Summary:

- Broadcom’s Q4 FY2024 earnings report shows strong revenue growth, driven by custom AI chip demand, pushing its market cap past $1 trillion.

- Broadcom’s custom AI accelerators for hyperscale customers differentiate it from Nvidia, with significant partnerships and a $60-90 billion market opportunity by 2027.

- The VMware acquisition has boosted growth and profitability, enhancing Broadcom’s AI infrastructure capabilities and positioning it for continued expansion.

- Despite execution risks, Broadcom’s strategic partnerships, financial performance, and focus on custom AI solutions justify a Strong Buy rating.

Ignatiev

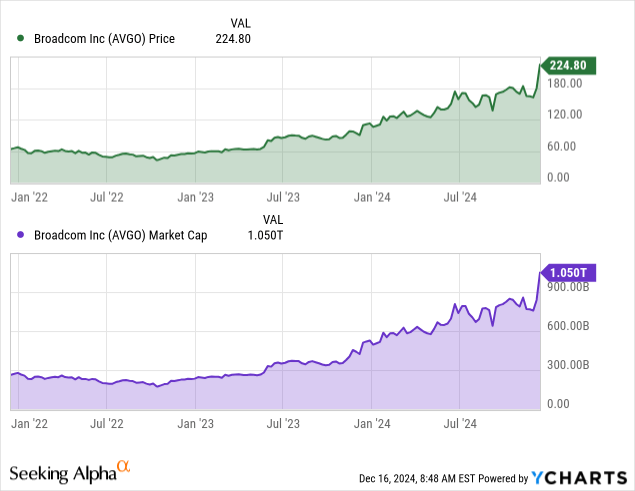

Broadcom’s (NASDAQ:AVGO) Q4 FY2024 earnings report marked a pivotal moment for the company, with its stock surging over 25% following strong revenue growth and soaring demand for its custom AI chip technologies. For the first time, Broadcom’s market cap crossed the $1 trillion milestone.

What stands out to me is Broadcom’s growing relevance as a serious competitor to Nvidia (NVDA) in the AI chip market. Hyperscalers like Google (GOOG) (GOOGL), Amazon (AMZN), Meta (META) and OpenAI are increasingly seeking more efficient custom-built AI chips tailored to their unique requirements. Broadcom’s focus on delivering these specialized solutions gives it a clear edge, particularly as it partners with OpenAI to develop custom AI chips designed to drive performance and revenue growth.

While everyone is focused on Nvidia’s upcoming Blackwell architecture, Broadcom is quietly building exactly what these AI giants need: chips designed from scratch for their unique requirements.

Broadcom’s strategy differs fundamentally from Nvidia’s approach. While Nvidia focuses on general purpose AI GPUs, Broadcom has carved out a unique position by developing custom AI accelerators (XPUs) specifically tailored for hyperscale customers. This strategy has already yielded significant results with three major hyperscale customers and two additional customers in advanced development stages.

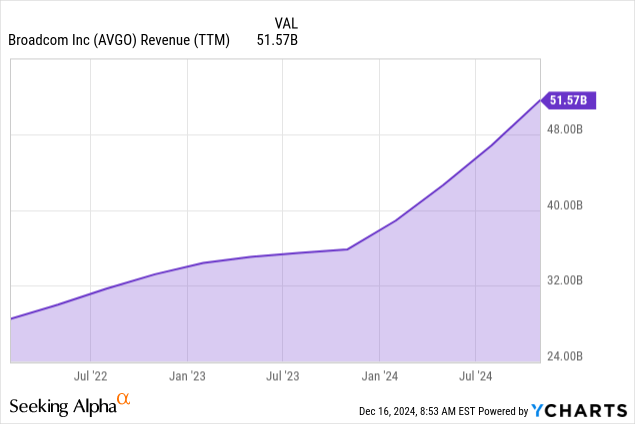

The company’s Q4 FY2024 financial results provide strong validation of this strategic direction. Breaking down the numbers reveals a compelling growth story: consolidated revenue reached $14.1 billion, marking a 51% increase YoY. More importantly, the semiconductor solutions segment which houses the AI initiatives generated $8.2 billion in revenue, 59% of total revenue and growing 12% YoY.

Why Custom AI Chips Are A Threat To Nvidia’s Dominance

Broadcom’s custom AI accelerator (XPU) program is central to its strategy, and the company has already established strong partnerships with three major hyperscale customers. Production has already begun with the first customer in 2024 with the second and third customers scheduled for 2025 and 2026, respectively. This phased approach enables Broadcom to continuously improve its technology and manufacturing processes while establishing a consistent revenue stream.

