Summary:

- Walmart is a solid company, with strong brand and scale advantages.

- However, the company appears wildly mispriced. Shares are trading at extremely stretched valuations, and capital returns to shareholders at this point should be meager.

- Growth isn’t expected to accelerate much in 2025, which means that the exuberance is likely a result of portfolio managers trying to find a place to ‘weather’ poor consumer conditions.

- If leading economic indicators improve over the next twelve months, we expect that the multiple will compress materially as money flows into more growth-oriented stocks.

- We rate WMT a ‘Sell’.

Robert Way/iStock Editorial via Getty Images

A few days ago, we put out an article calling Southern Company (SO) – the leading U.S. utility company – overvalued.

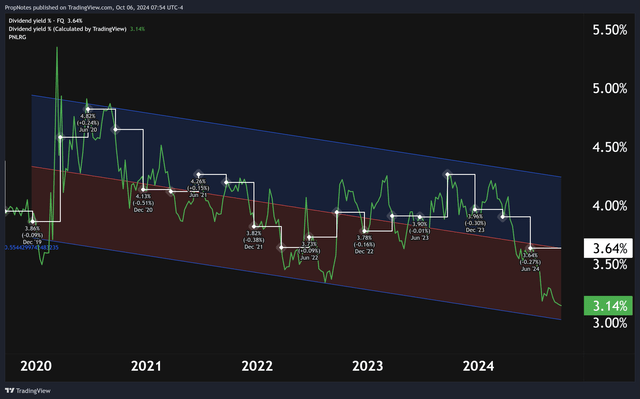

Our argument was focused on the SO’s modest growth outlook, extended valuation, and historically low dividend yield. While some don’t like using dividends as a way of valuing a stock, we think it can be a good indicator of a stock’s ‘true’ price relative to underlying distributable earnings:

… Clearly, this yield is low for SO historically, which shows how expensive shares have gotten vs. organic growth in the underlying business – aka ‘owner’s yield’.

In the end, given the meager yield, we rated SO a ‘Sell‘, arguing that the company would likely be ‘Dead Money’ for the foreseeable future.

Today, we’ll be taking a look at Walmart (NYSE:WMT), the leading U.S. consumer goods retailer.

While WMT has a better growth outlook than SO and is actually shrinking diluted share count, the stock looks very, very expensive on a historical basis.

With a lack of clear upcoming growth catalysts, we think WMT appears similar to SO, in that there’s a high likelihood that the stock could be ‘Dead Money’ for the foreseeable future.

As a result, we rate WMT a ‘Sell‘.

Let’s dive in.

WMT’s Financials

As always, we’ll start by taking a look at WMT’s financials.

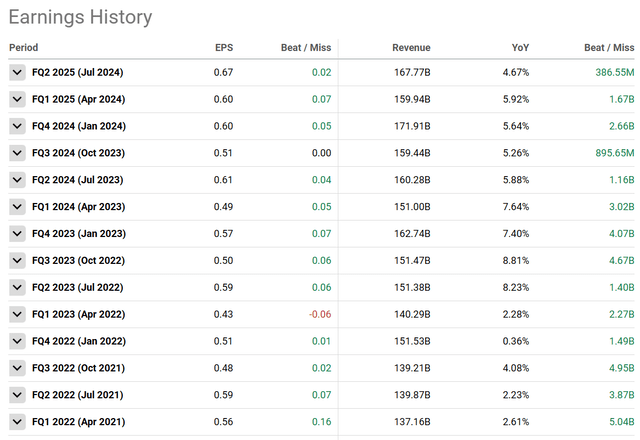

The company has done well in recent quarters, consistently beating analysts’ estimates for top and bottom-line results:

WMT does have a few misses here and there, but overall, it’s a strong track record.

Top line sales growth has been in the mid to high single digits range consistently, which is to be expected of a consumer goods retailer that has this level of scale and saturation.

