Summary:

- Covid hit Walmart’s gross margin, near 25.50% in 2019, but just 22.75% as of last quarter. That should improve with inventory issues.

- The supply automation initiative is huge if Walmart wants to leverage operating income growth and EPS growth off the 3-4% revenue growth.

- The stock never looks cheap, like a lot of staples, but cash-flow and free-cash-flow should improve with working capital improvement.

Joe Raedle

Walmart (NYSE:WMT) is scheduled to report their fiscal Q1 ’24 financial results on Thursday morning, May 18th, before the opening bell, and the Briefing.com consensus expectations are for $1.30 in earnings per share on $147.6 billion in revenue. IBES by Refinitiv estimates are also looking for $1.30 in EPS, on $148.5 billion in revenue.

EPS is likely to be flat year-over-year, while revenue is expected to be +5% versus the same quarter last year.

Walmart faces an easy compare against April ’22, when revenue fell 3% y.y and EPS was down 23%, mainly on the swollen inventory as inventory grew 32% y.y in Walmart’s calendar April ’22 quarter.

With the mid-February ’23 earnings release, WMT did not give guidance, but did affirm or re-confirm full-year fiscal ’24 comp guidance (Walmart US) of 2% – 2.5% and Sam’s comps of 5%.

The EPS guide for fiscal ’24 was quite weak, but Walmart usually under-promises and over-delivers on the numbers.

Looking at the notes from fiscal Q4 ’23, the last quarter, gross margin was still an issue although inventory growth is normalizing, while Walmart and Sam’s comps remain very strong. Grocery inflation is still heavy (so to speak) but some of the various inflation measures in March and April ’23 have started to indicate grocery and household inflation is declining, but I’d rather hear it from the country’s largest grocery retailer before giving that a lot of credence.

In the last few articles written on Walmart (here and here) in February ’23, the inventory glut was addressed and with the Jan ’23 quarter, WMT revenue did grow 7% y.y, while inventory was flat y.y, which is exactly what you want to see from the largest retailer in the world.

To give readers some idea how important “inventory turnover” is for WMT, cash flow (and really any retailer’s cash flow), in the January ’23 quarter, where revenue was up while inventory was flat y.y, WMT’s cash-from-operations generated for the quarter was $13.4 billion, while in the year ago quarter, when inventory swelled, cash-from-ops (and you have to remember this is the holiday quarter every year), was $7.3 billion.

Again, not to rehash the CFA discipline, but the three big components of cash-from-ops for every company are 1.) net income, 2.) adding back non-cash expenses like depreciation, 3.) the change in working capital, which (again) for a retailer is hugely important, and for which inventory and the change in inventory is quite important. Walmart’s inventory is moving in the right direction.

The big news:

That being said, that’s not the biggest news around Walmart heading into fiscal Q2 ’24 financial results.

In early April ’23 Walmart published 3-5 year revenue and operating income guidance of +4%.

That may not seem like much, but along with that operating guidance, Walmart said that their objective was to – by fiscal ’26 – have 65% of their store base serviced by automation, and have 55% of their fulfillment volume flow through fully-automated facilities with the goal of improving “unit-cost” volumes by 20%.

The point being that as Walmart achieves these metrics over the next few years, ultimately operating income will start to “leverage” revenue growth, so the 4% revenue growth and 4% operating income growth targets or goals that Walmart has stated should actually be better in terms of operating income growth. If Walmart can leverage operating income, they can also leverage EPS too.

Basically what WMT is saying is that “look, given our annual revenue of $550 billion per year (and more) it’s going to be quite difficult to get that growth rate materially higher, so we’re going to focus on the middle of the income statement and the costs in the supply chain (i.e. margins) since that is where the opportunity has always been”. (That’s me paraphrasing obviously.)

Way back in 1993, Walmart’s CEO at the time (David Glass ?) stated publicly that “our competitors operating margin is Walmart’s opportunity.”

That hasn’t changed in 30 years.

Walmart Trend in EPS / Revenue estimates:

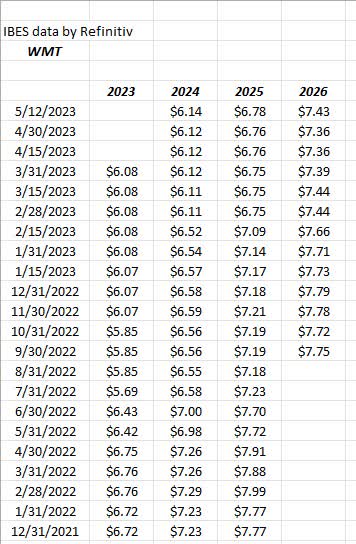

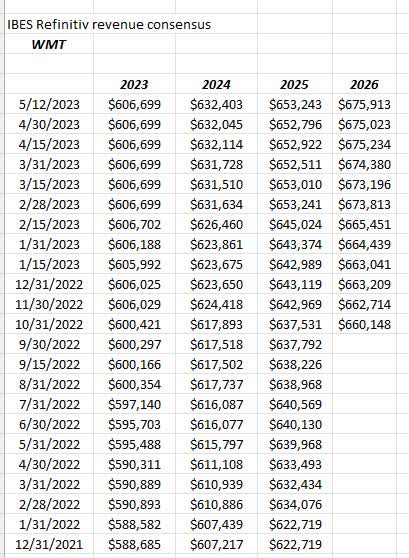

WMT EPS estimate revisions (IBES data by Refinitiv ) WMT revenue estimate revisions (IBES data by Refinitiv )

Readers can see the sharp drop in Walmart’s EPS estimates in early calendar 2022, after “over-ordering” and the swelling of inventory, and then the stabilization and the higher revisions since the summer of 2022.

