Summary:

- Visa’s stock has risen by 14% since it was last rated a ‘hold’.

- The company’s fundamentals show continued growth, with an increase in revenue, transactions, and net profits, but this doesn’t make it a prime prospect.

- If anything, V stock is becoming pricey and there is a risk of units becoming overvalued, leading to a more cautious stance.

Justin Sullivan

In November of last year, I decided to dig into one of the largest publicly traded companies on the planet. That happens to be payment processing giant Visa (NYSE:V). With a market capitalization of $581.2 billion as of this writing, the company dwarfs almost any other firm out there. Of course, you have the big tech companies that surpass it. You also have a couple of other firms like Berkshire Hathaway (BRK.A) (BRK.B) and Eli Lilly (LLY). But beyond that, you don’t have anything else. Back when I last wrote about the firm, it was not as large as it is today. Since then, the stock has risen by 14%. Considering that I rated it a ‘hold’, some investors might view my call as being overly conservative. But considering that I define a ‘hold’ as a company that should see upside or downside that more or less matches the broader market, and considering that the S&P 500 is up 14.7% over the same window of time, I call this a win.

Unfortunately, companies can’t continue to achieve rapid expansion forever. Yes, they can grow as their fundamentals improve. And there’s no denying that the most recent data provided by management shows continued growth. However, the stock is also getting quite pricey. And at some point, there becomes a true risk of units becoming overvalued. I wouldn’t say that we are ready for a downgrade just yet. But investors should definitely consider taking a more cautious stance if shares continue to climb as they have been.

Reassessing the situation

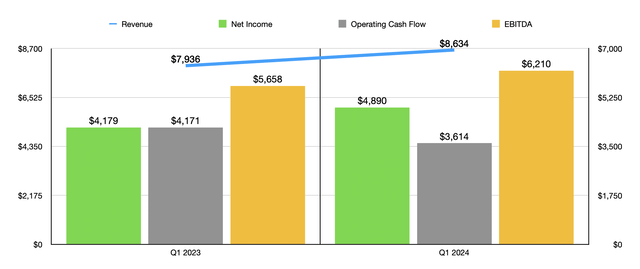

Fundamentally speaking, the picture for Visa and its investors is still quite positive. Consider financial performance for the first quarter of the 2024 fiscal year, which is the only quarter for which new data is available that was not available when I last wrote about the business. Revenue for that window of time came in at $8.63 billion. That represents an increase of about 8.8% compared to the $7.94 billion generated only one year earlier. In truth, there are multiple factors behind this increase. A company this large, for instance, rarely has only one or two drivers behind fundamental movements. But we can boil it down to a couple of the most important ones.

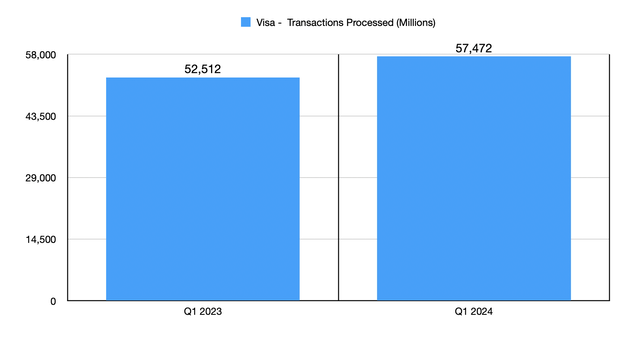

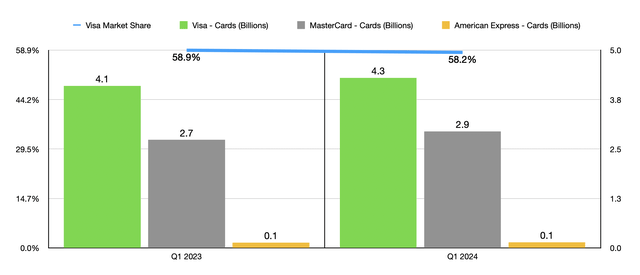

First and foremost, you have the number of transactions that the company processed. This number came in at 57.47 billion for the quarter. That’s 9.4% above the 52.51 billion transactions processed only one year earlier. The volume of payments transacted did not climb as much. But it still rose an impressive 8.2% from $3.54 trillion to $3.83 trillion. Both of these metrics are intertwined. And they are both reliant on the number of cards the company has in circulation. Unfortunately, management does not reveal the data quarterly down to the million marker. But they do provide it to the 100 million marker. The total number of cards in circulation at the end of the first quarter of 2024 came in at 4.3 billion. That’s up slightly from the 4.1 billion the company had in circulation one year earlier.

It’s great to see this kind of expansion. In some respects, the bottom line was really positive for the company. And in other respects, it could have been better. Take, for instance, the net profits of the business. At $4.89 billion, the bottom line for the firm was 17% higher than the $4.18 billion generated only one year earlier. There were a couple of reasons why, besides just seeing an increase in revenue, that the company’s bottom line improved as much as it did. For starters, marketing costs dipped slightly from 4.2% of sales down to 3.4%. Even more significant was a $332 million reduction in litigation provisions. Although interest expense for the company managed to rise rather meaningfully, growing from $137 million to $187 million, this was more than offset by investment income and other items skyrocketing from $24 million to $275 million. Other profitability metrics were somewhat mixed. Operating cash flow, for starters, dropped from $4.18 billion to $3.61 billion. However, EBITDA for the company improved from $5.66 billion to $6.21 billion.

