Summary:

- A mixed February Retail Sales report highlights potential weakness among US consumers as we head into the second quarter, though the jobs market remains solid.

- Walmart continues to execute well with rising earnings and industry-leading positioning, but investors are confronted with a high earnings multiple.

- Walmart’s technical situation is strong, with a solid uptrend and potential for higher prices ahead – I highlight key price levels to watch ahead of key corporate events.

Alexander Farnsworth

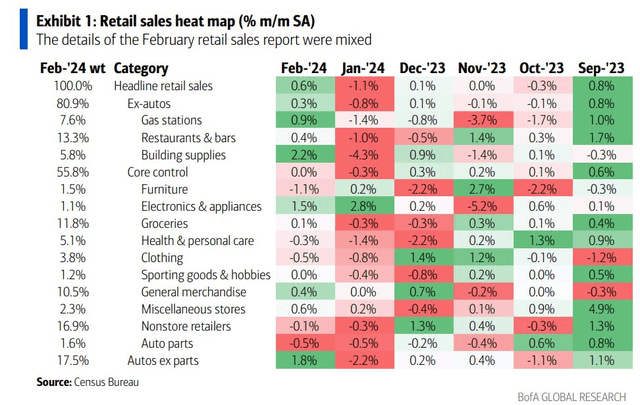

The February Retail Sales report was mixed. While there was a spending bounce back last month, negative revisions underscore potential emerging weakness among US consumers. That sentiment was largely echoed in earnings reports and outlooks from Nike (NKE) and Lululemon (LULU) last week as we approach the end of the first quarter. Still, the labor market remains on solid footing given Initial Jobless Claims numbers that continue to range in a sweet spot between 200k-250k each week.

I have a hold rating on shares of Walmart (NYSE:WMT) as it continues to execute well after inventory issues two years ago. With rising earnings and industry-leading positioning, this is a quality stock. But with a mid-20s P/E, shares do not come cheap.

February Retail Sales: A Mixed Bag

BofA Global Research

As most readers know, Walmart is the world’s largest retailer. It operates retail stores under the formats of Walmart Stores, Supercenters, Neighborhood Markets, and Sam’s Club locations in the United States as well as a growing e-commerce business (including Jet.com). Internationally, Wal-Mart also operates locations in several countries, including Canada, China & Mexico.

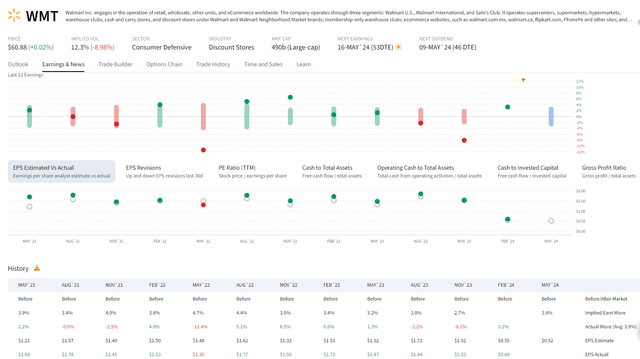

Walmart has met or exceeded earnings expectations in each of the past seven quarters, though EPS growth has slowed from more than 8% in mid-2022 (yoy) to just 5.6% in the most recent quarter. Data from Option Research & Technology Services (ORATS) show that WMT currently trades with a low 12% implied volatility percentage ahead of Wednesday’s potential news from the FTC regarding the retailer’s proposed takeover of Vizio (VZIO). The firm’s executives are also slated to participate in the Jefferies Value Retail Summit on the same day.

WMT: Low Implied Volatility Ahead of May Earnings

ORATS

Earlier this month, the company presented at the BofA Consumer Conference in Miami, FL. Market share increases were reported across categories, particularly in grocery and general merchandise, despite weakness in the broader industry. A key risk, though, is ongoing deflation in general merchandise, but WMT does have significant pricing power it can exert on suppliers to combat volatile wholesale price trends. The company also offered some details on its automation and labor productivity initiatives – it is investing in automated processes like shelf price changes to reduce worker hours.

