Summary:

- The stock is hovering around an all-time high level of $161.20.

- Strong momentum in the Comps sales and e-commerce business, incremental operating margins, and strong operating cash flow provide an investment case for upside potential.

- Robust growth in e-commerce is driven by strength in pickup and delivery.

- International sales are driven by solid momentum led by double-digit growth in Walmex, China, and Flipkart.

Wolterk

Investment Thesis

Walmart (NYSE:WMT) stock is hovering around an all-time high level of $161.20. Due to this, it is trading at 30.41x compared to 21.16x of the sector median based on the trailing twelve months P/E ratio. However, it is still trading at a discount compared to Walmart’s five-year average of 33.81x. Investors might ignore Walmart at current prices as it is overvalued compared to sector multiples. In reality, I believe investors shouldn’t be biased by a low valuation or a high valuation, but rather invest in businesses that are growing, showing operational efficiency and improving operating cash flows. The in-depth analysis of Walmart’s segments reveals strong momentum in the Comps sales and e-commerce business, incremental operating margins, and strong operating cash flow, providing an investment case for upside potential.

Stock Catalysts

1. Strong, Efficient Growth Across Segments

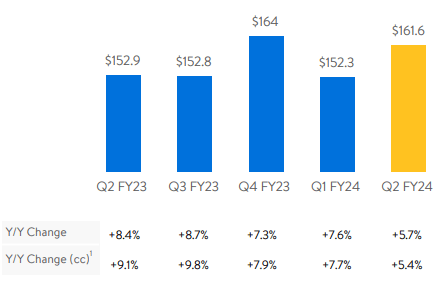

Walmart’s revenue reached $161.6 billion (5.7% revenue growth YoY) with strength across all segments in Q2-2024 driven by strong comp sales globally, including 6.4% for Walmart U.S. Moreover, the total e-commerce sales globally reached $24 billion (representing 15% of total revenue) driven by Omni channel, including pickup and delivery.

Q2-2024 Fillings, Walmart Total Revenue (in $ billion)

1a) Walmart U.S. Segment

Walmart U.S. is the largest segment and had net sales of $110.9 billion (5.4% revenue growth YoY) for Q2-2024, representing 69% of total revenue. The strength in sales is driven by strong growth in Comp sales of 6.4% with strength in the grocery, and health and wellness. Moreover, the company has gained market share in the grocery business with strong unit growth.

Walmart’s Quest For Online Market Share

Walmart is successfully managing the mix between the Omni channel store model and ecommerce as sales growth includes increases in both store and digital transactions. Growth in e-commerce of 24% in Q2-2024 is driven by strength in pickup and delivery. Furthermore, advertising sales increased by 36% during the same period. Walmart’s strength in its online business is further supported by an increase in weekly active digital users by 20%, and marketplace customer counts increased by 14%. Walmart has remained in the top position among large retailers in terms of market share for decades in the U.S. However, Walmart has lately been surpassed by Amazon (AMZN) driven by the change in consumer preference for online shopping and deployment of the internet. Walmart has invested heavily in building the e-commerce revenue stream and is now growing it as envisaged by 24% revenue growth in Q2-2024. Investors are closely watching trends in its e-commerce business and the possibilities of grabbing market share in the online business. I believe Walmart has a strong ecosystem in the retail business (although Amazon took the first mover advantage) and is building capabilities in the right direction, and could see upside potential in the stock due to further traction in e-commerce.

