Summary:

- Walmart’s shares have returned 13.9% per year since 1987, beating the S&P 500 by almost 300 basis points per year. The company has hiked its dividend for 50 consecutive years.

- Walmart is investing in its business, with a focus on international growth and expansion into higher-margin businesses like advertising, fulfillment services, and data ventures.

- Despite a low current yield of 1.4%, the company’s aggressive investments and expected reduction in CapEx indicate a promising future for its dividend and buybacks. However, I advise buying on weakness.

Kativ

Introduction

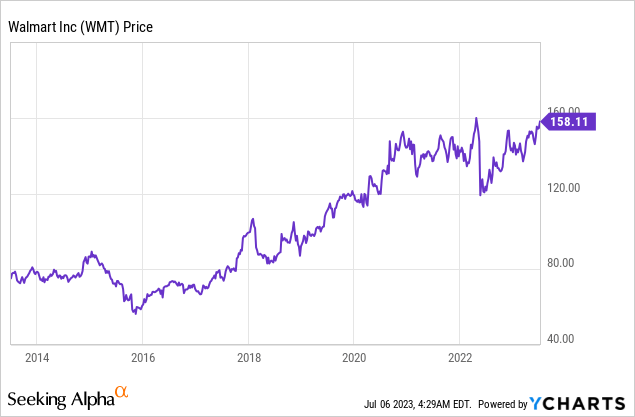

Almost all of my friends own Walmart (NYSE:WMT) shares in their dividend portfolios. I sometimes feel I’m missing out. Hence, in this article, I’ll take a closer look at the dividend qualities of this consumer giant with a $426 billion market cap. In this case, the timing of this article was influenced by the fact that Walmart shares are currently trading at an all-time high after rising 32% from their 52-week low and 12% year-to-date.

Despite consumer weakness, a hawkish Fed, and other issues, Walmart is doing fine, reporting strong earnings and plans to boost its business beyond traditional brick-and-mortar and domestic eCommerce.

Hence, in this article, I want to assess the attractiveness of the WMT ticker from the perspective of a dividend (growth) investor.

So, let’s get to it!

Rock-Solid, Wide-Moat Dividend Growth

I’ve always liked Walmart. However, I never bought it, as I wanted to buy stocks in areas with more potential growth. For example, I own the railroads that ship the company’s goods, the tractor producers that supply the farmers producing Walmart’s foods, the snack producer dominating the company’s snack aisle, and the self-storage operators where people store Walmart products they don’t use anymore (I’m half-kidding on the last one).

However, buying Walmart hasn’t been a bad deal for people – far from it.

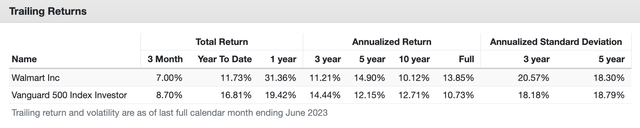

Looking at the table below, we see that WMT shares have returned 13.9% per year since 1987. This has beaten the S&P 500 by almost 300 basis points per year. Even better, the company has consistently performed really well with subdued volatility. While WMT was unable to beat the S&P 500 over the past ten years, it has still returned 10.1% per year. Over the past five years, it has returned almost 15% per year, outperforming the S&P 500 despite consumer weakness and the fact that the S&P 500 benefits from a lot of technology/growth exposure.

Even better, the company has done all of this without exposing investors to high risks. On the contrary! WMT has an AA-rated balance sheet, which is one of the best ratings in the world. It even beats some developed nations when it comes to its credit rating.

While its brick-and-mortar stores and online activities obviously face competition, investors have always been able to rely on Walmart’s ability to generate consistently rising income.

This consistency can also be seen in its dividend track record.

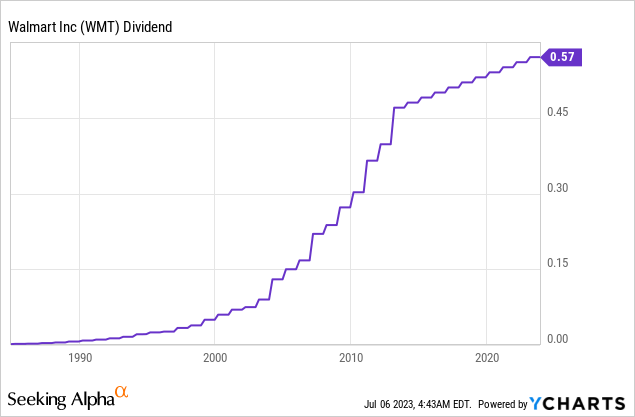

The company has hiked its dividend for 50 consecutive years, which makes it a member of the very exclusive dividend king club. While I would make the case that a dividend king isn’t necessarily better than a younger company with more growth potential, it’s a strong sign of stability and shareholder commitment. This is key for investors building a portfolio of consistent income.

