Summary:

- Visa achieved an 8% YoY increase in Q4 payments volume, driven by stable U.S. demand and strong international growth.

- Cross-border volume rose 13% YoY, with e-commerce fueling a 15% increase in card-not-present transactions, underscoring digital demand.

- Processed transactions grew 10% YoY, strengthening Visa’s market dominance and aligning with its FY 2025 growth guidance.

- Value-added services reached $2.4 billion, a 22% YoY increase, highlighting Visa’s successful diversification beyond traditional payment processing.

- Regulatory scrutiny over Visa’s market dominance, particularly in U.S. debit transactions, poses ongoing legal and revenue risks.

FinkAvenue

Investment Thesis

Since our last coverage, Visa (NYSE:V) has delivered a solid 24% return, demonstrating resilience and growth potential despite economic challenges. The company’s recent results emphasize its expanding market presence and strategic focus on diversifying revenue streams. With robust volume growth, increasing cross-border transactions, and advancements in digital payments, Visa remains well-positioned as a global payment ecosystem leader.

While investors should be interested in this company, they must consider the regulatory risk from continuing concerns about Visa’s market position and, by association, possible antitrust issues. Also, global economic uncertainty remains one factor to consider, since changes in consumer trends could adversely impact Visa’s volumes. Notwithstanding this, an established market position and diversified revenue strategy provide a long-term, solid growth foundation for the company.

Visa’s Payments Volume Surges 8% in Q4, Driven by E-Commerce and Global Growth

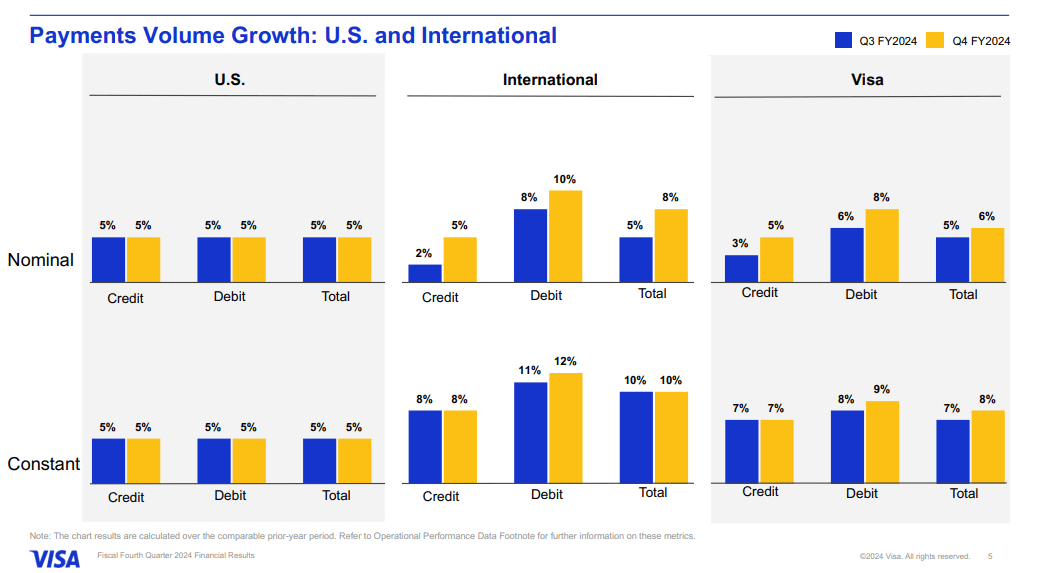

Visa’s payments volume increased 8% year-over-year (YoY) in Q4, boosting its revenue growth and showing constant upward movement. In the U.S., Visa’s largest market, consolidated payments volume stood at 5%. Both credit and debit transactions also rose by 5%. This constant performance indicates stable consumer spending patterns despite economic shifts or seasonal changes.