A generally upbeat tone at the event came after a very strong Q4 earnings report. Walmart posted operating EPS of $1.80, above the consensus forecast of $1.65 (pre-split numbers). Sales of $173.4 billion also surpassed estimates handily with 23% year-on-year growth in its Global eCommerce segment. Shares traded higher by 3.2% after the report and there have been mixed sellside EPS upgrades and downgrades since then.

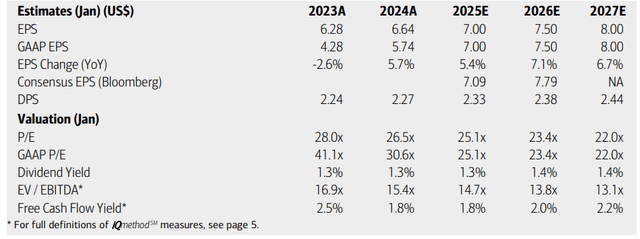

On valuation, analysts at BofA see earnings rising to $2.33 on a split-adjusted basis this year and $2.50 in the out year. Per-share profit growth is seen holding in the mid-to-high single digits through FY 2027. The current Seeking Alpha consensus forecast shows similar non-GAAP EPS numbers with sales growth in the 3% to 5% range. Dividends, meanwhile, are expected to rise commensurate with earnings over the quarters to come. WMT sells at a near-market EV/EBITDA multiple while its free cash flow yield is quite low.

Walmart: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts (Pre-Split Numbers)

BofA Global Research

Being a safe Staples stock with particularly healthy earnings stability, WMT normally boasts a premium P/E. Even if we assign a high 23.8 operating P/E and assume $2.50 of operating EPS over the next 12 months, shares should trade near $60. Moreover, the dividend yield is modest compared to its sector peers and there isn’t much free cash flow to potentially return to shareholders (on top of its shareholder accretive activities).

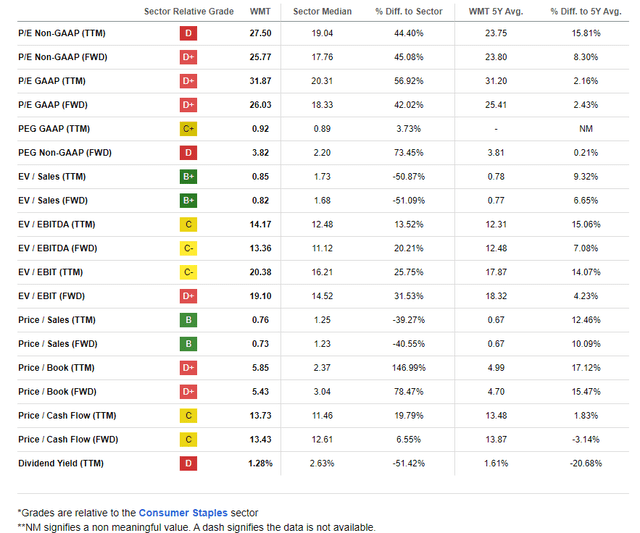

WMT: Lofty Earnings Multiples, Low Yield

Seeking Alpha

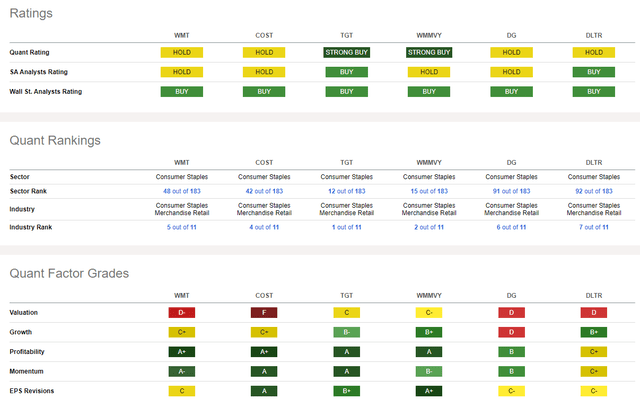

Compared to its peers, WMT features a weak valuation grade given those high earnings multiples mentioned earlier. Its growth trajectory is also nothing to write home about, especially when compared with companies like Costco (COST) and a potential recovery in Target’s (TGT) fundamentals. Still, Walmart has very healthy profitability trends and robust share-price momentum over the last several months.

