Summary:

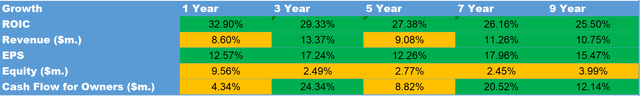

- Visa’s robust network and technology have driven its impressive 15% annual EPS growth.

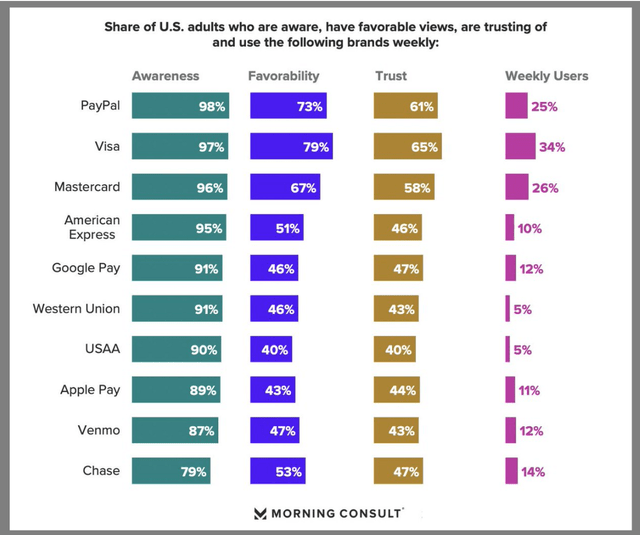

- Morning Consult’s 2023 survey solidifies Visa’s brand strength.

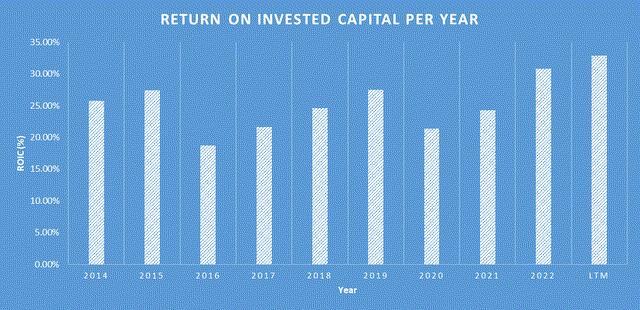

- Visa effectively allocates 85% of its free cash flow to shareholders, while maintaining a high ROIC.

- Based on a 10% annual growth in cash flow per share, Visa offers a 13% CAGR, making it a buy.

2Ban

Investment Thesis

In my opinion, Visa Inc. (NYSE:V) is a buy due to its multiple advantages that make it an attractive investment. The company’s technological infrastructure and expansive network have led to an impressive 15% annual growth in Earnings Per Share. This is validated by a 2023 Morning Consult survey, which emphasizes Visa’s robust brand and consumer trust. Financially, the company is committed to its shareholders, channelling around 85% of its free cash flow back to them via dividends and share repurchases, all while sustaining a high ROIC. Furthermore, a modest projection of 10% yearly growth in cash flow per share suggests a 13% CAGR over the upcoming five years. These elements collectively position Visa as both a market leader and a prudent investment.

Company Overview

Visa serves as a key player in the global financial system by facilitating electronic payments via its credit, debit, and prepaid cards. It doesn’t issue cards or extend credit but operates VisaNet, a network for transactions. The network can process over 65,000 transaction messages per second. Visa’s revenue comes mainly from transaction fees from merchants and additional fees from financial institutions for services and data processing.

The company faces competition from other card networks such as Mastercard (MA) and American Express (AXP), as well as fintech platforms like PayPal (PYPL) and Square (SQ). Blockchain technology and cryptocurrencies like Bitcoin also present potential challenges to Visa’s business model. Overall, Visa relies on its extensive network and multiple revenue streams but needs to innovate to stay competitive.