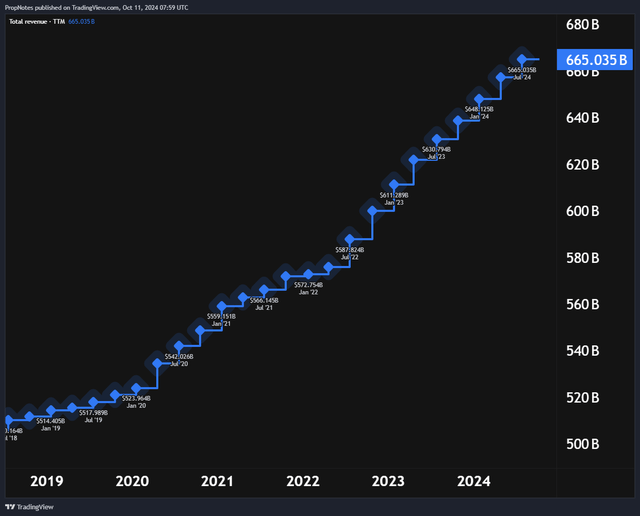

When you’re doing roughly TTM $665 billion in sales, it can be hard to grow organic results at a rate faster than inflation:

That said, the company’s future guidance on growth looks a bit weaker than the last 24 months of historical performance.

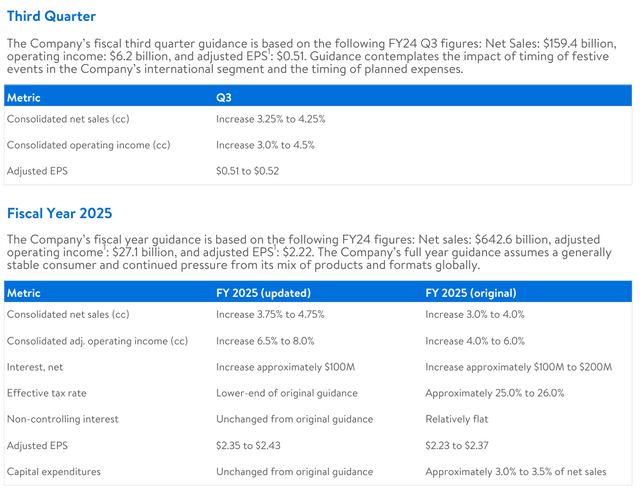

For the third quarter, WMT is projecting revenue growth in the 3.25% – 4.25% YoY range, with a similar level of growth in operating income:

While this does indicate stable margins, the overall level of growth is lower than the company has averaged since the start of 2023.

Additionally, looking at forward guidance for 2025, the company did raise guidance on the Q2 earnings call, which initially seems positive.

For FY ’25 sales, management is now expecting top-line growth YoY of 3.75% – 4.75%, and operating income growth of 6.5% – 8%. This raised guidance is a positive sign, and the variance in growth rates also means that management is expecting some margin improvements, which is welcome.

However, ultimately, these rates project WMT’s future trajectory as growing more slowly than the company did in 2023 through the present day, which isn’t great.

The projected slowdown hasn’t been directly discussed by management, but reading through the 10Q, we see macro factors like falling inflation and worsening global consumer trends as largely behind the deceleration.

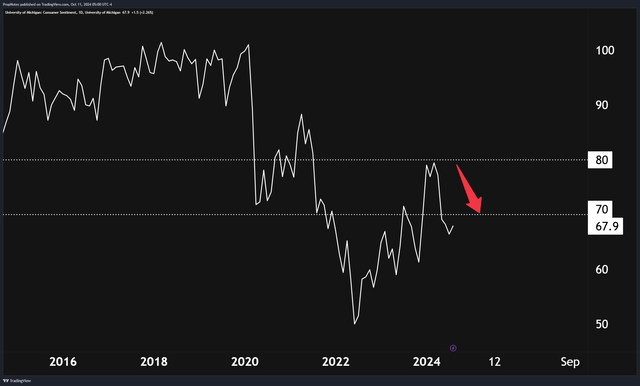

Consumer sentiment readings also remain poor, with the UMCS Index recently dropping below 70, a leading, negatively correlated GDP indicator:

In Q2, management mentioned that price trends were deflationary on the whole, which we expect will continue through some of the next year due to falling energy costs and higher competition for lower consumer spend:

Around the world, our customers and members continue to want four things. They want value; they want a broad assortment of items and services; they want a convenient and enjoyable experience buying them; and they want to do business with a company they trust…

As it relates to value, we’re lowering prices. For the quarter, both Walmart U.S. and Sam’s Club U.S. were slightly deflationary overall. Walmart U.S. food prices were slightly inflated as we exit Q2, but down 30 basis points versus Q1. In Walmart U.S., we have more than 7,200 rollbacks across categories. Customers from all income levels are looking for value, and we have it.

