Summary:

- Walmart announced a 3-to-1 stock split, potentially attracting retail investors with a lower stock price.

- Walmart has a history of strong performance during economic downturns, making it a good investment during uncertain times.

- With the recent announcement, this may entice more well-known companies to follow suit to attract more retail investors.

- After the stock split, I expect Walmart to aggressively buy back its shares to decrease their share count.

- Since the last stock split 25 years ago, Walmart has outperformed the S&P in total returns.

stocknshares

Introduction

Retail giant Walmart (NYSE:WMT) recently announced a 3-to-1 stock split, scheduled to take place at the end of February. If so, I will be initiating a position in the retailer immediately following the split. With several high-quality companies trading at rich valuations currently due to economic uncertainty, I think it’s likely other companies will follow suit in the coming months. In this article, I discuss why Walmart is a stock to consider following the stock split.

Previous Thesis

I last covered Walmart back in October, stating this was one stock you would want to own in a recession. And although we’ve managed to evade a recession so far, one is still not out of the question. One reason to own a high-quality company like Walmart is their well-known brand. Walmart is a global brand, and the company also did quite well during the Great Financial Crisis.

During that time, the company managed to increase its net sales by high single digits from 2007-2009. Although this next potential recession is expected to be mild in comparison to the GFC, this will still place downward pressure on several high-quality businesses if one comes to fruition. And if one does, I suspect WMT will do just fine.

Stock Split Announcement

The retailer last split its stock in April of 1999 where they conducted a 2-for-1 split. During that time, Walmart was trading around $50 per share. Since going public, Walmart has done a total of 9 stock splits, making the upcoming one their tenth.

Stock splits don’t really add any value to the company. These are typically just to attract more retail investors into the company, since the stock usually trades at a much lower price afterward. Walmart is expected to trade on a post-split basis Monday, February 26th.

Using the current share price of roughly $166, this would put the price at roughly $55 a share. Of course, this is subject to change depending on the trajectory of the share price. With this announcement, I think it’s likely other high-quality businesses will split their stocks to attract additional investors. One in particular I think could see its stock split soon is insurance giant Aflac (AFL). I wrote an article back in December discussing how the high valuation could lead the company to split its stock in the near future.

Shareholder Post-Split Returns

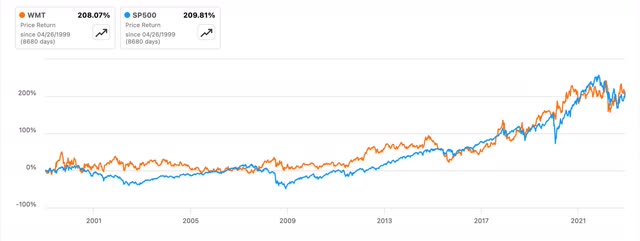

Investing in Walmart the day after the last stock split would have given investors a price return of more than 208%, in-line with the S&P’s return of nearly 210%.

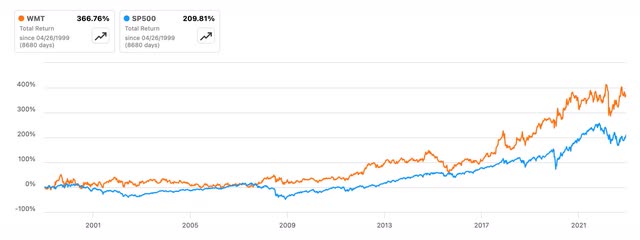

If you throw in dividends, you would have handily outperformed the S&P by 150% over the same period. So, if you had invested $10,000 in Walmart right after the last stock split, you would have more than tripled your money and outperformed the S&P over the same time frame.

For long-term investors who are not only focused on income, but growth as well, I also think Walmart is a great buy today after the split given its global recognition and historically strong financials. They’re also continuing to grow the business, which I discuss later in the article. And it will definitely be tougher with the emergence of other businesses, more notably Amazon (AMZN).

But in the last year Walmart is up 17% despite the challenging backdrop, flexing their financial muscle while their peers, Target (TGT) and Dollar General (DG) are both down double digits.

Dividend & Buybacks

If the current dividend of $0.57 remains the same, then the 3-for-1 split would put the dividend at $0.19 a share, or an annual payout of $0.76. Walmart is currently a Dividend King, so, technically they would keep their status as this is not considered a dividend cut.

Walmart has been buying back its shares over the years, decreasing their share count over the past decade from 3.2 billion shares to the current 2.7 billion. In the past few years, the retailer ramped up its share repurchases, buying back almost 70 million in FY22 and nearly 74 million in FY23.

During the latest quarter, management bought back a total of $111 million worth of shares. YTD, the retailer has decreased its share count by 1.3 million and had a remaining $18.1 billion on the current program.