Extensive Global Network Is an Advantage

In my view, Visa’s competitive advantage is evident in its extensive global network, which covers over 200 countries, and its advanced technological infrastructure. These have been nurtured through long-term relationships with important stakeholders like financial institutions and merchants. Beyond just facilitating payments, Visa offers value-added services such as fraud detection and data analytics, aiding clients in enhancing their operations.

The system Visa has built is capable of processing billions of transactions annually, with a focus on both high volume and security. This creates a high barrier to entry for potential competitors, as replicating such a network would require significant resources, time, and specialized knowledge. Additionally, the trust Visa has garnered from its stakeholders further cements its competitive position. Trust is a crucial element in the financial services industry and is not easily duplicated.

It’s worth noting that Visa’s Earnings Per Share has grown at over 15% annually for the last nine years. In my opinion, this impressive financial performance is largely attributable to the sustainable competitive advantage that Visa’s network and technology provide.

Industry Leading Brand Strength

In a 2023 survey study by Morning Consult, Visa ranked exceptionally well, further emphasizing its strong position in the market. The company came in second in awareness at 97%, just behind PayPal. However, Visa outperformed all competitors, including PayPal (PYPL), Mastercard (MA), and American Express (AXP), in other key categories. It ranked first in favorability at 79%, in trust at 65%, and in weekly users at 34%. In my opinion, these survey results underscore Visa’s robust brand and reputation. The company not only has a large, committed customer base and attracts skilled talent but also enjoys high levels of trust, which is crucial for a payment processing company. The high rankings in favorability and weekly users also indicate that Visa’s services are not just well-known but actively preferred and used, solidifying its competitive advantage in the financial services sector.

Excellent Capital Allocation

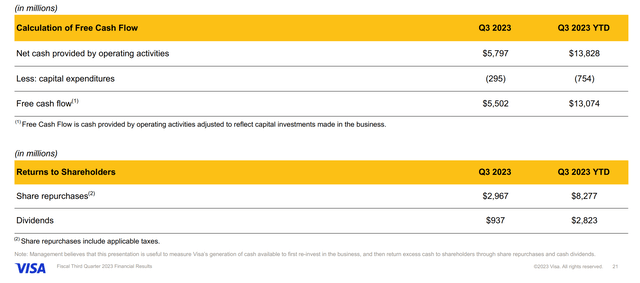

Visa excels in shareholder-friendliness, primarily through its dedication to returning a substantial amount of its free cash flow to investors. As of Q3, 2023, Visa had generated $13,074 million in free cash flow. Of this amount, $8,277 million was allocated to share repurchases and $2,823 million was spent on dividends. This means that approximately 63% of its free cash flow was used for share buybacks and about 22% was distributed as dividends, totalling around 85% of the free cash flow being returned to shareholders.

Visa’s Q3 2023 Earnings Presentation

Moreover, Visa’s high Return on Invested Capital further underscores its efficient use of capital. The company’s 9-year average ROIC stands at around 25% per year. This high ROIC suggests that Visa is highly effective in allocating the remaining cash that is reinvested into the business, generating strong returns as a result.

Visa’s approach to capital allocation is twofold: a significant portion of its free cash flow is returned to shareholders through share buybacks and dividends, and the remainder is efficiently reinvested in the business. This strategy has proven to be effective, making Visa an attractive investment for those seeking both income and growth.

