Summary:

- Walmart reports before the opening bell on Thursday morning, November 16th, 2023, with Street consensus expecting $1.52 in EPS and expected revenue growth of $159.7 billion.

- Year-over-year (YoY) growth for the three components is expected at 1%, 5% and 5% respectively, so expectations are rather subdued despite the stock bumping around at all-time-highs.

- For fiscal year ’25, (ends January ’25), Walmart is expecting $7.11 in EPS, $28.7 billion in operating income and $665 billion in revenue for “expected” EPS growth of 10% on 2% revenue growth.

Scott Olson

Walmart (NYSE:WMT) reports before the opening bell on Thursday morning, November 16th, 2023, with Street consensus expecting $1.52 in EPS, $6.3 billion in operating income and expected revenue growth of $159.7 billion.

Year-over-year (YoY) growth for the three components is expected at 1%, 5% and 5% respectively, so expectations are rather subdued despite the stock bumping around at all-time highs.

For the all-important holiday quarter of January ’24, (WMT’s fiscal Q4 ’24), Street consensus is currently expecting $1.66 in EPS, $6.8 billion in operating income and $169.4 billion in revenue for expected YoY growth of -3%, +6%, and +3% respectively.

For fiscal year ’25, (ends January ’25), Walmart is expecting $7.11 in EPS, $28.7 billion in operating income and $665 billion in revenue for “expected” EPS growth of 10% on 2% revenue growth. We’ll see how that fiscal ’25 estimate changes in the next few quarters.

Walmart typically guides cautiously.

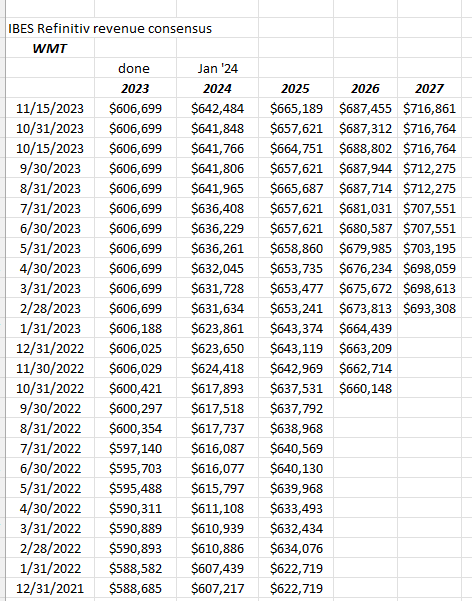

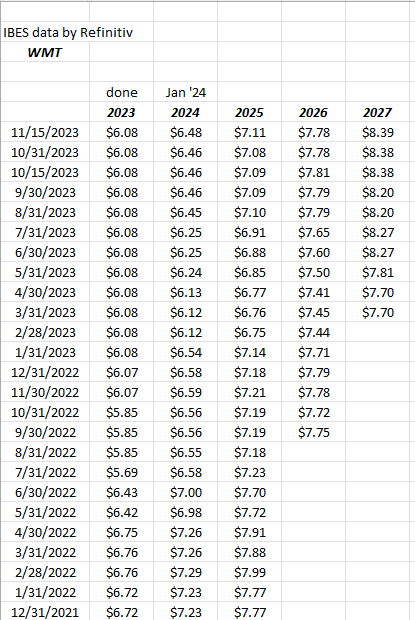

EPS and revenue revisions

Readers should examine Walmart’s revenue revisions first, particularly for 2025 and beyond (fiscal ’25 begins Feb 1, ’24), and note the steady increases to revenue estimates.

Next, readers should note the EPS revisions for the same periods.

This is the margin story. Steady increases in WMT revenue revisions have led to spotty trends in EPS revisions. But this pattern is likely abating.

While Target’s (TGT) results today might get everyone excited about Walmart’s expected earnings report tomorrow, I would caution readers to not extrapolate Target’s results into Walmart’s expectations for tomorrow’s earnings report release.

Readers need to click on the above spreadsheet to see the history of WMT’s inventory-to-sales growth. WMT started to have issues in 2019, probably due to China and early Covid, then 2020 and the work-from-home solved that problem, only to see Walmart incur significant supply chain issues from the April ’21 through the July ’22 quarters, and now that has also been corrected.