In transaction types, Visa saw a 2% rise in card-present volume and a 6% increase in card-not-present volume. E-commerce growth largely led to this card-not-present increase. International markets also boosted Visa’s payment volume. Latin America rose by 24%, and CEMEA saw a 19% rise. Europe followed with a 12% rise in payments volume. Asia Pacific grew under 1%, excluding Mainland China, which aligns with Visa’s projections, but other regions compensated for Asia Pacific’s lower growth.

Q4 2024 Earnings Deck

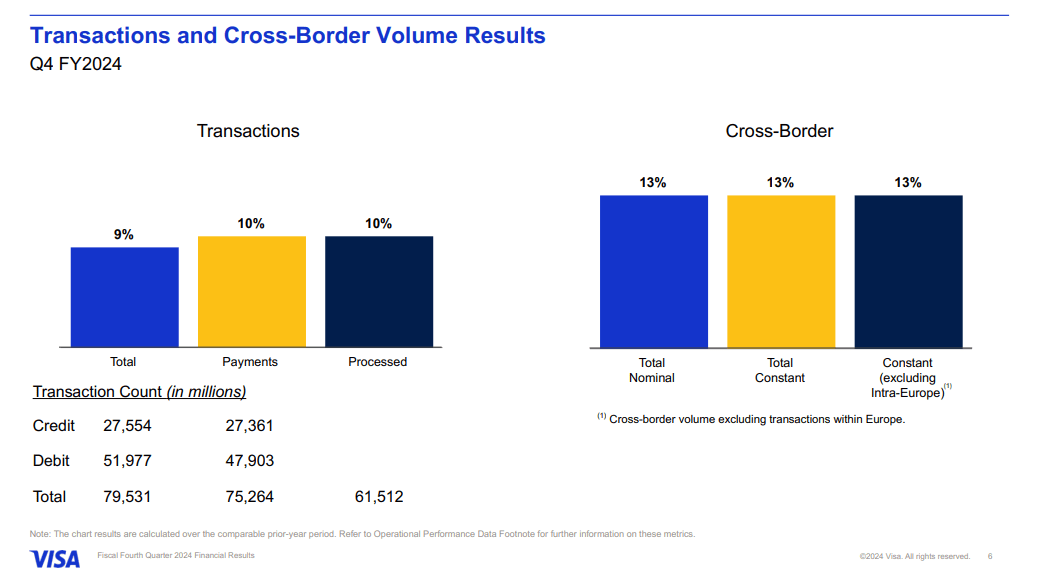

Additionally, Visa’s cross-border volume, excluding intra-Europe, rose 13% YoY in Q4. This points to Visa’s adaptability to the changing cross-border payments landscape. E-commerce has boosted cross-border volume growth, with card-not-present volume hitting a 15% increase YoY. This compares to a 12% rise in cross-border travel volume. The higher rate of card-not-present transactions indicates a considerable demand for digital commerce beyond travel.

Visa’s cross-border travel volume remains indexed to pre-2019 levels, though Asia Pacific inbound and outbound travel dropped a bit. Visa’s Q4 data show constant travel volume trends in Latin America, Europe, and CEMEA. Lower outbound travel volume in CEMEA during Ramadan slightly impacted the total volume. The stable travel demand in Latin America marks Visa’s diversified cross-border volume.

Moreover, Visa’s processed transactions rose by 10% YoY in Q4, demonstrating its stability in a competitive payments industry. Processed transaction growth reflects Visa’s capability to capture high transaction volumes, strengthening Visa’s market lead and extending its transactional presence.

Visa’s capability to handle increasing transaction volumes boosts market trust and growth. Visa’s stable transaction growth also matches its earnings targets and long-term scale. This stability supports Visa’s FY guidance, projecting the growth of processed transactions and payments volume into 2025. Therefore, Visa’s reliability in transaction-based revenue remains solid, even amid economic shifts.

Q4 Earnings Deck

Further, Visa’s value-added services hit $2.4 billion in Q4, a 22% YoY increase. Marketing, consulting, and issuing services largely led to this rise. This expansion reflects Visa’s strategy to diversify beyond traditional processing. Visa’s consulting and marketing services give clients data insights and target strategies. This approach builds client relationships and brings steady revenue.