1b) Walmart International Segment

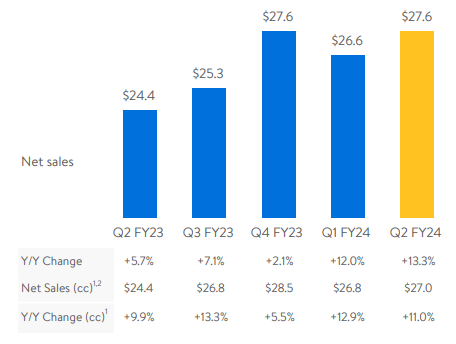

Q2-2024 Fillings, Walmart International Revenue (in $ billion)

Walmart International is the second-largest segment and had net sales of $27.6 billion (13.3% revenue growth YoY) for Q2-2024, representing 17% of total revenue. The strength in sales is driven by solid momentum led by double-digit growth in Walmex, China, and Flipkart. Global transactions are impacted by currency fluctuations and Walmart has managed well as revenue growth is positively affected by 2.2%, due to currency rate fluctuations. In terms of product categories, food and consumables has shown strong growth as well as growth in private brand penetration across markets. In the International segment, e-commerce revenue increased by 26% with solid growth in China, Flipkart, and Walmex.

Walmex is the Mexican and Central American Walmart division and had net sales of $10.7 billion (10.1% revenue growth YoY) for Q2-2024, representing 10% of international revenue. The strength in the Walmex division is driven by continued strength in food and consumables. Furthermore, comp sales grew 8.5% with 120 new stores opened in the past twelve months. Moreover, the China division is showing solid performance with 21.7% revenue growth and has more potential in the China market with e-commerce penetration at 47%. Walmart has a majority stake in India’s Flipkart, which includes e-commerce platforms of Flipkart and Myntra, as well as with a majority stake in PhonePe, a digital transaction platform. This shows Walmart’s efforts to continue to enhance e-commerce initiatives worldwide.

In a nutshell, e-commerce investments in customer experience show solid double-digit growth in the Walmart U.S. and Walmart International segments. I believe the upside in the stock from current levels will be driven by performance in e-commerce business. Furthermore, the management has estimated an increase of 3% revenue growth in Q3-2024 and 4.5% in FY-2024. In the next earnings report, investors should watch for revenue growth driven by the e-commerce business.

2. Consistent Operating Discipline

I support my buy case investment thesis only if revenue growth translates into better operational efficiency.

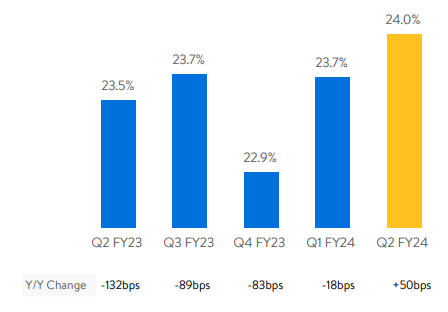

Q2-2024 Fillings, Walmart Gross Profit Margin (in %)

Walmart’s gross profit margin increased to 24% in Q2-2024, an increase of 50bps compared to Q2-2023. The improvement in margin is due to lapping FY-2023 elevated levels of markdowns and supply chain costs. However, this is marginally offset by ongoing product category mix pressure as grocery and health and wellness sales outperform general merchandise sales. Within the Walmart US segment, the sales mix shifted 240bps in Q2-2024 from general merchandise to grocery, and health and wellness.

Operating expenses in Q2-2024 are 20.3% (% of revenue) compared to the previous quarter of 20.4%. Moreover, current quarter expenses are on the lower side compared to average operating expenses of 21% for the last twelve months. This shows Walmart is managing operating expenses prudently in a higher inflation environment globally.

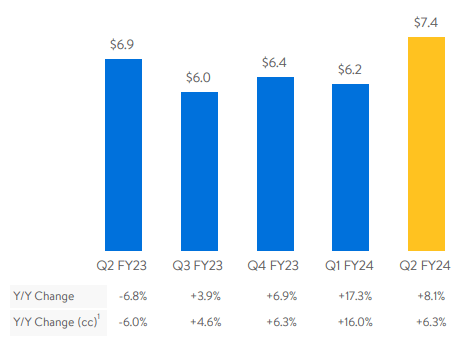

Q2-2024 Fillings, Walmart Adjusted Operating Income (in $ billion)

