Summary:

- Carlsberg seals deal with Britvic for $4.2B.

- Eli Lilly acquires Morphic Holding to strengthen its immunology pipeline.

- Devon to buy Grayson Mill Energy’s Williston Basin business.

- Hedge funds show interest in energy and materials stocks.

designer491

Listen below or on the go on Apple Podcasts and Spotify.

Merger Monday deals in beverages, energy, drugs and entertainment. (0:15) Hedge funds like commodity-linked stocks. (2:35) Apple iPhone sales said to be shoring up. (3:17)

This is an abridged transcript of the podcast.

Merger Monday:

Carlsberg (OTCPK:CABGY) finally sealed its acquisition of U.K. soft drinks company Britvic (OTCQX:BTVCY), paying $4.2 billion.

Jefferies analyst Kevin Mundy sees upside from the creation of a single company with a leading soft drinks and beer portfolio in Great Britain, as well as the enhancement of Carlsberg’s Western European growth and cash flow profile. In addition, the deal is seen as strengthening the PepsiCo (PEP) relationship, including the securement of certain long-term bottling agreements.

In a bid to strengthen its immunology pipeline, Eli Lilly (NYSE:LLY) will buy biopharmaceutical company Morphic Holding (MORF) for $57 a share in cash, or an aggregate of ~$3.2 billion. Morphic is developing a portfolio of oral integrin therapies for the treatment of serious chronic diseases, including autoimmune, cardiovascular, and metabolic diseases, fibrosis, and cancer.

Devon Energy (DVN) will buy Grayson Mill Energy’s Williston Basin business in a cash and stock deal valued at about $5 billion, consisting of $3.25 billion of cash and $1.75 billion of stock. Devon said the deal significantly expands its position in the Williston Basin with the addition of 307,000 net acres, with production from the acquired properties expected to be maintained at ~100,000 barrels a day in 2025, of which 55% is oil.

Paramount (PARA) and Skydance Media ended their dance and agreed to merger terms. Shari Redstone gets a $1.75 billion cash infusion, while common holders get $15 per share for half their holdings, with a majority potentially facing losses.

Howard Jay Klein, who leads The House Edge investing group, says it’s Redstone’s let-them-eat-cake moment. He adds that a combination with Sony (SONY) would’ve been preferable.

“Under the combined flag, we’d see Sony’s PlayStation geniuses have these among other PARA properties to work on: Nickelodeon, Teenage Mutant Ninja Turtles, SpongeBob, Comedy Central, MTV, and the rich sports deals of CBS, among many other big-time legacy IP possibilities in filmed entertainment. Not to even talk about the golden cash cows like The Godfather, Mission Impossible, Transformers, Indiana Jones, Forrest Gump, and Top Gun, plus their sequels and dozens of other blockbusters.”

Turning to the market, stocks are slightly higher, with the Nasdaq (COMP.IND) trailing the S&P (SP500) and Dow (DJI), but there is little conviction.

Commodity-sensitive stocks have caught the attention of the hedge fund community. Hedge funds bought energy and materials stocks at the fastest pace in five months, driven by long buys, according to Goldman Sachs’ Prime Services desk.

“Collectively, these commodity-sensitive sectors were net bought for the third straight week,” they said.

“After being net sold in six prior straight weeks, Materials (XLB) was net bought for the third straight week,” they added. “On a subsector level, net buying in Containers & Packaging and Metals & Mining outweighed modest net selling in Paper & Forest Products and Chemicals.”

“Energy (XLE) has now been net bought in three of the last four weeks. On a subsector level, both Oil, Gas & Consumable Fuels and Energy Equip & Services were net bought on the week.”

Wedbush says Apple’s (AAPL) iPhone is seeing more signs of stabilization across various markets, based on recent supply chain checks.

Analyst Dan Ives says, “We believe after a better than expected March quarter, spots of optimism for iPhone growth are forming in various markets, and ultimately we now believe June will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter. China remains the linchpin of growth for Apple, and now this key region is set to see growth once again, starting with the iPhone 16 in our view.”

Argus is cautious on Southwest Airlines (LUV) ahead of the carrier’s Q2 earnings report. The firm thinks Southwest will require time to accelerate revenue growth and improve its network.

Analyst John Staszak says: “With employee costs high and aircraft deliveries delayed, the road to recovery is likely to take longer than anticipated.”

