Summary:

- Walmart’s ability to maintain profit margins amid inflationary pressures makes it a reliable investment to protect purchasing power in an inflationary environment.

- Walmart plans to build or remodel over 150 stores in the next five years, enhancing customer experience and expanding its physical footprint while integrating advanced technologies.

- While Walmart’s current share price of around $60 reflects its strong market position, a more conservative valuation approach suggests an attractive buying opportunity under $40.

Alexander Farnsworth

Walmart Inc. (NYSE:WMT) is a powerhouse in the retail industry, recognized for its strong presence both in physical stores and online. In my view, the company’s robust financial performance and resilience in challenging economic conditions are well-documented. The current share price, hovering around $60, reflects Walmart’s stability and market confidence. However, for value investors seeking an attractive entry point, I believe purchasing shares under $40 would offer an excellent opportunity to maximize long-term returns.

Walmart’s Strengths

Expansion and Modernization: In my opinion, Walmart’s plan to build or remodel over 150 stores in the next five years demonstrates its commitment to enhancing accessibility and improving customer experience. This strategic initiative not only expands Walmart’s physical footprint but also ensures that existing locations meet modern retail standards.

Technological Integration at CES 2024: At CES 2024, Walmart unveiled its strategy to employ cutting-edge technologies to revolutionize operations and customer interactions. These innovations include advanced inventory management systems, AI-driven customer service tools, and seamless omnichannel shopping experiences, positioning Walmart as a leader in tech-driven retail.

Diversification in Core Business Sectors: Walmart continues to dominate the grocery sector and is expanding into new ventures like drone deliveries and online gaming. This strategic diversification, in my view, allows Walmart to capture broader market segments and reduce dependency on any single revenue stream.

Inflation Hedge: Walmart’s ability to maintain profit margins despite rising costs makes it an effective inflation hedge. The company manages costs efficiently and leverages its massive buying power to negotiate favorable terms with suppliers, protecting its profit margins in an inflationary environment.

Business and Operations Analysis

Operational Excellence and Innovation: Walmart leverages its massive scale to achieve operational efficiencies that drive down costs while enhancing service delivery. In my opinion, investments in robotics and automation within distribution centers illustrate Walmart’s commitment to streamlining operations. The company’s implementation of blockchain technology for food safety enhances traceability and efficiency in its supply chain.

E-commerce and Omnichannel Capabilities: Walmart has robustly expanded its e-commerce and omnichannel offerings, integrating online and physical operations. This strategy not only caters to the convenience that modern consumers demand but also positions Walmart strongly against purely online competitors.

Strategic Positioning for Growth

Market Expansion and Diversification: Walmart continues to explore new markets and demographic segments, particularly focusing on health and wellness products. The launch of its own low-cost insulin brand highlights Walmart’s initiative to address cost concerns in healthcare. However, Walmart is also closing some of its health clinics in the Walmart Health division.

Technological Investments: Walmart’s venture into artificial intelligence through acquisitions and partnerships underscores its initiative to stay at the forefront of retail innovation. The company’s tech incubator, Store No 8, exemplified its pursuit to harness technology for logistics improvement, customer experience enhancement, and new product development. However, it has been announced that Walmart will be closing Store No 8.

Grocery Sector Landscape and Outlook

The global food & grocery retail market was valued at $11,932.5 billion in 2023 and is expected to grow at a CAGR of 3.2% from 2024 to 2030. Key growth drivers include increased online grocery sales, consumer polarization, and home cooking trends due to the COVID-19 pandemic.

Sector Trends and Consumer Behavior: The grocery sector is witnessing a significant shift with increased consumer preference for organic and locally sourced products. Walmart has responded by expanding its assortment of these products, which meets customer demand and competes directly with specialty retailers.

Competition Analysis

Navigating Competitive Waters: Walmart faces stiff competition from traditional grocers like Kroger and technology-driven platforms like Amazon. Its strategy focuses on leveraging its extensive physical store presence combined with aggressive pricing and broad inventory to maintain significant market share.

