Summary:

- Walmart’s e-commerce and omnichannel growth, driven by expanded distribution centers and third-party sellers, is a key factor for the ‘Buy’ rating with a $90 target price.

- E-commerce growth, including a 20% year-over-year increase and a 32% rise in marketplace services, significantly boosted WMT’s same-store sales.

- The Company’s automation and AI initiatives are expected to reduce operating costs and enhance margins, contributing to a 6% annual revenue growth forecast.

- Key risks include ongoing prescription opiate litigation, rising labor costs, and reduced share repurchase activity, potentially indicating management’s view of stock overvaluation.

Alexander Farnsworth

Walmart (NYSE:WMT) has been growing their e-commerce and omnichannel presence over the past few years, by expanding their distribution centers, logistics, 3rd party sellers as well as overall e-commerce technology. I think the company is starting to harvest its past investments, and the e-commerce business has contributed significantly to the overall same store sales growth. I am initiating a ‘Buy’ rating with a one-year target price of $90 per share.

Growth In E-Commerce And Marketplace

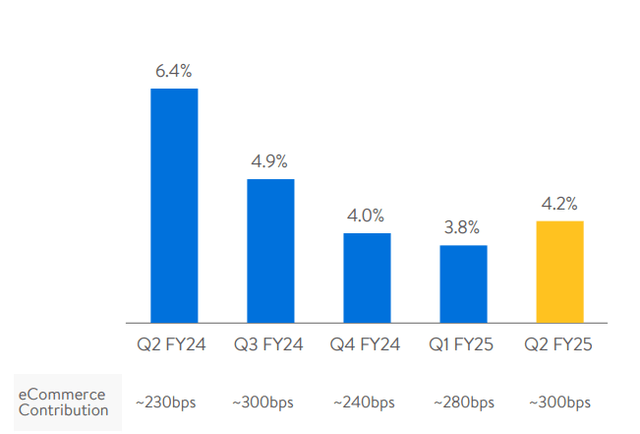

As indicated in the chart below, e-commerce has become a significant growth driver for Walmart U.S. businesses over the past few quarters. Walmart released its Q2 FY25 result on August 15th, reporting 20% year-over-year growth in e-commerce business.

The strong growth in the eCommerce has been driven by several factors:

- As a brick-and-mortar retailer, growing the omnichannel is not an option but a necessity, in my view. Walmart has been expanding their distribution centers, fulfillment centers, e-commerce technology, inventory integration as well as marketplace services over the past few years. Walmart’s extensive physical footprint provides them advantages to their e-commerce business. The omnichannel approach provides customers more choices to shop online and in physical stores.

- Walmart allows third-party sellers to use the company’s supply chain to fulfill online orders. Most importantly, Walmart manages product return services for these 3rd parties. For 3rd party sellers, Walmart servers another online place to distribute products, similar to Amazon’s (AMZN) 3rd party service. I think the growth in marketplace plays an important role in the overall e-commerce growth for Walmart. In Q2, the marketplace service grew by 32% year-over-year, with advertising sales growing by nearly 50%.

- Lastly, Walmart has been expanding their product categories such as beauty and premium products in their online channel. As reported by Bloomberg, Walmart is teaming up with StockX, a sneaker marketplace, to offer pre-verified shoes through Walmart’s marketplace. This partnership has the potential to expand Walmart’s product categories and grow its pre-owned products offering.

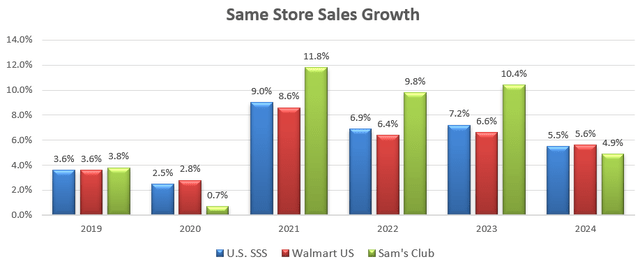

As depicted in the chart below, Walmart has delivered solid same store sales growth over the past few years, with e-commerce playing an important role.

Recent Result And Outlook

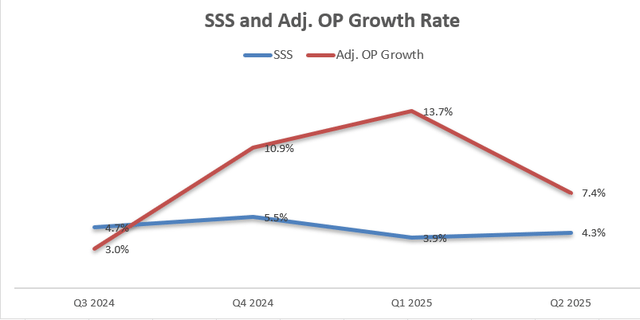

As illustrated in the chart below, Walmart delivered 4.3% growth in same store sales and 7.4% growth in adjusted operating profits in Q2 FY25. My biggest takeaway from the quarter is their strong growth momentum in ecommerce and GLP-1 drugs.

