situation could have on margins is still real.

Visa also faces an ESG risk primarily from a cyber security perspective. The huge amount of sensitive user data held and processed by Visa means any successful security breach could have huge implications for the company. However, given Visa’s utmost dedication to maintain the most secure payments processing platform in existence, I believe the company is doing all it can to mitigate against this threat and thus does little to concern me.

The competitive threat from Mastercard should not be underestimated, especially given the highly skilled and hungry management team working at the firm. Nonetheless, Visa’s unrivalled status as the clear market leader means a significant industry disruption would be required to dethrone the king.

While such an event is possible and often unexpected, the expectation for Visa would be to harness any such change with their own solution. I fully believe given the expertise of the management that this would be achieved.

Summary

Visa is still the undoubted market leader in the global, digital payments processing industry. Their VisaNet payments network is unrivalled technologically with their closest business competitor Mastercard only posing a latent threat to Visa’s dominant position.

Their continued development of new value-added services and innovative network services has allowed the company to become the most globally accepted form of digital payments.

A strong start to FY23 combined with a fantastic FY22 has spurred investor sentiments and tangible returns. While 2023 looks a little more uncertain from a macroeconomic perspective, Visa’s robust set of revenue streams and great profitability even at their current scale should help the company retain value for shareholders even in the event of a recession.

Given Visa’s truly dominant market position and historic outperformance of index funds, I have entered into a substantial position in Visa which equates to approximately 1/5 of my total portfolio value.

Therefore, I rate Visa a Strong Buy thanks to its truly industry leading business and my belief that this business model has real potential to earn investors excellent long-term returns. My exit strategy for Visa is quite simple: unless something cataclysmic were to change in the way we pay, and Visa wasn’t able to adapt to this new norm, I am never selling.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.