Similarly, Visa Direct showed a solid 38% YoY rise in Q4 transactions. Its success in Latin America, with peer-to-peer (P2P) app interoperability, boosted growth. This success boosts Visa’s presence in Latin America and shows demand for flexible payment solutions. Thus, the 38% Visa Direct growth boosts Visa’s revenue by aligning with real-time payment trends.

As a result, Visa hit a 12% YoY increase in net revenue in Q4, surpassing targets. Lower-than-projected incentives and currency shifts helped boost revenue. Visa’s sharp management of incentive costs maximized its net revenue, reflecting solid financial control amid pricing competition. The 12% growth shows Visa’s payments and cross-border transaction strength. Visa’s diverse model supports growth across economic cycles and demand shifts. Visa’s commercial volume hit a 5% YoY increase, slightly below Q3 but stable across its commercial base.

Looking forward, Visa’s FY 2024 consolidated revenue rose by 10%, meeting growth targets. Despite regional volatility, Visa managed stable growth rates. Visa projects payments volume, processed transactions, and cross-border volume to show stable trends into 2025. This approach assumes a stable economic environment. Hence, Visa’s 2025 guidance shows projected growth in e-commerce, cross-border transactions, and value-added services.

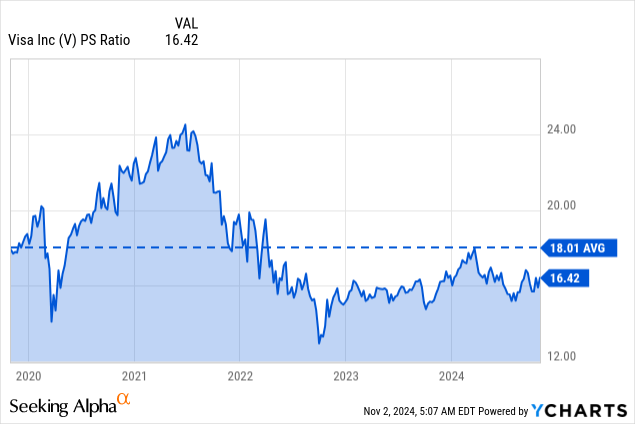

These projections support Visa’s long-term top-line growth. Based on its progressive revenue model, Visa’s stock is undervalued in terms of the long-term average of the top-line valuation metric (PS ratio). Therefore, the stock has more room for upside value growth.

Visa Faces DoJ Scrutiny: Monopoly Allegations and Potential Impact on Revenue

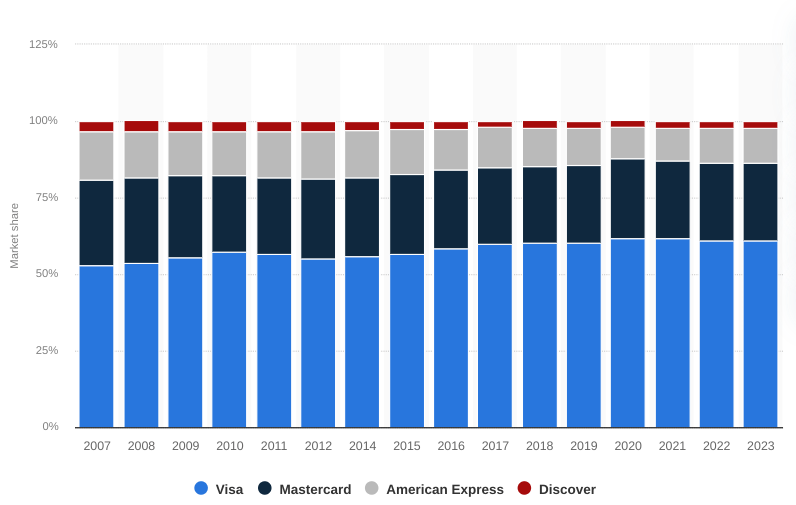

Due to its alleged monopolistic practices, Visa may face extensive legal and operational challenges. The Department of Justice (DoJ) accuses Visa of monopolizing the US debt market, asserting that Visa holds over 60% of debit transactions nationwide. The DoJ claims Visa’s dominant role in this market allows it to charge over $7 billion in fees annually and pass these costs to consumers.