Target also had a very easy compare in their October ’22 quarter, while Walmart had a 14% EPS upside surprise on a 3% revenue beat in their October ’22 quarter. The point is Walmart does not have near the easy compare as Target did against the October ’22 quarter.

Walmart has had positive comps while Target’s are still negative.

Ultimately, for Walmart it’s all about margins:

Rather than reinvent the wheel, here’s a link to the August ’23 WMT earnings preview, and also the post-earnings analysis and summary.

The one thing that did occur to me about the Walmart earnings preview for the July quarter’s report was that the 15-year decline in operating margin may be due to the fact that grocery is 50-70% of Walmart’s total revenue, that in and of itself may have accounted for a big part of the margin compression since grocery is a “low-margin, high turnover” product, and fits very well with the “asset turnover” aspect of the DuPont ROE model.

Whatever the attribution (and I was attributing a lot of the margin compression to Amazon’s (AMZN) growing presence), the fact is grocery is lower margin, and as grocery grew at a percentage of Walmart revenue, margins declined, but with the AI and supplier initiatives announced in April ’23, Walmart does want to get that operating margin higher.

We’ll see how margin improvement develops in the October ’23 and January 24 quarters for the retail giant.

Summary/conclusion: A lot of the problem issues around supply chain and logistics are abating for Walmart (and not just Walmart) thus the results in calendar ’24 should be cleaner, but let’s continue to watch margins and cash flow in the next few quarters.

An interesting read for blog readers who are interested in the Walmart-Amazon steel cage match, is “Winner Sells All,” a book about Walmart’s evolution into e-commerce by Jason Del Rey.

I enjoy these type of reads (halfway through Winner Sells All) since it provides background and context as well as a look into a company’s culture, that are difficult to be gleaned from Wall Street research reports.

Jason takes a look at Walmart’s evolution into and around e-commerce (Jet.com) and the fact is Walmart was very late to the party, but Amazon has not found an effective grocery answer with Amazon Fresh, so as long as Walmart’s revenue remains heavily tilted towards grocery, their $665 billion in annual revenue seems safe to a large degree.

In one article written for www.seekingalpha.com in the last few years, I noted how Amazon’s total revenue is now closing in on Walmart’s annual revenue (WMT’s $665 billion for fiscal ’25 vs. Amazon’s expected $709 billion in calendar 2025) but AMZN’s “online store” revenue is just $225 billion of Amazon’s trailing-twelve-month (TTM) revenue of $554 billion or just 50% of the total.

Walmart’s grocery market share is really a fortress in terms of its “moat” or susceptibility to disruption. You’d think AMZN would have made better inroads into that segment by now, but they haven’t.

I was thinking too of the Kroger (KR)–Albertsons (ACI) merger. You’d have to think that is being driven to try and compete with Walmart in grocery and retain whatever market share Kroger has currently.

Clients own more Walmart today than they have in the last 10 years, but I can’t tell readers that the stock won’t be down $5-10 on Thursday morning. There is a lot of moving parts to a retailer that size, and the stock is bumping against all-time highs.

WMT has a secular single-digit EPS and revenue growth, with revenue likely around mid single-digits, and EPS potentially in high single-digits or low teens.

The supply chain and AI initiatives should drive margin gains – the question is timing.

The stock looks expensive trading at 23x forward EPS (3-year avg) for expected 5% EPS growth the next 3 years, driven by expected 4% revenue growth.

Walmart on a price-to-sales basis remains a cheaper metric at 0.62x TTM revenue, while the cash flow valuation at 11x and 22x cash flow and free cash flow looks cheaper than the P/E.

Walmart’s cash flow per share valuation is usually about half its P/E valuation.

The stock isn’t cheap, but like many consumer staples stocks, it never looks attractive on a valuation basis.

Still, with so much attention paid to large and mega-cap tech and “disruption” and “technology moats” Sam Walton and Walmart are one of America’s original disruptors. With $665 billion in revenue and expected to grow, Walmart remains one of America’s fortress companies.

None of this is advice or recommendation. Past performance is no guarantee of future results. I could very well be wrong. (All EPS and revenue data sourced from IBES data by Refinitiv.)

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.