UBS reiterated its Buy rating on Nvidia (NVDA) and raised its price target to $150 from $120, noting that recent checks indicate that demand for its upcoming Blackwell line is “exceedingly robust.”

Analyst Timothy Arcuri says that based on the recent checks into Blackwell, it’s likely that Nvidia could earn roughly $5 per share in 2025 as the order pipeline for NVL72 and NVL36 is “materially larger” than it was just two months ago as the budgets for the major hyperscalers firm up.

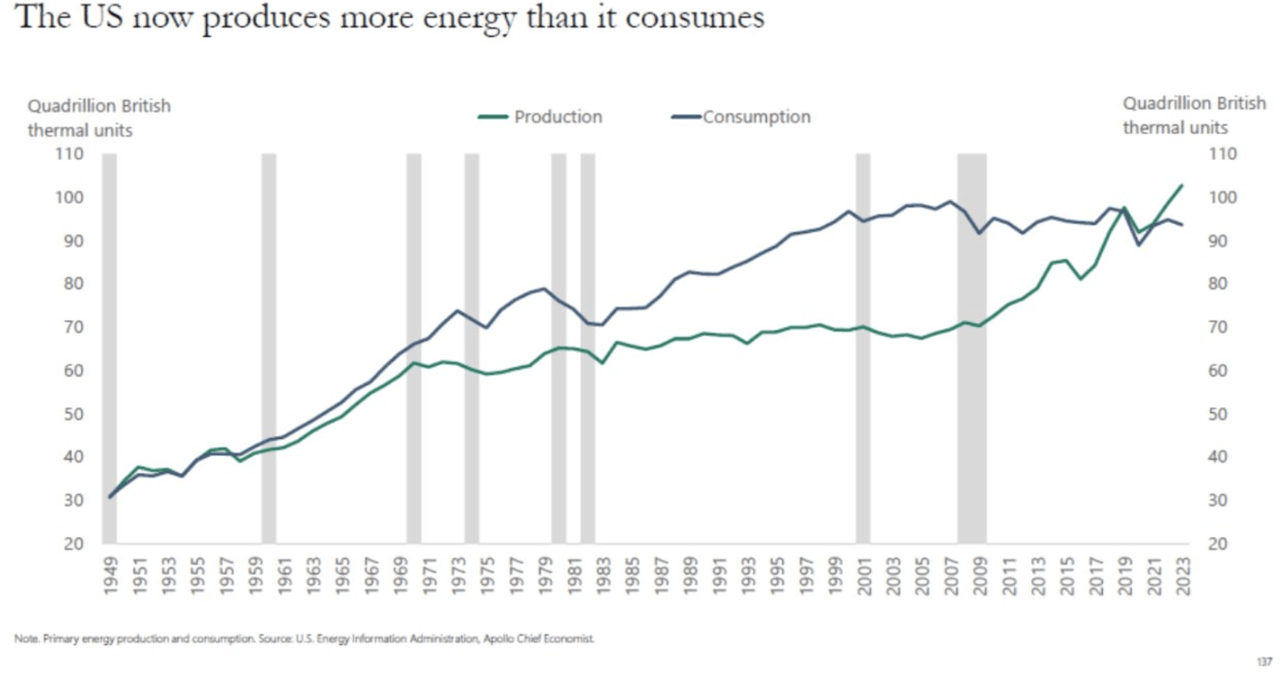

In other news, there’s an energy chart from Torsten Slok, who is the chief economist at Apollo Group, is making the rounds.

Slok notes that the U.S. is producing more energy than it is consuming, to a degree that’s never been seen before. Production has outweighed consumption since 2021, which ended a 60-year trend.

The chart also shows U.S. energy consumption is lower today than it was in 1999 (despite crypto mining and AI datacenters—power suckers that didn’t exist then).

In the Wall Street Research Corner, recent numbers have raised the prospect of the U.S. economy slowing down at a faster pace than expected.

But Apollo Asset Management has turned to a rather piquant data point to underscore the strength of economic activity.

“The TSA has daily data for the number of people scanning their boarding pass with a TSA agent, and it continues to show no signs of the economy slowing down,” they said.

TSA checkpoint numbers for total traveler throughput have been higher year to date than any of the past years since the outbreak of COVID-19 (which includes 2020, 2021, 2022, and 2023).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.