Summary:

- Visa faces moderate risks with rising interest rates and year-over-year declines in cryptocurrency value and transactions.

- Visa currently has a negative tangible book value of equity due to their tangible assets exceeding their book value of equity.

- Utilizing the discounted cash flow approach, with modest assumptions, results in an intrinsic value 40% below market value, leaving a little margin of safety.

- Using an implied DCF approach, Visa would need to grow revenue at 15% for 5 years, when their historical Revenue CAGR is almost half of that at 7.93%.

- Considering the risks outlined below surrounding Visa as well as their historical financial discipline and profitability results in a hold rating.

Justin Sullivan

Introduction and Thesis

Visa Inc. (NYSE:V) operates as a global payments technology company. The company offers products, solutions and services that facilitate secure, reliable and efficient money movement for participants in the ecosystem. The company offers a wide range of Visa-branded payment products that its clients, including nearly 15,000 financial institutions, use to develop and offer core business solutions, including credit, debit, prepaid and cash access programs for individual, business and government account holders. The company remains focused on moving the trillions of consumer spending in cash and checks to cards and digital accounts on Visa’s network of networks.

Overall, the company faces risks such as decline in Crypto value, regulations surrounding crypto, increasing interest rates, and a hefty $14 billion share repurchase program that could prove to be dilutive for shareholders if stock price does not continue to rise. Additionally, the company has a negative tangible book value of equity due to the large value of their intangible assets.

On the other hand, Visa is a staple in the financial services/transactions industry and has an impressive track record of financial discipline and profitability. For the reasons mentioned above, I maintain a hold rating on Visa.

Problems Surrounding Visa

Visa’s recent ventures into crypto currency enabled payments could prove to be dilutive to Visa’s earnings considering the recent declines in the value and overall transaction level of bitcoin. Additionally, regulations surrounding Crypto currency are uncertain and higher interest rates could suppress transaction volume for Visa. Lastly, Visa has a stock repurchase program of $12 billion, but no insider buying.

Crypto Winter

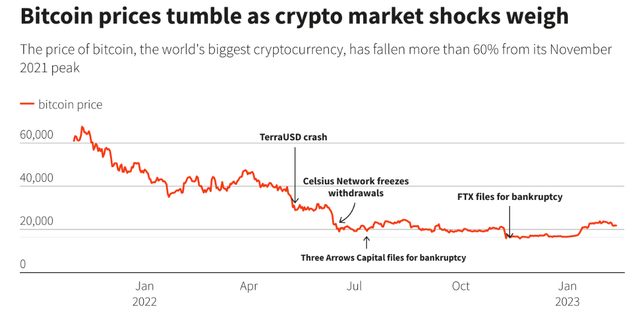

Crypto in general has seen steep declines since Q4 2021. Please refer to the annotated graph from Reuters below depicting the recent Bitcoin crash.

Bitcoin lost nearly 66% over a 15-month span from October 2021 to January 2023. As of 2021, Visa offers clients the ability to enable the use of crypto for payments. Visa has already made large infrastructure investments to support the crypto enabled payment option for clients and had plans to partner with major crypto firms. Per the Reuters article, “U.S. payment giants Visa (V.N) and Mastercard (MA.N) are slamming the brakes on plans to forge new partnerships with crypto firms after a string of high-profile collapses shook faith in the industry, people familiar with the matter told Reuters”. A possible discontinuation of Crypto operations at VISA could result in large infrastructure losses to the company.

Regulation

There is hardly any guidance regarding the use of Crypto Currency in the US, as international standards differ drastically. To quote an article from Brookings “Few countries have excelled at writing and enforcing clear regulations governing digital currencies, but even by the standards of a profoundly ambiguous and poorly enforced area of regulation, the United States has struggled when it comes to defining not just what policies to promote but also what the goals of those policies should be. China, for instance, has taken a strong stance against cryptocurrencies by banning all transactions of virtual currencies in hopes of cracking down on cybercrime and fraud, and it has simultaneously begun rolling out a state-backed blockchain services network. El Salvador’s government, by contrast, has made Bitcoin a form of legal tender, requiring that all businesses accept the cryptocurrency as payment and creating a $150 million trust to facilitate conversions between Bitcoin and dollars”. Regulation is still unclear, and this lack of clarity results in a perceived increased risk for the company.

Federal Funds Rate

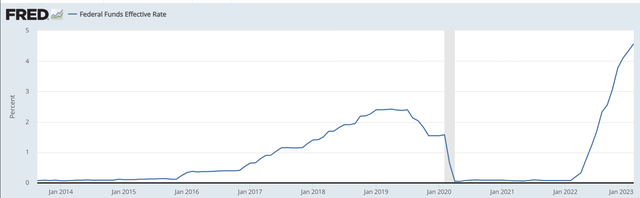

The Federal Funds rate has seen significant sharp increases over the last year, jumping from .25% in January 2022 to 4.5% as of January 2023

Increases in the Federal Funds Rate leads to a higher overall interest rates within the economy. Higher interest rates deter spending and delays investment projects. As less projects are taken on and spending decreases, overall volume for Visa transaction should decrease as well resulting in lower anticipated revenues and earnings.