Recent Developments: Corporate Layoffs and Retail Closures

Walmart has announced the layoff of hundreds of corporate staff as part of a restructuring effort to better position the company for future needs. Additionally, the broader retail landscape is seeing numerous store closures, indicating potential headwinds for Walmart.

Financial Highlights for Q1 FY25

Walmart’s Q1 FY25 performance reflects a strong start to the fiscal year, underpinned by robust growth in e-commerce and effective strategic initiatives across its global operations. Revenue grew by 6.0%, amounting to $161.5 billion, and operating income saw an increase of 9.6%, reaching $6.841 billion. E-commerce growth globally increased by 21%, while the advertising business expanded by 26%.

International Operations

Walmart International experienced a remarkable 12.1% increase in net sales, driven by strong performances in Walmex, China, and Flipkart. The operating income for this segment grew by 31.7%, benefiting from lower losses in e-commerce and better performance in high-margin services.

Financial Analysis

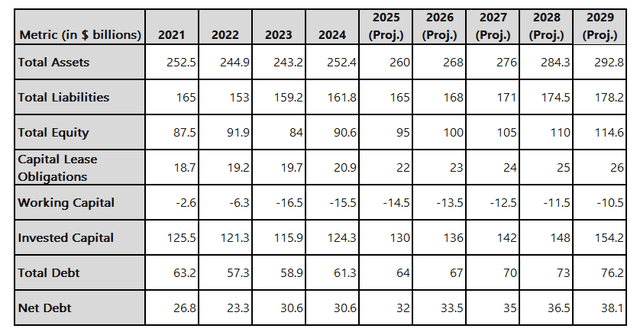

Balance Sheet Strength: Walmart’s balance sheet remains robust, underpinned by substantial asset holdings, including vast real estate assets. The company maintains a healthy liquidity ratio with substantial cash reserves, ensuring it can meet short-term liabilities and invest in growth opportunities.

Revenue Growth and Cash Flows: Walmart has demonstrated consistent revenue growth over the past decade. Diversification into e-commerce and the integration of omnichannel retailing have bolstered revenue streams. Operating cash flow has been robust, supporting capital investments, dividend payments, and debt servicing.

Debt Situation: Walmart maintains a conservative debt-to-equity ratio compared to industry standards. Interest coverage ratios remain healthy, and the company’s debt is well-structured with long-term maturities, reducing the pressure of immediate repayments.

Dividend History: Walmart has a long-standing history of providing shareholders with steady dividend payouts, which have consistently increased over the past 47 years. This stability and growth of dividend payments reflect Walmart’s strong free cash flow and commitment to returning value to its shareholders.

Valuation Analysis

To establish a comprehensive valuation and derive a price target for Walmart, we utilize the Discounted Cash Flow (DCF) methodology.

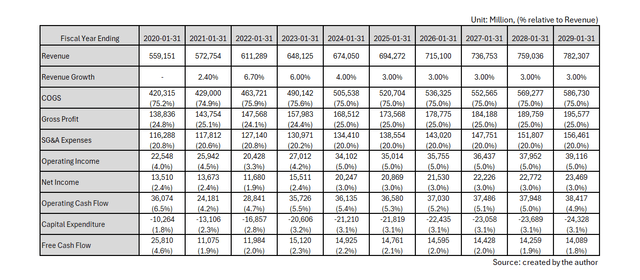

DCF Table

| Year | Projected FCF (in $ billions) | Discount Factor (8.21%) | Present Value (in $ billions) |

|---|---|---|---|

| 2025 | 18.5 | 0.924 | 17.09 |

| 2026 | 19.3 | 0.854 | 16.48 |

| 2027 | 20.1 | 0.789 | 15.87 |

| 2028 | 21.0 | 0.729 | 15.31 |

| 2029 | 21.9 | 0.674 | 14.76 |

| Terminal Value (2030) | 348.9 | 0.674 | 235.16 |

| Total Enterprise Value | 314.67 |

Valuation Assumptions:

- Free Cash Flow Projections: We project moderate growth in free cash flows over the next five years.

