Summary:

- Walmart’s stock has struggled over the last 3 years, despite being one of the better-performing stocks during the pandemic.

- The company’s revenues have stagnated, and its net margins remain at a 10-year low.

- Walmart’s international segment has also experienced a decline in earnings, and the stock is now significantly overvalued.

bgwalker

The market environment has been very fluid in the last several years. While in 2020 the economy entered a recession, inflation levels then reached a 40-year high as growth levels accelerated after the Covid shutdowns ended. More recently, inflation rates have come down, and the economy is also showing growing signs of a slowdown.

One of the best-performing companies during the pandemic was Walmart (NYSE:WMT). The leading retailer’s value-based business model gave them an advantage during the initial recession, and also when prices began to rise significantly in early 2021.

Still, while Walmart was one of the better-performing stocks in the market during the pandemic, the stock has struggled over the last 3 years.

Walmart was well positioned in 2020, but the company has struggled to grow revenues over the last several years, and the stock price is up just around 5% since late 2020 when the stock reached a short-term peak of nearly $152 a share.

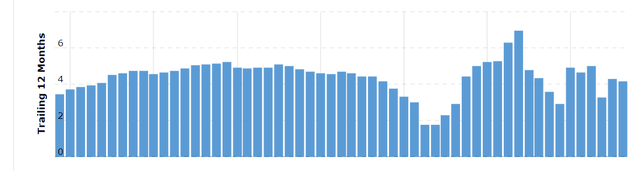

A chart of Walmart’s revenues (Macrotrends)

Walmart hasn’t been able to consistently grow revenues since early 2022, and the stock has underperformed the broader indexes since reaching a short-term peak 3 years ago.

Today, I am changing my rating on Walmart from sell to strong sell. I last wrote about the retailer in January 2023, when I rated the company a sell. Today, I am changing my rating of the stock to a strong sell. Customers will likely trade up as prices likely continue to fall, the company’s net margins remain at a 10-year low, and the international segment of the business has stagnated. The stock also now looks significantly overvalued using multiple metrics.

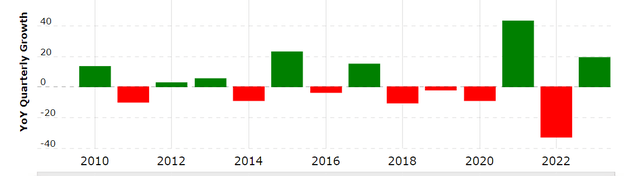

Walmart reported first quarter earnings of $152.30 billion and normalized earnings per share of $1.47 a share. The company beat earnings expectations of $147.99 billion and $1.42 a share. While Walmart’s earnings looked solid on its face, the report also showed several warning signs. The company’s international earnings have stagnated now for several years, and Walmart’s recent quarterly revenues overseas fell by 13%, or $3.5 billion. Walmart’s international revenues peaked in 2021 at $121.36 billion, and the company’s overseas earnings have fallen over the last 2 years.

A chart of Walmart’s international revenues (Statista)

The company’s next earnings report will be scheduled for Thursday, August 16th, and while management is likely to again report solid domestic earnings per share and revenues, the key will be to look at net margins, international growth, and the company’s long-term plan to retain the new customers the company got during Covid and when during the recent inflationary period when many individuals were more focused on value.

Walmart’s net margins also remain near 10-year lows at 1.82%.

A chart of Walmart’s net margins (Macrotrends)

Walmart took significant market share during the pandemic, and the company’s revenues reached near 10-year highs from 2020 to 2022. The company’s earnings adjusted for the share buyback program and cash flow are also growing at a slower pace.

A chart of Walmart’s earnings per share (Macrotrends)

Walmart’s earnings peaked in October 2020, and the share price is up just 5% since then, despite the significant share buyback programs management has repeatedly implemented.

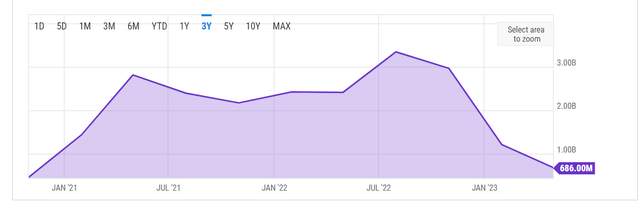

The company’s cash flow also peaked nearly 3 years ago, in early 2021.

A chart of Walmart’s quarterly cash flow (Macrotrends)

Walmart’s dividend growth over the last 5 years has not been impressive, since the company’s cash flow hasn’t grown from even 2015 levels. Management has increased the dividend by just 1.87% on average since 2018.

A Chart showing many shares Walmart has bought back (YCharts)

The company’s inability to grow cash flow is an issue since Walmart’s balance sheet is not strong, so there isn’t much flexibility. The company has just $10.57 billion, or $3.93 per share in cash, on the balance sheet. This leading retailer also has $66.06 billion in debt, and a debt-to-equity ratio of .83. The current payout ratio is 54.22%, so there is minimal room for any significant dividend increases moving forward. The company’s board just authorized a new $20 billion dollar buyback program in late 2022 as well.

Walmart earned $523 billion in 2020, $559 billion in 2021, and $572 billion in 2022. Today, inflation levels are beginning to fall significantly, with prices increasing at 4% in May, and 3% in June. As the rate of price increases continues to slow, many of the customers that traded down to the value that Walmart offers will likely trade up when the economy begins to recover. Still, Walmart hasn’t been able to consistently grow revenues since early in 2021 when the company’s quarterly earnings reached a short-term peak of $152.87 billion.

This is why Walmart now looks significantly overvalued now. The company trades at 29.64x predicted forward GAAP earnings, 19.07x forecasted forward EBIT, and 14.92x projected forward cash flow. Walmart’s 5-year average valuation is 26.09x likely forward GAAP earnings, 17.89x forecasted forward EBIT, and 13.53x expected forward cash flow. The sector median valuation is also 20.24x projected forward earnings, 15.60x expected forward EBIT, and 13.05 predicted forward cash flow. Analysts are projecting Walmart to grow revenues by 6-8% over the next 5 years, the company’s growth multiple is likely significantly overvaluing Walmart’s business model.

Walmart has performed well over the last several years by taking significant market share during the pandemic when customers traded down for value during Covid and the recent period of historically high inflation. Still, the company’s margins are still at near 10-year lows, and with prices beginning to fall, many customers will likely consider trading up when the economy recovers. This leading retailer’s international revenues have also fallen over the last 2 years, and the company’s high store count makes significant domestic expansion unlikely. While Walmart has operated efficiently in a tough environment since 2020, the company’s best days are likely in the past.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.