Share Buyback and Insider Activity

According to the companies’ annual report, “On December 13, 2021, the board of directors of Visa Inc. (the “Company”) authorized a new $12.0 billion share repurchase program. Of the previous authorization that had $4.7 billion of authorized funds as of September 30, 2021, approximately $3.5 billion had been utilized as of December 15, 2021”. Visa used approximately $4 billion of these funds for a stock repurchase, and the impact can be seen on their stock chart when the stock rebounded from ~$185/share to ~$207/share by the end of the month.

Visa Stock Price (Google Finance)

Stock repurchases in the billions are going to increase the price of the stock, especially with another $8 billion in dry powder. There is a lot of speculation about stock buybacks, some think it shows a sign of confidence while others look to it as a risky scenario that could destroy shareholder value.

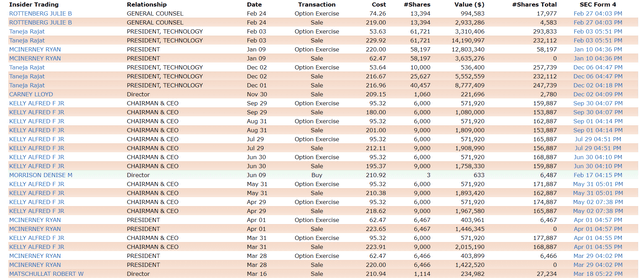

In addition to share repurchases, it is interesting to see if management and executives share the same sentiment regarding share buybacks. Surprisingly, since March 18, 2022, to present day only one buy has occurred.

Insider Buying/Selling (Finviz)

The increased volume of sales from the company makes one think management and executives may not share the same optimism as the company regarding share buybacks.

Valuation Analysis

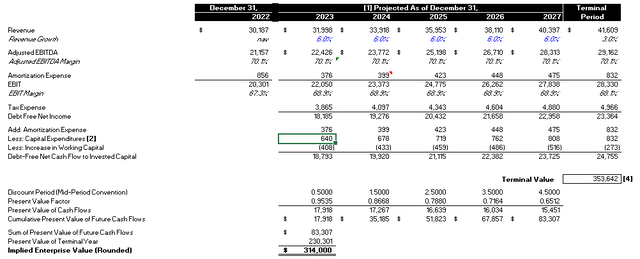

Conclusion of Value (Data sourced from Capital IQ, Calculations performed by Author)

When looking to assess Visa’s price per share, I thought the best way is to utilize the discounted cash flow to arrive at the present value of Visa’s future earnings.

Above is a summary of my analysis, showing a calculated enterprise value utilizing the DCF approach of $314.4 billion, compared to its market value of $450.1 billion as of March 3, 2023. This implies that Visa is trading ~43% above my concluded projected enterprise value.

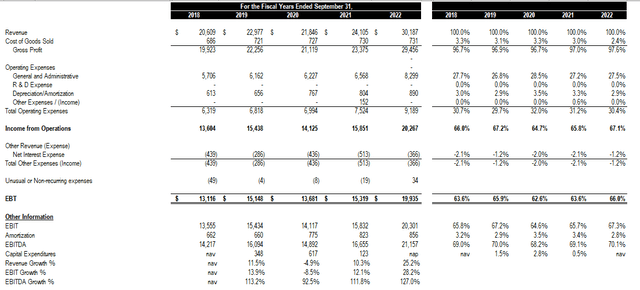

Income Statement (Data sourced from Capital IQ, Calculations performed by Author)

Visa has shown modest revenue growth from 2017 to 2022, with a CAGR of 7.93% over the five-year period. Visa has maintained stable EBITDA margins at 70% of revenue and moderate revenue growth.

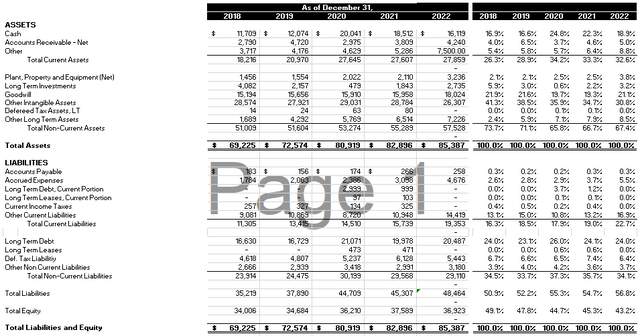

Balance Sheet (Data sourced from Capital IQ, Calculations performed by Author)

Visa’s balance sheet stayed roughly flat year over year at $85 billion. Additionally, the company has a 55% Debt to Equity ratio, no problem with their interest coverage ratio at 58x. Visa also has a sizeable cash position, almost matching their debt balance. Overall, Visa shows financial discipline with a negligible debt position and a superior ability to service its debt requirements all while moderately expanding its balance sheet.