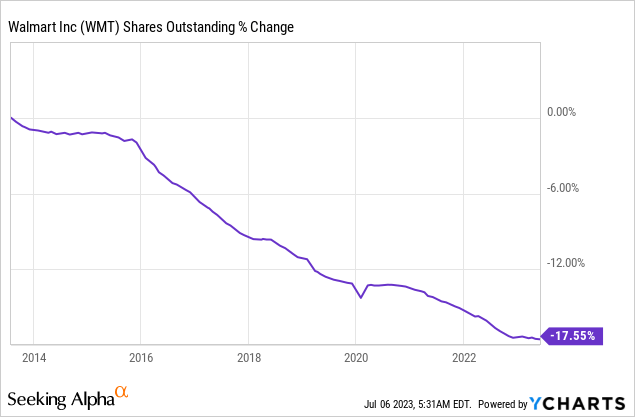

Walmart also buys back stock. Since 2013, WMT has bought back 18% of its shares, which added to its stellar stock price performance.

Having said that, it’s now time to give you a few details that bother me a tiny bit.

As much as I love dividend consistency and stability, the company currently yields only 1.4%. While most long-term investors are sitting on a decent yield on cost, this isn’t a great yield for new investors, especially not because the stock has shown utility-like dividend growth over the past ten years.

When I say utility-like, I mean slow dividend growth rates almost in line with inflation. After all, utilities are often very capital-intensive and mature businesses that need to be careful when it comes to making dividend commitments.

- On average, over the past ten years, WMT has hiked its dividend by 2.8% per year, which is in line with pre-pandemic inflation.

- Over the past five years, that number has dropped to 1.8%.

- In February, the company hiked its dividend by 1.8%.

The company maintains a 35% payout ratio, which means dividend growth hasn’t come down because the company has reached a limit of what it can distribute.

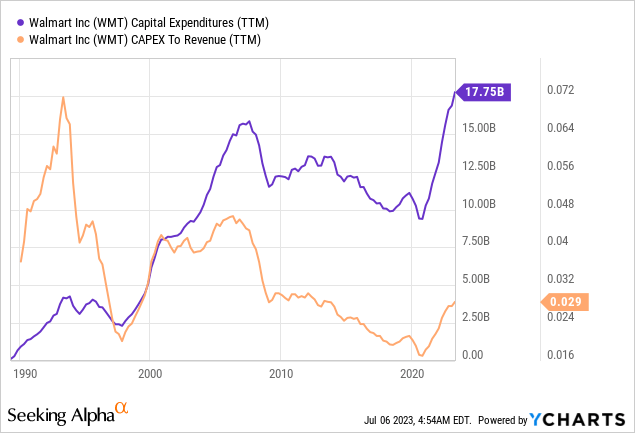

No, I believe that dividend growth is slow because of aggressive investments in its business.

We also need to take into account that the stock has returned more than 10% per year over the past ten years, which means investors looked beyond weak dividend growth.

They saw something they liked, which is what we’ll discuss next.

WMT Is Investing And Innovating

I just mentioned that the dividend payout ratio was rather low. The reason why dividend growth hasn’t been more juicy is that the company is boosting investments in its business.

On a TTM basis, CapEx has risen to almost $18 billion. This is 3% of its revenues, the highest percentage in roughly a decade!

One focus is international growth. In the 2023 fiscal year, roughly 17% of the company’s sales were generated outside of the US borders.

That’s not a lot. However, that’s where a lot of potential growth is hidden.

During last month’s Evercore ISI Consumer & Retail Conference, Walmart CFO John Rainey explained that the international portfolio has become more focused, with India’s Flipkart and PhonePe generating a lot of excitement.

Mr. Rainey suggested that these businesses could potentially become $100 billion ventures in the future. However, he also noted that Walmart’s international portfolio extends beyond India and that they are comfortable with their current presence worldwide.

Essentially, the company is saying it has exposure everywhere it wants exposure. Now, the goal is to expand its footprint in the markets it already serves.

Needless to say, the level of advancement differs across regions, with China having a balanced mix of brick-and-mortar and e-commerce, India being mainly digital, and countries like Canada, Mexico, and Chile offering room for further expansion of these additional services.

