Summary:

- Rivian Automotive partners with Volkswagen, receiving billions in investment for a joint venture to counter Tesla and lower development costs.

- The deal with Volkswagen allows Rivian Automotive to address profitability concerns and potentially accelerate the profit timeline.

- Rivian Automotive’s valuation still offers a high margin of safety with cash accounting for almost 60% of market value.

hapabapa

A week ago, Rivian Automotive, Inc. (NASDAQ:RIVN) shocked investors positively by announcing that it was partnering with automaker Volkswagen AG (OTCPK:VLKAF) and that the German auto giant would invest billions of dollars into a joint venture with the American electric vehicle company.

The new alliance is obviously directed at countering Tesla, Inc. (TSLA) and aims to lower development costs for both companies.

Though Rivian Automotive still has considerable sales (and estimated correction risks) in a market that is seeing a slowdown in EV shipments, I think that the deal is sensible and makes strategic sense for both companies.

My Rating History

My last article on Rivian Automotive entitled Rivian: 80% Of Market Value Is Now Cash was a ‘Hold’, primarily because the electric vehicle company’s market valuation consisted of 80% out of cash. This cash cushion created a substantial margin of safety for investors.

I am modifying my stock classification for Rivian Automotive to ‘Buy’ after the electric vehicle company surprised investors with a strategic investment from German automaker Volkswagen at the end of June.

With Volkswagen putting billions of dollars into a 50:50 joint venture, I think that the risk/reward relationship is looking much better for Rivian Automotive.

Deal Implications Of Volkswagen, Rivian Partnership

At the end of June, Volkswagen and Rivian announced that they are going to enter into a partnership that will see the German automaker invest $1.0 billion this year and an additional $4.0 billion by 2026 into a 50:50 joint venture. This joint venture will develop next-gen electrical architecture for EVs as well as software.

It should be noted, however, that the agreement does not mean that both companies will jointly develop new electric vehicles. The joint venture will use Rivian Automotive’s hardware and technology platform and both companies will develop their own electric vehicle brands moving forward. In short, Rivian Automotive is contributing its EV tech while Volkswagen is financing the joint venture in order to speed up its own electric vehicle development.

The agreement is nonetheless significant, particularly for Rivian Automotive, whose pure-play positioning in the electric vehicle market has led to some investor concerns in recent quarters, particularly as they relate to the company’s profit trajectory. With sales falling behind earlier expectations as the electric vehicle market shows signs of saturation, investors are worried about Rivian Automotive’s sky-high losses. The blockbuster deal with Volkswagen could help trim those losses.

The blockbuster deal with Volkswagen could help trim those losses, particularly because the $5.0 billion investment to be made by the German automaker could take pressure off of Rivian Automotive’s cash flow. Sharing development costs and expenses is a great way for Rivian Automotive to alleviate its challenges with cash flow, which unfortunately is still very much negative.

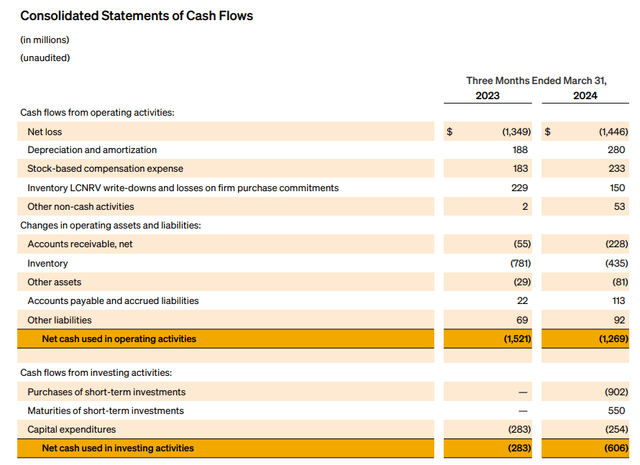

In the most recent financial quarter, Rivian Automotive had a negative operating cash flow of $1.3 billion and the company has been consistently unprofitable on a free cash flow basis as well, primarily because of growing capital expenditures related to the ramp of its various EVs.

Consolidated Statements Of Cash Flows (Rivian Automotive Inc)

The sharing of development costs could be a boon for Rivian Automotive, obviously, because the electric vehicle company needs to urgently address concerns about its lack of profitability. The agreement with Volkswagen should allow Rivian Automotive to do just that and potentially even accelerate its profit timeline.