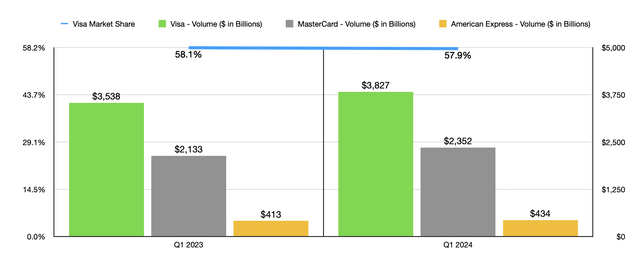

Before we get on to valuing the company, I do think it’s worth touching on a couple of other important metrics and how the firm stacks up to similar enterprises like Mastercard (MA) and American Express (AXP). While the company did see the number of cards in circulation rise, its market share of the big three actually slipped. With the number of Mastercard cards climbing by 7.8% from 2.73 billion to 2.94 billion, and the number of American Express cards jumping 5.9% from 133.3 million to 141.2 million, Visa’s share of the big three dropped from 58.9% in the first quarter of 2023 to 58.2%. Payment volume achieved by Visa did manage to rise by 8.2% year over year. But for Mastercard, that was 10.3%, while for American Express, it was 5.1%. All told, Visa saw its share of payment volume amongst the big three decline from 58.1% to 57.9%.

When it comes to the 2024 fiscal year in its entirety, management expects rather nice growth. Low double-digit revenue growth is anticipated while earnings per share growth is forecasted to climb at a rate that is in the low teens. In all likelihood, the earnings per share growth will be aided by significant share buybacks. In just the first quarter of 2024 alone, management repurchased 15 million shares for $3.61 billion. This represents a decline from 16 million shares one year earlier. But at that time, the repurchase only cost about $3.12 billion. Even after allocating such a large amount of capital to share buybacks, the firm has $26.4 billion left under its current share buyback program. And when you consider that operating cash flow last year was $20.76 billion, it’s not unreasonable to think that further meaningful buybacks will occur throughout 2024.

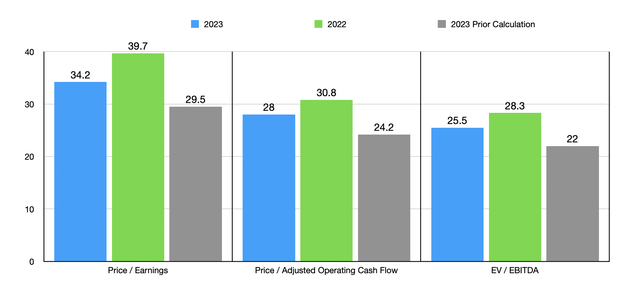

Given how vague management has been when it comes to other profitability metrics, not to mention profits for the first quarter of this year, I believe that valuing the company on a forward basis will not be terribly reliable. If, instead, we just use historical data for 2022 and 2023, we can get some picture of what the stock looks like and the opportunity it offers. In the chart above, you can see precisely this approach using the price-to-earnings scenario, as well as both the price-to-operating cash flow scenario and the EV-to-EBITDA scenario.

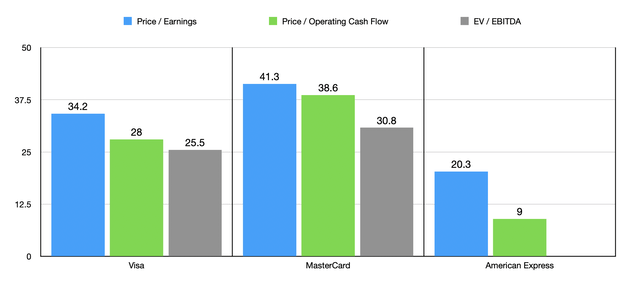

On an absolute basis, shares do look very pricey. Normally, such a high reading across the board would lead me to make the claim that the firm in question is overvalued. But it’s important to keep in mind that very high-quality businesses that continue to post growth almost every year often warrant a premium over what you would otherwise anticipate. Even so, shares are getting closer to being overvalued. After all, it was the price of the stock that led me to be most cautious in my prior article last year. And as you can see in the aforementioned chart, shares are much more expensive now than then. Admittedly, the company is not the most expensive player out there. Rival Mastercard, for instance, is trading at a price-to-earnings multiple of 41.3. Its price-to-operating cash flow multiple is 38.6, while its EV-to-EBITDA multiple happens to be 30.8. But of course, as we just demonstrated, Mastercard has been snatching up a little bit of market share along the way recently.

I do think it’s imperative for me to point out that while shares of American Express do appear cheaper in the last chart in this article, there are some key differences here that make it not exactly comparable to its other rivals when it comes to valuation. For starters, while American Express issues cards directly to customers, Visa and Mastercard only make theirs available through partnering institutions. The second is that, financially speaking, American Express is set up like a more traditional bank or other financial institution, which makes comparability a bit difficult. Specifically, you can’t really calculate an EV to EBITDA multiple for a firm like that because the interest expense it incurs is essentially operating cost in a sense that is not true for companies that are more traditional in their structure.

Takeaway

In the long run, I have no doubt that Visa will go on to create significant additional value for its investors. Management is clearly dedicated to continued growth while also focusing on returning capital directly to shareholders. But this does not necessarily make the company a great opportunity to buy into at this time. Shares look rather pricey, both on an absolute basis and relative to its largest competitor. This, combined with the dip and market share, leads me to believe that there are better opportunities to be had. And because of that, I have decided to keep the company rated a ‘hold’. But it wouldn’t take much more of a change in condition or share price for a downgrade to be warranted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is in cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!