This slowing top-line growth isn’t necessarily something the company can ‘fix’, but headwinds are headwinds and still impact the top and bottom line.

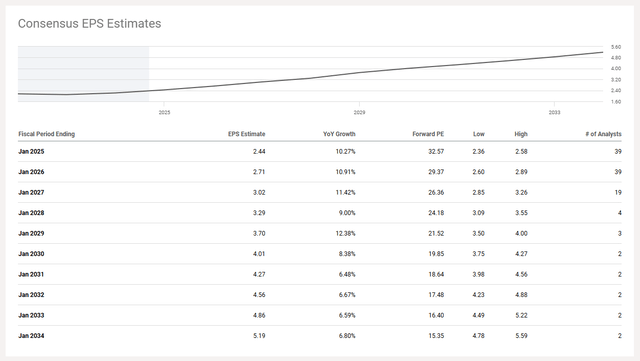

For their part, analysts see EPS growing in the 10% – 11% for the next few years, which is mostly in line with company management, but our pessimism around the U.S. consumer makes us think it will be at the lower end of the range:

Taken together, WMT is doing a solid job executing, and the company still enjoys a market leading position, brand, and scale. This is evidenced by the company’s massive revenue and stable margins in a highly competitive market segment.

However, broadly, we don’t see the company as a ‘growth’ story.

WMT’s Valuation

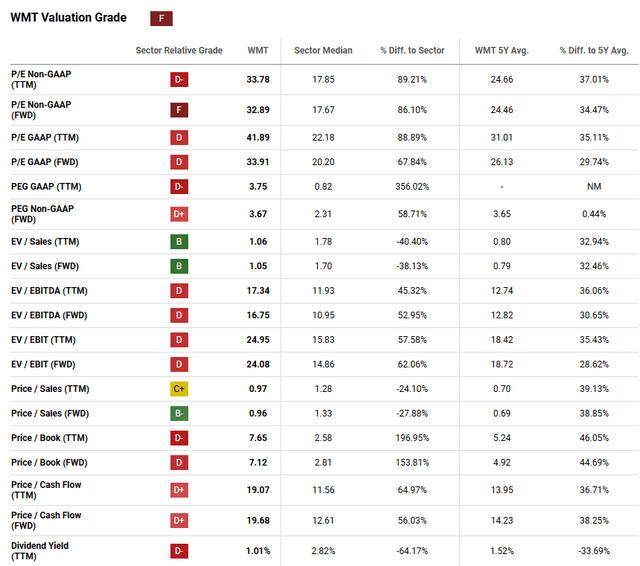

Within that context, WMT’s valuation seems very, very expensive, bordering on ridiculous.

Right now, WMT is trading at roughly 41x net income, and nearly 1x sales. For a company with 2.3% net income margins, this is very, very expensive.

Seeking Alpha’s Quant rating system gives WMT an ‘F’, which, we think, is completely warranted:

The important metric here is the TTM PEG ratio, which stands at 3.75. This is more than quadruple the sector average of 0.82x.

While we’re happy to admit that a company like WMT should trade with a premium to the sector, this massive multiple, especially relative to growth, has us concerned.

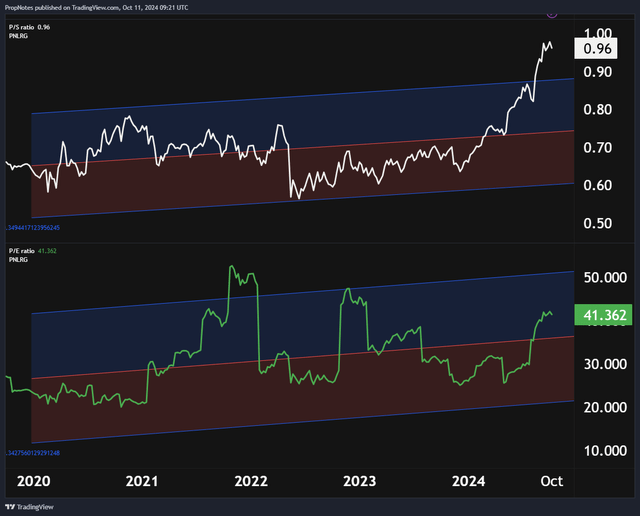

On a historical basis, WMT is also trading at a dizzying multiple:

On the top line, you can see how the multiple is now trading well outside of the standard deviation band of the 5-year linear regression. This indicates that the valuation is very likely to retrace in coming quarters, even if the company grows results and shrinks this ratio somewhat organically.