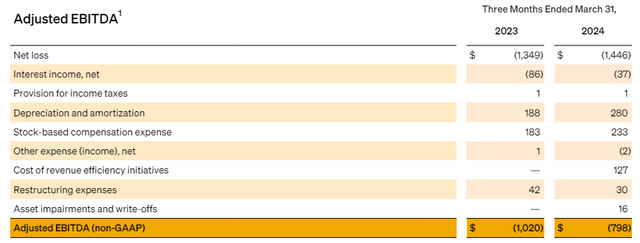

As of right now, Rivian Automotive is still losing a lot of cash on its operations and the electric vehicle company reported an adjusted EBITDA loss of almost $800 million in the last quarter. Though EBITDA losses narrowed $222 million YoY, investors today are much less willing to finance ongoing operating losses for electric vehicle companies simply because risk attitudes have changed in a market that needs to absorb steady news of slowing electric vehicle sales growth.

If Rivian Automotive gets to reign in its negative EBITDA with the help of Volkswagen, I think the EV company has a great chance to grow into a higher valuation moving forward.

Adjusted EBITDA (Rivian Automotive Inc)

Rivian Automotive Is A Steal Based On Cash Value

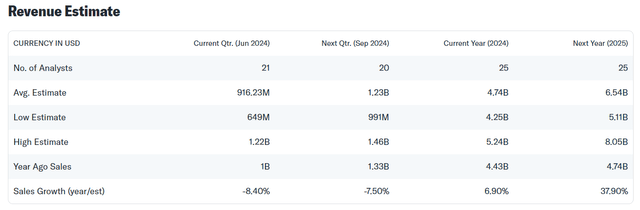

Rivian Automotive’s consensus sales estimates are falling and have done so for quite a while as the market came to terms with the notion of slowing growth in the market.

The consequence has been a steady flow of estimate revisions for Rivian Automotive’s sales: Presently, the market models $6.54 billion in sales for the EV company in 2025 which is down about 1% since my last piece on the company was published in May.

Revenue Estimate (Yahoo Finance)

Electric vehicle companies have suffered a reset in their sales estimates in the last year as demand issues began to be widely reported. Tesla’s attempts to boost electric vehicle shipments, starting last year, through aggressive promotions have further amplified the problem for large EV companies: They are competing for lower-than-anticipated sales in the electric vehicle industry, pushing companies like Fisker over the cliff and into bankruptcy.

If consensus estimates for 2025 are correct, Rivian Automotive’s stock is valued at 2.04x leading sales, though the electric vehicle company has sold for significantly higher sales multiples in the past. Taking into account the downtrend in sales estimates, an alternative approach to valuing Rivian Automotive might be based on Rivan Automotive’s substantial cash and investment balance.

Rivian Automotive presently has a market value of $13.4 billion. As of March 31, 2024, the EV company had $7.86 billion in cash stashed on its balance sheet which includes the value of its short-term investments. Rivian Automotive’s total cash balance (including short-term investments and restricted cash) dwindled by $3.9 billion over the last twelve months, meaning the company had a cash burn of about $1.0 billion per quarter.

Based on last quarter’s balance sheet, this means that 59% of Rivian Automotive’s valuation now consists of cash. The scaling up of production is going to cost Rivian Automotive a substantial amount of money moving forward, but with Volkswagen stepping up and helping fund the joint venture, the EV company could see less cash burn in the next two years, which in turn could accelerate Rivian Automotive’s profit schedule.

Though Rivian Automotive’s cash-to-market-value percentage is down from 80% in May, it nonetheless reflects a high margin of safety for investors that are concerned about Rivian Automotive’s risks in a softening market, particularly with the EV company now likely sharing development costs and risks with Volkswagen. Rivian Automotive will probably continue to lose money on its EV production moving forward, but the cash-to-market-value percentage is still rather excessive and limits risks for investors, in my view.

Rivian Automotive will likely continue to see negative cash flow as it ramps up R2/R3 production, but with Volkswagen throwing $5.0 billion at a joint venture with Rivian Automotive, I anticipate that cash will continue to make up about 50% of the company’s balance sheet.

With such an excessive cash balance and a more favorable cash flow outlook, I see a substantial margin of safety for Rivian Automotive.

Why The Investment Thesis Still Has Considerable Risks

Rivian Automotive has sales and sales estimate correction risks in a market that is seeing slowing demand for electric vehicles. The bankruptcy of Fisker is another example of the heightened risks that investors in electric vehicle companies are facing.

Though Rivian Automotive is not at risk of bankruptcy given its considerable cash power, I think that we are going to see more bankruptcies in the sector moving forward with only the largest EV companies able to survive.

My Conclusion

Rivian Automotive has done a blockbuster deal with VW here and I think that the electric vehicle company is set to profit through an accelerated profit timeline and alleviating pressure on its costs.

As Volkswagen is primarily financing the joint venture, Rivian Automotive could finally be put into a position that allows it to address its weak point: high EBITDA losses in a low-demand environment.

Furthermore, Rivian Automotive’s valuation still contains a very big margin of safety as the company’s cash accounts for almost 60% of its market valuation.

Though sales estimates can be anticipated to remain under pressure in the short term, Rivian Automotive’s risk/reward relationship looks much better to me. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.