Ratio Analysis

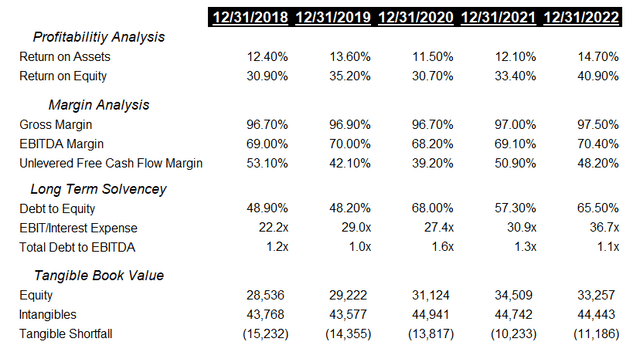

In addition to looking at the company’s financial statements, I performed a detailed ratio analysis on Visa’s fundamentals.

Ratio Analysis (Data sourced from Capital IQ, Calculations performed by Author)

Visa has shown solid profitability over the last 5 years as demonstrated by their return on assets and equity margins ranging from 11.5%-14.7% and 30.9%-40.9%. Additionally, the company has impressive Gross margin of 97.5% and EBITDA margin of 70.4% in the most recent fiscal years performance.

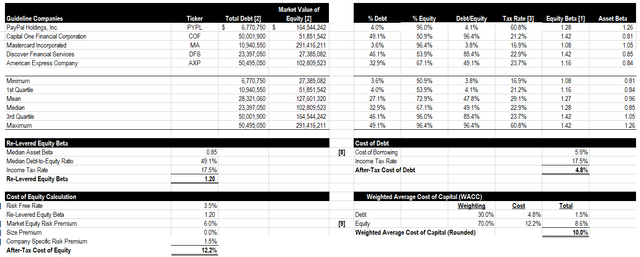

The first step in my DCF analysis is projecting the growth of revenue. I selected a 6% growth rate and consider this to be a moderate assumption based off of their 5-year historical CAGR of 7.93%. Additionally, I held the projected adjusted EBITDA margin constant at 70.1%, using fiscal year 2022’s most recent EBITDA margin for guidance. I also believe this represents a modest margin assumption considering the risks mentioned above surrounding Visa. Next, I selected a WACC of 10.0% based on assumptions from guideline public companies as well as data from Kroll. Below is a snapshot of my WACC conclusion.

Guideline Public Companies (Data sourced from Capital IQ, Calculations performed by Author)

I selected a Depreciation/Amortization ratio of 1.18% of revenue for the projection periods based off of historicals. I also selected the Capex ratio of 2.0% of revenue for the projection periods based off of historicals. Lastly, I assumed a Capex ratio of 2.0% of revenue for the projection periods based off of historicals.

Discounted Cash Flow (Data sourced from Capital IQ, Calculations performed by Author)

Conclusions of Valuation Analysis

Using the DCF approach to back into Visa’s current share price, Visa would have to achieve a 15% growth rate over the next five years with a 3% terminal growth rate to achieve a price of $219.06. Considering their 5-year historical revenue CAGR of 7.93%, an implied growth rate of 15% based off of the current price per share seems aggressive. Based off of more conservative projections, the DCF shows that Visa is trading at a ~40% premium to earnings. Although this is a reasonable premium for a blue-chip company, I would like to see a larger margin of safety given the risks surrounding Visa as well as the current economic conditions.

Risks

Visa has several factors that could affect the future projected cash flows and thus the present value of the company’s common shares and ultimately leading to a sell or buy rating.

Cryptocurrency is down nearly 66% in the last 15 months but has gained some momentum recently. As of year to date 3/3/2023, Bitcoin has gained 34.63%, showing signs of recovery. If this trend continues, Visa could continue to see increases in transaction volume from crypto currencies as volume and price action return.

Inflation has been rising from 1.23% in 2020 to 4.69% as of 2021. Inflation can deter consumer demand, and compress company margins ultimately resulting in declined profitability and revenues. Additionally, a faster than anticipated recovery could prove to be beneficial for Visa and accelerate transaction volume.

Visa’s business model is highly dependent on transaction volume and debt payments to generate revenue. With higher costs of debt via the federal funds rate, coupled with higher cost of living due to inflation, visa could see a downturn in revenues from a decline in business transactions.

When looking at Visa’s tangible book value, one can see that the intangibles account for nearly 50% of total assets. Visa’s book value of equity currently sits at $33.2 billion as of 12/31/2022. Visa’s intangible assets as of the same date are equal to $44.4 billion, resulting in a $11 billion dollar short fall in tangible book value to equity.

Conclusion

Visa operates as a global payment’s technology company that maintains financial discipline as well as impressive historical profitability and growth. The Crypto Winter, combined with rising interest rates, can act as a catalyst for decreased revenue and profitability for Visa. With modest revenue projections, and constant EBITDA margins, Visa stock is a hold with its market value trading at a ~43% premium to the intrinsic value, calculated via the discounted cash flow approach and considering its negative tangible book value of equity.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.