As reported by Managed Health Executive, about 42% of those with commercial insurance could be eligible for GLP-1 drugs used to treat type 2 diabetes. However, only 3% of adults with employer insurance had a prescription in 2022, indicating significant growth potential for GLP-1 drugs overall. Walmart and other pharmacies could potentially benefit tremendously from increased GLP-1 prescriptions.

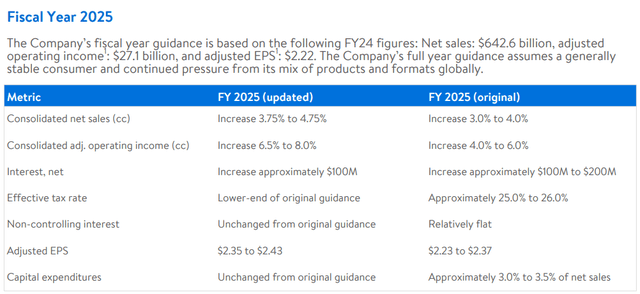

Walmart raised the full-year guidance for revenue and operating income, guiding for 3.75-4.75% revenue growth and 6.5%-8% operating income growth, as detailed in the table below:

I am considering the following factors for Walmart’s near-term growth:

- With the current high-interest rate environment, consumers are facing tight cash flow for purchasing discretionary product categories. In the latest earning, Dollar General indicated that consumption among low-income households was very weak in the U.S. market. Compared to Costco (COST), Walmart’s customers tend to have relatively lower household income levels. The weak consumer sentiment may have some negative impact on Walmart’s retail sales. I estimate Walmart will achieve 2% growth in the same store sales growth for their physical retail business.

- As e-commerce is a top priority for Walmart, I believe the company will continue to expand product categories, engage more third-party sellers, and expand their distribution network in the near future. I estimate e-commerce will contribute 4% to the overall same store sales growth.

- On the margin side, Walmart has been leveraging AI and automation to reduce operating costs. During the earnings call, Walmart anticipated that by the end of the year, about 3,000 stores out of its total 4,600 will be automated to some extent, which can speed up the distribution network and reduce overall costs. Additionally, the fast-growing e-commerce could potentially expand Walmart’s gross margin over time. The 3rd party seller services will be a key margin driver for Walmart, as the service leverages Walmart’s existing infrastructure and distribution network with low incremental costs.

Valuation

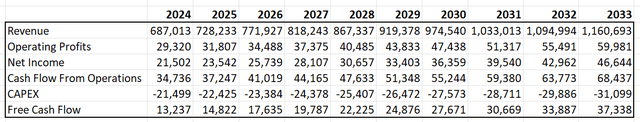

As discussed above, I estimate Walmart’s revenue will grow by 6% annually. I forecast Walmart will achieve 20bps margin expansion driven by 10bps from e-commerce growth and 10bps from distribution automation and back office integrations.

Walmart has been allocating around 3% of total revenue towards CAPEX over the past few years, and I assume a similar spending pattern in the near future. With these assumptions, the DCF can be summarized as follows:

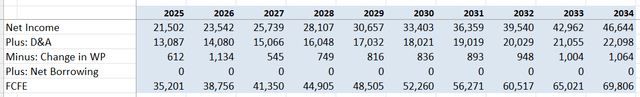

I calculate the free cash flow from equity (FCFE) as follows:

The cost of equity is calculated to be 8.6% assuming: risk free rate 3.7%; beta 0.7%; equity risk premium 7%.

The one-year target price of Walmart’s stock price is calculated to be $90 per share after discounting all the future FCFE at discount rate of 8.6%.

Key Risks

- Prescription Opiate Litigation: Walmart was involved in over 340 prescription opiate litigations cases as of March 4th, 2024, and the company has filed an appeal with the Sixth Circuit Court of Appeals, according to their 10-K. The outcomes of the lawsuit and appeals are unknown at this moment.

- Labor Costs: As a big retailer, labor costs represent a big portion of total operating costs. Walmart raised the minimal wage for store employees to $14 an hour last year due to the rising inflation. Compared to other retailers, Walmart’s employee wages are relatively lower. I anticipate that the company will continue to face pressure for wage increases from its employees.

- Shares Repurchase: Walmart spent almost $10 billion per year to repurchase their stocks from FY22 to FY23. However, the company only repurchased $2.78 billion of own stocks in FY24, and $2.1 billion during the first half of FY25. The reduction in shares buyback could indicate that the management believes the stock price is overvalued.

End Notes

I think Walmart, Home Depot (HD) and Costco are quite successful in their omnichannel strategy compared to other physical retailer companies. The three companies have built decent ecommerce businesses that significantly contribute to overall same-store sales growth. I am initiating a ‘Buy’ rating with a one-year target price of $90 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.