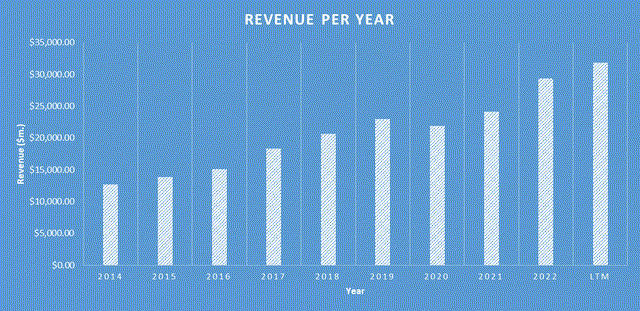

Financial Analysis

Over the past 5 years, the company has demonstrated remarkable financial performance. Its revenue has shown a consistent and strong growth, increasing from $20,609.00 million in 2018 to $31,831.00 million in the last 12 months in 2023, representing a compound annual growth rate of approximately 9%. The earnings per share (EPS) has been equally impressive, growing steadily from $4.42 to $7.88, reflecting the company’s ability to translate revenue growth into bottom-line success. The book value has seen a small upward trend, growing from $34,006.00 million in 2018 to $38,981.00 in the last twelve months, indicating a CAGR of approximately 3%. The book value growth has been slow, largely due to the large quantities of share buybacks being completed by the company over the past 5 years.

As of the most recent quarter, the company reported cash and cash equivalents of $18,756.00 million. The company’s total debt stands at $20,560.00 million, a modest amount that reflects the company’s conservative approach to leverage where the total amount of debt could be paid off in about 2 years of free cash flow. The company’s current ratio, a measure of its ability to cover short-term liabilities with short-term assets, is 1.49, which is generally considered healthy.

I expect Visa’s upcoming quarterly earnings results to be strong, where I think revenue growth will likely in the high single digits, with earnings growth likely in the low double digits. Looking beyond the next 12 months, assuming that we do not enter a significant macroeconomic downturn, the company should maintain its strong growth, likely a few percent points slower than its historical averages due to the companies scale and deep market penetration. However, I do think Visa can grow free cash flow around 10% per year due to their expansion network infrastructure, their brand strength and talent management team.

Valuation

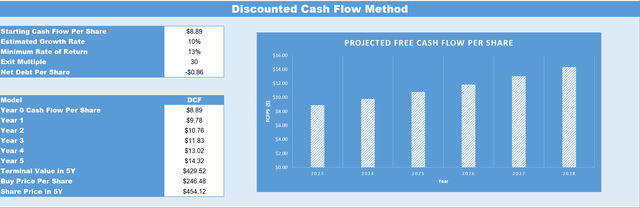

When considering valuation, I always consider what we are paying for the business (the market capitalization) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business, as seen below.

Visa’s current TTM Cashflow per Share as of Q3, 2023 is $8.89. Based off the sustainable competitive advantages that Visa have such as a high barrier of entry, a strong brand as well as a management team that can reinvest capital at a high rate of return, I believe that Visa’s Cashflow per Share should grow conservatively at 10% annually for the next five years. Therefore, once factoring in the growth rate by Q3 2028 Visa’s Cashflow per Share is expected to be $14.32. If we then apply an exit multiple of 30, which is lower than Visa’s mean price to free cashflow ratio for the previous 10 years of 33, this infers a price target in five years of $454.12. Therefore, based on these estimations, if you were to buy Visa at today’s share price of $247.14, this would result in a CAGR of 13% over the next five years.

Therefore, in my opinion based on this valuation model, Visa is a buy. However, it should be considered that an exit multiple of 30, while it is close to historical averages, this is still quite high. Investors must keep in mind that if the multiple was to retract to 20, then the future returns would be significantly lower. Therefore, a more conservative investor may wish to add this stock to their watchlist for now, while an investor with a more aggressive framework should buy Visa now, and then average down if the stock price of Visa falls.

Conclusion

Visa’s multiple strengths make it a compelling investment opportunity. The company’s robust network and technological capabilities have fueled a remarkable 15% annual growth in Earnings Per Share. This is further corroborated by Morning Consult’s 2023 survey, which highlights Visa’s strong brand and reputation, particularly in terms of consumer trust and favorability. Financially, Visa is shareholder-friendly, allocating about 85% of its free cash flow back to investors through share buybacks and dividends, all while maintaining a high Return on Invested Capital (ROIC). Moreover, based on a conservative estimate of 10% annual growth in Cashflow per Share, Visa is projected to offer a Compound Annual Growth Rate (CAGR) of 13% over the next five years. These factors collectively indicate that Visa is not just a market leader but also a sound investment, particularly for those with an aggressive investment strategy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.