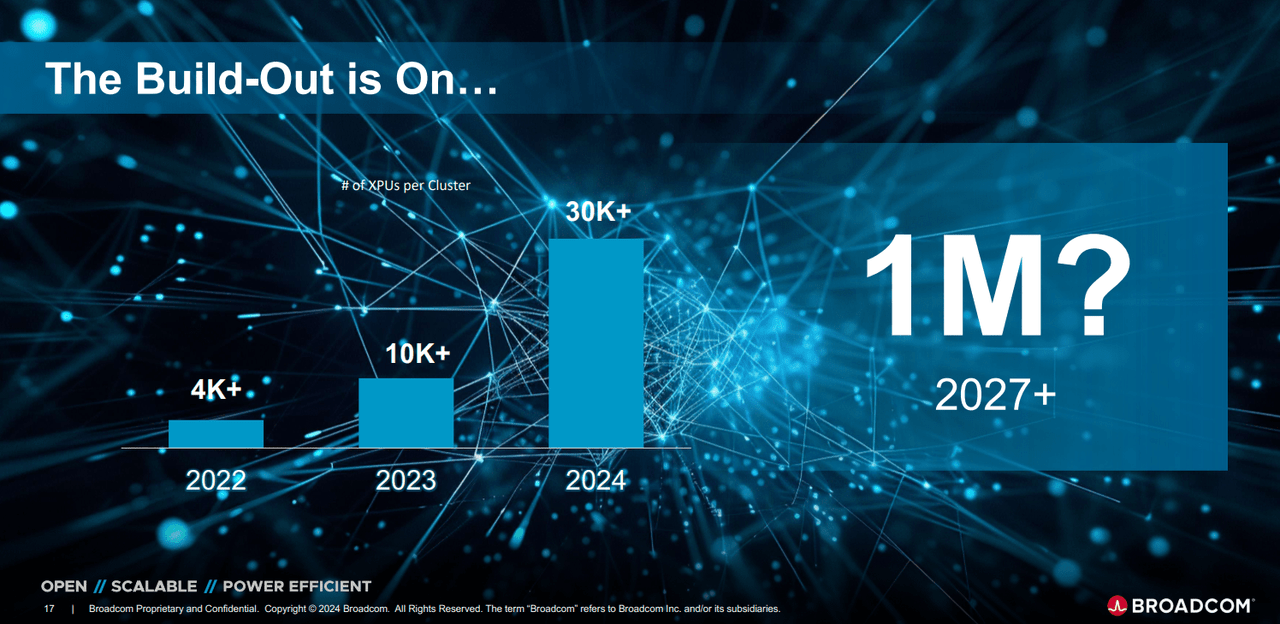

What I find especially significant is the scale of deployment these customers are planning. According to the management, the individual cluster sizes have grown from 4,000+ XPUs to 10,000+ in 2023, 30,000+ in 2024 and potentially reaching 1 million XPUs per cluster by 2027. This exponential growth in cluster size directly translates to revenue potential, supporting the company’s projection of a $60 to 90 billion Serviceable Addressable Market (SAM) by 2027.

Broadcom’s leadership in networking infrastructure provides a crucial competitive advantage. The company’s Tomahawk and Jericho product lines dominate the Ethernet networking space, offering superior performance compared to InfiniBand solutions. The performance data reveals that Ethernet-based solutions provide 10% improvement in job completion time and 30x faster failover recovery (53 microseconds versus 1600 microseconds for InfiniBand). These performance advantages become increasingly critical as AI clusters scale to hundreds of thousands of nodes.

Customers achieve 30% lower operational costs and 77% faster new storage deployment compared to traditional solutions. Furthermore, the company’s extended reach capabilities for copper cables (4m+ versus 2m industry standard) and linear pluggable optics offering 33% lower power consumption demonstrate clear technical leadership in connectivity solutions.

Beyond the three existing hyperscale customers, the company is in advanced development stages with two additional customers potentially expanding its SAM significantly beyond the current $60 to 90 billion projections. Broadcom’s market position and growth prospects reveal a compelling expansion story that, I believe, will fundamentally reshape the AI chip industry over the next three years.

