Summary:

- Walmart is focused on higher-margin growth initiatives, including international expansion, e-commerce, advertising, and data monetization.

- The company is investing in optimizing and automating fulfillment and in-store operations to drive operating leverage and attractive returns for investors.

- Recent improvements in capital efficiency ratios strengthen the investment thesis for Walmart, but further analysis is needed to determine if it can outperform the market.

Niloo138

Investment Thesis

With a focus on higher-margin growth initiatives, including international expansion, e-commerce, advertising, and data monetization, Walmart (NYSE:WMT) is poised for long-term growth. Efforts to optimize and automate fulfillment and in-store operations promise to drive significant operating leverage, delivering attractive returns for investors with a long-term focus. Recent improvements in capital efficiency ratios, driven by investments in higher-margin growth initiatives, further strengthen the investment thesis for Walmart.

However, I need to develop a deeper understanding of the business and its growth drivers and potential to put Walmart on my wish list or open a position, but my initial analysis for this article has catapulted the company onto my investigation list, earning it the effort of a more robust analysis of the business and deeper research into its growth prospects.

What It Requires To Get Into My Portfolio

I won’t invest in an individual stock that I don’t believe can outperform SPY over the long run. If I lack confidence in Walmart’s potential to beat the market, I would be better served investing my money into SPY and eliminating the single company risk that comes with individual stocks, even with a company like Walmart.

For a stock to beat the market over a long period of time, the company must hold some kind of edge. This edge could be an extremely favorable valuation or a misunderstanding that the market has regarding the company’s growth prospects. It could also be a stock that can break DCFs. Companies that break DCFs can grow well beyond the bounds of a normal DCF.

If you were a junior analyst at an investment firm in 1962 and were to model that sixty-two years after going public, Walmart would have grown its EPS at a 20% rate over the last five years, you would have been laughed out of the room, fired, and called crazy. That is an example of a DCF breaker.

Given that Walmart is extensively covered by Wall Street analysts and professional investors, finding a unique investment edge may pose a challenge. Therefore, it is important for me to find a compelling argument that justifies investing in this stock. Walmart needs to be a DCF breaker to beat the market from here, especially given its lackluster growth profile over the last ten years.

The Case for Walmart

Walmart’s business model is built to last, serving the needs of people worldwide through its e-commerce platform, retail stores, and Sam’s Club. With a vast global footprint, Walmart’s business is likely to remain viable for the long haul, minimizing the risk of permanent capital loss for investors.

Walmart’s international prospects and growing e-commerce segment provide options for longer-term growth. Advertising, data monetization, and automation efforts are areas of opportunity for both growth and margin improvement.

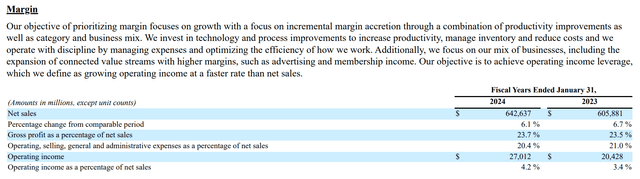

Walmart is a very efficient and well-managed business with a good deal of operating leverage. This manifested itself in significantly improved operating margins in fiscal 2024. Operating margin expanded to 4.2% from 3.4%, driven by SG&A expenses decreasing as a percentage of sales and a 20 basis point gross margin expansion.

Walmart’s Operating Margins (WMT 10-K, February 2024)