- WACC (Discount Rate): We use a WACC of 8.21%, reflecting Walmart’s cost of capital.

- Perpetual Growth Rate: After the projection period, we use a perpetual growth rate of 2.5%.

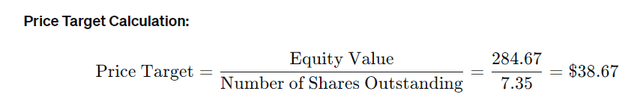

Price Target Calculation:

- Enterprise Value: $314.67 billion

- Net Debt: $30 billion

- Equity Value: $284.67 billion

- Number of Shares Outstanding: 7.35 billion

This results in a calculated price target of $38.67, providing a clear benchmark for potential investors.

Why Buy Under $40?

Margin of Safety: Purchasing Walmart shares under $40 offers a significant margin of safety, protecting investors against potential market volatility and downturns.

Inflation Protection: Walmart’s ability to maintain profit margins amid inflationary pressures underscores its strength as an inflation hedge.

Potential for Rate Hikes: If inflationary pressures persist, potential rate hikes by the Federal Reserve could affect consumer spending, making it prudent to purchase Walmart shares at a lower price point to ensure a better margin of safety and value.

Upside Risks to the Thesis

While the current valuation suggests looking for an entry point under $40, several factors could lead to an upgrade of Walmart to a Buy rating. These upside risks could significantly enhance Walmart’s growth prospects and financial performance, making it a more attractive investment at higher price points.

Accelerated E-commerce Growth: Rapid expansion in online sales and global e-commerce could boost overall revenue and profitability. Successful integration of online and offline operations and innovative digital strategies could strengthen Walmart’s position against competitors like Amazon.

Technological Advancements: Breakthrough innovations in AI, machine learning, and blockchain, as well as enhanced data analytics for inventory management and personalized marketing, could lead to significant cost savings and improved profit margins.

Strategic Acquisitions and Partnerships: Strategic acquisitions in high-growth sectors and partnerships with leading technology firms could diversify revenue streams and drive growth. Collaborations in AI, cloud computing, and digital payments could enhance Walmart’s capabilities and market positioning.

Stronger-than-Expected Economic Recovery: A stronger economic recovery leading to increased consumer spending and stabilization of inflation at lower levels could drive higher sales growth and improved profit margins.

Enhanced Competitive Positioning: Market share gains from competitors and initiatives to enhance brand loyalty and customer engagement could lead to higher customer retention and repeat purchases.

Financial Metrics: Consistently higher-than-expected earnings growth and improved return on investment from strategic initiatives could justify a higher valuation for Walmart.

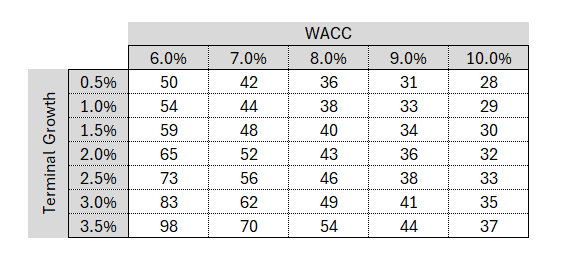

Valuation Range

Given the sensitivity of valuation to the assumptions, I would give a valuation range from around $28 – $98. Given my calculations, I would be comfortable holding Walmart’s stock until near $100, which is the upper range of my valuation.

By Author

Conclusion

Walmart is a great company with a proven business model, extensive retail network, and robust financial performance. While the current share price of around $60 is fair, value investors should consider purchasing Walmart shares under $40 to capitalize on potential long-term gains and ensure a healthy margin of safety. By taking a disciplined approach to valuation and timing, investors can benefit from Walmart’s continued growth, resilience, and inflation-protective qualities in the retail industry. Additionally, monitoring the upside risks could provide compelling reasons to upgrade Walmart to a Buy rating, reflecting the enhanced attractiveness of the stock as an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.