The OpenAI Partnership

I’m particularly excited about Broadcom’s recently announced partnership with OpenAI. Instead of trying to compete head-on with Nvidia in the training chip space, Broadcom is focusing on what I consider the next big opportunity in AI computing. Broadcom is adopting a strategic approach to challenge Nvidia’s dominance in the AI computing market by focusing on the opportunity in AI inference rather than directly competing in the training chip space.

Training an AI model is a one-time event whereas inference, where the model applies its learning to make predictions and decisions, occurs countless times across various applications. Broadcom aims to capitalize on this by developing custom-built inference chips tailored to the specific needs of different hyperscalers.

Currently, hyperscalers utilize the same types of GPUs for both training and inference, regardless of their unique requirements. By creating specialized inference chips, hyperscalers can achieve significant improvements in speed and power efficiency, resulting in reduced operational costs. This approach not only addresses the limitations of generic GPUs but also presents a compelling alternative for hyperscalers seeking optimized solutions for their inference workloads.

Broadcom’s strategy centers on leveraging the untapped potential of AI inference and offering customized solutions that cater to the diverse needs of hyperscalers.

The company has assembled a dedicated chip team of about 20 people, led by veterans Thomas Norrie and Richard Ho, who previously built Tensor Processing Units at Google. Through Broadcom, OpenAI has already secured a manufacturing slot with TSMC for their first custom designed chip targeting a 2026 launch.

OpenAI’s compute costs are projected to hit $5 billion this year against revenue of $3.7 billion. By developing custom chips specifically optimized for OpenAI’s needs, Broadcom is solving a critical business problem for one of AI’s most important players.

While Nvidia continues to dominate in training chips, I believe Broadcom is positioning itself to lead in what could become an even larger market for inference chips.

Broadcom is ramping up its AI game through VMware

When Broadcom announced its VMware acquisition, many analysts, including myself, were skeptical about the $69 billion price tag. But in just one year they’ve dramatically improved both growth and profitability simultaneously. VMware, which is now part of Broadcom’s infrastructure software segment, delivered $5.8 billion in revenue during Q4 FY2024. What’s truly exceptional here isn’t just the 196% YoY growth, but the efficiency with which it’s being achieved.

Before the acquisition, VMware was spending about $2.4 billion quarterly with operating margins below 30% but Today, under Broadcom’s management, quarterly spending has been cut in half to $1.2 billion while operating margins have more than doubled to 70%.

The key to this success, I believe, lies in Broadcom’s focus on VMware Cloud Foundation (VCF). Rather than trying to be everything to everyone, they’ve focused on what matters most: a full software stack that virtualizes entire data centers. This focus has paid off spectacularly.

And I believe that it will continue to grow at the same pace or even faster due to the new demand cycle for AI optimized cloud infrastructure.

Broadcom Is Not Overvalued

The recent surge in Broadcom’s market capitalization past $1 trillion may look a bit stretched, But I think that not only is the current valuation justified, but it may actually undervalue the company’s long-term potential in the AI market.

Because of Broadcom’s extraordinary execution in FY2024. The company delivered revenue growth of 44% YoY reaching $51.6 billion, but what truly stands out is the explosive growth in their AI business. AI revenue surged 220% YoY to $12.2 billion, representing 41% of semiconductor revenue.

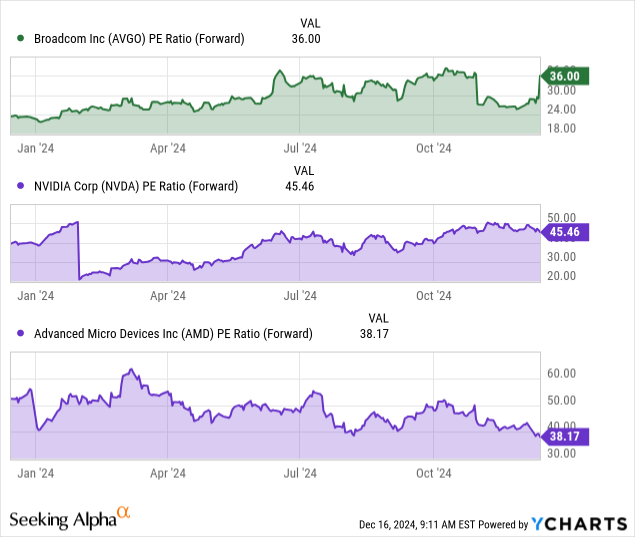

I see a company that’s actually undervalued relative to its growth profile and market opportunity. The forward P/E ratio of 36x might seem high at first glance, but it tells only part of the story. What’s crucial to understand is that this multiple is significantly lower than other major AI semiconductor players. For context, Nvidia trades at a forward P/E of 45.4x, while AMD (AMD) commands a multiple of 38.1x.

