Summary:

- Walmart unveils GenAI search tool at CES 2024, combining AI and shopper data for personalised shopping experience, capable of generating significant returns.

- Walmart is investing $9 billion in upgrading over 1,400 stores to enhance layouts, product offerings, and integrate new technology.

- Walmart’s financial performance remains strong and rewards investors through a forward annual dividend yield of 1.45% and share repurchases.

Scott Olson

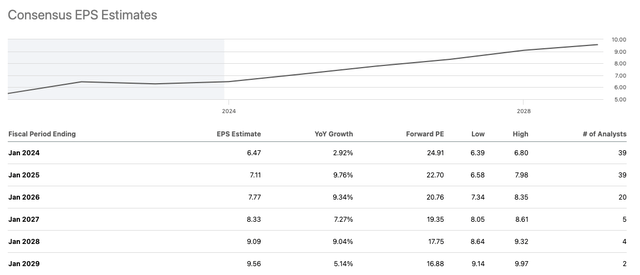

Walmart Inc. (NYSE:WMT), the world’s largest company by revenue and the largest private employer, has been a cornerstone of the global retail industry for decades. With a market capitalisation of $432.08 billion and a forward price-to-earnings ratio of 24.91, it remains attractive relative to many of its top retailer peers. Walmart continues to showcase its resilience and adaptability in a rapidly evolving retail landscape through drone deliveries and rolling out its GenAI search tool, which is anticipated to yield substantial returns. The company’s commitment to progress is evident through technology as well as through its investment of over $9 billion in store upgrades. Moreover, Walmart’s stock price has shown a positive long-term upward trend. For the current fiscal year, the consensus earnings estimate of $6.47 points to a change of +2.92% from the prior year. Therefore, investors might want to consider a bullish stance on this stock.

Historic stock trend (SeekingAlpha.com)

Recent Developments

Walmart is making headlines with its digital-first approach to the changing retail landscape. It has recently unveiled its GenAI search tool at CES 2024, which combines Microsoft’s AI model with shopper data for a personalised shopping experience. This move, along with developing an InHome Replenishment tool, signals Walmart’s commitment to leveraging technology to enhance customer engagement and sales.

Moreover, an IDC study commissioned by Microsoft found that for every $1 a retail and consumer packaged goods company invests in AI, it is seeing a return of $3.45. This suggests that Walmart’s investment in the GenAI search tool could yield significant returns. In addition, the tool is being expanded to 11 countries in 2024, indicating Walmart’s confidence in the tool’s value and its potential to enhance operations on a global scale.

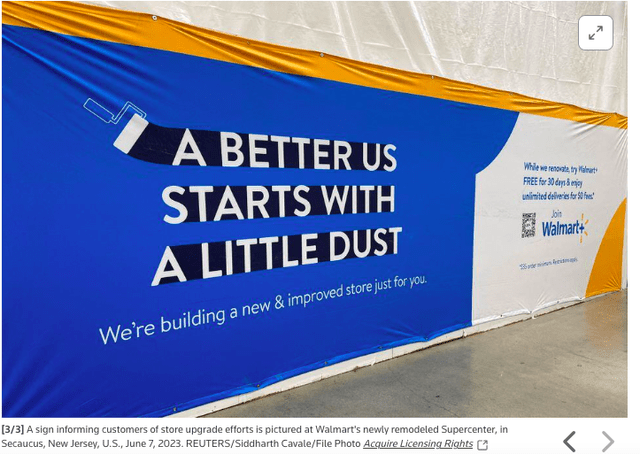

Moreover, Walmart is investing over $9 billion in upgrading more than 1,400 stores. The funds will be used to enhance and modernise select US stores, focusing on improved layouts, expanded product offerings, and the integration of new technological features.

Financial Performance

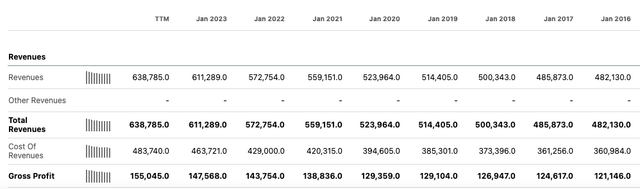

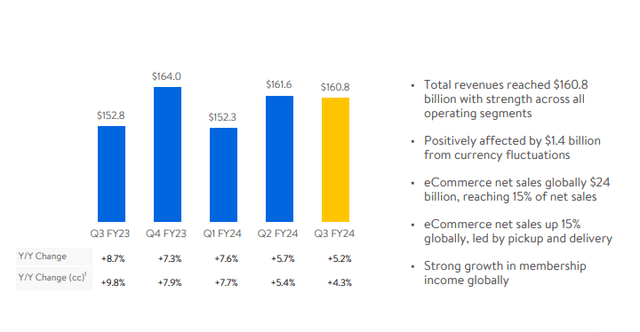

Walmart’s financial performance is strong, with a total revenue of $638.79 billion over the past 12 months. In Q3 2024, the company experienced a quarterly revenue growth of 5.20% YoY, beating expectations. However, its cautionary approach to the rest of the year has made investors wary of the potential growth ahead.

Annual revenue and gross profit (SeekingAlpha.com)

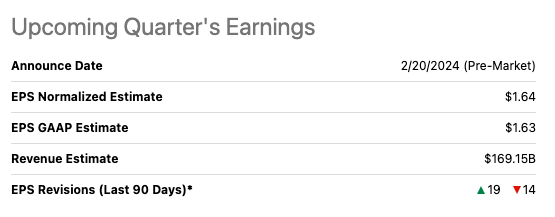

The company has consistently exceeded its quarterly EPS expectations since 2021, with only one missed quarter in almost three years. For the last quarter of the year, the expected EPS is $1.64. While revisions have been mixed, more analysts have made positive revisions compared to negative ones.