The company emphasized the interdependence of these ventures, where Walmart’s value proposition of convenience plays a crucial role in advertising to customers and facilitating third-party seller fulfillment.

Flipkart Wholesale (India) – Walmart-Owned

In this case, advertising is a significant opportunity for Walmart, considering the relatively low penetration compared to competitors in major markets.

As most people know, Walmart’s advantage lies in its scale, with hundreds of millions of customers, enabling the leverage of digital opportunities.

So, if it enters a highly competitive market, it can use its scale to dominate smaller players and gain market share. It’s as if you were to start playing Monopoly with more starting cash than your friends.

While entering new competitive markets is tough, I believe that WMT will be successful. German stores like Aldi and Lidl have shown that it is possible by using scale and competitiveness. Just like WMT, they benefit from their size, marketing, and affordability.

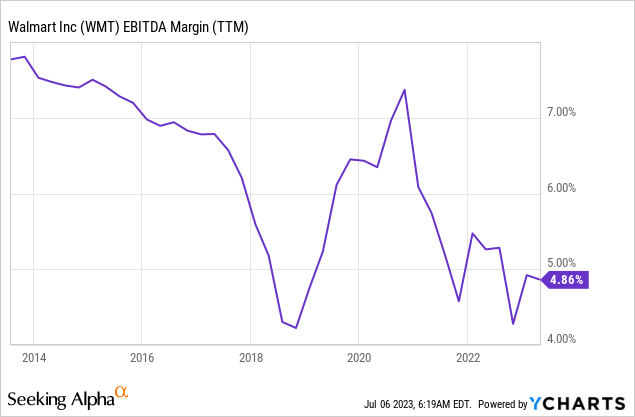

That said, WMT is also expanding other capabilities. One key focus is the company’s margin expansion strategy. After all, a cost-focused retailer cannot easily boost its margins without losing customers. It needs to come up with something more sophisticated.

Walmart is focusing on faster growth in higher-margin businesses like advertising, fulfillment services, and data ventures. In addition to this, the company is boosting eCommerce channels, marketplace expansion, and third-party sellers as options to boost margins. What this means is that WMT isn’t squeezing its existing customers but adding new capabilities.

In advertising, the company indicated that the media business’s growth would be measured as a percentage of Gross Merchandise Value (“GMV”) rather than digital sales. The company believes that the industry’s high watermark for media business as a percentage of GMV is around 9% to 10%.

Considering Walmart’s unique business mix, the company estimated that achieving a similar level would translate to roughly 6% to 7% of GMV for Walmart. This aspiration would position Walmart among the top advertisers in the United States, which is a huge deal for future margins and business growth.

Furthermore, the shift towards general merchandise (“GM”) and the improvement of unit economics through supply chain investments were identified as additional drivers for margin expansion.

The company projects a 20% reduction in fulfillment costs over the next five years, with 65% of stores expected to be served by automation. These changes aim to enhance customer experience, reduce unit costs, and contribute to overall margin growth.

So, if inflation starts to ease, I believe WMT could see a significant rise in margins on a prolonged basis.

More Numbers, Outlook & Valuation

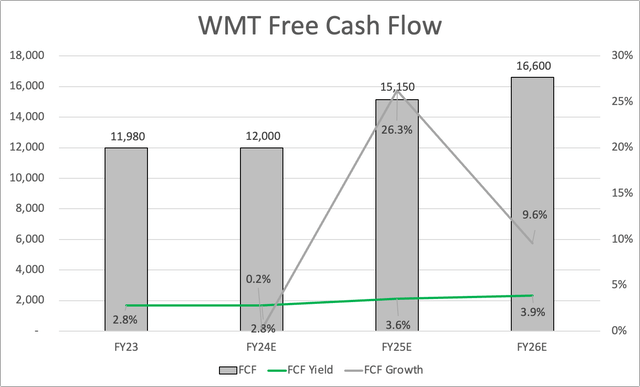

Based on the aforementioned investments, WMT is expected to reduce CapEx. In its 2021 fiscal year, the company spent $10.3 billion on CapEx. This year, that number is expected to peak at $17.4 billion. Two years from now, it’s expected to be $16.7 billion.

This is expected to result in much higher free cash flow in FY26 (calendar year 2025). The implied free cash flow yield is almost 4%, which is good news for the company’s dividend and buybacks.