Additionally, on the bottom line, WMT is at least a third more expensive than the S&P 500 – which is trading at ~30x – all the while having a much less robust growth profile.

Historically, it’s also in the ‘blue’ zone, indicating that it’s running hot above historical numbers.

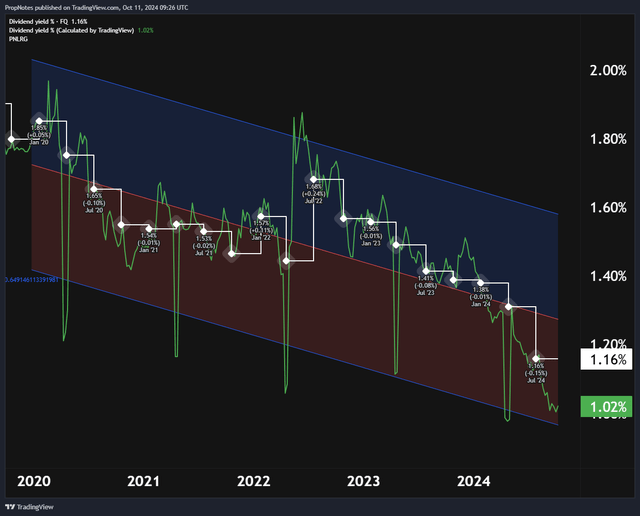

Finally, if you look at WMT on a ‘capital returns’ basis, the company is a terrible value. The dividend yield is trading at the very bottom end of the regression channel, which would be even more extended if there weren’t annual hiccups in this data, skewing the deviation lower:

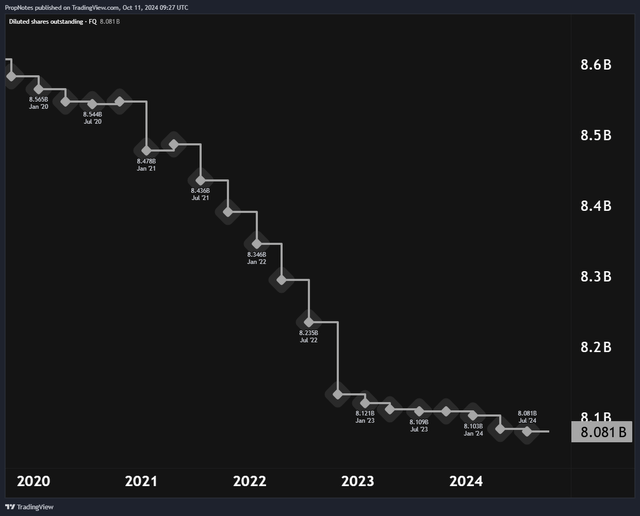

At the same time, as the stock has gotten a lot more expensive, it has severely limited the number of shares that WMT’s buyback program can retire.

As a result, repurchases have dwindled:

Take these together, and we think it’s unlikely that WMT will produce meaningful returns for the next year.

But why is WMT so expensive? If it isn’t the growth, what is driving returns?

In our view, it seems as though WMT has benefitted from investor interest in safe, stable companies in a period of global macro instability.

Looking for a safe haven from potential volatility, or looking to get away from issues with expected consumer spending over the next year? It looks like many portfolio managers have dumped their risky stocks and piled into WMT.

Other companies, like Costco (COST), have similar looking chart and valuation situations, likely as a result of the same phenomenon.

If the economy stays weak, we could see WMT’s valuation remaining up here or even expanding a bit further, so we wouldn’t recommend a ‘short’ position.

However, if you’re a long-time WMT investor, this appears to be one of the best-ever ‘price tags’ that you will have been able to get for your shares.

Plus, we don’t think this investor exuberance will stick around, especially if leading economic indicators improve over the next twelve months.

Summary

Thus, we rate WMT a ‘Sell‘.

We’re fans of the company, but not the valuation.

As a result, it’s probably time to ring the register and deploy into more well-priced growth opportunities.

If you’re looking for ideas, we’ve highlighted a few of those recently here, here and here.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.