Summary:

- Walmart Inc. stock has declined since October while other consumer discretionary stocks have been performing well.

- The stock is currently in a state of uncertainty, with no clear breakout or breakdown in sight.

- Walmart’s growth prospects are weak, with decelerating revenue and rising operating expenses, making it unattractive for investment.

Alexander Farnsworth

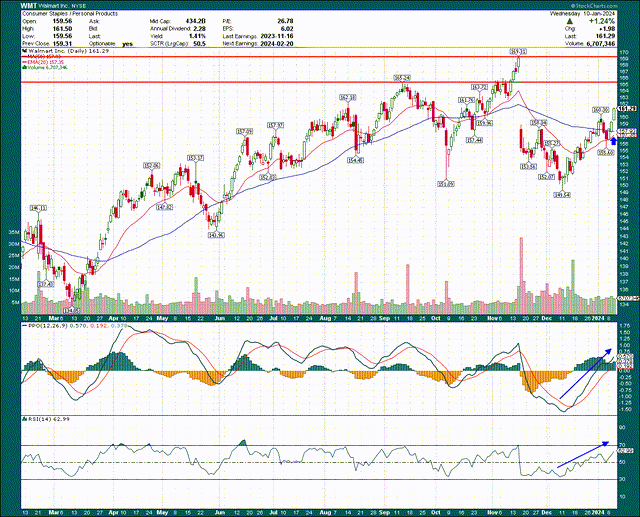

Consumer discretionary stocks have been absolutely flying since equities made a major bottom in October. That success has not translated equally, however, across the group, and discount retail OG Walmart Inc. (NYSE:WMT) has seen its stock actually decline from October. I don’t particularly like the look of the chart, and given fundamental momentum and a full valuation, I don’t think Walmart is worth your investment capital at the moment. Let’s dig in.

Walmart stock is in no-man’s land

I say Walmart is in no-man’s land because it has successfully tested support on the downside, but has a mountain of resistance not far overhead. The stock needs to either break out of this structure or break down below it, but right now, I don’t see an edge for bull or bear. That means we cannot effectively place the odds in our favor, and I’m choosing to sit this one out until such time that one side regains control.

The rising moving averages (blue arrow above) should be strong support moving forward. The move on Wednesday produced a new relative high, so bullish momentum is building. Those moving averages need to hold any pullbacks or the December low at ~$150 is back in play. For now, momentum via the PPO and 14-day RSI look good, and my bias is that Walmart will test resistance overhead, but given my fundamental outlook, I don’t see how that move will be sustained.

Weak growth prospects drive a weak outlook for the stock

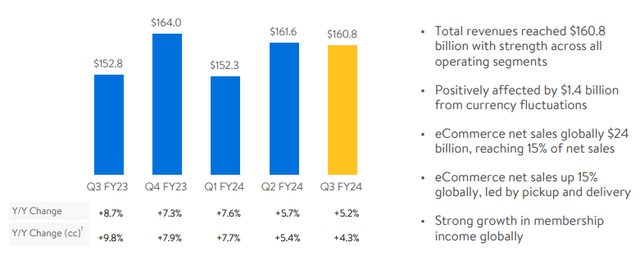

We all know Walmart is a massive behemoth of diversified retail, so we’re not going to see huge growth year-over-year; that’s not what this is. However, investors demand something on the growth front and I just don’t see sustainable, meaningful growth here. Let’s start with basic top line revenue.

Year-over-year we’re looking at mid-single digit gains in revenue, and that’s fine. However, we can see that the most recent quarter was worse than FQ2, as well as last year’s FQ4. There’s a bit of seasonality built in there, but Walmart is so diversified with categories like groceries that seasonality is becoming increasingly irrelevant. Forex translation also boosted the top line by $1.4 billion in the most recent quarter, making up about 18% of the total revenue gain year-over-year.

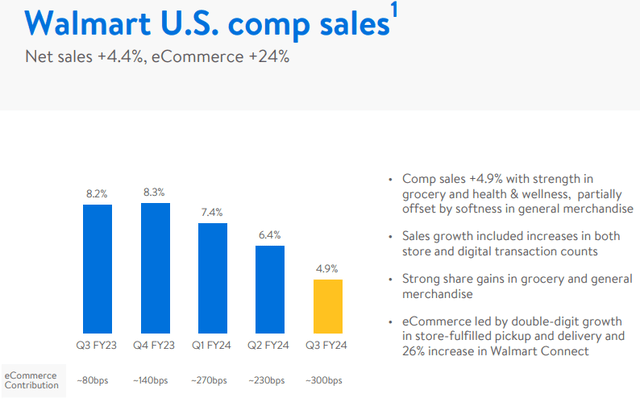

We see decelerating growth, particularly in comparable sales.