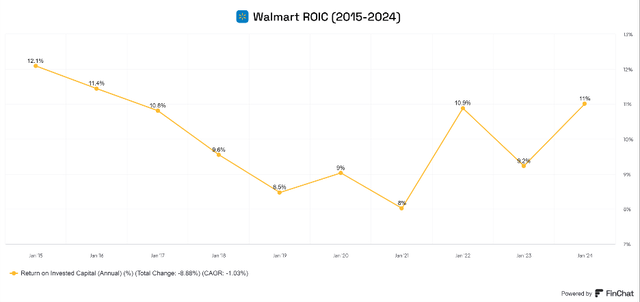

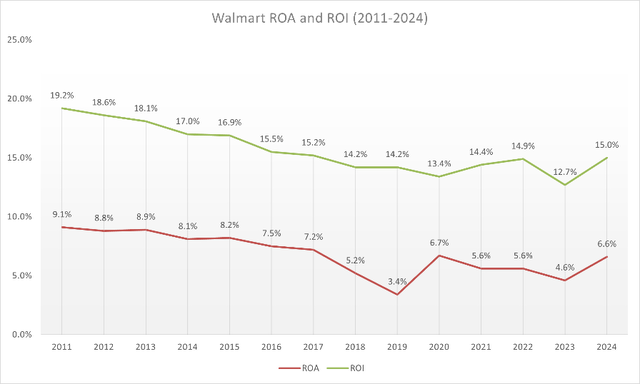

Capital Efficiency

Recent improvements in capital efficiency ratios have me wondering if Walmart is on to something. However, Walmart has had mixed results in recent years, when it comes to its recent track record in terms of ROIC, ROA, and ROI. Since 2015, the company has seen its ROIC drop dramatically before eventually rising through the pandemic. ROI and ROA steadily declined since at least 2011, before showing significant improvements in 2024. I want to see these metrics continue to improve or develop a full grasp on how these numbers will continue to improve after learning more about the company’s growth initiatives and how they are positioning Walmart to do this.

Walmart’s ROIC Trend (www.FinChat.io) Walmart’s ROI and ROA (Author-generated chart (data from WMT 10-Ks))

The reason behind the recent upticks in Walmart’s capital efficiency metrics might be due to its investments in its higher-margin growth initiatives beginning to pay off. Based on the commentary of management during the last earnings call, this appears to be the case.

Walmart’s Growth Initiatives

During the Q4 FY 2024 earnings call in February 2024, Walmart CFO John David Rainey discussed the four key growth initiatives that Walmart believes will drive improved margins in the years ahead. The four initiatives are labeled as Business Mix, Supply Chain Transformation, Product Mix, and Geographic Mix.

Business Mix

Walmart’s focus on diversifying its business mix is a pivotal part of its growth strategy. By expanding into higher-margin businesses such as global advertising and Walmart U.S. Marketplace, Walmart is already seeing benefits to its profitability. Global advertising revenue increased by 28% to roughly $3.4 billion, while Walmart U.S. Marketplace revenue surged by 45% on the strength of its fulfillment services, and global membership income grew 20%.

These segments not only offer higher structural margins compared to traditional retail operations but also support its retail revenue streams. I believe that all of this enables Walmart to continue investing in its core business and in other areas for margin expansion.

Global advertising revenue has improved from $2.2 billion in fiscal 2022, to $3.4 billion in fiscal 2024. This represents a two-year CAGR of 27.2%, an incredible growth opportunity if this can continue anywhere close to this rate for the next several years. Unfortunately, Walmart doesn’t directly report advertising revenue, and the earliest mention I can find is in the fiscal 2022 earnings transcript. I think this provides a benefit to investors digging deeper, as it isn’t always apparent how big these segments are until they become material enough to report them. By the time that happens, it becomes large enough to potentially drive the stock higher.

Supply Chain Transformation and Automation

Walmart is transforming its supply chain through automation. This involves retrofitting regional distribution centers with automated storage and retrieval systems. Walmart has invested in utilizing the services of Symbotic (SYM), as well as making a significant equity investment in the company. Symbotic is an AI-powered robotics and automation systems company that specializes in transforming traditional warehouses into fully automated facilities. One look at this demo video will show you how much Symbotic can improve the efficiency of Walmart’s fulfillment centers.

Walmart is pushing to automate 55% of its fulfillment centers and 65% of its supercenters by FY 2026. This is expected to cut costs by as much as 20%. Walmart is also extending its automation push into its stores, which it believes has freed up its store associates to spend more time helping customers, improving customer satisfaction.

I believe this strategic shift not only promises to improve inventory management and operational productivity but also aligns with long-term financial benefits such as cost reductions. Not only will more efficient fulfillment operations help drive profitability in e-commerce, but it will also support efficiency in its core brick-and-mortar retail business.

Furthermore, greater efficiency should allow Walmart to continue increasing margins and strengthening its pricing power. With greater profitability, the company can increase profits or ward off any low-cost market entrants by lowering prices when necessary. This dual-role of efficiency is a competitive advantage for Walmart.

Product Mix

Walmart’s strategy to optimize its product mix focuses heavily on expanding its e-commerce assortment, particularly in general merchandise. This expansion is designed to secure Walmart’s position as a primary retail destination, with enhancements in both online and offline offerings. The company is actively remodeling stores to align with this goal, planning an additional 650 remodels in FY 2025. Management stated that improved store aesthetics and functionality have been shown to improve sales and customer perception. Walmart’s emphasis on general merchandise, especially during a period of variable consumer demand post-2020 and 2021, is believed to be crucial for maintaining its competitive advantage and fostering customer loyalty by Walmart’s management team.