In Q2-2024, adjusted operating income increased by 8.1% in comparison to a 5.9% growth in total revenue. This is very crucial for investors to gauge operational performance. Walmart has successfully achieved incremental growth in operating income, which means growth in operating income is greater than revenue growth, showing better cost management. Walmart U.S. margins increased by 7.6% and international margins by 14.1%. This shows Walmart is doing cost management across its operations and has resulted in improving operating income. Furthermore, the management has estimated an increase of 1% in operating margin in Q3-2024 and 7.5% in FY-2024. Going forward, investors should watch for incremental growth in operating income as this will be helpful for higher EPS and higher valuations.

3. Sustaining Positive Cash Flows

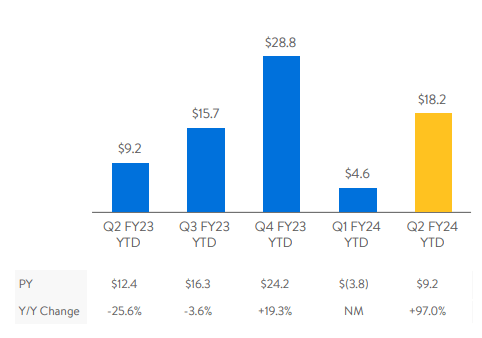

Q2-2024 Fillings, Walmart Operating Cash Flows (in $ billion)

In the high inflation environment, Walmart is able to manage to increase operating income and net income. Better operational performances resulted in strong cash flows for the company. In Q2-2024, the company had $18.2 billion operating cash flow, which is almost twice compared to the same period last year. Furthermore, the management has returned $2 per share to shareholders through dividends and share repurchases. As management is expecting growth in the topline and bottom line for FY-2024, I believe Walmart will be able to maintain strong operating cash flows. Also, Walmart was able to maintain Return on Assets and Return on Investment at 5.6% and 12.8% respectively, an improvement over the previous quarter.

Valuation Analysis

| Peers | Price | Forward EPS | Forward P/E Multiple |

| Walmart (WMT) | $157 | $6.46 | 24.43x |

| Costco Wholesale (COST) | $534 | $14.57 | 36.65x |

| Target Corporation (TGT) | $121 | $7.59 | 16.04x |

| Dollar General (DG) | $154 | $10 | 15.54x |

| Dollar Tree (DLTR) | $123 | $6 | 20.60x |

| Implied Price | |||

| 75th Percentile | $162 | $6.46 | 25x |

| Median | $120 | $6.46 | 18.50x |

| 5-Year Average | $218 | $646 | 33.81x |

Based on the above analysis, Walmart is trading at a premium compared to its peers based on the forward PE multiple. However, it is still trading at a discount compared to Walmart’s five-year average of 33.81x. Given its strong position in the retail industry and solid business, I believe Walmart should trade at a higher multiple compared to peer’s median. The target price of $162 is based on the 75th percentile of forward PE multiple 25x, which shows Walmart stock is not overpriced. However, I believe investors may want to wait for the PE multiple to normalize around 20x to buy this stock. This level provides a better margin of safety.

Risk Factors

1. Walmart is generating significant revenue from international operations, and currency fluctuations can adversely impact the revenue.

2. It is showing strong momentum for its e-commerce business. I believe investors are watching this trend closely for upside potential in the stock. Underperformance in e-commerce could impact investor sentiments.

Final Thoughts

The key investor takeaway is that Walmart is a solid company with robust historical revenue growth and projected growth. Walmart is poised to outperform due to sustained Comps sales, strong growth in ecommerce, better management of cost structure, operating margin expansion, and a sustained level of operating cash flow. However, investors should watch the impact of e-commerce on revenue growth closely.

Investment Strategy

- For new investors in Walmart, it’s advisable to wait for the P/E multiple to normalize around 20x, in my view.

- For existing long-term investors, they can continue to hold and watch for a stock level of $120 for accumulation with a forward PE multiple of 18.5x.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.