Competitor Analysis

Seeking Alpha

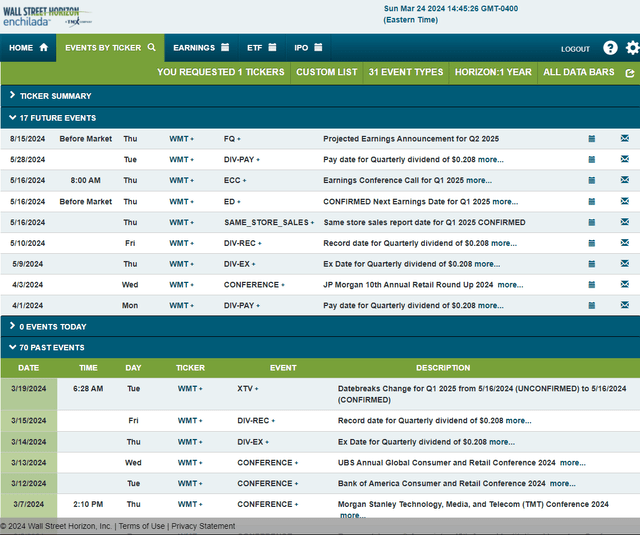

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q1 2025 earnings date of Thursday, May 16. Before that, the company is slated to present at the JP Morgan 10th Annual Retail Round Up 2024 from April 2 to 4. Shares trade ex a $0.208 dividend on Thursday, May 9.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

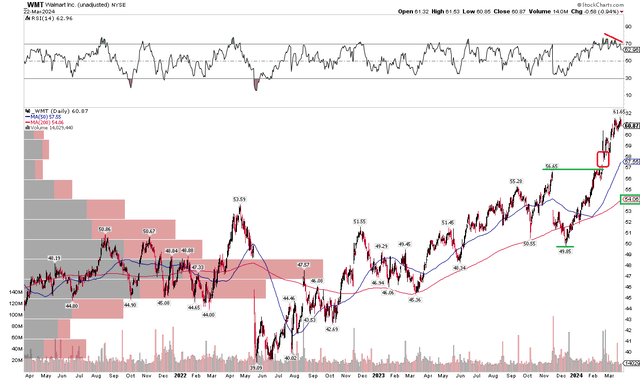

WMT has kept pace with the S&P 500 over the past year. That’s an impressive feat considering that the SPX has returned about 35% in that time. The Consumer Staples ETF (XLP), by contrast, is up just 8%, dividends included, from late March 2023. Notice in the chart below that WMT is at fresh all-time highs, now about 10% above its long-term 200-day moving average.

There are a couple of notable points of concern, though. First, there’s an emerging negative divergence as evidenced by a drift lower in the RSI momentum oscillator at the top of the graph. Second, a gap lingers right near the breakout point from earlier this year. Thus, a pullback to $57 would be quite reasonable and would not dent the broader uptrend. The stock also has a history of tagging the 200dma periodically, so an eventual drop to that point would make sense.

For now, though, the bulls are in charge of the trend, and WMT looks favorable for higher prices ahead. We can even figure a measured move upside price objective to about $64 based on the height of the decline from November and December last year – that $7 range, added on top of the $57 breakout point, yields $64.

Overall, WMT is in a solid uptrend, and a buy-the-dip strategy makes sense when strictly looking at the technicals.

WMT: Bullish Uptrend, Spotting Support near $57

Stockcharts.com

The Bottom Line

I have a hold rating on WMT. I see this strong-momentum stock as near fair value while its technical situation is impressive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.