Summary:

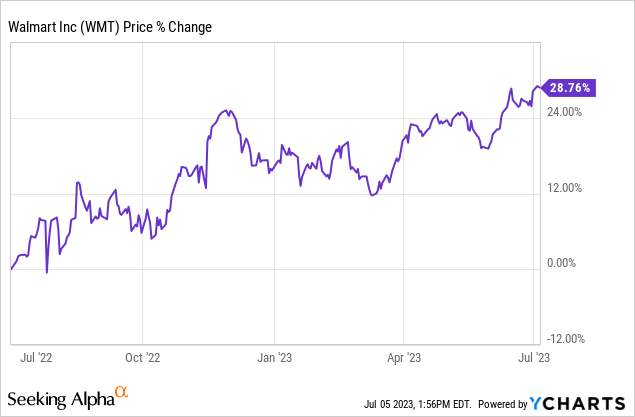

- Walmart’s share price is now back near its all-time high.

- The rapidly declining inflation will likely weigh on price increases, which should subsequently impact growth.

- Walmart+ and advertising are two potential growth catalysts, but their current size is not large enough to make an impact.

- The current valuation is meaningfully higher than other retail companies and its historical average.

YvanDube

Investment Thesis

Walmart’s (NYSE:WMT) share price has quietly risen nearly 30% in the past year and is now back near its all-time high. Unlike the market, I am less optimistic about the company’s near-term outlook. The easing inflation will likely put pressure on price increases while the slowing economy will also impact demand. Walmart+ and advertising are two emerging segments with great potential but they are currently too small to make a meaningful impact. Considering the macro headwinds and elevated valuation, I believe the company’s near-term upside potential should be relatively muted.

Macro Headwinds

Walmart is one of the world’s largest retailers, currently operating over 10,000 stores across the globe. The Arkansas-based company also owns Sam’s Club, a membership warehouse club, and Flipkart, an Indian e-commerce company.

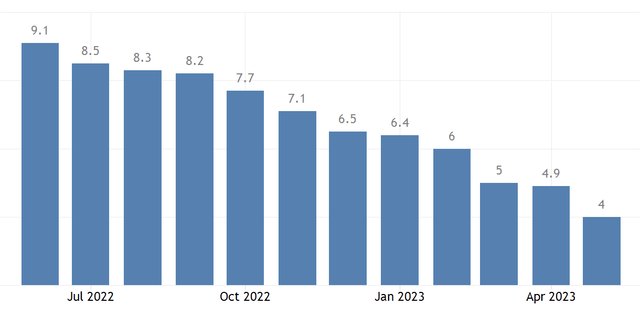

Thanks to soaring inflation, Walmart was able to raise prices significantly in the past two years. In many cases, the increase was even higher than the inflation rate, as the company leveraged its strong branding and customer loyalty. This also benefited margins as most incremental revenue flows directly to the bottom line. However, this tailwind is now fading as inflation continues to decline rapidly. As shown in the chart below, the US CPI (consumer price index) dropped from 9.1% in June last year to just 4% in May.

I believe this will weigh on growth and margins moving forward, as most of the company’s sales growth comes from price increases. For instance, during the latest quarter, average pricing increased 4.4% YoY (year over year), while the number of transactions was only up by 2.9%.

Besides, the slowing economy may also put further pressure on financials and pricing. While the unemployment rate remains extremely resilient at just 3.7%, overall consumer spending has been moderating. The resumption of student loan payments is also expected to extract $430 billion from 43 million Americans. The impact is evident in recent earnings from notable retailers such as Dollar General (DG), which meaningfully slashed its guidance, citing a faster-than-expected deterioration in the macro backdrop.

Kelly Dilts, Dollar General’s CFO, on macro impact

Moving to an update on our financial outlook for the fiscal 2023 year, we’re seeing a much more challenging macroeconomic environment than we anticipated. And this is having a significant impact on our customers’ spending levels and behavior.

Walmart+ and Advertising

While the retail segment will likely be soft due to macro headwinds, Walmart+ and advertising should be two meaningful growth catalysts in the near term, as the company continues to diversify its business.

After seeing the success of Amazon Prime (AMZN), Walmart also launched Walmart+, its own subscription service last year. It costs $13 per month and provides services such as free shipping and return, Paramount+ streaming, fuel savings, and more. The company has not disclosed the current number of subscribers but Morgan Stanley’s (MS) recent survey points to approximately 21.5 million. There should be ample room for expansion as Amazon Prime has over 160 million members. The rising penetration should continue to drive the bottom line, as its margins are vastly higher than grocery sales.