Walmart has expanded its number of SKUs offered through its e-commerce marketplace from 170 million in fiscal 2022 to 400 million in fiscal 2023. The company now strategically uses artificial intelligence to more effectively target items to its customers, with the intent of making Walmart a one-stop shopping experience. As the company further grows its marketplace, I believe it will feed back into its fulfillment services and in-store pickup. This is the power of its flywheel effect. Walmart expands item offerings, strengthens its fulfillment services, and increases traffic in stores by expanding its in-store pickup demand. Nicer retail locations could incentivize customers to then shop in store, leading to increased sales of items that the customer may not have intended to purchase in the first place.

Geographic Mix

Walmart’s international operations represent a significant opportunity for growth. The company is focused on specific markets like India, Mexico, and China. These regions are driving considerable growth in sales and operating income, with Walmart International reporting a 10.6% increase in sales and over 15% growth in adjusted operating income in constant currency terms in FY 2024. Investments in Flipkart and PhonePe underscore Walmart’s commitment to capturing market share in high-growth regions. The company plans to reach $200 billion in GMV and double profits by FY 2028 from FY 2023 levels.

International expansion is a major reason I am considering Walmart as an investment idea. If the company can successfully grow in new markets at faster rates than its U.S. operations have been growing, the company could see sustained growth for many more years. This kind of growth might be able to outlast the DCF models of even the most long-term focused analysts.

Flipkart represents a major growth opportunity for Walmart. The Indian e-commerce market is expected to grow at a CAGR of 21.5% between 2024 and 2029. Meanwhile, India’s middle class is expected to grow from a 31% share of the population in 2023 to a 38% share in 2031 and 60% by 2047. The runway in this market is long, and Walmart appears to be positioned for success going forward.

Here are some estimates on the market growth for some of these areas for Walmart.

|

Walmart’s High-Growth Opportunities |

|||

|

Market Segment |

CAGR |

Time Period |

Source |

|

Data Monetization Market |

16.6% |

2024-2032 |

|

|

Global E-Commerce Market |

15.8% |

2024-2029 |

|

|

USA Connected TV Ad Expense |

11.4% |

2024-2028 |

|

|

India E-Commerce Market |

21.5% |

2024-2029 |

Mordor Intelligence – India E-Commerce |

Each of these initiatives is key to Walmart’s strategy to enhance its margins and drive sales growth by focusing on areas with potential for high growth and efficiency. This multifaceted approach not only helps in achieving immediate financial goals but also sets the stage for sustainable long-term growth.

The Argument Against Walmart

Stock Returns

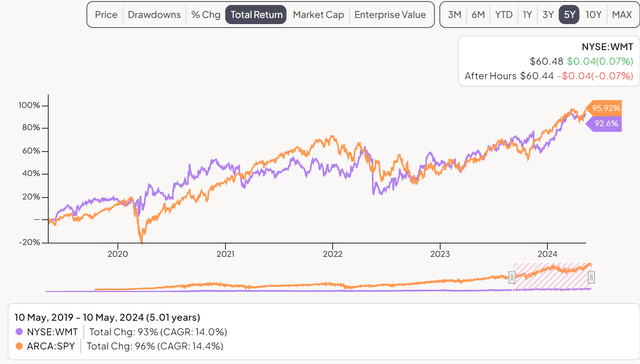

One of my favorite ways to screen stocks is to simply look at past returns. Walmart has crushed the market since its inception as a public company, but the returns of decades ago really don’t matter much, as the company is much more mature now and past returns are not a guarantee of future success.

Over the last five years, Walmart has matched the returns of SPY, my proxy for the S&P 500, nearly down to the penny.

WMT vs SPY – 5-year Total Returns (www.FinChat.io)

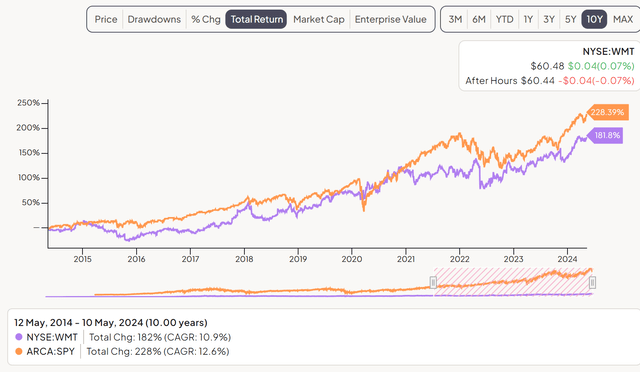

However, it has significantly trailed SPY over the last ten years.

