Summary:

- Walmart is well-positioned in the current retailing environment, with branded and private-label assortments as well as Sam’s Club that captures bulk-buying demand.

- Wall Street didn’t like the company’s outlook for the current holiday quarter, and the selling pressure broke the company’s multi-month technical uptrend.

- In this article, we address the Walmart’s technical backdrop, its latest quarterly results, as well changes to our valuation model since the last update.

- Though we like Walmart quite a bit, the firm’s equity may have to trade sideways for some time before potentially resuming its advance.

Alexander Farnsworth

By Brian Nelson, CFA

The discounted cash flow [DCF] method to valuing stocks is another avenue an investor can pursue in addition to valuation multiple analysis. The benefits of using the DCF are multifold. For starters, the application of the DCF helps to value the precise stock one is looking at and avoids systematic overvaluation or undervaluation tendencies that may come with relative valuation analysis. The DCF also forces the analyst to think about all of a company’s key valuation drivers, from revenue growth to earnings expansion to the generation of free cash flow and beyond. No other method cuts through the qualitative quite like the DCF model.

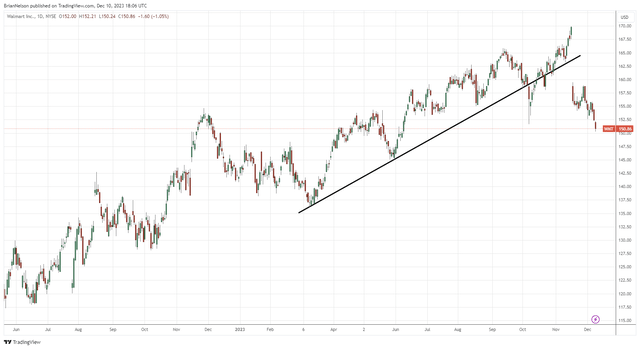

Walmart’s shares have broken through its uptrend. (Trading View)

In addition to the DCF and relative valuation measures, we like to look at a technical assessment of the firm, and we think this dynamic has the greatest hold on Walmart’s (NYSE:WMT) stock of late. Walmart was in a solid uptrend for most of 2023, but the market’s reaction to its quarterly report drove sufficient selling where it now has broken through its uptrend to the downside. We expect the firm will have to consolidate for some time, yet before it may resume its advance. In this article, we wanted to update readers on our new fair value estimate and discuss the firm’s latest quarterly results. With that said, let’s dig in.

Latest Earnings Report

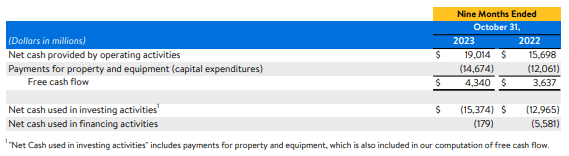

Walmart reported third quarter results On November 16 for fiscal 2024 that revealed sales expansion of 5.2% and an increase in adjusted operating income of 3%. The big box retailer’s adjusted earnings per share increased 2% in the quarter from the same period a year ago. Walmart’s operating cash flow during the first nine months of the year was a solid $19 billion (up $3.3 billion from last year’s period), while traditional free cash flow, as measured by cash flow from operations less all capital spending, came in at $4.3 billion (up $0.7 billion on a year-over-year basis), as shown in the image below. The retailing giant ended the quarter with a ~$43.2 billion net debt position and, year-to-date, has bought back 8.7 million shares of stock. Walmart upped its outlook for the remainder of fiscal 2024, too, but its targets came in a bit shy of what the Street was looking for.

Walmart’s free cash flow generation during the first nine months of its fiscal year has shown a nice jump. (Walmart)

We think Walmart is one of the best-positioned companies for the current market environment, as it offers a wide selection of private label and branded items coupled with its valuable Sam’s Club membership warehouse that captures incremental demand from those seeking the convenience of bulk buying. Despite a warning from Walmart about some softness in consumer spending in the back half of October, we think the consumer remains quite resilient given a slowing pace of inflation and even disinflation across many items (e.g. eggs). Consumers continue to look to save money by eating more at home as menu prices at restaurants have soared, and while Walmart was somewhat cautious with its outlook for the remainder of fiscal 2024, it still raised its fiscal year guidance. Net sales growth for fiscal 2024 is now targeted in the range of 5%-5.5% (was 4%-4.5%), while adjusted earnings per share is now targeted in the range of $6.40-$6.48 per share (was $6.36-$6.46 per share). The market had been looking for more, but we think Walmart remains in good shape.