With the 3-for-1 split, their share count is expected to increase to 8.1 billion. Although this is a significant increase in shares, I expect management to continue to repurchase additional shares under the current authorized program for the foreseeable future.

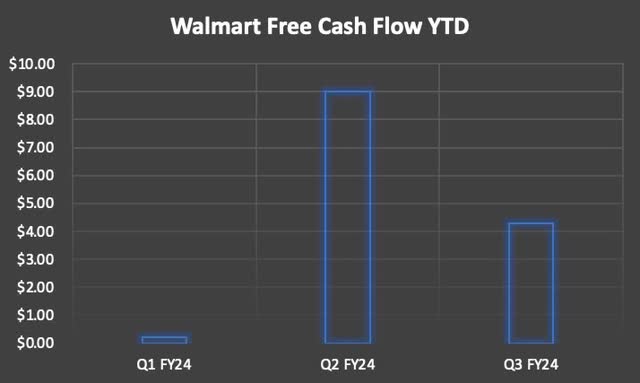

With 8.1 billion shares outstanding, WMT would need at least roughly $6.2 billion in annual free cash flow to cover the annual payout of $0.76. YTD, the company has brought in nearly $42 billion in operating cash flow and $13.5 billion in free cash flow. So, I think it’s safe to say the dividend will be well-covered post split.

Further Expansion

Even with Walmart being a retailer of choice for many and a globally-known brand, the company plans to continue expanding its store count over the next 5 years with more than 150 new stores in the U.S. Additionally, the plan to convert smaller stores into Supercenters. Furthermore, they also opened their third e-commerce fulfillment center.

So far this year, the retailer hasn’t opened any additional stores but plans to further expand for the foreseeable future. One reason for this is to compete with the behemoth Amazon, who has been steadily growing its e-commerce platform. And as the company expands its store count footprint, I expect their financials to follow suit.

I also expect the retailer to follow in the footsteps of several other businesses by focusing on expansion outside of the United States, focusing on India. During Q3 earnings management addressed this stating they have a unique opportunity to not only grow in India, but Mexico, Canada, and Chile as well.

Sales internationally have been going well for Walmart with sales up more 5.4% with Walmex sales up 9%. Sales in China were also up 25%, with the strong performance in Sam’s Club and e-commerce. So, the company has plenty of room to continue growing and shows no signs of slowing down in the future.

Upcoming Earnings

Walmart is set to report their Q4 earnings at the end of this month, and I expect the company to deliver another strong quarter to end the year due to consumer holiday shopping. Although inflation is still a factor that affects consumer behavior, it does seem to be moderating, which likely provided a small boost to their confidence since WMT’s last earnings.

I also expect the company to benefit from their “Big Billion Days” event in the upcoming quarter as well, as this was pressured by international expense leverage last quarter. WMT has consistently beat on earnings this year despite the challenging backdrop, and I suspect this will continue in the coming quarter.

In the above chart, you can see analysts are expecting Q4 EPS of $1.63, potentially putting full-year EPS near the top of management’s guidance of $6.40 to $6.48. I think the retail giant will deliver another strong quarter with a sizable beat, in turn likely driving the share price to go higher.

Valuation

Even being up double digits on the year, WMT still offers some upside to their price target of nearly $180 in my view. Using the midpoint of earnings guidance, this gives WMT a P/E of nearly 26x, higher than their 5-year average of 23.5x, indicating the stock may be overvalued currently. But with a forward P/E of 25x because of the expected earnings increase, this also signals the stock could see further upside as well.

To put this into perspective, both peers Target (TGT) and Dollar General (DG) are trading below their 5-year average P/E averages at roughly 17.74x and 15.20x respectively. But, quality usually commands a premium so unless you catch companies like WMT in a downturn, you’re normally going to pay a pretty penny for the stock.

Either way, if you’re a long-term investor, WMT’s current share price shouldn’t be of any concern with the stock split announcement. Furthermore, I think the stock is trading at a decent valuation currently, although their current P/E is above their 5-year average. Additionally, if WMT manages to deliver another strong quarter, I think the share price will likely see further upside above $170 per share (based off of the pre-split price).

Conclusion

As it gets further into the month, I expect Walmart’s share price to increase as it gets closer to the stock split date. Whenever it is announced, I expect the share price to rise rapidly as new investors pile into the well-known retailer. Those looking to start a position shouldn’t go all in right away, as history tells us the stock will likely decline after rising.

I suggest dollar-cost averaging into the stock and adding heavily on any signs of share price weakness. With the announcement, hopefully several other well-known companies trading at rich valuations follow in Walmart’s footsteps and split their stock to attract more investors. Due to the announcement of the stock split, I continue to rate WMT a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.