Visa’s substantial market share provides leverage over merchants and banks and prevents these clients from choosing alternative networks. The DOJ argues Visa has established contracts with harsh penalties for banks and merchants who use other networks that deter competition and limit payment options. Now, these allegations may serve as an element of downside pressure on V’s stock in upcoming quarters (till the settlement or resolution)

At its core, Visa’s considerable market share and high fees have reportedly led to billions in additional consumer costs. While Visa’s North American operating margin stands at 83% (in 2022), these high margins depend on elevated fees sustained through Visa’s monopolistic stance. Visa’s dependency on these fees poses a risk if regulatory pressure intensifies, forcing Visa to adjust its fee structure or open the market to more competitors. This could hurt Visa’s revenue from debit processing, directly affecting its top-line performance.

statista.com

Moreover, The DoJ also claims that Visa stifles advancements by forming exclusionary agreements with fintech and tech firms. Visa allegedly incentivizes potential competitors to partner rather than enter the market independently. For instance, Visa abandoned a $5.3 billion merger with Plaid after the DoJ challenged it. This effort to prevent competitive advancements raises questions about Visa’s capability to lead the evolving payments industry. Visa’s strategy of limiting competition through partnerships could soon fail, especially if regulators crack down, leaving Visa exposed to competitors advancing within the industry.

Further, Visa’s considerable market share within the U.S. debit sector has developed over time, with debit transactions rising since 2007. Yet, this growth is largely attributed to Visa’s exclusionary practices. As the DoJ points out, Visa’s dominance in the debit market does not translate to credit or alternative payment systems. Smaller networks could begin taking Visa’s debit market share if Visa’s restrictions lessen. Visa’s reliance on debit fees poses another concern if payment dynamics shift as alternatives like digital wallets or account-to-account payments become more common.

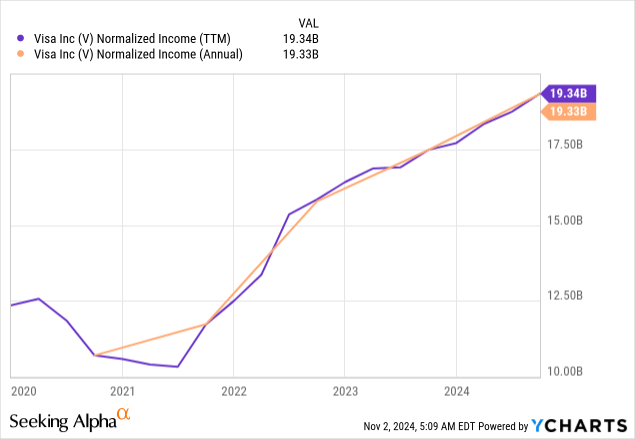

Finally, Visa’s high profitability in North America indicates its capability to derive income. The DoJ’s actions challenge Visa’s reliance on high transaction fees. If Visa must cut or adjust these fees, North American operating margins will suffer. Visa’s consolidated net income of $19.3 billion (2024) relies heavily on the current fee structure in the US. A regulatory push for fee reductions or expanded competition in the debit network could reduce Visa’s debit payments volume growth, related revenue, and stable operating margins. This would potentially impact Visa stock’s valuation based on reduced long-term targets for growth.

Takeaway

Visa’s Q4 results highlight its solid growth trajectory, driven by an 8% rise in payment volume, strong international performance, and gains in cross-border and e-commerce transactions. The company’s diversification into value-added services and real-time payment solutions further bolsters its market position and revenue stability. However, potential antitrust challenges and regulatory scrutiny around its market dominance present risks that could impact future revenue and operating margins. Overall, Visa’s strong market position and strategic expansion support a positive long-term outlook, though investors should remain cautious of regulatory headwinds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.