Quarterly EPS results (SeekingAlpha.com) Q4 2024 Earnings expectations (SeekingAlpah.com)

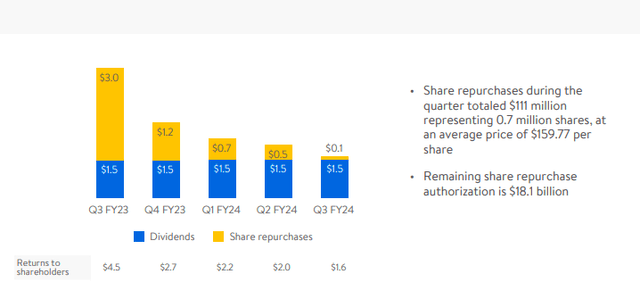

Walmart has a history of returning capital to shareholders through dividend and share repurchases programs.

Return to shareholders (Investor presentation 2023)

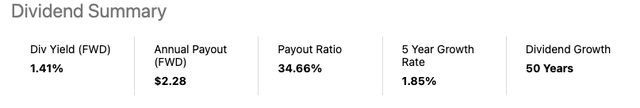

The company has a forward annual dividend rate of $2.28 and a forward annual dividend yield of 1.41%. The payout ratio is 34.66%, indicating that the company retains a significant portion of its earnings for reinvestment or debt repayment. We can see that the company generates a significant amount of levered free cash flow at $10.398 billion, although we see a decline over the last almost three financial years, indicating cash burn.

Dividend overview (SeekingAlpha.com) Annual levered free cash flow (SeekingAlpha.com)

If we look at the company’s balance sheet, we can see its’ total assets slightly decreased to $243.46 billion from $244.86 billion. Cash and short-term investments fell significantly by 41.57% to $8.63 billion. Total liabilities increased to $159.47 billion from $152.97 billion. This suggests a tighter cash position and higher debt, which could impact future investment or dividend decisions. It’s crucial for investors to monitor these changes for their potential impact on Walmart’s financial health and investment returns.

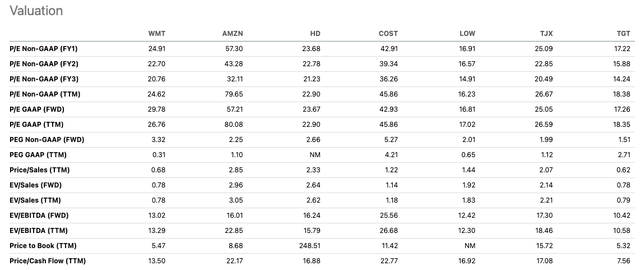

Valuation

Walmart could be considered overvalued if we compare it to the consumer staples sector median of 17.99. However, as the globe’s second largest retailer according to market cap, I believe it is more relevant to compare the stock to alternative retailer giants such as Amazon (AMZN), Home Depot (HD), Costco (COST), Lowe’s (LOW), TJX (TJX) and Target (TGT). The stock is compelling if we considering the Price-to-Earnings (P/E) ratio, the TTM PEG, and the company’s TTM price to sales ratio.

Relative peer valuation (SeekingAlpha.com)

Walmart’s P/E ratio is 26.22, which is lower than Amazon, Costco, and TJX, indicating that it may be competitively priced. Although there are alternatives that are better priced such as Target at 17.22. Furthermore, Walmart has been proactive in integrating AI into its operations. The company is using AI to ensure that shelves in its nearly 4,700 stores and 600 Sam’s Clubs stay stocked with customers’ favourite products. This is a significant step towards enhancing customer experience, operational efficiency, and increased sales.

Strong sales growth (Investor presentation 2023)

Moreover, Walmart’s transition to eCommerce and its comparison with Amazon in terms of performance and AI adoption is noteworthy. While Amazon has been a pioneer in using AI for operations like “Just Walk Out” shopping, Walmart is not far behind. The company is continuously innovating and exploring unique AI use cases to stay competitive. This year EPS is expected to grow YoY by 2.92% to $6.47. This growth is expected to be driven by the company’s strategic investments in AI and eCommerce, as well as its strong market position.

Consensus EPS growth (SeekingAlpha.com)

Risks

Investing in Walmart, like any other investment, comes with its own set of risks. One of the primary concerns is the shift in consumer behaviour towards online shopping. As more commerce moves online, Walmart, which still generates the majority of its sales from physical stores, may struggle to grow as quickly as the competition and could lose market share. Additionally, Walmart has warned that it expects to face pressure due to inflation, recessionary headwinds, and more cost-conscious consumers. Other risks include the prospect of higher fuel costs, which can negatively impact store traffic trends, and food price deflation, which can be a drag on Walmart’s results, given that grocery is Walmart’s largest product category. Furthermore, the entry of discount chains into the US market is expected to further lower prices in the industry, potentially pressuring Walmart to slash prices to keep up with rivals. Lastly, the stock is currently trading at a relatively high price-to-earnings ratio if we compare it to other retailer peers.

Final Thoughts

Walmart is a massive company with big plans, lots of cash to back up these plans and a lot more growth potential across the globe through technological and store investments. The company’s digital-first mindset is compelling if we look at the potential return that AI could have on the company. While being cautious of near-term headwinds and more cost-conscious shopping behaviour. The company is aimed for the future; it has a strong financial position and a strong market position, is committed to returning capital to shareholders, and is more attractive than some of its retail peer giants. Therefore, investors may want to take a bullish stance on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.