WMT vs. SPY – 10-year Total Returns (www.FinChat.io)

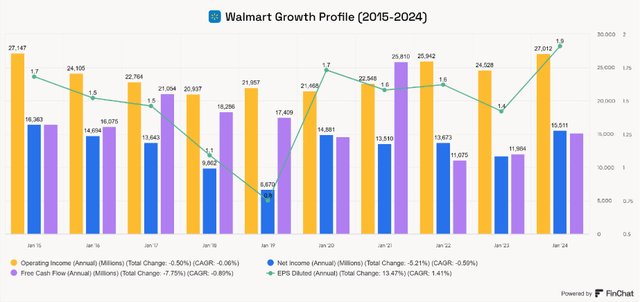

Financially, Walmart hasn’t exactly impressed me with its growth.

Walmart Growth Trends (www.FinChat.io)

This chart leaves me wondering if Walmart is simply a market performer trading at a premium and dependent on buying the stock at the right time. The thing about premium valuations is that they might stay that way for a long time, but eventually, every company runs out of growth opportunities and becomes a company in decline. However, Walmart is attempting to delay this as long as possible with the growth initiatives outlined above. The 2010s were likely a time of refocusing for Walmart, as it developed its e-commerce platform and positioned itself to modernizing and optimizing itself as a technology-forward retailer.

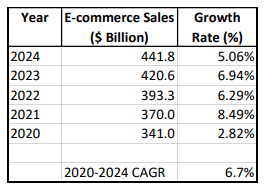

Uncertain E-commerce Growth

Since 2020, Walmart has grown its e-commerce sales by a 6.7% CAGR. However, it is fair to wonder if e-commerce growth has normalized since the pull-forward that occurred during the early pandemic era. It remains to be seen if Walmart can maintain a 6.7% growth rate in this segment going forward, but if it can continue its recent growth internationally, this may be another reason to own the stock. If e-commerce continues to provide synergies with Walmart’s other areas of focused growth, then even low-single digits e-commerce growth might be enough to provide value for shareholders.

Walmart E-commerce Sales (Author-generated Table (Data from WMT 10-K Reports))

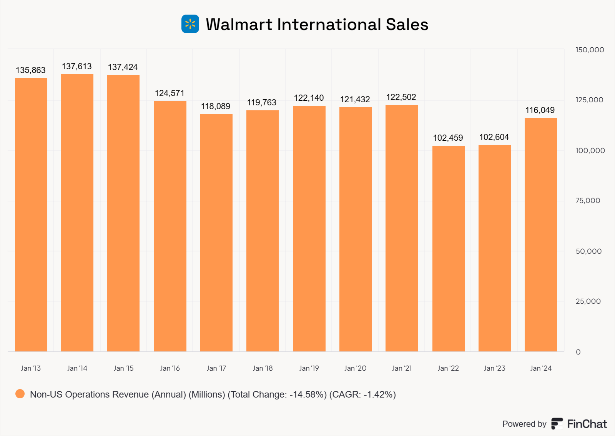

Lackluster International Growth

When looking at international sales, we see that Walmart’s sales contracted during 2022 and 2023 before returning to growth in 2024. Could this be the growth opportunity needed to justify investing in the stock?

WMT International Sales (www.FinChat.io)

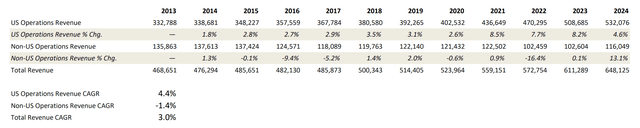

When we compare Walmart’s U.S. and International Sales, we see that Walmart hasn’t had the success we’d like to see.

Walmart U.S. and International Growth (Author-Generated (data from www.FinChat.io))

To convince me that Walmart has made the right investments in international growth, I want to see a continuation of the international growth Walmart achieved in fiscal 2024.

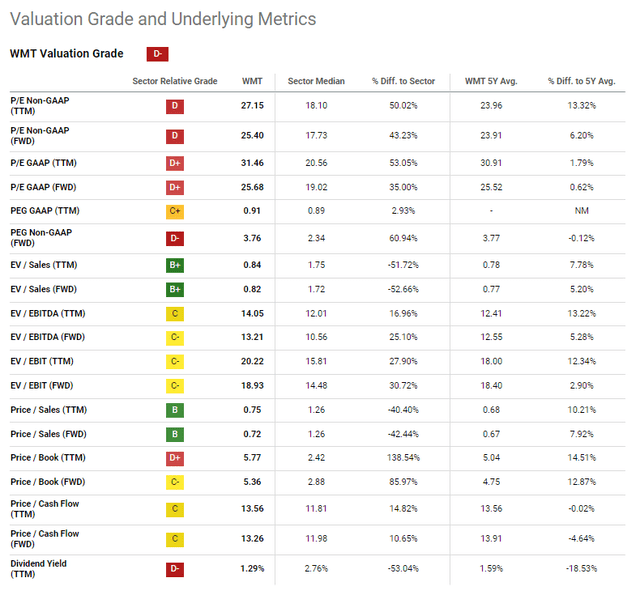

Valuation Is A Mixed Bag

WMT Valuation (www.SeekingAlpha.com)