This chart is not amazing if you’re looking to be bullish on this stock. U.S. comp sales are being driven currently by health & wellness, which includes the very successful pharmacy business filling a higher mix of branded pharmaceuticals. To a lesser extent, grocery remains a driver of sales growth, but keep in mind that cost inflation has been driving grocery prices for all players for a couple of years now. With inflation coming down all the time, can the company continue to produce meaningfully higher comp sales in that critical category? I have my doubts.

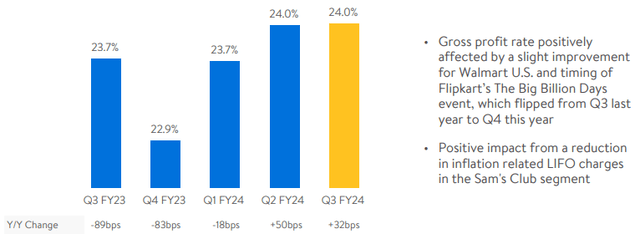

On the plus side, gross margins – which are razor thin for Walmart – have sustained at higher levels in recent quarters.

To be fair on my comment about inflation driving grocery prices higher, if input costs moderate in the coming quarters on groceries, and Walmart can sustain some of the pricing power it has gained through this process, margins could come up. We’ll see, as that requires a strategic decision to compete less on price than Walmart normally does, but that’s a possibility in terms of margin upside.

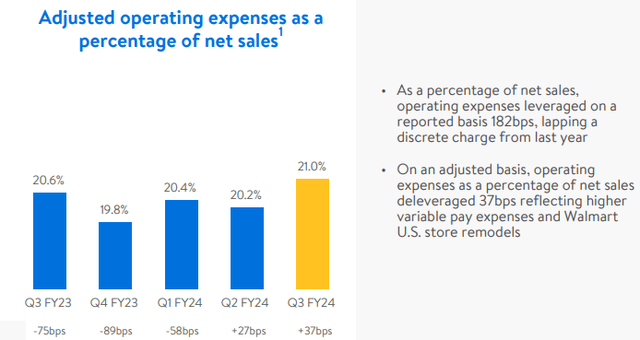

The issue is that Walmart’s operating expenses continue to climb, and meaningfully so.

We see deleveraging yet again as the company continues to go through a store remodel effort, as well as higher compensation costs. The latter is something the entire retail industry has struggled with since the pandemic, and as workers demand ever-higher wages, this may remain an issue. Keep in mind that’s a structural reset higher in wage costs, so there must be a structural reset higher in margins to offset this for the same level of profitability.

Profitability for a retailer boils down at its core to two things: its ability to capture gross margin, and its ability to leverage down operating costs as much as possible. Gross margins are on a gradual rise, but so are operating costs, so the former is simply covering the latter for no real gain. With revenue growth modest and declining, as well as steadily rising expenses, I don’t see a lot of cause for optimism here on the earnings growth front.

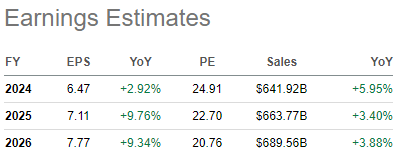

Analysts are looking for about 3% EPS growth this year, but closer to 10% for the next two years.

Seeking Alpha

As we can see, that 10% growth is supposed to be generated off of <4% sales growth, meaning the other ~6% has to come from margins and share repurchases. The company has a modestly sized allocation of potential share repurchases still outstanding, but at last check was about 4% of the current market cap. If all of that is purchased we could expect to see a 4% tailwind to EPS based upon a lower share count, all else equal. The problem is that share repurchases have all but stopped recently, so I have my doubts.

That means margins have to do the heavy lifting here to get to 10% EPS growth, and given my concerns above, I’m just not sure. If we sum this up, it is my view that there is a lot of optimism priced into current EPS estimates for FY2025/2026, and that means there’s downside risk. For a stock that is already fully-priced, that’s simply not attractive to me.

Speaking of fully priced

Let’s finally turn our attention to the valuation, which is nowhere near the point where I’d want to own this stock.

Shares are going for 24X forward earnings at the moment, which is slightly above the 3-year mean. However, keep in mind that growth prospects are deteriorating at the moment, based upon the evidence above surrounding decelerating comp sales and rising operating expenses. Now, if those things suddenly reverse course and shoot higher, I’ll eat my humble pie. But for now, Walmart Inc. stock is overpriced in my view when we combine historical context around EPS growth prospects and valuation.

For these reasons, I don’t think Walmart is anywhere near a short opportunity, but I also don’t think you need to bother on the long side. I see very limited upside at the moment and cause for concern on out year growth estimates. Walmart gets a hold from me, but I think you simply look elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.