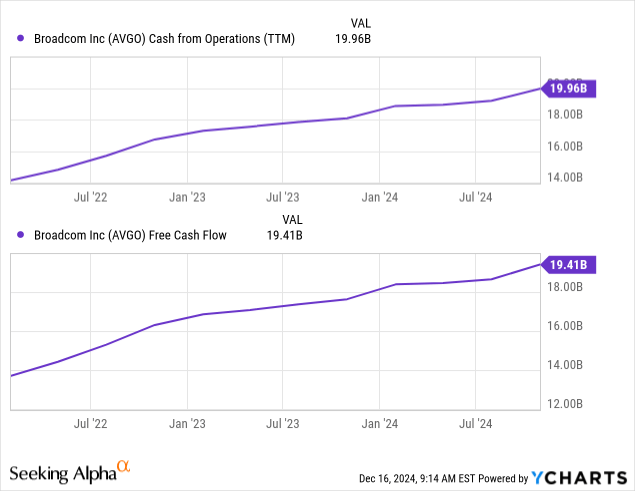

The company’s operating margin of 63% and adjusted EBITDA margin of 65% are industry-leading figures that demonstrate exceptional operational efficiency. The free cash flow margin of 39% is particularly impressive, as it shows the company’s ability to generate substantial cash while investing heavily in future growth.

Moreover, Broadcom’s financial health is exceptional. The company generated $19.96 billion in operating cash flow and $19.41 billion in free cash flow in FY2024. This combination of growth, profitability and cash generation should command a premium multiple.

In my view, the market is still catching up to the reality of Broadcom’s transformation into a leading AI infrastructure provider. While the $1 trillion market cap might seem rich, the company’s combination of proven execution, superior profitability and massive growth opportunity in AI suggests significant upside potential remains.

Hurdles Ahead

While I maintain a bullish outlook on Broadcom’s prospects in the AI chip market, the most immediate challenge I see is execution risk, particularly in meeting the aggressive development timelines for custom AI accelerators. Looking at Broadcom’s current roadmap, the company is simultaneously managing development programs for multiple hyperscale customers with production timelines staggered from 2024 through 2026.

While Broadcom has secured manufacturing capacity with TSMC for its custom chips, the company needs to scale from supporting clusters of 30,000+ XPUs in 2024 to potentially 1 million XPUs per customer by 2027. This is a nearly 33x increase in manufacturing capacity requirements. The magnitude of this ramp-up creates inherent risks and capacity constraints.

Nvidia’s dominance in the AI chip market is formidable, with over 80% market share and strong brand recognition. Their upcoming Blackwell architecture threatens to raise the performance bar even higher. What particularly concerns me is Nvidia’s extensive software ecosystem, which creates significant switching costs for potential customers. While Broadcom’s custom approach differentiates it from direct competition with Nvidia, any performance or efficiency advantages need to be substantial enough to justify customers’ investment in custom solutions.

We ended the fourth quarter with $9.3 billion of cash and $69.8 billion of gross principal debt. During the quarter, we replaced $5 billion of floating rate debt with new senior notes. We use cash on hand to pay a mix of senior notes, which came due in Q4 and additional floating rate debt, reducing debt by $2.5 billion. – AVGO Q4 2024 Earnings Call Transcript

While the company’s strong cash flow generation ($19.962 billion in operating cash flow for FY2024) provides some comfort, a downturn in AI spending could strain the company’s financial flexibility.

Final Verdict

I am initiating coverage of Broadcom with a Strong Buy rating. My conviction is driven by:

- The company’s clear path to capturing a significant share of the $60-90 billion AI chip market by 2027.

- Strong execution in custom AI solutions and networking infrastructure.

- Strategic partnerships with key players like OpenAI.

- Robust financial performance and cash flow generation.

I believe Broadcom represents a compelling opportunity for investors seeking exposure to the AI chip market. The company’s focus on custom solutions and strategic partnerships positions it uniquely to capture value in both the consumer and enterprise AI markets.

As the AI infrastructure market continues to evolve, I expect Broadcom’s strategic positioning and execution to drive substantial shareholder value creation over the next 3 to 5 years.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.