Walmart currently trades at only a 1.8% premium to its 5-year TTM GAAP P/E, and only a 0.6% premium to its 5-year Forward P/E, and receives a D- valuation grade from Seeking Alpha. On an EV/EBITDA basis, it trades at a 13.2% and 5.3% premium to its TTM and Forward 5-year multiples, respectively. Seeking Alpha’s low valuation score of D- appears to be due to its relative valuation to its sector and less to its own usual premium valuation.

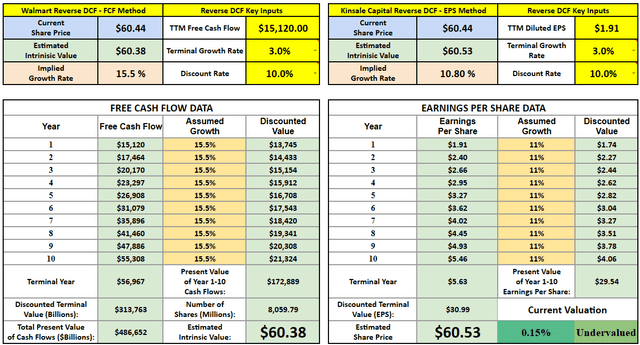

Reverse DCF

Using a reverse DCF for Free Cash flow, Walmart would need to grow FCF at 15.5% annually for ten years, using a 3.0% terminal rate and a 10.0% discount rate. Using the same model for EPS growth, Walmart would need to grow EPS at 10.8% annually for ten years.

Walmart Reverse Discounted Cash Flow Analysis (Author-Generated)

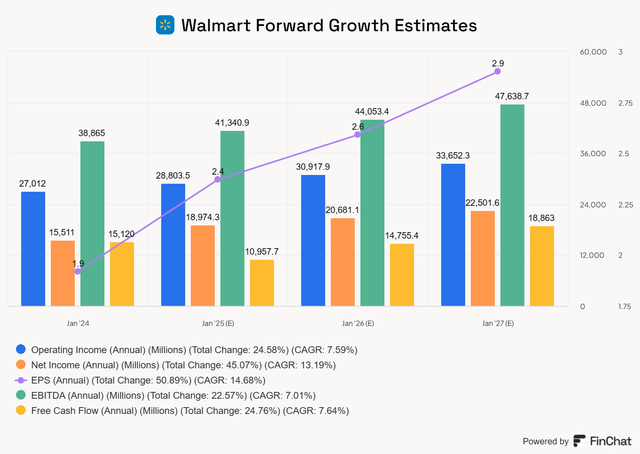

According to FinChat.io, analysts are expecting FCF growth of 7.6%, and EPS growth of 14.7% annually over the next three years.

Walmart 3-year Analysts Forward Estimates (www.FinChat.io)

Walmart would be considered overvalued using FCF and undervalued using EPS, based on these growth estimates. I prefer to use FCF in my modeling and I am leaning towards Walmart being more overvalued than not, with the admission that I need to do a deeper analysis to confirm this.

Conclusion

The best course of action will be to dig deeper into the various growth initiatives that might provide a long runway for sustained growth. If Walmart can drive margin improvements and sales growth, the company may be able to fully exploit its operating leverage and inflect operating income and free cash flow generation higher. If this happens, Walmart stock would likely represent an attractive investment idea, even at what looks to be a premium valuation today.

When I first started researching Walmart, I did not hold high expectations as an investment idea. However, I see opportunities for sustainable growth and believe there might be an avenue for market-beating returns from here. At this time, I do not have enough confidence to consider Walmart stock a buy, but I will be adding it to my investigation list and plan to dig deeper into its business model and individual growth levers. I am listing Walmart as a Hold, but only because I need more knowledge to consider it anything else. If I were a shareholder, I would be happy to hold my position or even DCA into it while researching further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not own shares in WMT and do not plan on initiating a position within the next 72 hours. I also do not own shares in SYM, and do not plan on initiating a position at this time.

Readers are encouraged to perform their own due diligence. This article is not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.