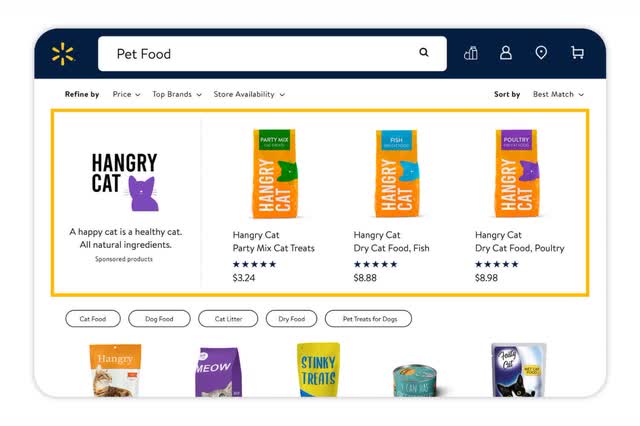

Advertising is another growth catalyst with a high-margin profile. After scaling its online website, the company is now trying to monetize its digital real estate through advertising. It currently offers search ads and display ads to brands and sellers of all sizes. The segment has been seeing strong momentum, with revenue up nearly 40% YoY in the last quarter. I believe Walmart+ and advertising are something worth keeping an eye on moving forward.

Elevated Valuation

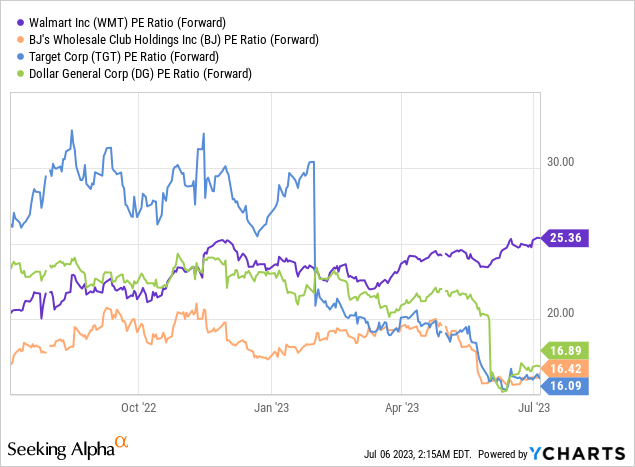

After the recent rally, Walmart’s valuation looks quite elevated in my opinion. The company is currently trading at an fwd PE of 25.4x, which is meaningfully higher than other major retailers such as Dollar General, Target (TGT), and BJ’s Wholesale (BJ), as shown in the first chart below. The peer group has an average fwd PE ratio of just 16.5x, which represents a major discount of 35%.

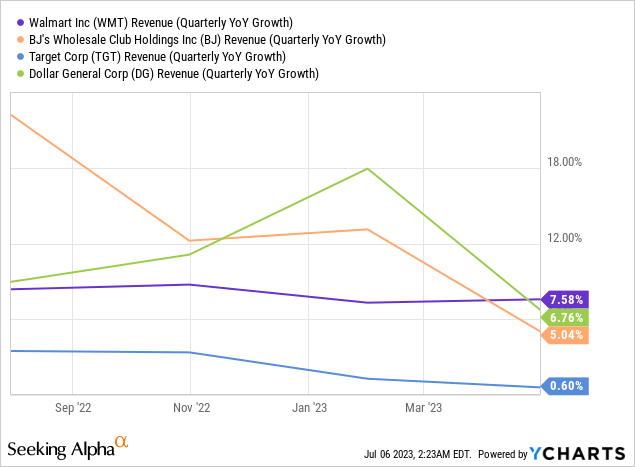

The huge valuation gap seems unjustified as Walmart’s revenue growth of 7.6% is only slightly above its peers’ average of 4.1%, as shown in the second chart below. On a historical basis, the current multiple also represents a premium of 10.4% compared to its 5-year average fwd PE ratio of 23x.

Investors Takeaway

Overall, I do not think now is the right time to dive into Walmart. The rapidly declining inflation will weigh on pricing while the slowdown in the economy will further impact consumer demand and spending. Walmart+ and advertising are seeing great momentum but their run rates are currently too low to offset the potential moderation in grocery sales. The company’s valuation is also elevated, with multiples meaningfully above peers. I do not see much upside potential from the current price level, therefore I rate it as a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.