Remember, Walmart is currently set to report its fiscal Q1 ’24 quarter, so readers should only be interested in looking at 2024-2026 estimate trends.

An unambiguous positive is the consistent trends in positive revenue revisions for fiscal 2024-2026.

The fact that revenue revisions are consistently positive while EPS revisions are sometimes negative and sometimes positive means gross and operating margins are the key metrics for Walmart and the stock price.

Just looking at EPS estimate revisions, you can see why WMT has staked its claim to 4% revenue and 4% operating income growth (y.y) for the next 3-5 years, which I do think it can leverage over time.

“Average ticket and traffic” – last 5 years, includes Covid

| Avg tkt | traffic | |

| 4-qtr avg | +5.2% | +1.2% |

| 8-qtr avg | +4.4% | +2.1% |

| 12-qtr avg | +10.4% | -2.4% |

| 16-qtr avg | +8.3% | -1.0% |

| 20-qtr avg | +7% | -0.5% |

Source: earnings reports

This table shows the incredible impact Covid had on Walmart and really retail America from early 2020 through the exit from it in calendar 2022, and now what is really a return to “normal” for traditional brick-and-mortar retailers.

Here’s “average ticket and traffic” pre-Covid, 2015 – 2019 inclusive:

| avg tkt | traffic | |

| 4-qtr (ends cal ’19) | +2.4% | +1% |

| 8-qtr avg | +1.9% | +1.4% |

| 12-qtr avg | +1.5% | +1.3% |

| 16-qtr avg | +1.2% | +1.3% |

| 20-qtr avg | +1.0% | +1.3% |

Source: valuation s/sheet and earnings releases

This table should show readers how stable the inflation and operating environment was in the last half of the last decade, and what that meant for Walmart’s two important levers: average ticket and traffic.

The first table, which is the last 5 years should show readers that Walmart has the ability to raise “price” (average ticket”) and I’m sure it’s done selectively.

But inflation has been a double-edged sword for Walmart as it has meant tighter gross margins (higher cost-of-goods-sold) as well as the ability to raise prices.

Valuation:

Like a lot of consumer staples, WMT’s average PE of 22x (next 3 years) for an expected 6% EPS growth and 3% revenue for fiscal years ’24 to ’26, almost leaves the stock looking expensive.

The only metric that ever looks appealing on WMT is the price-to-sales metric of 0.6-0.7x.

Price to cash-flow is currently 13x and free-cash is 31x, which is too lofty, but cash-flow has been disrupted from Covid and the calendar ’22 inventory glut, which should continue to improve going forward (cash-flow that is).

Summary / conclusion:

Clients probably own more Walmart today than at any point in the last 5 years, but it’s still a smaller position. However, as Walmart puts distance between the Covid years of 2021-2022, and they use their ability stabilize the supply chain again, gross margin should stabilize and inventory and working capital should return to a more normal state.

Again, the big initiative is automating the supply chain, and removing costs and expenses from that process.

This story has been told before (by me on the Seeking Alpha site) but in the late 1990s, early 2000s, I had a friend who had a consulting firm and one of their clients was a car-seat manufacturer who wanted to become a Walmart supplier, and in order to do that Walmart’s operations team had to inspect and approve their manufacturing, etc. and Walmart went into this manufacturer and actually told them how they could become leaner and meaner and lower their costs of manufacturing. (Maybe it’s commonplace in the business, but I was shocked at that story.)

Recently Walmart generated some not-so positive headlines in Chicago about the closure of some stores, but that was a smart thing for Walmart to do. I lived in a high-rise condo in Lincoln Park, just north of downtown Chicago for years and Walmart tried opening one of their Neighborhood Express stores at Chicago Avenue, one block west of Welles, under the “L” tracks, years ago, and ultimately the store was closed. I shopped there several times, tried to patronize the brand hoven its “everyday low price” but you could tell it was a struggle to get it to work, with no real parking and small square footage.

Today, I still shop at Walmart in the western suburbs of Chicago and still like the value. Their in-house brand does not have the same cachet’ as Kirkland (Costco’s (COST) proprietary brand) and probably represents a good opportunity to develop that in-house brand into something more formidable. (Or maybe not.)

If Walmart could begin to leverage operating income growth this calendar year, through the stated supply-chain automation objectives, by increasing margins, I think it would be a huge step forward for the retail giant.

Ultimately, this process should bring down grocery inflation too.

Look at the gross margin y.y change on Thursday morning and listen to what CEO Doug McMillon (or his team) say about grocery inflation for the summer months.

A number of bullish calls have been made on the stock in the last month, part of that undoubtedly due to the automation of the supply chain announcement, but ultimately investors will need some evidence this transition is taking hold.

The stock has been range-bound since late 2020, with a technical breakout in the shares with a $160 close or better, preferably on good volume.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.