At this point, it also needs to be said that the all-time high is supported by resilient spending. In its first quarter, the company saw strong growth in areas that mattered most.

Walmart saw 26% growth in e-commerce, profit rose by 17.3%, and international sales on a constant currency basis rose by 12.9%.

Furthermore, in light of consumer weakness and price sensitivity, the company continued to gain market share in the grocery category, attracting higher-income and younger shoppers. Private brand penetration has also increased.

However, the company sees challenges in certain categories, such as dry grocery and consumables, where the company is facing high single-digit to low double-digit cost inflation. The persistently high rates of inflation in these categories are affecting families and creating uncertainty for the company, particularly in the back half of the year.

The impact on discretionary spending and general merchandise categories is a key concern.

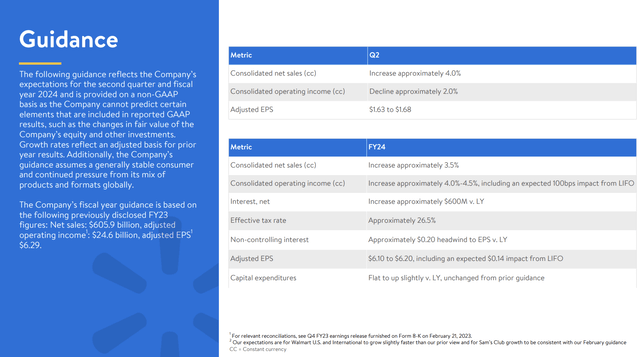

Having said that, the company believes its guidance reflects an appropriate amount of conservatism considering the external environment. The strong performance, multiyear momentum, and ability to serve customers in various ways at a value point are encouraging to management.

Looking ahead to Q2 and the rest of the year, the focus is on reducing merchandise costs and retail prices to combat inflation, improving execution in pick-up and delivery, and managing expenses and inventory by item and category.

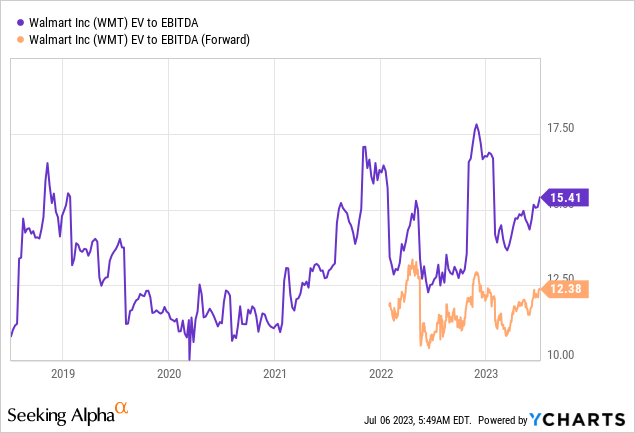

With this in mind, WMT shares are trading at 28x next year’s free cash flow, 15.4x LTM EBITDA, and 12.4x NTM EBITDA.

The free cash flow multiple is a bit elevated, but we can ignore that, as it’s caused by higher investments in its business with a high likelihood of strong returns.

The EV/EBITDA valuation is fair. I would put the fair value 10% above the current price.

Analysts have put the consensus price target at $169, which is 7% above the current price.

Having said all of this, I’m not a buyer of WMT at current prices. As much as I believe that WMT’s investments will be successful, I’m not chasing the price at these levels. I prefer to buy beaten-down stocks with better valuations (and higher yields in some cases).

The dividend yield is low, and a lot of good news has been priced in.

Investors looking to buy WMT might be better off waiting for a correction, although waiting for weakness comes with the risks of missing more upside.

Takeaway

Walmart is an intriguing stock for dividend investors seeking stability and consistent income. With a rock-solid balance sheet and a remarkable track record of dividend increases for 50 consecutive years, Walmart has proven its commitment to shareholders.

Although the current yield of 1.4% may not be very enticing for new investors, the company’s focus on aggressive investments in its business, both domestically and internationally, shows its commitment to long-term growth.

Walmart’s expansion into higher-margin businesses, such as advertising and fulfillment services, along with its emphasis on eCommerce channels and marketplace expansion, indicates a strategic approach to boost margins and cater to evolving customer demands.

With the expected reduction in CapEx and related projected increase in free cash flow, Walmart’s dividend and buybacks look promising for the future.

Despite facing competition and maintaining slow dividend growth rates, Walmart’s overall risk/reward profile remains attractive for investors looking for a reliable dividend payer.

However, I would advise to buy on weakness.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.