Updated Valuation Statistics

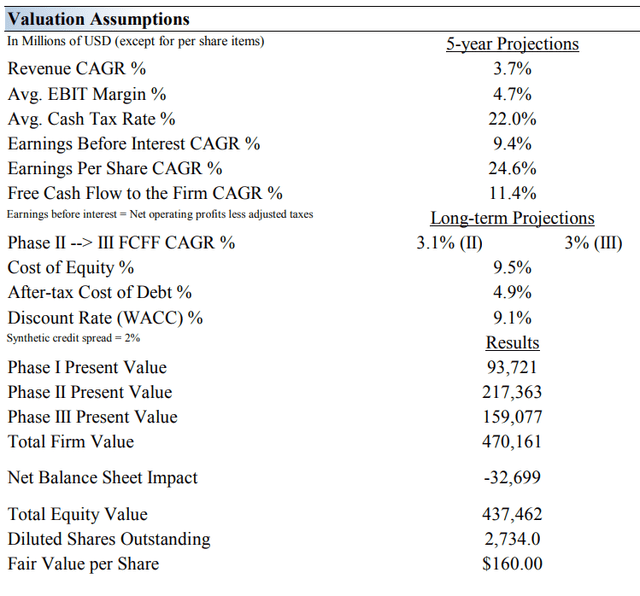

Valuentum’s summary valuation statistics for Walmart. (Valuentum)

We last wrote about Walmart on Seeking Alpha in this June 2022 article, and our fair value estimate stood at $137 per share with a margin of safety in the range of $110-$164 per share. At the time, we were forecasting a compound annual revenue growth rate of 3.2% over the next five years and a 5-year projected average operating [EBIT] margin of 4.9%. It turns out that our forecasts for the top-line were somewhat conservative, as we underestimated Walmart’s ability to handle the difficult post-COVID-19 environment, both with respect to inventory issues and selective pricing efforts.

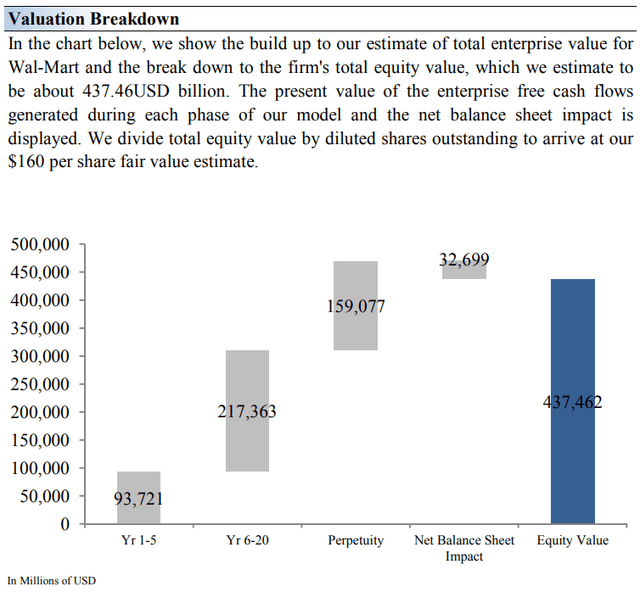

The biggest delta with respect to our new $160 per share fair value estimate comes in the form of stronger top-line expectations over the next five years (and into perpetuity), but slightly lower margin performance over the next five years. At that time, we noted that Walmart may offer an opportunity, but today we think technical dynamics will continue to weigh on shares for some time, keeping them below our updated fair value estimate as shares seek to consolidate before potentially resuming an advance.

Our valuation breakdown of Walmart. (Valuentum)

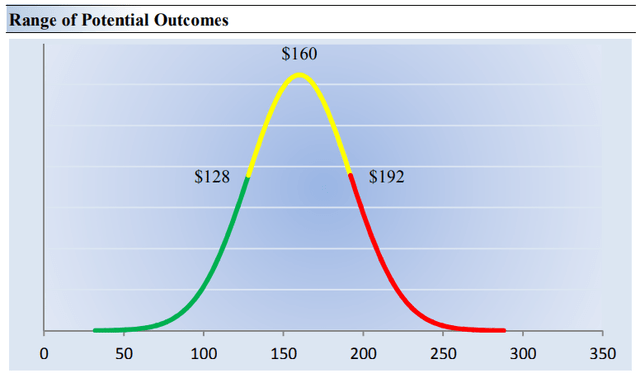

Margin of Safety

The DCF valuation process arrives at what one might think is the best fair value estimate of a firm, but because the future forecasts within the DCF are quite sensitive to certain operating assumptions, it is vitally important to use the DCF in the context of a margin of safety, or a fair value estimate range. For example, if one thinks a stock is worth $100, it is probably much better to say that one thinks the stock is worth between, let’s say, $80 and $100, given the sensitivity of the fair value estimate to future operating assumptions and the discount rate. In this context, we think shares of Walmart are worth between $128-$192, a rather large fair value estimate range for the big box retailer, but one that captures the uncertainty embedded in our future fundamental expectations. Even small changes in mid-cycle expectations can have a large impact on Walmart’s fair value estimate.

Walmart’s margin of safety. (Valuentum)

Concluding Thoughts

Walmart’s shares are now trading in the low end of our fair value estimate range (~$151 per share), and the company’s warning about some softness in sales in October coupled with the breakdown in its uptrend may suggest shares may move sideways for some time yet before potentially resuming their advance. We were a bit too conservative with our top-line growth rate assumption when we last wrote about Walmart on Seeking Alpha, and our updated fair value estimate now captures an incrementally stronger revenue environment relative to our last update here, despite some of the challenges Walmart may face as consumers seek to trade down to value offerings. All told, we like Walmart in the current economic environment, but its shares aren’t yet at levels that have sufficient margin of safety. We’ll be watching them closely, nonetheless.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, VOO, and SCHG. Some of the securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.